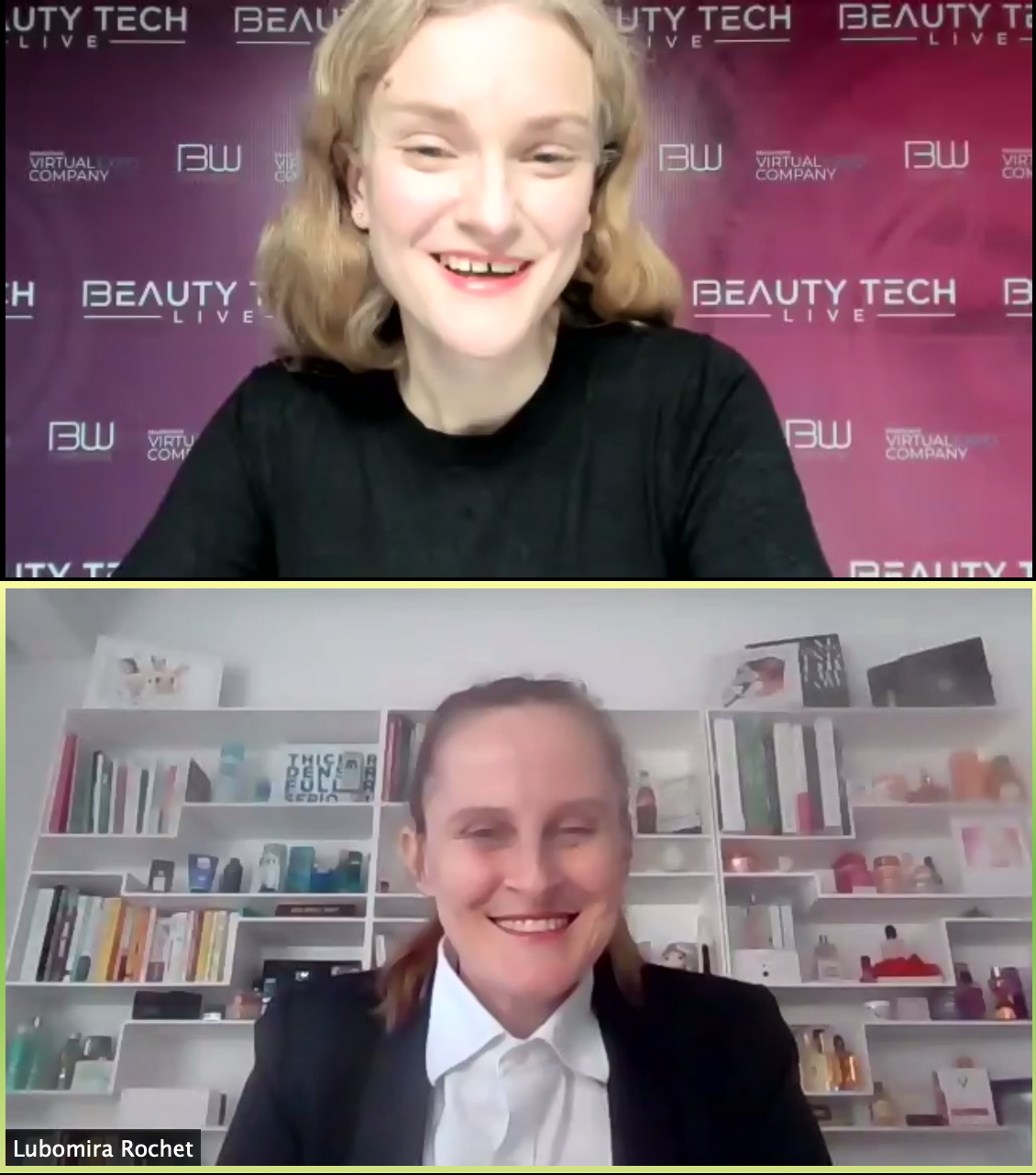

INTERNATIONAL. L’Oréal Group Chief Digital Officer Lubomira Rochet delivered an illuminating keynote address at the Beauty Tech Live, which officially opened its doors today.

In conversation with BW Confidential Editor-in-Chief Oonagh Phillips, Rochet analysed the fast-changing beauty ecommerce landscape and highlighted the trends and tools that will shape the industry in the years to come.

Rochet, a Franco-Bulgarian economist, has been Chief Digital Officer of the L’Oréal Group since March 2014. She is also a member of the Group’s Executive Committee.

L’Oréal Group’s ecommerce business increased +60% through 2020, and now represents 25% of its total revenues. Rochet discussed L’Oréal’s digital and ecommerce strategy and how the beauty giant is managing its incredible digital acceleration.

“Ecommerce has always been a part of our strategy, but the magnitude of our recent growth has been spectacular” Rochet said. “For example, we’ve seen 200-300% growth day after day in the hair care category. So, one of the first things we did to manage this growth was to invest in real-time analytics. This is so that we can manage data and insights daily instead of just every quarter.

“We built entire analytics systems and increased e-tailer partnerships to better understand categories, product evolution and reorganised our media spend.”

L’Oréal Group predicted that 50% of its business will come from ecommerce sales by 2023. When asked what impact do pure play e-tailers, direct-to-consumer and specialist ecommerce retailers have on L’Oréal’s business today, Rochet said: “The ecommerce market is vastly different in various countries and zones. In Asia, pure players and digital-native platforms like Lazada and WeChat are very important, but in Europe the distribution is more even. In Japan, for example, direct-to-consumer (D2C) is very important, but also depends on the offline distribution landscape.

Commenting on whether D2C is a priority for L’Oréal, Rochet said: “Luxury brands like Kérastase and SkinCeuticals work very well with D2C. These brands have strong brand equity and a higher price point to help us make this channel profitable.

“However, for mass market brands like L’Oréal Paris, Garnier and NYX, we don’t have a D2C approach. The higher the price point, the better D2C experience you can offer customers. We are also using our learnings with D2C to inform our pure play retailer strategies.”

Ecommerce and digital made up for approximately 50% of L’Oréal’s brick and mortar losses during the COVID-19 crisis; and according to Rochet, brick & mortar players can and should capitalise on digital opportunities to drive recovery. “While some brick and mortar retailers struggled due to COVID-19, other accelerated,” Rochet said. “Walmart, Carrefour and Watsons have all accelerated and it’s a movement that it here to stay.”

So, how can physical players adapt to an increasingly digital world? Rochet said it’s all about marketplace, membership and convenience. “I’ve seen many retailers embrace a marketplace strategy to great effect. A marketplace approach increases their offer, making them more profitable and also more consumer-centric.

“Strong membership programmes can also be leveraged online, particularly in the world of personalised beauty. Our own subscription platform Color and Co., which is focused on hair colour and personalisation, is performing very well. The more you get into personalised beauty the more a subscription or membership model makes sense,” she added.

“The services that come with the shopping experience also have an important role to play. Whether that’s virtual makeup, telecommunication, shade finders, or last-mile delivery. At this moment, digital is really a playground of innovation.”

As livestreaming continues to make waves in China and the wider Asia Pacific region, Rochet believes that there is still a way to go before the livestreaming model can make the same impact in Western markets. She said, “Livestreaming is huge, but its adoption in Western markets depends primarily on the platforms. The moment that Facebook, Instagram and Amazon decide they will go big on livestream shopping is when the trend will take off outside of Asia Pacific.”

Rochet added, “We’ve had a few livestream experiments on our own ecommerce platform and know that it works. It’s very appealing for customers due to the close relationship with influencers and beauty experts and the instant gratification of the experience. We saw 10-12% conversion rates with our livestream experiments. These come from small consumer bases, but certainly validate the model.”

Commenting on the wider shift to social commerce, Rochet said: “There was a time when brand building and selling were separate worlds, but now they have become linked. Social platforms want to integrate a frictionless shopping experience. The biggest challenge will be to fix the shopping experience because ecommerce isn’t their native business model.”

So, how is L’Oréal keeping track of emerging trends and how does it determine what trends to prioritise? “We want to be where our consumers are,” Rochet said. “We will carefully monitor the players and trends and build capabilities on the belief that sooner rather than later 50% of our business will become digital.”

Rochet concluded by underscoring the importance of linking beauty tech with real-world experiences, she said: “We believe that beauty tech — which we define as how beauty experiences are powered online — will be a huge priority in the near to long-term. We started with ModiFace a few years ago on the belief that AR will change the beauty experience. However this is inextricably linked to physical real-world experiences too.

“These strategies can’t be purely an online play, but a combination of online and offline. Tech is an enabler, but the key is to create a junction with human experiences through beauty tech.”

View this post on Instagram