|

Jean-Paul Agon: “Chinese consumers are at the heart of L’Oréal’s focus and energies” |

CHINA. L’Oréal Group today underlined the vital role of travel retail as an engine of growth for its luxury beauty business, and said that Chinese consumers would become the leading purchasers by nationality worldwide of its luxury products by 2014 or latest 2015.

These were among the highlights of a major press conference hosted by the company’s Chairman & CEO Jean-Paul Agon in Shanghai on Wednesday, attended by leading Chinese and international media. The Moodie Report was the sole travel retail media invited. The press conference was one element of a fascinating three-day tour of key L’Oréal Luxe locations in China and Hong Kong, from major department stores to downtown duty free outlets such as DFS Galleria Sun Plaza.

Speaking in Shanghai today, Agon said: “Chinese consumers are at the heart of L’Oréal’s focus and energies. A potential 250 million new Chinese consumers will be using L’Oréal’s products within the next 10 to 15 years, making China the number one contributor to our ambition of winning 1 billion new consumers and to our strategy of universalization. A significant portion of these consumers will be recruited by our Luxe brands.”

|

Nicolas Hieronimus: Travel retail and China among the great engines of luxury beauty growth |

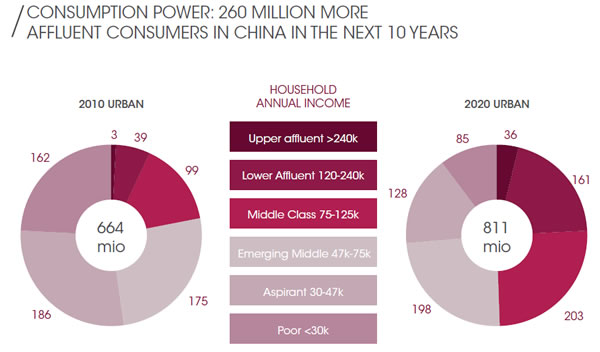

The company bases its estimates on forecasts that a further 260 million Chinese will enter the middle class by 2020, adding to its potential consumer base.

The company launched its new Clarisonic product in China in January, and will follow with the relaunch of YSL Beauté through its first boutique in downtown Shanghai in May. In a further development, the group will open its first store in the rail channel in China, with a Kiehl’s outlet planned for the departures concourse at Shanghai Hongqiao High Speed train station. It will open within the next two months, L’Oréal Luxe China General Manager Stephan Rinderknech confirmed to The Moodie Report.

On the potential for the group’s brands among Chinese consumers at home and abroad, Agon added: “This is just the beginning. The penetration levels of luxury and especially cosmetics are still relatively low. There is still a limited number of Chinese cities where we have beauty counters and we’ll see steady growth in the penetration and in the number of consumers we engage. For example, Lancôme has 170 counters in China, but over 2,000 in the USA, so the scope for growth is huge. We are unconcerned about a temporary slowdown in China’s growth, as that growth is still very robust.”

|

L’Oréal Group Chairman & CEO Jean-Paul Agon addresses Chinese and international media, along with (left) L’Oréal Luxe President Nicolas Hieronimus, (centre right) L’Oréal China CEO Alexis Perakis-Valat and (far right) General Manager China Stephan Rinderknech |

L’Oréal Luxe President Nicolas Hieronimus underlined that optimism, noting: “China is the fifth largest country in the world today for luxury and the second for the luxury beauty market behind the US. By next year or 2015 Chinese consumers will be our largest nationality, driven by a new generation that is under 30, by growth in the lower tier cities and by many touchpoints with the consumer, from e-commerce to boutiques to international and domestic airports, as well as new locations like rail stations.

“As well as bringing new products to the market we have been challenged by China too. We have raised our game in retail excellence and even recreated our brands, such as Helena Rubinstein, prompted by this market. We have learned to create specific products for Chinese consumers, tailored our advertising for this market and we have recruited a new generation of Chinese management. Our Management Committee here is 75% Chinese and 55% women. Plus we hope to eventually internationalise brands such as Yue Sai, our Chinese traditional medicine brand. That could be the first great Chinese luxury beauty brand internationally.”

Strategic role of travel retail

Both Agon and Hieronimus highlighted the “strategic” role of travel retail in growing the luxury division’s business. The Travel Retail arm provided 17% of L’Oréal Luxe sales in 2012, growing by +13.8% year-on-year for a total above €900 million.

Agon said: “L’Oréal Luxe has been a pioneer in travel retail as well as in the China market over the years, starting 40 years ago. It’s a very important channel for our business.”

Hieronimus added: “It’s vital for a number of reasons: it’s an expanding distribution channel; international travel is showing healthy organic growth, and Asian consumers are now travelling more and more worldwide. Among the Chinese, 60% of their luxury purchases are made abroad so we have to serve them wherever they shop. By 2015 there will be 100 million Chinese travelling abroad each year (from 70 million in 2011) and airports are the best place to engage and seduce these travellers.

“Travel retail is also a channel that provides us with wonderful opportunities to showcase our brands, in a way that you cannot always do elsewhere. We are very committed to this business.”

|

The Moodie Report Vice Chairman Dermot Davitt with L’Oréal Luxe Worldwide Travel Retail Managing Director Barbara Lavernos at the event in Shanghai’s Portman Ritz-Carlton Hotel |

Earlier, in a presentation in Hong Kong on Monday, L’Oréal Luxe Worldwide Travel Retail Managing Director Barbara Lavernos had introduced the channel to journalists from the consumer media, many of whom were unfamiliar with the business.

She noted: “Our customers today are global shoppers, and that has changed how we operate our business. Travel retail is like a sixth continent in the world, with a population of 4.8 billion and over 11 billion by 2030 [ACI projections of worldwide travellers -Ed]. In six years, travel retail will be a US$100 billion business, from US$49 billion today. That makes it a shopping “˜El Dorado’.

“Within this, Chinese are number four in travel numbers but number one in beauty spend; Russians are number ten in travel numbers but number two in spend; Koreans are seventh in travel numbers but number three in spend and Brazilians – only 23rd ranked by traffic – are the fourth highest spenders on beauty in travel retail.

She added: “What are the major drivers now and in future? The global shopper in beauty is still looking mostly for fragrances (50% of purchases today) but more and more they are looking for skincare, which is the fastest growing category.

“Targeting men remains a high priority, and developing gifting (38% of spend) through exclusives is key. Premiumness is also vital, led by our flagship brands such as Lancôme. Of the top 25 doors for Lancôme worldwide, 13 are in travel retail. And the number one door in any channel is DFS Galleria Sun Plaza in Hong Kong, which sells 1.2 Lancôme products per minute every day.”

|

Lancôme’s number one door worldwide, at DFS Galleria Sun Plaza in Hong Kong |

On the other big opportunities, Lavernos noted: “The number of passengers entering the shops is still relatively low at 15%, but that is good news in some ways. It means we have scope to grow, and that will happen with the development of new walk-through stores at airports, which increase penetration, and with more retail-tainment programmes at airports, plus enhanced Trinity partnerships.”

|

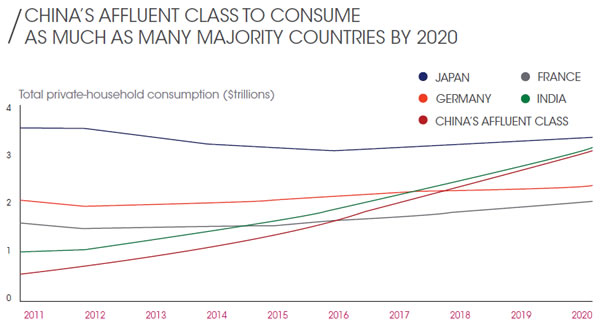

The rise of affluent Chinese underpins the bright prospects for luxury goods in the country, as outlined by L’Oréal Luxe in the presentations today (above and below) |

|

Hieronimus underlined the group’s aim to target Chinese and other high-spending international shoppers “wherever they travel, rather than where they live”.

He noted that Brazilians are the number one overseas purchasing nationality at Sephora’s Champs Elysées store in Paris; that 60% of net sales at Galeries Lafayette in Paris come from Chinese, Japanese, Russian and Middle East visitors, and added anecdotally that at Harrods in London, the top ten individual highest spending clients include four Chinese, two Nigerians and two Russians.

He concluded: “We are committed to giving Chinese people the most innovative and aspirational products and the most sublime consumer experiences [through] our local talents.”

|

The Moodie Report’s Dermot Davitt with L’Oréal Luxe – Travel Retail Worldwide Communications Director Valérie Sanchez at a cocktail hosted by the beauty group on The Bund in Shanghai |

Note: Watch out for a feature on L’Oréal Luxe’s China strategy in the next issue of The Moodie Report China in coming days; plus the group’s luxury strategy and travel retail business (featuring an interview with President Nicolas Hieronimus) will be the focus of a major report in the next print edition of The Moodie Report, out in May.