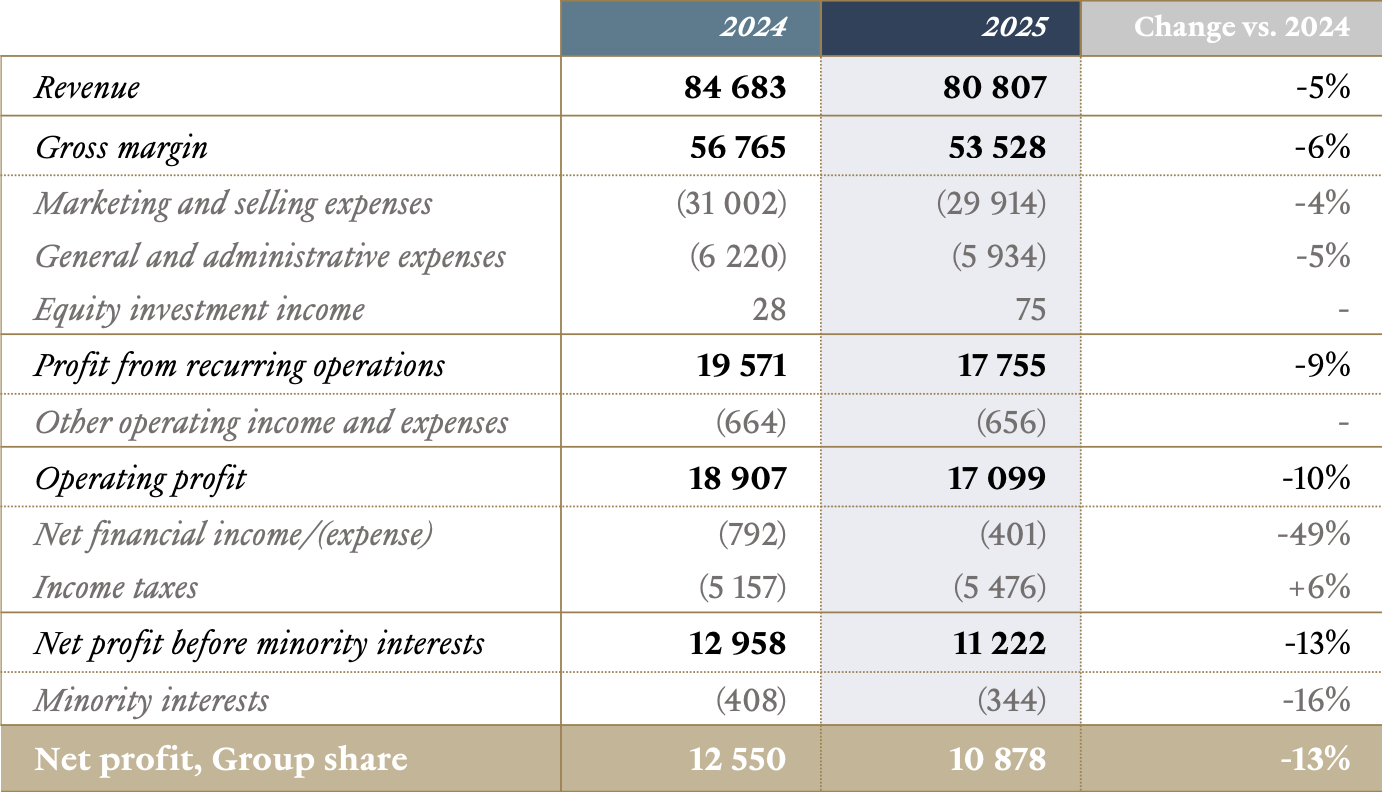

FRANCE/INTERNATIONAL. Leading luxury goods group LVMH Moët Hennessy Louis Vuitton today revealed full-year results for 2025, with revenue down by -5% year-on-year (-1% on an organic basis) to €80.8 billion.

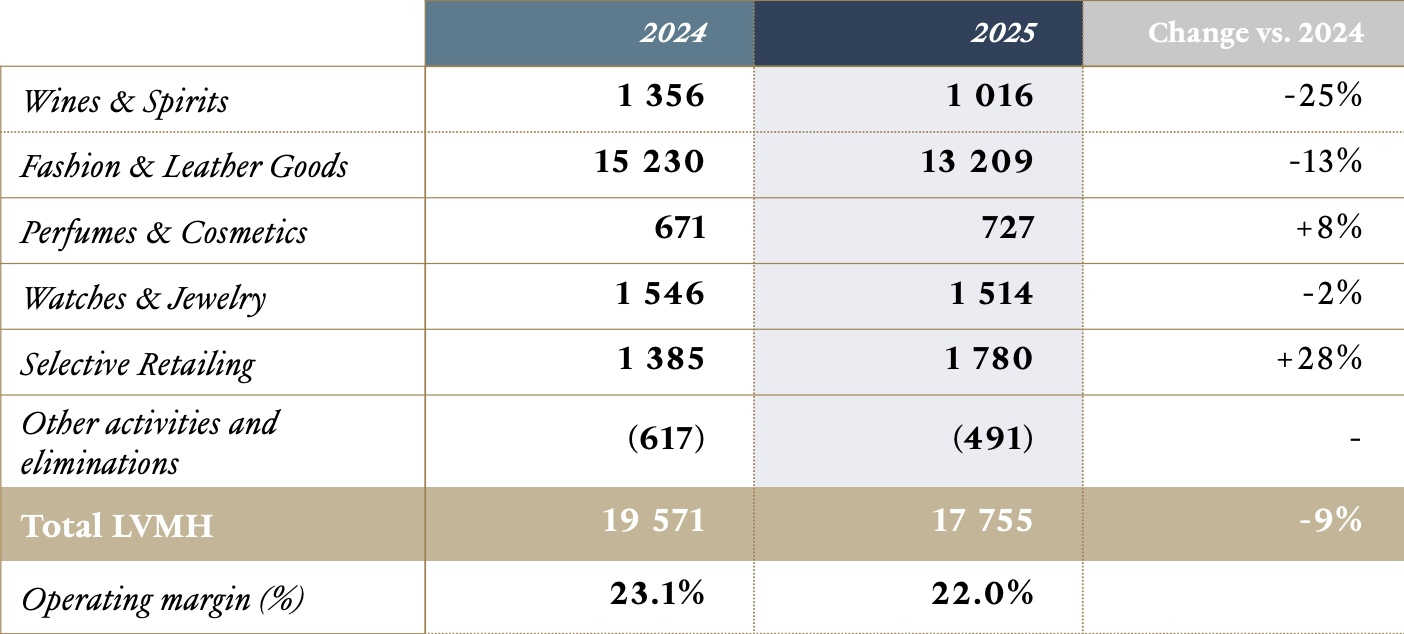

Profit from recurring operations slipped -9% to €17.8 billion, with an operating margin of 22%, with the figures affected by currency fluctuations. The group share of net profit amounted to €10.9 billion, down by -13% year-on-year.

A company statement said LVMH “showed good resilience and maintained its innovative momentum despite a disrupted geopolitical and economic environment”.

Crucially, Asia (outside Japan) showed improvement in sales trends compared to 2024, with a return to growth in the second half of the year. Japan by contrast was down versus 2024, when it posted growth in tourist spending due to the weaker Yen. Among the other key regions, Europe posted a sales decline in the second half of the year and the USA saw growth, led by solid local demand.

By business group, Selective Retailing posted organic revenue growth of +4% in 2025, with profit from recurring operations up +28%.

As reported, China Tourism Group Duty Free is to acquire DFS Group’s travel retail businesses in Hong Kong and Macau and intangible assets in Greater China. The luxury travel retailer is owned by LVMH and DFS Co-Founder Robert Miller. DFS has said it is continuing to assess the future of its non-China operations, following the agreement.

Of DFS performance in the year, LVMH noted, “At DFS, initiatives to streamline operations helped achieve a major improvement in profitability, despite business activity still being held back by prevailing international conditions.”

The group highlighted improved foot traffic in Hong Kong and Macau and a “solid performance” for the DFS Galleria in Okinawa, Japan.

Revenue for Wines & Spirits was down -5% in organic terms compared to 2024 with profit from recurring operations -25%.

LVMH said, “2025 confirmed the slowdown in demand observed since 2023, following several exceptional years. The impact on customers of trade tensions also weighed on the key markets of China and the United States.

“LVMH’s Champagne houses maintained their market share of 22% of all Champagne-appellation shipments, and Provence rosé wines continued to outperform the rosé category worldwide. Revenue for Hennessy Cognac was held back by weaker local demand, mainly due to issues with customs duties in China and the United States.”

Perfumes & Cosmetics showed flat growth in organic terms, while profit from recurring operations was up +8%, bringing the operating margin to 8.9%.

In fragrances, Parfums Christian Dior benefited from the launches of Miss Dior Essence and Dior Homme, while Sauvage remained the world’s best-selling men’s fragrance, noted LVMH. Innovations in makeup (within Forever and Dior Addict) also contributed to the Maison’s performance. Guerlain was buoyed by the latest additions to its Aqua Allegoria and L’Art & La Matière fragrance lines.

Fashion & Leather Goods posted a -5% slide in organic revenues with profit from recurring operations down -13%, mainly affected by unfavourable currency fluctuations. The operating margin remained high at 35%.

Highlights of the year included the launch of La Beauté Louis Vuitton, a new creative universe led by Dame Pat McGrath, and the Maison’s first season as an Official Partner of Formula 1.

Watches & Jewelry recorded organic revenue growth of +3% year-on-year with profit from recurring operations down -2%. Tiffany & Co. continued to renovate its store network and strengthen its product offer, while the store concept inspired by The Landmark in New York continued its global rollout.

LVMH Chairman and CEO Bernard Arnault commented: “Once again in 2025, LVMH demonstrated its solidity and effective strategy upheld by its highly engaged teams. The Group was buoyed by the loyalty and growing demand shown by our local customers.

“This momentum was once again underpinned by the powerful desirability of our brands… and by our ambition of offering our customers extraordinary stores and cultural experiences, as demonstrated by The Louis in Shanghai, our House of Dior stores in a number of cities around the world, and our new Tiffany & Co. locations in Milan and Tokyo.”

He added, “In 2026, in an environment that remains uncertain, our Maisons’ ability to inspire dreams – coupled with the highest levels of vigilance with regard to cost management and our environmental and social commitments – will once again be a decisive asset underscoring our leadership position in the luxury goods market.” ✈