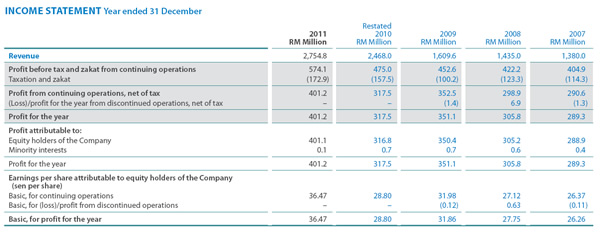

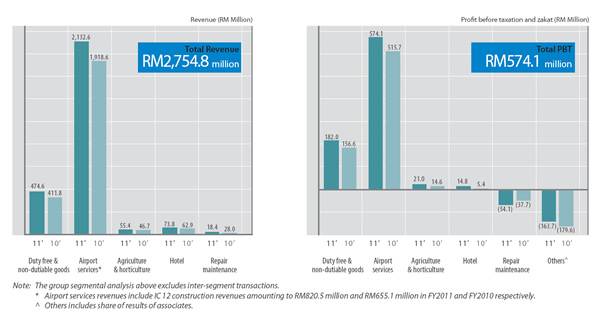

MALAYSIA. Malaysia Airports Holdings Berhad (MAHB) has recorded revenues of RM2,754.8 million (US$900.6 million) for the financial year ended 31 December 2011, representing growth of +11.6% over the previous year. This included double-digit increases in non-aeronautical revenues, and within this of in-house retail revenues (see below).

Earnings before interest, tax, depreciation and amortization (EBITDA) grew +7.8% to RM826.5 million (US$270.2 million). Profit before tax (PBT) stood at RM574.1 million (US$187.7 million), representing an increase of +20.9%.

Stripping out the effects of IC 12 (a new accounting standard, see detail below*), revenues for FY2011 were RM1,934.3 million (US$632.4 million), which was +6.7% higher than the RM1,812.9 million (US$592.7 million) registered in FY2010. PBT for FY2011 was RM535.9 million (US$175.2 million), a growth of +20.3% over FY2010.

Commenting on MAHB’s performance, Managing Director Tan Sri Bashir Ahmad Abdul Majid attributed the increase in operating revenues to stronger results from the airport operations segment, driven by strong air travel demand.

MAHB recorded double-digit passenger growth of +10.7% in FY2011, with a total of 64.0 million passengers passing through MAHB’s 39 airports in Malaysia. Both international and domestic passenger movements registered strong growth at +10.3% and +11.1% respectively. Total passenger movements in flagship gateway Kuala Lumpur International Airport (KLIA) improved by +10.6%, with both KLIA’s Main Terminal Building and KLIA Low Cost Carrier Terminal (LCCT) recording positive growth of +7.6% and +14.3% respectively. All other airports recorded an aggregate growth in total passenger movements of +10.8%.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

MAHB’s non-aeronautical business continued to outperform the aeronautical business by contributing 54.0%, or RM1,045.4 million (US$341.8 million), to the group’s revenue (excluding IC 12 effect). This is in line with the group’s long term plan to further grow this branch of business.

Tan Sri Bashir Ahmad said: “Our non-aeronautical revenues recorded growth of +11.3% to RM897.8 million (US$293.5 million) on the back of improved performance in the retail and rental businesses. MAHB’s own retail business grew by +14.9%, ahead of overall passenger traffic growth of +10.7%, to RM473.3 million (US$154.7 million) in FY2011. This was due to an increase in passenger volume and higher retail spending per passenger.

“Revenues from rental of space, advertising and other commercial segments also grew by +7.5%, to RM424.4 million (US$138.7 million), contributed mainly by the addition of new tenants and upward revision of rental charged to some retail tenants effective December 2010, higher tenant occupancy rate in 2011 and increased carpark revenue due to higher pax movements and larger number of airport visitors,” Tan Sri Bashir Ahmad added.

The non-aeronautical revenue is broadly derived from commercial activities in the airport operations business, as well as the non-airport operations business. Commercial activities in the airport operations business comprises revenue from lease of commercial spaces (rental), operations of duty free and non-duty free outlets, management of food & beverage outlets, management and operations of airport parking facilities, advertising business, the Airside Transit Hotel and the Free Commercial Zone at KLIA. The non-airport operations business includes revenue derived from Pan Pacific KLIA hotel operations, agriculture and horticulture activities, project and repair maintenance services and other activities.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

Malaysia Airports Niaga Sdn Bhd, the retail arm of MAHB, opened seven new outlets at the new wing of Kota Kinabalu International Airport and another at Langkawi International Airport in the year. The company said it had also improved its offering for the core product categories, expanded its food & beverage business, consolidated its focus on more relevant fashion brands and embarked on strategic marketing initiatives to boost revenue for the group.

MAHB-owned Eraman was the first retailer nationwide to launch the Gucci Guilty Intense fragrance, enjoying a two-week head start in the market. In addition, the Food & Beverage Division expanded its business operations into Langkawi International Airport when its franchised outlet for Marrybrown was opened at the airport in October 2011. The division also rolled out its in-house brand, the Apron series, comprising Apron Café, Apron Bites and Apron Marche.

This year, a number of new outlets will take shape at KLIA’s Contact Pier and Satellite buildings, as well as at Penang International Airport and Kota Kinabalu International Airport. These outlets will comprise offerings from all product categories, based not only on stand-alone but also hybrid concepts. Some of these will be exclusive, MAHB said.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

“Despite the ongoing global economic crisis, the political upheavals in North Africa and Middle East, and the natural disasters in North Asia and Oceania, the travel and tourism industry remained robust for Malaysia. As an airport operator, MAHB has been enjoying steady growth from carriers. The continuous growth by the full service carriers and low cost carriers had significantly contributed towards the strong passenger throughput at our airports in 2011. The travel and tourism industry outlook for year 2012 remains positive, MAHB has projected an overall passenger movement growth of +6.6% based on the expectation that GDP growth in Malaysia and Asia Pacific region remains robust.

“Notwithstanding the recent downward revision in 2012 global GDP forecast by International Monetary Fund and reduction in Malaysia GDP forecast, we remain optimistic with our 2012 forecast; this is evidenced by our stable past performance, whereby we have been able to sustain growth of +5% to +7% even during relatively poor economic conditions in the past. MAHB through its marketing efforts have been aggressively pursuing airlines globally through its various marketing initiatives.

“Malaysia is excellently placed in the growth area of Asia Pacific generally and Southeast Asia specifically to be able to capitalise on the catchment area of 400 million people who live less than 2.5 hours from Kuala Lumpur. KLIA as Malaysia’s main gateway and other regional international airports that are operated by MAHB are well positioned to be key hubs for the Southeast Asian region,” Tan Sri Bashir Ahmad concluded.

*NOTE: IC Interpretation 12 (IC 12) is a new accounting treatment for certain service agreements in Malaysia effective from 1 January 2011. In this case, MAHB re-states the impact of construction revenues and costs in accordance with works on Klia2 and Penang International Airport, which are public sector infrastructure assets and services currently being undertaken by MAHB. In FY2011 and FY2010, MAHB recognised the construction revenues and costs in relation to the aforesaid projects amounting to RM820.5 million (US$268.2 million) and RM782.3 million (US$255.8 million) respectively.

[houseAd2]