MALAYSIA. Malaysia Airports Holdings Berhad (MAHB) has reported an -85.8% drop in sales year-on-year in the first half of 2021 to RM60.5 million (US$14.34 million).

The steep fall in the face of low air traffic numbers due to COVID-19 travel restrictions was delivered during a media briefing presented by MAHB Senior General Manager, Commercial Services Hani Ezra Hussin.

MAHB manages 39 airports across Malaysia of which five are international, 16 are domestic and 18 are STOLPorts (short take-off and landing airports). It also manages Sabiha Gökçen International Airport in Istanbul, Turkey.

Sales at the number one airport managed by MAHB, Kuala Lumpur International Airport (KLIA), fell by -89.1% to RM37.6 million (US$8.91 million) from RM345.9 million (US$82 million) during the corresponding period last year.

The low sales numbers reflected the collapse in passenger traffic across MAHB’s airports during the reporting period. Total passenger volumes in Malaysian airports fell -84.6% to three million during the period, from 19.2 million in H1 2020.

Passenger volume at KLIA slumped -90.3% to just 1.1 million compared to 11 million in the first half of 2020.

Hussin reported that 278 tenants across the airports represented by MAHB benefited from various forms of fee relief, with rental rebates of a minimum -50%.

Two-year contracts extensions have been offered to those tenants upon settlement of 2020 rentals, with an additional two years extension for newly-awarded contracts to invest in outlets.

A new overarching rental model for the tenants has been introduced, which is tied to passenger volumes.

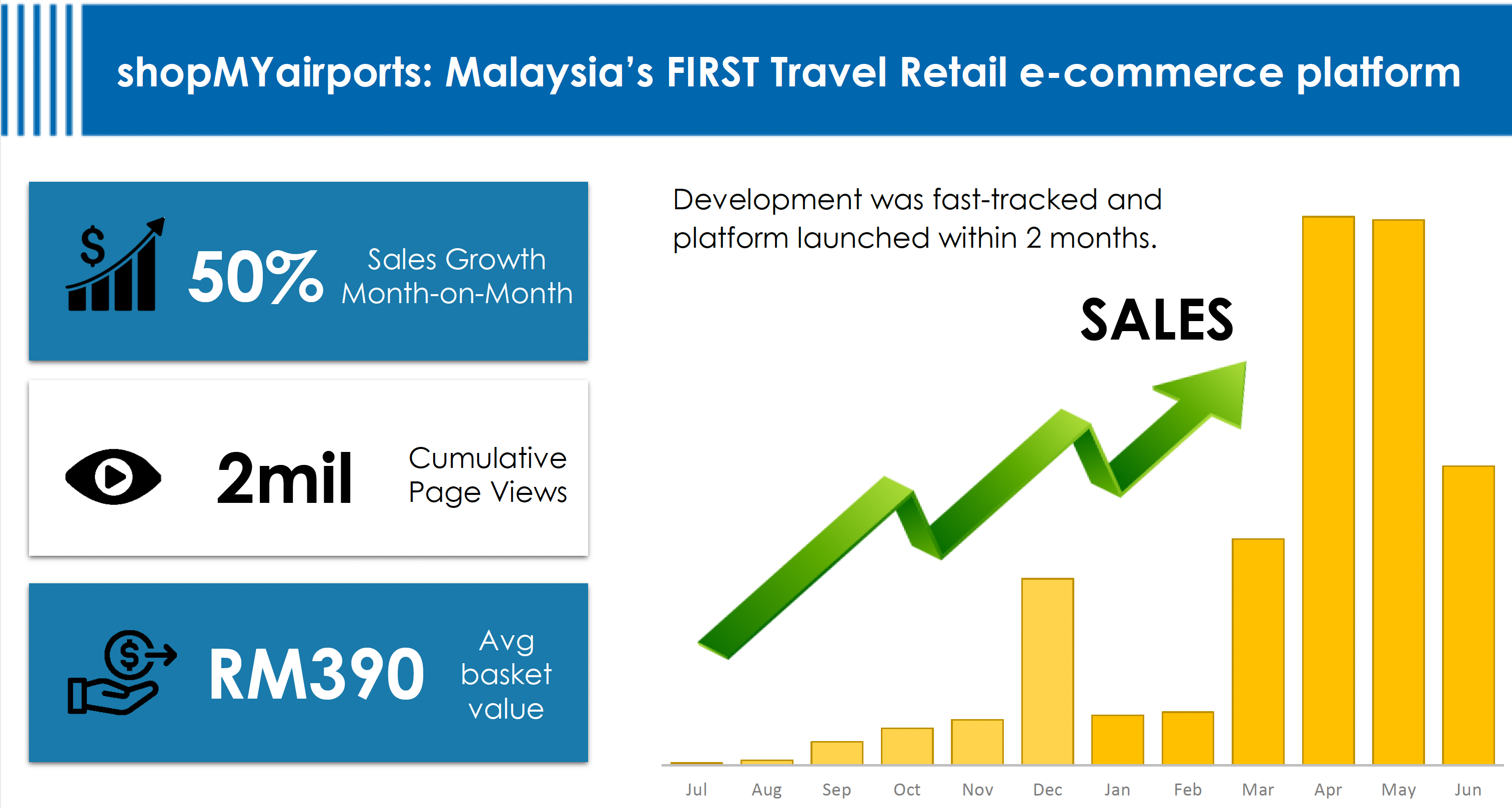

To offset falling airport retail incomes, in July 2021 MAHB introduced shopMYairports as an alternative sales channel, Malaysia’s first travel retail ecommerce platform.

Since its introduction, the platform has achieved an average +50% month-on-month growth, attracting more than two million page views. The average basket value to date has been RM390 (US$92.44).

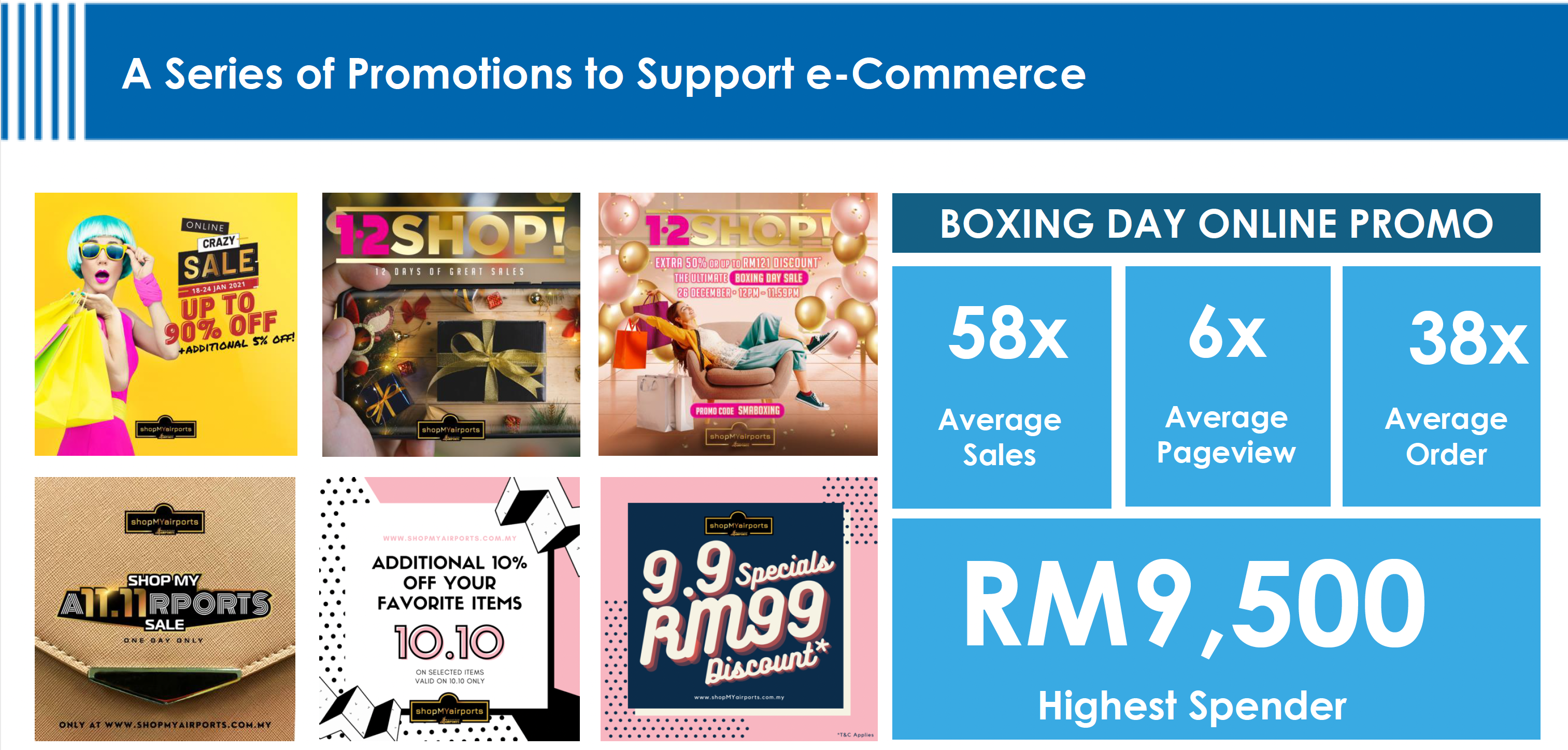

A range of online promotions on Boxing Day last year achieved sales 58 times greater than average daily ecommerce revenues up to that point.

KLIA has staged three in-airport ‘KLIA Crazy Sales’ during the pandemic period, enabling duty free retailers to sell their stocks as duty paid. The significant footfall attracted to the airport for these events also enabled KLIA F&B operators to benefit from significantly increased sales.

The three special sales events brought in RM7.6 (US$1.8 million) to airport retailers.

Keep an eye out for an interview with MAHB Senior General Manager, Commercial Services Hani Ezra Hussin on our web site in the coming days.