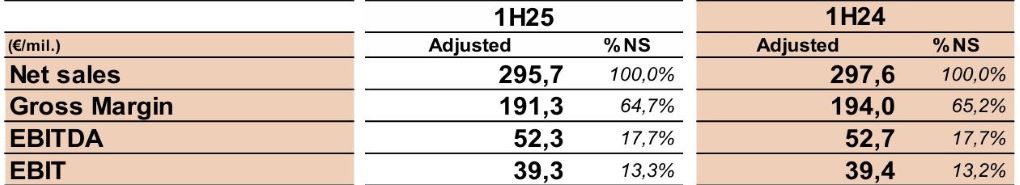

Italian eyewear house Marcolin reported a subdued revenue performance in the first half of the year, with net sales up +0.3% at constant exchange rates to €295.7 million (US$337.7 million), attributed to ongoing external headwinds.

Adjusted EBITDA stood at €52.3 million (US$59.78 million), accounting for 17.7% of net sales, in line with last year’s margin despite a challenging macroeconomic environment.

EMEA led regional performance with net sales of €161.3 million (US$184.3 million), growing +7.3% at current and +7.0% at constant exchange rates. The Americas followed with €98.7 million (US$112.8 million), down -7.4% at current and -4.6% at constant exchange rates.

Asia continued to represent a high-potential market for the group, despite a temporary slowdown driven by sourcing schedule shifts among large distributors recovering from the previous quarter.

In line with its operational performance, Marcolin’s adjusted net financial position of €323.1 million (US$369.4 million) remained consistent with the figure recorded in 31 December 2024, reflecting a balance between strong operating cash flow and seasonal working capital absorption.

The first half of the year was marked by the renewal of key licensing agreements with Max Mara, Guess, adidas and GANT, alongside a new exclusive partnership with rag & bone. ✈