CHINA. The Moodie Davitt Report Founder & Chairman Martin Moodie gave the closing keynote address during the fifth annual Luxury Symposium event hosted by the French Chamber today (21 April) in Hong Kong which was broadcast worldwide.

The Luxury Symposium annually gathers over 200 high-level speakers and participants, presenting thought-provoking talks and discussion on the state of the luxury industry. This year, the event embraced a virtual format, hosting a half-day virtual conference which welcomed leading luxury industry figures from around the world.

“Hainan might have been the sector’s key beneficiary in 2020 thanks to the global travel restrictions but having claimed a place at travel retail’s top table, there is no chance of it relinquishing that position”

Moodie’s presentation, entitled ‘Hainan — The Lighthouse of Travel Retail’, highlighted the growing importance of Hainan to the global travel retail industry amid the context of the COVID-19 crisis. It also placed particular emphasis on the island’s enhanced offshore duty free shopping policy, the related liberalisation of allowances across categories and the recent proliferation of duty free licences.

It also underscored Hainan’s crucial role in the Chinese government’s dual-cycle approach to maximising domestic consumption and repatriating spend by Chinese travellers abroad.

Moodie began, “I’ve called my presentation today ‘Hainan – The Lighthouse of Travel Retail’ and I think that figurative allusion is a pretty good description of the role that the Chinese island province has played in what has otherwise been a very dark, very stormy, very troubled travel retail channel since early on in the pandemic.

“That’s an important global context, for the events of 2020 and indeed early 2021 have elevated Hainan’s importance within a travel retail channel that had hitherto been a star turn for many of the world’s great brands across categories such as luxury, beauty and wines & spirits in recent years. A dual star turn really, in that travel retail serves as a window to the world, an international showcase, as well as a very valuable direct revenue and profit generator.”

Since its introduction in September 2011, Hainan’s offshore duty free business had grown into a US$5 billion channel by the end of 2020, Moodie said. Even after experiencing a -22% decline in visitor numbers because of COVID-19, sales rose by +127% last year and the growth is set to continue. UBS projects a compound annual growth of +40% from 2019-2025, Moodie noted.

He said that Hainan’s allure as a shopping paradise had been greatly enhanced by the 1 July 2020 enhancement of the offshore duty free policy, which tripled the annual allowance to RMB100,00 (US$15,300). The policy also extended the number of categories to include cell phones and alcohol, removed the single purchase value constraint and raised the limit on cosmetic SKUs from 12 to 30.

“The results were startling,” Moodie said. “While the traditional duty free hotspots suffered, with South Korea down by -38% and pretty much left with just a wholesale Daigou business and Dubai Duty Free declining -67%, Hainan smouldered and then burst into flame.

“While many of the media headlines focus on the extraordinary top-line growth… the relentless rise of the island’s offshore duty free sector – and the big picture thinking behind it – warrants more serious examination than simply being viewed as some temporary 21st century travel retail El Dorado. Hainan is here to stay.”

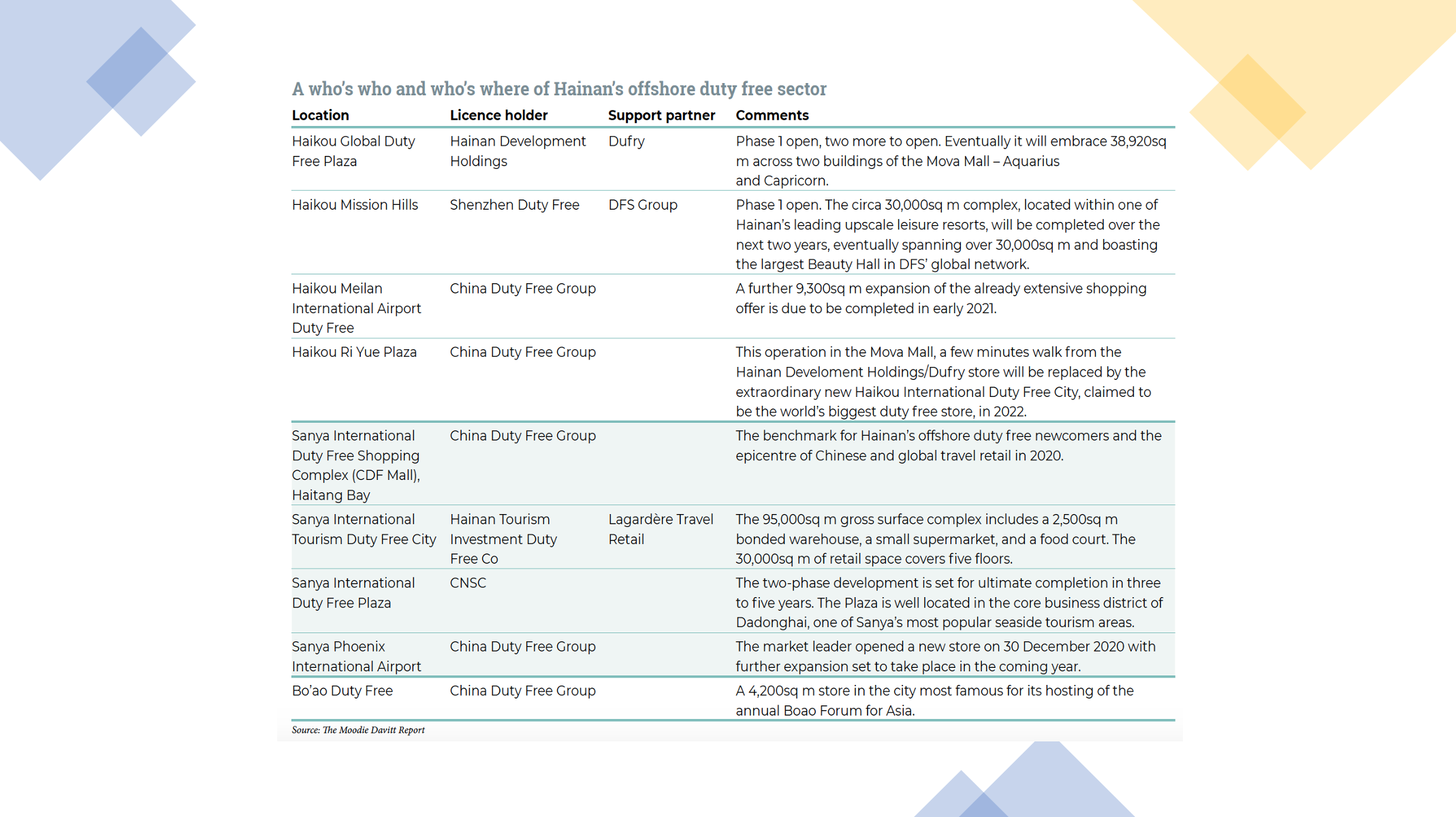

Moodie also painted a picture of Hainan’s rapidly-evolving landscape as an ‘industry within an industry’ and outlined the latest policy developments and key players. The line-up includes state-controlled giants such China Duty Free Group and CNSC; plus Shenzhen Duty Free and local Hainan government-controlled players in varying degrees of partnership with international travel retailers such as DFS Group, Dufry and Lagardère Travel Retail.

“The enhanced duty free shopping policy wasn’t the only pro-business, pro-consumer policy introduced. It’s part of a wave that is set to swell further in 2021,” he added. “This February, for example, the authorities announced that visitors to the island could have their goods posted back to the Mainland instead of having to carry them.

“Similarly, Hainanese residents travelling to the Mainland could pick up their purchases on return, instead of having to carry them on the journey. Another key stimulus came with the issuing of licences to several newcomers, resulting in a proliferation of retailers in both the capital Haikou in the north and the shopping heartland of Sanya to the south.”

He added, “The authorities are also set to introduce a Residents’ duty free policy, which will allow a whole range of shops to sell an array of goods – as yet unspecified – to local residents who will not have to leave the island, subject to a certain allowance. Similarly, we expect the main Hainan offshore duty free allowance to be enhanced in the relative near-term and several market insiders believe that the increase will be considerable.”

Moodie also recapped some of the latest project developments in Hainan, citing the Haikou Mission Hills project and Haikou International Duty Free City as key examples. Commenting on the inaugural China International Consumer Products Expo, set for 7-10 May, he said: “That event has attracted extraordinary support, especially given the global pandemic. At a time when the MICE industry is on its knees worldwide, the Hainan Expo will be attended by 630 overseas companies and over 1,200 brands from 69 countries, a result that really underlines the growing importance of Hainan to a whole range of industries, including luxury.”

He continued by underlining the role of offshore duty free in the island’s ambitious Hainan Free Trade Port programme, which will see an island-wide Free Trade Port system focused on trade investment and liberalisation by 2025.

He said, “The Free Trade Port masterplan epitomises President Xi’s ‘dual-cycle’ concept, which lies at the heart of China’s current development policies. The masterplan, revealed amid great fanfare on 1 June 2020, meant that “China’s door is opening wider and wider, and Hainan is becoming the new highland of China’s reform and opening up”, Moodie said, citing the words of Hainan Provincial Bureau of International Economic Development Director Han Shengjian.

‘Dual Cycle’ refers to a combination of ‘internal circulation’ (domestic production, distribution and consumption) and ‘external circulation’. Under the strategy, domestic development takes priority, reinforced by international development and contact.

According to Moodie, authorities expect the offshore business in Hainan to rise to RMB60 billion (US$9.3 billion) this year and climb to at least US$15.5 billion in 2022. Recently, Hainan Free Trade Port suggested on its WeChat Official Account that sales could climb to US$46.5 billion by the end of 2025 in line with the province’s 14th Five-Year Plan.

“Put those numbers in the context of pre-COVID record results for the South Korean duty free market in 2019 (at US$21.3 billion the world’s biggest) and you realise the sheer scale of the opportunity and why so many brand companies are putting as many eggs in the Hainan basket as they can fit,” he added. “Last year the Korean duty free was worth US$13.2 billion, down -38%. If a similar decline happens this year – and let us hope it does not – Hainan would overtake Korea as the world’s biggest duty free market.”

Commenting on Hainan’s already spectacular performance this year, Moodie said. “2021 is off to a flying start. Despite the softening impact of the northern China COVID-19 outbreaks on visitor arrivals (-30%), the seven-day Chinese New Year holiday period in February generated RMB1.5 billion (US$231.9 million) in revenue — an approximate doubling of sales from the equivalent holiday period in the benchmark pre-COVID year of 2019.

“Hainan’s overall duty free market sales grew +22% quarter-on-quarter in Q1 to RMB13.9 billion (US$2.13 billion), 90% or so of it captured by China Duty Free Group according to Goldman Sachs.”

Proliferation must be matched by professionalism

Moodie also discussed the impact of new players on China Duty Free Group’s long-term dominance in Hainan. “Despite the flurry of new competitors introduced in late December and early January, China Duty Free Group posted a +329% revenue increase year-on-year in Hainan to RMB12.8 billion (US$1.96 billon) for Q1, up +12% quarter-on-quarter.

“Human resources and training are a massive issue in Hainan today. Brands need nurturing, tender loving care in terms of merchandising, pricing, brand image and service. Work needs to be done, and expert support and advice sought.”

“The cake is clearly going to grow but without cannibalising China Duty Free Group’s volumes and perhaps not even too much of its share. As Goldman Sachs noted recently, CDFG carries a lot more SKUs and product variety. In beauty, for example, it sells over 7,000 items, vs. 300-400 for other stores. And Haitang Bay is a destination in itself.

“How the remainder of the cake will be sliced will depend on a combination of the respective retailers’ brand pulling power and support, location, marketing and communication professionalism, and – importantly – differentiation.

“The challenge for all the newcomers is to convince luxury brands to support them and beauty houses and others to create meaningful personalised presences. Neither is a given. Many brand companies are wary of heavy discounting and are adopting a wait and see attitude before committing to the new arrivals.

“Human resources and training are a massive issue in Hainan today. Brands need nurturing, tender loving care in terms of merchandising, pricing, brand image and service. Work needs to be done, and expert support and advice sought.”

While some of luxury’s biggest players have yet to enter Hainan, Moodie says it is only a matter of timing and of finding the right opportunities, even if they are outside the main duty free licence holders. “There’s a lot of tourism infrastructure development going on and plenty of opportunities for such brands to choose their target – and their moment,” he said.

Moodie also cited CDFG’s rising luxury credentials. He highlighted the retailer’s recent luxury partnership with Richemont and Foundation de La Haute Horlogerie to host the first-ever Watches & Wonders Sanya in late 2020. The event featured a roll call of high-end watch names from Cartier to IWC, Panerai to Piaget, he noted. CDFG is also hosting its first-ever ‘Watch Carnival’ at five different duty free stores in Hainan, again featuring great names in watchmaking.

Finally, Moodie offered his insights on how Hainan’s offshore duty free market will evolve when Chinese shoppers can travel internationally again. He said: “While any recovery of international travel will change the relative revenue share of Hainan to Chinese and global travel retail, it is unlikely to suppress the volume rise.

“Hainan might have been the sector’s key beneficiary in 2020 thanks to the global travel restrictions but having claimed a place at travel retail’s top table, there is no chance of it relinquishing that position.”

Going back to China’s ‘dual-cycle’ approach. Moodie says that Hainan’s position as shopping paradise is stable as it complements the Chinese government’s goal to maximise domestic consumption. He said, “Beijing’s priority, fundamental to the ‘dual cycle’ concept is to ensure that Chinese spending (as well as production and distribution) benefits Chinese hands. Expect more pro-business, pro-consumer policies, not just in Hainan but on the Mainland too.

“The mantra is clear: capture that spend pre-departure, on- and post arrival, and in domestic locations. The thinking is highly coordinated, long-term and strategic. And Hainan is its golden light.”

Note: Every fortnight The Moodie Davitt Report publishes Hainan Curated, in association with Foreo, a curated selection of all recent stories from the offshore duty free sector. Click here to subscribe free of charge and to view all back issues.