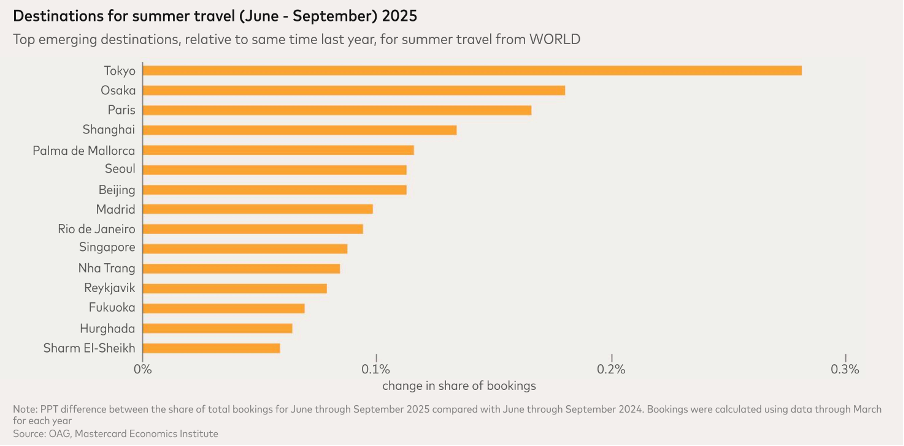

INTERNATIONAL. Tokyo and Osaka are the top two trending summer travel destinations according to a newly released Travel Trends 2025 report on consumer spending in the travel economy from the Mastercard Economics Institute (MEI).

Analysing OAG data on flight bookings through March for travel from June to September and comparing each destination’s current share to its 2024 results, MEI identified the 15 highest-trending destinations (those with the largest relative gains).

The recent Japanese Yen depreciation may have contributed to the rise in Tokyo and Osaka’s popularity among value-conscious travellers. Buoyed by a weaker Yen, Tokyo became the most visited city in the world in 2024 displacing Bangkok, which had held the top spot for the past decade.

Other destinations on the list highlight the importance of value, particularly in the Asia Pacific region. It also underlined the appeal of beach towns worldwide such as Mallorca, Nha Trang and Rio de Janeiro, said MEI. Nha Trang in Vietnam makes its debut in the top 15 this year.

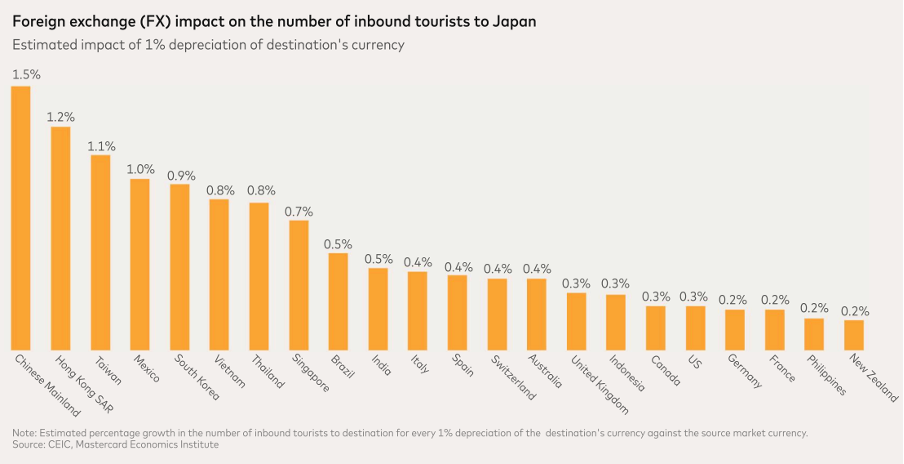

The Travel Trends 2025 report also provides insight into how currency swings can impact travel decisions, especially during the summer months.

MEI analysed bilateral exchange rate movements and tourist arrivals from 2000 to 2024 across 24 major tourism markets.

The findings revealed that a -1% depreciation of the Yen against the Chinese Yuan is associated with a +1.5% increase in tourists from the Chinese Mainland. In contrast, the number of visitors from New Zealand and the USA rose only around +0.2% in response to the same degree of depreciation relative to their currencies.

In 2024, Singaporean visitor numbers to Japan hit record highs despite rises in airfare and hotel prices, as the Singapore Dollar (SGD) rose +40% vs. JPY.

MEI’s report found that travellers from Asia are more sensitive to exchange rate shifts, as such movements can affect their purchasing power during international travel, a prominent element in their travel planning.

This responsiveness highlights the importance of pricing, promotional offers and real-time exchange rate tracking in destination marketing and retail pricing strategies.

The report revealed a shift towards more intra-regional business travel among those from Chinese Mainland, France, Germany and Singapore. UK business travellers are spending a growing share of their travel budgets in Eastern Europe, the Middle East and Africa, and Latin America and the Caribbean.

Japan’s business traveller spend has moved towards Europe, while Brazil’s has shifted towards Asia Pacific, Canada and the USA.

MEI analysed Mastercard’s transaction data and determined the mix in each region of in-person corporate-card cross-border spending by issuing country.

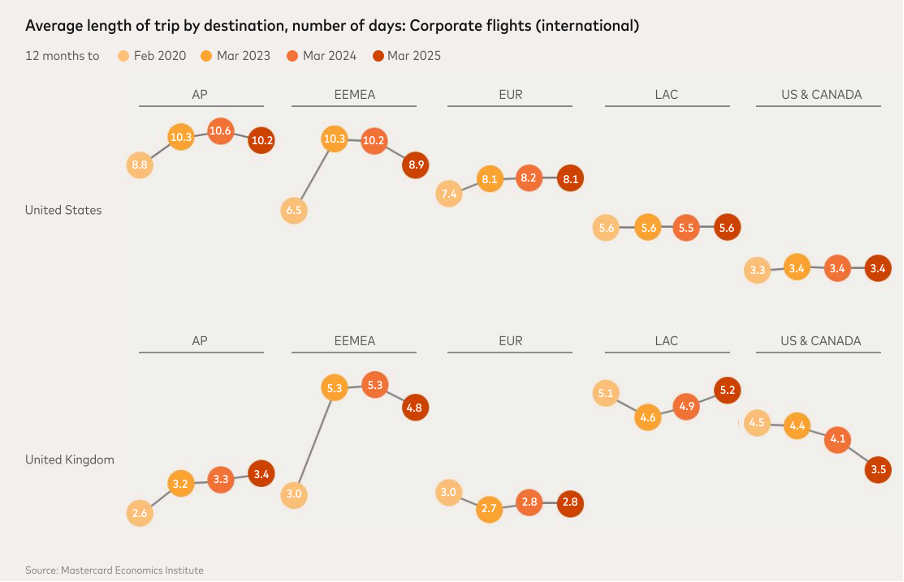

A further finding revealed business travellers are staying for longer on international trips. MEI’s analysis of corporate flight bookings originating from the USA and UK suggests the average business trip lasts longer now than it did prior to the pandemic.

From February 2019 to February 2020, the average trip to Asia Pacific for US business travellers lasted 8.8 days, increasing to 10.2 days in 2025. Similarly, the average length of a business trip from the USA to Europe increased from 7.4 to 8.1 days.

Corporate travel from the UK also conforms to this trend, however trips to Canada and the USA shortened between 2020 and 2025.

The full Mastercard Economics Institute Travel Trends 2025 Report can be accessed here.