CHINA. A slower-than-expected demand recovery in China’s beauty market, especially in prestige cosmetics, allied to “lingering headwinds” in the Hainan and South Korean travel retail sectors have marked Q3 calendar year performance among the sector’s big players. Those are among the key findings in a new Goldman Sachs Investment Research Report.

CHINA. A slower-than-expected demand recovery in China’s beauty market, especially in prestige cosmetics, allied to “lingering headwinds” in the Hainan and South Korean travel retail sectors have marked Q3 calendar year performance among the sector’s big players. Those are among the key findings in a new Goldman Sachs Investment Research Report.

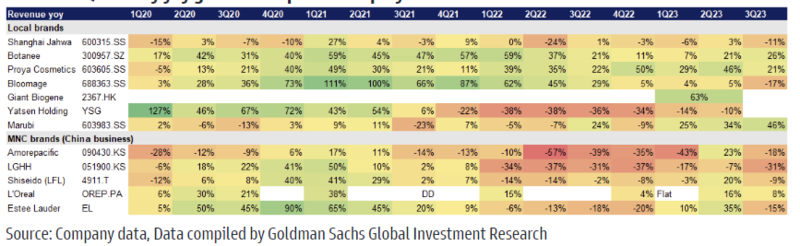

“Q3 is an off-peak season for cosmetics spending with a relatively soft cosmetics demand recovery, and most of the leading MNC [multi-national corporation] brands saw a growth deceleration compared to 2Q23, similar to what we have seen for local brands,” the firm wrote.

“Specifically, the prestige segment has seen a challenging backdrop amidst the trade down/bi-polarisation trend, and players including Estée Lauder/LG H&H/Amorepacific that have meaningful exposure to prestige cosmetics have seen pressure in the quarter.”

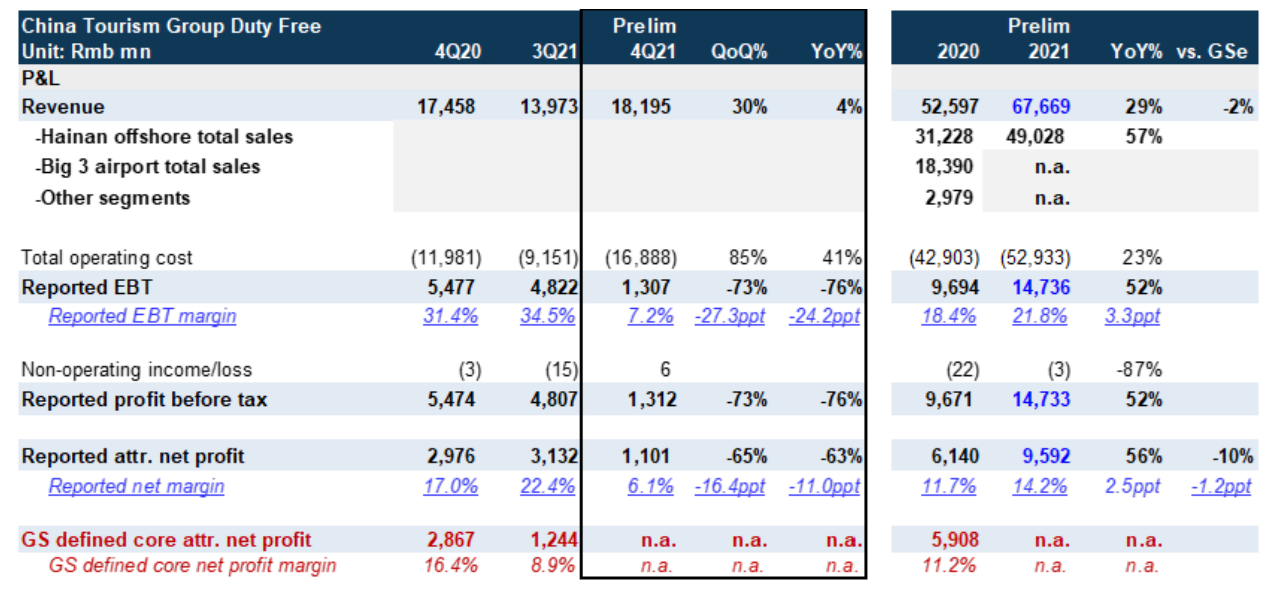

The report highlighted “unfavourable policies” in South Korea and Hainan (i.e. rebate cuts in the Republic and a tightened approach to daigou trading in Hainan).

“Traffic has been recovering, though on a slower-than-expected pace, and some companies are delaying their expectation for a stronger recovery towards next year,” Goldman Sachs commented. “Meanwhile, players including Shiseido and Estée Lauder also noted conversion rate/per capita purchase tracking below the pre-COVID level.”

The report noted a performance divergence among the leading beauty players, with outperformance from L’Oréal and L’Occitane, vs. growth pressure from The Estée Lauder Companies and Korean/Japanese brands (the latter negatively impacted by the recent nuclear water issue).

“Brands seem to have been facing a dilemma between growth and margin – for L’Occitane, which had solid growth within the quarter, management noted that additional marketing investment was required to support the performance; while for players like Amorepacific, which views profitability as a priority, China sales continued to experience a sharp decline,” Goldman Sachs said.

“We expect the wide divergence among brands to continue amid more normalised market growth, and we believe only players that have comprehensive onshore capacity in terms of R&D, operations, marketing and sales channel can deliver sustainable outperformance.”

Interestingly, the firm’s top picks within its China cosmetics coverage remain Proya (the Hangzhou company founded by Hou Juncheng in 2006) and Hong Kong-listed Giant.

“Some brands may benefit from customers’ rising preference for value-for-money/functional products. For instance, Proya notably outperformed during this Singles Day, and exceeded MNC leaders to become No.1 in cosmetics on Tmall/Tik Tok; Giant, with its enhanced ingredient focus (recombinant collagen), also delivered a strong performance during the shopping festival,” the report said. ✈

Recent Moodie Davitt coverage of key beauty houses’ performances

Asia travel retail inventory issues and muted China recovery hit The Estée Lauder Companies in Q1

“Stellar” Sol de Janeiro helps L’OCCITANE Group deliver strong first-half results

China and Asia travel retail pressures hit Amorepacific’s Q3 revenues