Nestlé International Travel Retail (NITR) has revealed its updated recovery strategy, built around delighting consumers and focusing on the business fundamentals, as global travel slowly reopens. NITR also revealed its upcoming product innovations and underscored its big ‘regeneration’ mission to go beyond sustainability.

NITR is doubling down on trusted confectionery brands, leading with regeneration, leveraging opportunities in the non-confectionery category and engaging with consumers offline and online.

KitKat

KitKat has proven to be resilient brand within the travel retail channel. According to the company, KitKat is currently at 60% of 2019 sales levels this year, a figure that will increase to almost 80% by 2022, it said.

The brand is launching the travel retail exclusive KitKat Senses Roasted Almond flavour in May 2022. The new expression, which offers ten fingers of classic crispy wafers coated in smooth milk chocolate and crunchy roasted almonds, builds on the success of the Senses range.

The brand is also launching two new KitKat Pops flavours: Hazelnut & Cocoa Nibs and Peanut Corn. The two new expressions are available in border stores from 1 March 2022 and builds on the success of the KitKat Pop Chocs. KitKat Pops is also undergoing a line redesign.

The two KitKat releases aim to inspire consumers to live their breaks and will be supported by online and in-store promotions. This includes CGI, engaging ecommerce content in multiple languages and the continued use of the KitKat Bus, under the Live Your Break campaign umbrella.

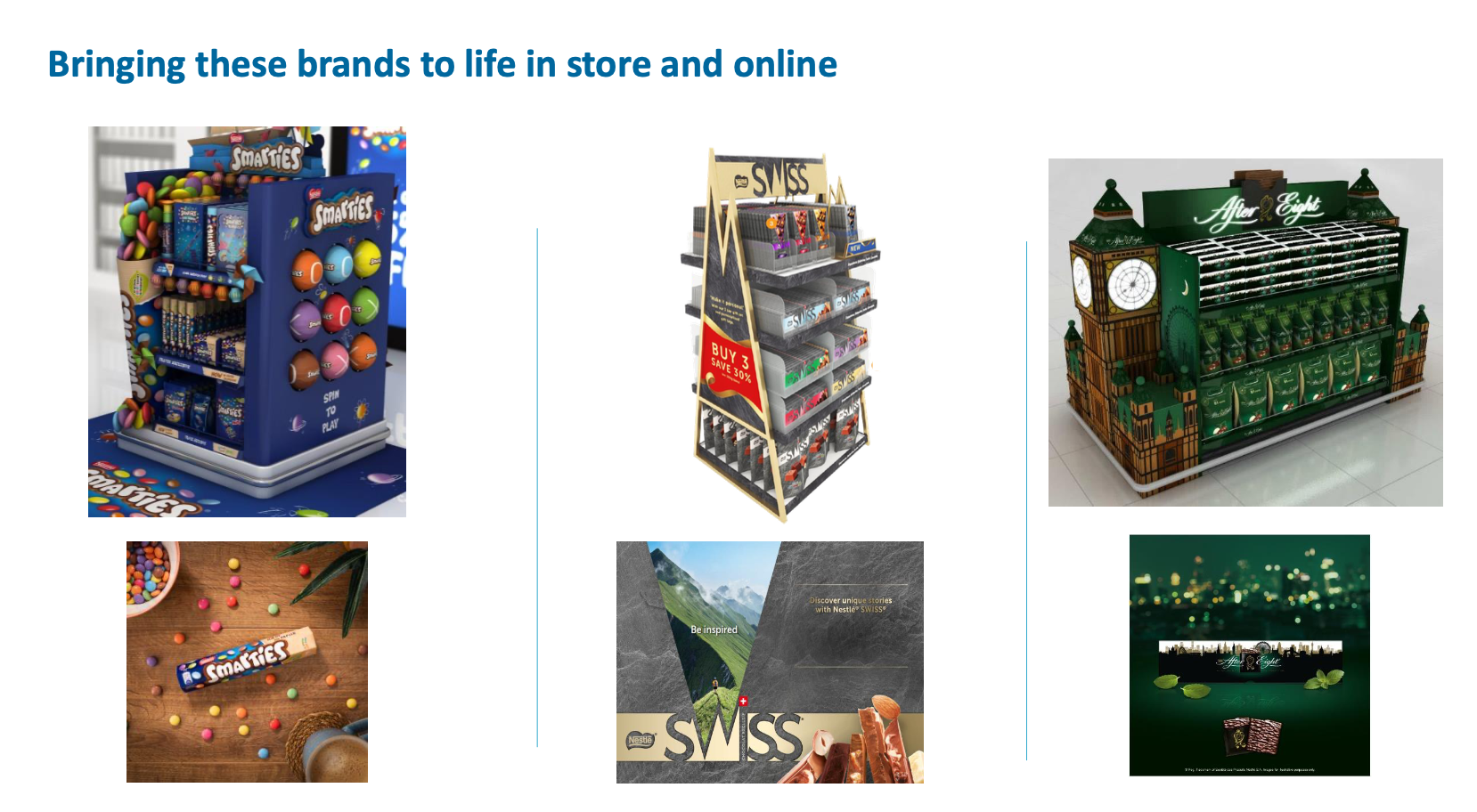

Smarties

Smarties became the first global confectionery brand to completely switch to recyclable paper packaging. The brand won a sustainability hero award and is currently performing at 51% of 2019 sales levels, said NITR.

The brand is launching new Smarties Activities Kits in November 2021, building on the ethos of its ‘Learn Through Play’ programme. The kits, designed to inspire colourful creativity and imaginative fun, include puzzles, stickers, eight coloured pencils and four Smarties hexatubes – all contained in a sustainable tin.

Swiss

NITR is optimising the travel retail-exclusive Swiss portfolio by scaling up the Indulgent Tablets range to cater to more self-treat snacking occasions rather than gifting. It is putting greater emphasis on the indulgent 170g tablets range, 300g tablets and chunk bags.

After Eight

After Eight is expected to reach 64% of 2019 sales levels by 2022. The brand is launching the limited edition Mojito Cocktail Mint flavour in March 2022, which is targeted to young adults.

Commenting on NITR’s non-confectionery priorities, NITR Marketing Manager Tamara Spada said: “We believe it is vital to support category growth beyond confectionery. Our research shows that there are significant untapped opportunities for trusted brands such as Nescafé and Nido in greater travel retail, while illuma has a specific Chinese target.”

Nescafé

As part of NITR’s strategy to delight consumers beyond the confectionery category, Nescafé is launching the Gold Roastery Collection. The new line offers two distinct flavour profiles, Rich & Intense and Smooth & Delicate.

Both flavours were developed to appeal to shopper taste preferences and will launch in April 2022 with a limited global distribution. Rich & Intense offers powerful notes blended with smooth milk chocolate and roasted almond, while Smooth & Delicate offers rich caramel and toasted biscuit notes. Both expressions come in 100% plastic-free 95g packaging.

Spada said: “We know that there are still unfulfilled consumer needs within the travel retail coffee market. Taste is the top priority for shoppers when they make coffee purchases, yet 77% of instant coffee offers don’t satisfy all shopper taste preferences,” she said.

According to NITR, Nescafé has enjoyed triple-digit growth in travel retail, despite the pandemic, particularly in non-airport channels.

Nido

Globally trusted milk brand Nido will be supported by attractive in-store points of sale. The brand is currently available in more than 50 countries and will be offered as a complete portfolio of products to address the nutritional needs of growing families. The brand has been traditionally successful in the Middle East and Africa.

Illuma

Wyeth’s super premium infant formula brand Illuma will be showcased in Asia Pacific and Middle East travel retail. Illuma was developed to meet the uncompromising standards of Chinese mothers. It blends human affinity technology with advanced ingredients.

With NITR adapting its approach to meet the changing landscapes of travel retail, General Manager Stewart Dryburgh shared his insights on how the confectionery company is delighting consumers, focusing on fundamentals and contributing to category growth beyond confectionery.

He also previewed NITR’s big regeneration mission and how Nestlé is going beyond sustainability to protect, renew and restore the planet.

The Moodie Davitt Report: What is your overall view on the recovery of the confectionery category in travel retail? What strategies is NITR adopting to help drive that recovery?

Stewart Dryburgh: Although traffic is still well down on 2019, passenger traffic will recover and we’re already seeing increases in footfall and average spend per head where consumers are able to celebrate their freedom. We foresee growth accelerating through 2022 but, mindful of ever-increasing ecommerce, our biggest challenge remains ‘how do we continue to drive footfall and spend?’. The answer lies in delighting consumers with a portfolio cognisant of what’s important to them – and in particular this includes sustainable offerings and self-treat products.

How is Nestlé ensuring a sustainable supply chain amid the current state of the world

Fundamentals are the less sexy part of the presentation as it covers what’s bubbling underneath the surface. Ensuring supply is a big fight and we now must book container ships far in advance.

The critical thing is having good quality forecasting. That’s difficult to achieve in the variable world were in right now – where you never know when one government will shut down or not. However, if your forecast is accurate, you can meet the demand. The problem comes when you have fluctuations in the forecast. It’s like wearing a jacket that’s too tight and you don’t have enough product to meet demand on time or end up with too much volume stuck in a container that can’t travel.

Close working relationships with retail partners is key, as well as putting the right range in the right location. We discovered that confectionery consumption shifted to more self-treat purchase occasions rather than gifting and so we are adapting our offer to meet that. For example, our KitKat innovations are more snacking, self-treat oriented. We also learned that border stores and duty free shops can help drive our bottom line.

Prudent investment is another fundamental we are focusing on. We overcame the difficulties of last year and survived. However, there was also an over-optimism when it came to recovery too – so it’s all about having the foresight to see a certain trajectory and invest in the right way.

Let’s talk about the shift away from gifting more self-treat in confectionery consumption. How has this shift impacted your product strategy? Is this a temporary change – or a more long-term shift in the confectionery category?

It’s a temporary change. Long-haul travel and business travel will return and so gifting will come back. In the meantime, snacking and sharing is more fundamental to what’s happening out there today.

The non-confectionery category is also showing promise, particularly in non-airport channels. Do you see NITR placing more importance on non-confectionery product categories in the future?

The non-confectionery category has been critical for us in the last 18 months. Non-confectionery, especially in non-airport environments has been super important for us. We were already bringing coffee in Cannes in 2019 and we’re seeing big opportunities here.

While the airport business has stalled due to the crisis, the impact has not been the same with border stores and duty free stores. In fact, that business has been extremely robust because it is less expensive to present those products in those avenues. Strategically, those channels are useful as they protect our bottom line.

What we have started to see is that there are more and more opportunities in the non-confectionery category, and this started even before the crisis.

One example is Nido’s popularity in the Middle East. It is a humble milk powder but Nido is the leading brand because it targets a special shopper need. The geographic opportunities for certain non-confectionery brands are massive.

We touched briefly about how NITR is investing in creating engaging digital content. In your view, what constitutes engaging digital content?

How to deliver engaging content is such a huge topic. In a world where everyone is bombarded with content, we need to have something that stops people. Brands are doing some wacky stuff out there, but I think our big regeneration idea is going to be huge. What is beyond sustainability in 2021? That is what we seek to answer.

Could you tell us more about NITR’s mission to go beyond sustainability?

We may not have all the solutions, but we are getting there. We aim to bring goodness back to the soil, rethink how we operate in emerging countries, explore how we can incentivise regenerative farming and how we can go beyond Net Zero.

I will be talking about this big Regeneration Mission at the Virtual Travel Retail Expo. Moving us from sustainability to regeneration is extremely powerful. To me engaging content means engaging ideas – and nothing is more engaging than that.