EUROPE. A new report commissioned from York Aviation by the European Travel Retail Confederation (ETRC) has highlighted the potential benefits of arrivals duty free to the aviation eco-system.

The report, which was launched today in Brussels by ETRC and Airports Council International (ACI) Europe, showed how arrivals duty free have helped airports to develop in three markets: Norway, Switzerland and Türkiye.

James Brass, Partner at York Aviation and author of the report, showed the key roles of arrivals shops in providing an additional commercial revenue stream that supports investment and growth of the aviation ecosystem, connectivity and serves travellers’ needs. Other speakers included ETRC Secretary General Julie Lassaigne and ACI Europe Deputy Director General Morgan Foulkes.

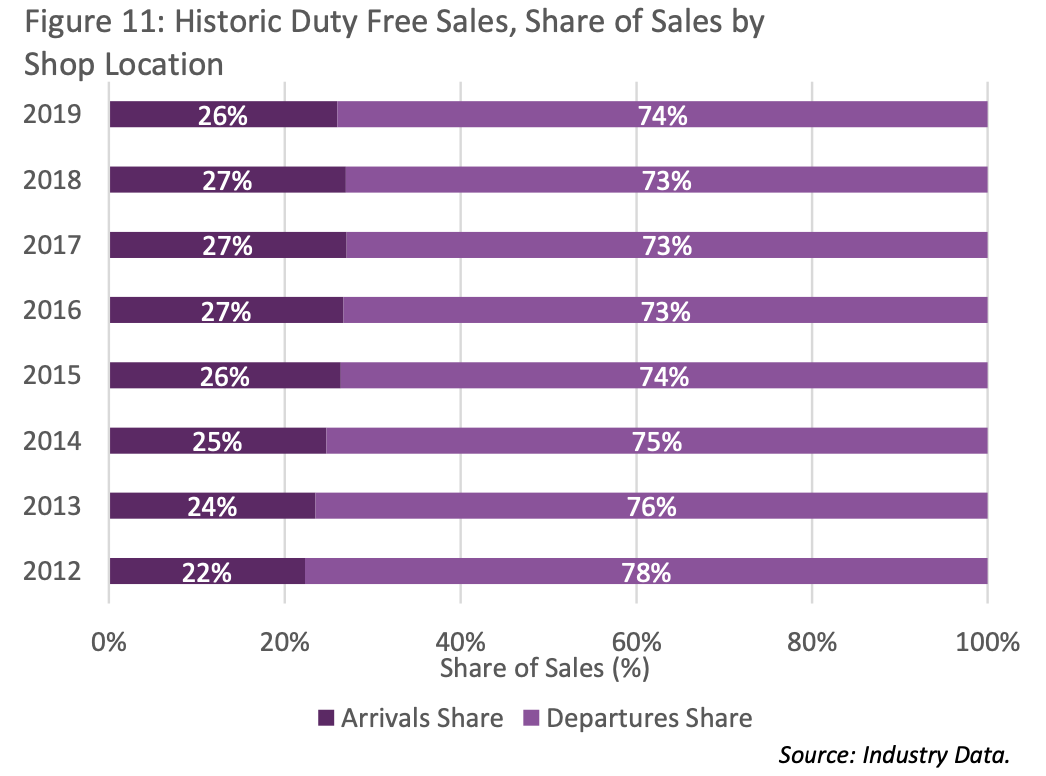

By way of example, since arrivals duty free shops were introduced in Norway in 2005, arrivals duty free sales have grown at a compound average rate of +10% and by 2015 made up 59% of duty free sales. Following their introduction, arrivals shops

rapidly overtook sales in departures. These stores are also key to the profitability of airport company Avinor.

At Oslo, the largest and most 2015 profitable of Norway’s airports, arrivals duty free retail income is 50% of all duty free retail income.

The report states: “Between 2005 and 2019, duty free sales grew +108%, cementing their position as source of income central to Avinor’s viability. Arrivals shops have been central to this success.”

It noted too that arrivals duty free shops have reduced the need for public subsidy and allowed the airport market to work more effectively.

The case studies also considered the evidence around some common objections to arrivals shops, namely the potential to interfere with domestic markets and the potential to increase smuggling. Based on historical data, there is no evidence to suggest an impact on domestic markets nor smuggling, the report noted.

The report aims to contribute to the discussion about expanding the scope of duty and tax free sales to inbound passengers at EU airports. This in the context of the impact assessment recently launched by the EU Directorate-General on Taxation and Customs Union (DG TAXUD) on VAT rules applicable to the travel and tourism sector. The European Commission intends to present a legislative review in 2023.

Morgan Foulkes said: “The damage to European airports from COVID-19 has been unprecedented. Arrivals duty and tax free shopping is a cost-neutral measure for governments but one which could support the financial sustainability of our EU airports. Over 60 countries currently allow arrivals duty and tax free shopping, including all EEA countries. It is time to review EU legislation to bring EU airports in line with global practice.”

“The report clearly shows that arrivals duty-free is a proven business model that can deliver reliable revenue stream to the travel ecosystem with wider positive impacts. As part of the ongoing EU initiative on the VAT rules applicable to travel and tourism sector, we call on the European Commission to propose necessary changes to allow arrivals duty-free in the EU to support the resilience and competitiveness of EU aviation,” concluded Julie Lassaigne.