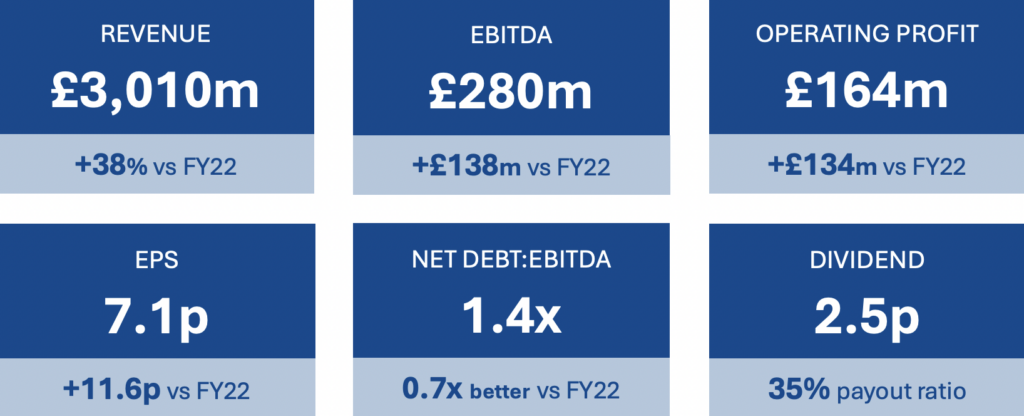

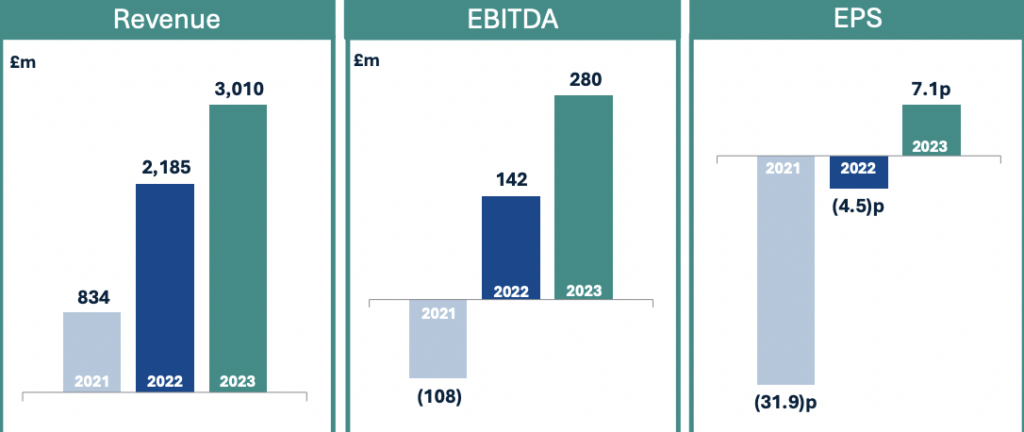

UK/INTERNATIONAL. Leading travel food services group SSP today announced a robust set of preliminary results for the financial year to 30 September, with revenue climbing by +38% year-on-year to £3 billion and EBITDA doubling to £280 million. Pre-tax profits leapt by +250% to £88 million.

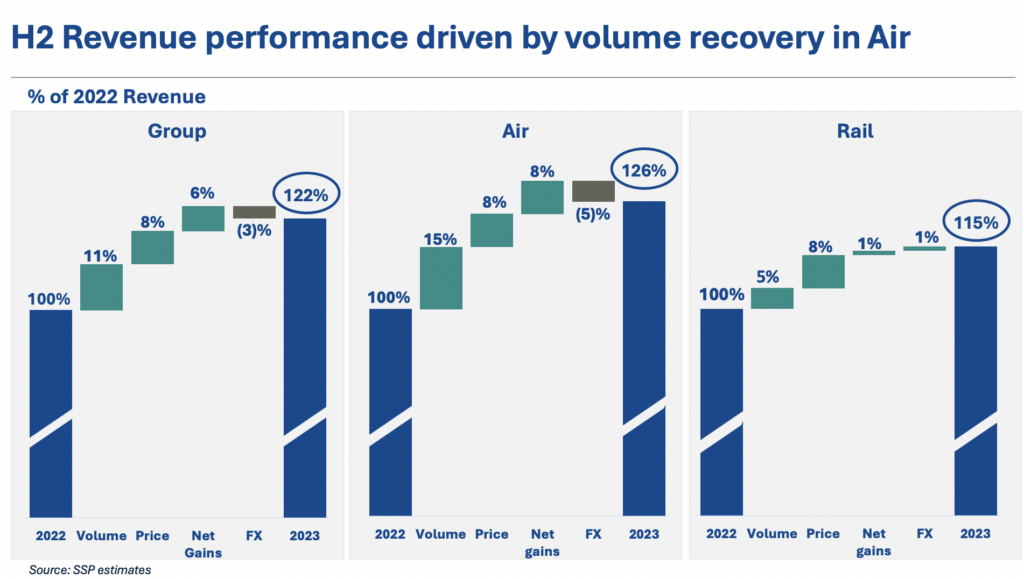

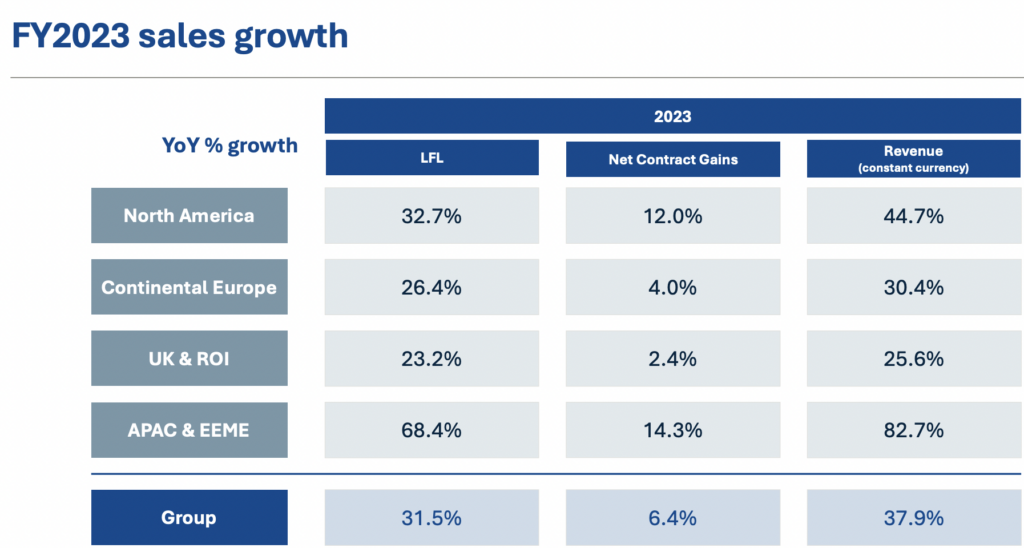

Second-half revenue growth reached +25% year-on-year on a constant currency basis including like-for-like growth of +19% driven by recovery in passenger numbers, with North America (+24%) and APAC and EEME (+44%) the principal contributors, plus net gains of +6% from an enhanced contract pipeline.

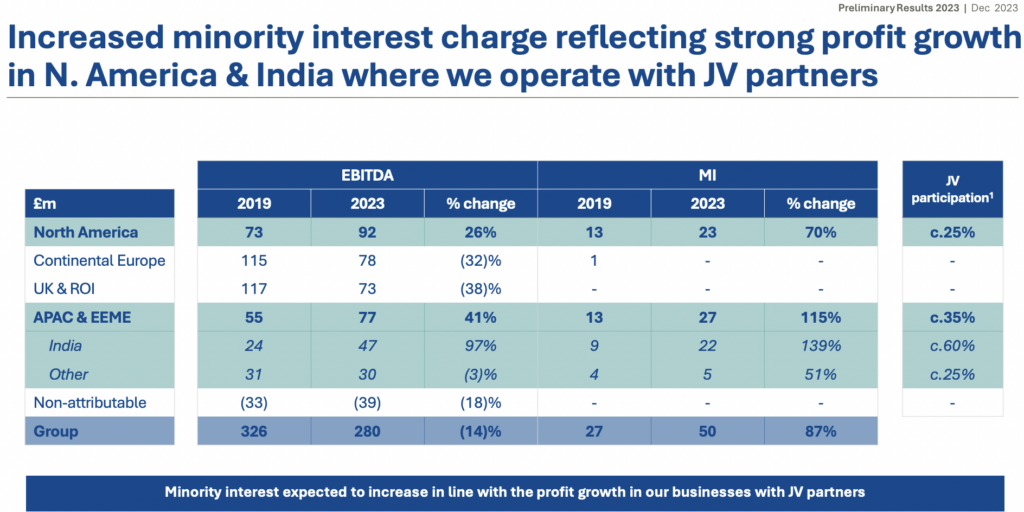

The strong profit performance was buoyed by the North America and APAC and EEME (Eastern Europe & Middle East) regions, reflecting “faster recovery in demand in these markets and strong profit conversion, as margins increased in line with revenue growth,” said the group.

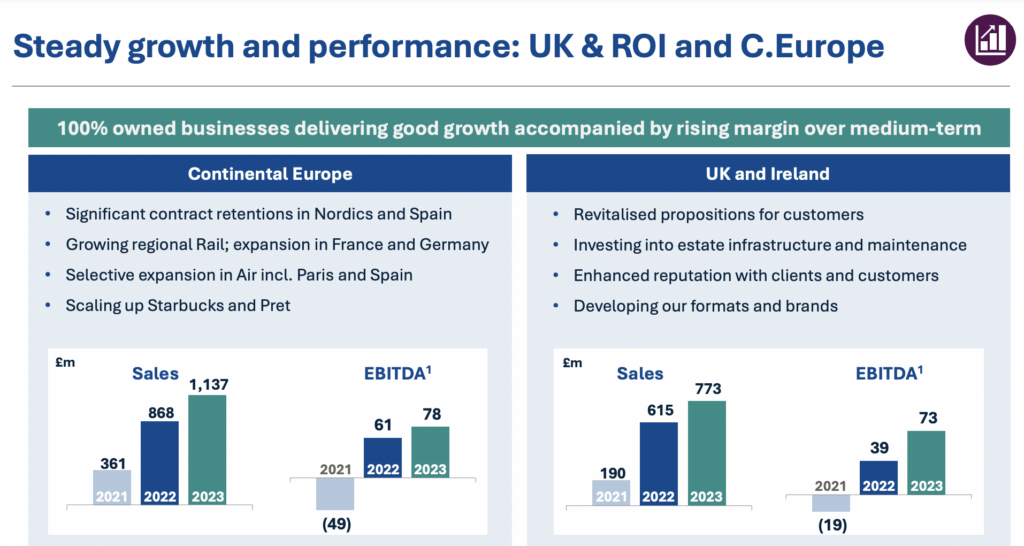

Conversely, profit growth in UK and Continental Europe was hit by the relatively slower revenue recovery in the rail channel and disruption caused by strikes and civil protests.

Trading momentum has continued into the new financial year with group revenues in the first eight weeks up +22% on a constant currency basis.

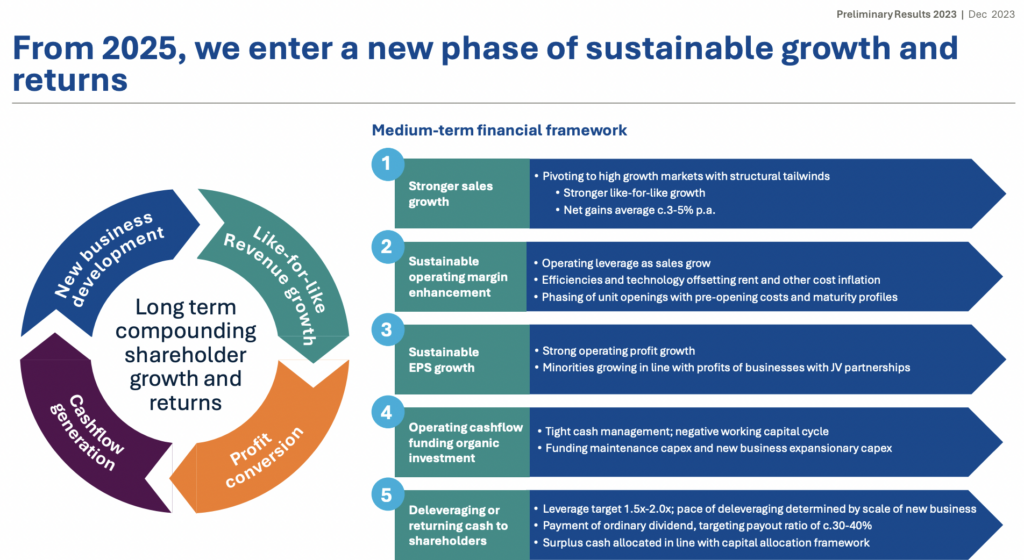

The secured pipeline of contracts yet to open (at the end of September 2023) now represents estimated annualised revenues of around £450 million, once fully mobilised. In 2024 SSP expects organic net gains of around +5% (excluding the full year of the Midfield Concessions acquisition, which will add a further +2% to sales), all of which should be delivered from the secured pipeline. In the medium-term net gains between +3% to +5% on average are anticipated. SSP Group CEO Patrick Coveney said: “This has been a year of strong financial, operational and strategic progress for SSP. We are continuing to lay the foundations for accelerated expansion in key growth markets such as North America and Asia Pacific. We are also making clear strides in enhancing our customer proposition, our digital capabilities and our sustainability initiatives.

SSP Group CEO Patrick Coveney said: “This has been a year of strong financial, operational and strategic progress for SSP. We are continuing to lay the foundations for accelerated expansion in key growth markets such as North America and Asia Pacific. We are also making clear strides in enhancing our customer proposition, our digital capabilities and our sustainability initiatives.

“Our ongoing focus on these areas has led to SSP delivering strong like-for-like growth, high levels of new business, a robust margin recovery, and even closer relationships with our clients and brand partners. We are very pleased to be taking the important step today of proposing to reinstate the ordinary dividend.

“SSP is in very good shape, and we are excited by the opportunities in front of us. We are building strong momentum across all areas of the business thanks to the efforts of our outstanding colleagues across the world, as well as the ongoing support of our clients and brand partners. The commitment of our people, the structural growth in travel demand and the strength of our business model mean we are well placed to deliver compounding growth and returns in the years to come.” Speaking to The Moodie Davitt Report soon after the results were announced, Coveney added: “All of our key metrics are in good shape. Doubling profitability was important from a balance sheet point of view.”

Speaking to The Moodie Davitt Report soon after the results were announced, Coveney added: “All of our key metrics are in good shape. Doubling profitability was important from a balance sheet point of view.”

He highlighted the net debt figure of £392 million at the end of September 2023, and the improved ratio of net debt to EBITDA from 2.1x to 1.4x as a strong signal to the financial markets about the health of the business. “It underlines the fact that we have the resources to continue growing sustainably. Another indicator that I’m delighted about is that we can reinstate a dividend to shareholders.”

The company also said it is making good progress against its strategic priorities. These include pivoting to higher growth markets – around two-thirds of sales from the secured new business pipeline is planned to come from North America and APAC. Another strategic platform is a strengthened portfolio of partner brands, including new partnerships with BrewDog in the UK and Europe, Breakfast Club in the UK and Jones the Grocer in Singapore alongside those with existing partners, including Pret, Hard Rock Café, Popeyes and Starbucks.

Coveney said that the scale of SSP’s geographical pivot “can sometimes be missed”. He noted: “If you look at our EBITDA delivery, 53% comes from North America and Asia Pacific, in which we also include the Middle East. That compares to 43% a year ago and 35% in 2019. And that trend will only continue in 2024 and beyond. That’s the biggest sustained change in our business in recent times.”

Coveney said that the scale of SSP’s geographical pivot “can sometimes be missed”. He noted: “If you look at our EBITDA delivery, 53% comes from North America and Asia Pacific, in which we also include the Middle East. That compares to 43% a year ago and 35% in 2019. And that trend will only continue in 2024 and beyond. That’s the biggest sustained change in our business in recent times.”

Coveney added: “We’re putting 67% of our growth capex into those two regions. We are tracking the new aircraft deliveries, new routes and the traffic growth. India [where SSP partners with Travel Food Services -Ed] is a great example. By outlet numbers India is our second largest market worldwide but it could be our biggest in the next 24 months.” In its results today, SSP noted that profits via its TFS joint venture had doubled this latest financial year compared to 2019. The group also plans entry to six new airports in India, Coveney noted, while highlighting the growth of the aviation business – aircraft supply in India is expected to leap by +70% by 2026/27.

In its results today, SSP noted that profits via its TFS joint venture had doubled this latest financial year compared to 2019. The group also plans entry to six new airports in India, Coveney noted, while highlighting the growth of the aviation business – aircraft supply in India is expected to leap by +70% by 2026/27.

On the wider strategy for Asia Pacific, Coveney said: “We are pivoting from being a China-centric business pre-COVID to one focused much more on southeast Asia today.”

“In North America we are seeing sustained momentum,” Coveney added. “At the beginning of our last financial year we were in 38 airports, but we have gained 11 more in just over a year, including through the acquisition of Midfield Concessions Enterprises. With a share of around 10%, we have room to grow in a large and growing market.”

Coveney also stressed the importance of building alongside partners, notably in joint ventures, across the high-growth markets of North America and Asia Pacific.

“We plan to invest more together with our local partners, the right local partners, in those strategic markets that will benefit from structural growth, as we aim to grow our market share.”

The company noted the benefits of local knowledge, access to brands and concepts, and relationships with clients and government that local partners provide.

“These attributes enable us to run the day-to-day business operations more effectively as well as improving our ability to win new business. In equal measure, our JV partners contribute to the capital costs of expansion in addition to taking a share of profitability.”

Riyadh Airport entry and pipeline expansion

SSP Group also announced a first step into Saudi Arabia with a ten-unit contract across three terminals at Riyadh Kind Khalid International Airport. Coveney said: “Combine this new contract with the quality of units we have opened at Abu Dhabi International Airport Terminal A, and it underlines how we are increasingly bringing to life our proposition in the Middle East.”

During FY2023 SSP also secured entry to Italy, through a rail contact in Rome, and to Iceland at Reykjavik Airport. It said it had also maintained high retention rates on contracts, including at London Gatwick, London Heathrow, Newcastle, Liverpool, Marseille and Trondheim airports.

Most of its new business gains in the past year were in the air channel, with 14 new airport clients secured, including Dulles Washington Airport in the USA, Calgary Airport in Canada, Menorca Airport in Spain and Krabi Airport in Thailand.

In aggregate, SSP said its net new business win level across the group (in terms of forecast sales from new business) is ahead of the pre-pandemic average. The Midfield Concessions acquisition, announced in June, has added 40 new units, including at four new airport locations (Detroit Metropolitan Wayne County, Denver International, Philadelphia International and Cleveland Hopkins International) and is expected to contribute a total of around US$100 million to revenues on an annualised basis.

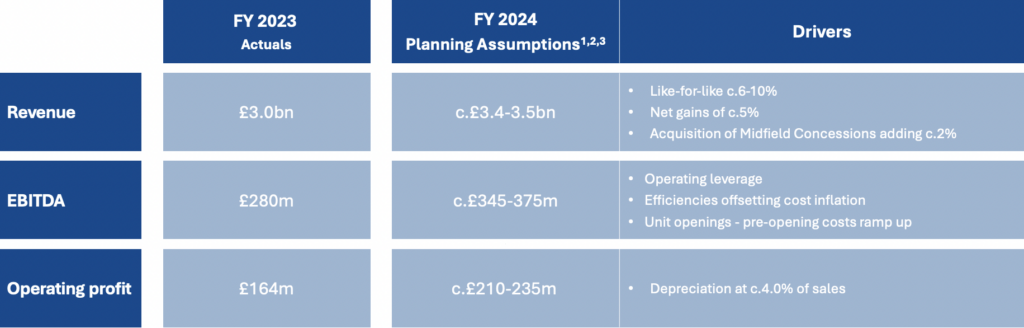

Looking ahead, SSP is planning for like-for-like sales growth in FY2024 of between +6% and +10%, reflecting the expectation of continued recovery in passenger demand as well as increased spend per passenger including price increases.

In 2024 revenue should reach £3.4-3.5 billion with a corresponding underlying pre-IFRS 16 EBITDA within the range of £345-£375 million and an underlying pre-IFRS 16 operating profit within the range of £210-235 million, all on a constant currency basis.

Regional performance

In North America, revenue of £668.8 million increased by +46.9% compared to the previous year, and +25.4% versus 2019 levels (both at actual exchange rates). The performance included a significant contribution from net contract gains, many alongside joint-venture partners.

During the first half, the sales recovery ran at +27.1% above 2019 levels and +71.8% ahead of 2022. During the second half, sales increased by +24% compared to 2019 and +31.4% versus 2022, including a sales benefit from the acquisition of the Midfield Concession business, with the transfer of six of the seven airports completed in June.

During the first eight weeks of the new financial year trading has remained encouraging, said SSP, with sales currently running +33% ahead of 2023 on a constant currency basis.

The underlying operating profit for the year was £68.2 million, compared to £18.4 million in the prior year, and the reported operating profit was £67 million (2022: £17.3 million). In Continental Europe, revenue of £1,136.7 million represented an increase of +31% compared to 2022 and +9.6% versus 2019 levels (both at actual exchange rates). Most markets in Continental Europe recovered strongly in the first six months of the year, running +9.3% above 2019 levels across this period (+56.9% ahead of 2022), helped by the extended European summer holiday season which stretched into the autumn.

In Continental Europe, revenue of £1,136.7 million represented an increase of +31% compared to 2022 and +9.6% versus 2019 levels (both at actual exchange rates). Most markets in Continental Europe recovered strongly in the first six months of the year, running +9.3% above 2019 levels across this period (+56.9% ahead of 2022), helped by the extended European summer holiday season which stretched into the autumn.

During the second half year, sales strengthened further to +9.8% above 2019 levels (+16.2% above 2022), driven by strong air passenger numbers over the late spring and summer and despite the impact of protests and travel disruption in France, as well as more challenging comparatives from 2019.

Since year-end, trading in the region has made further progress, with sales currently running +14% above 2023 levels on a constant currency basis. The underlying operating profit for the period was £51.9 million compared to £22.6 million in the prior year, with a reported operating profit of £32.6 million (2022: £82 million).

Revenue in the UK & Ireland of £773.6 million represented an increase of +25.8% compared to 2022 and a recovery to 92% of 2019 levels (both at actual exchange rates). During the first half year, sales recovered to 85.2% of 2019 levels (+41% ahead of 2022), reflecting recovery in both leisure and commuter travel, despite the impact of regular strike action impacting the rail business.

In the second half, underlying UK trading in both the air and rail channels continued to strengthen, with revenues averaging 97.8% of 2019 levels (+16.5% above 2022), despite the rail sector continuing to be hit by industrial action. Since year-end, sales are running +22% above 2023 levels on a constant currency basis. The underlying operating profit for the UK was £66.1 million compared to £23.5 million in the prior year, with a reported operating profit of £54.6 million (2022: £27.7 million).

Revenue in APAC and EEME of £430.6 million represented an increase at actual exchange rates of +74.2% compared to 2022 (+82.6% on a constant currency basis) and +12.2% versus 2019 levels (+21.1% on a constant currency basis). Revenues recovered rapidly throughout the first half, including an “exceptional performance” in India (TFS), where sales more than doubled year on year. Australia, Thailand and the Middle East have also performed particularly well.

First-half sales for the APAC and EEME region as a whole grew by +142.4% compared to the equivalent period in 2022 (at actual exchange rates). In the second half of the year, compared to 2022, sales improved by +41.2% at actual exchange rates (+53.9% on a constant currency basis).

In addition, the region continued to benefit from net gains, with strong contributions from new openings in Malaysia, Australia, Thailand, Bahrain and India. During the first eight weeks of the new financial year, trading in the APAC and EEME has continued to improve, with sales currently running +29% ahead of 2023 levels on a constant currency basis. The underlying operating profit for the year was £71 million, compared to £13.5 million in the prior year, and the reported operating profit was £72.2 million (2022: £14.6 million).