The problematic North Asia travel retail sector and a soft Mainland China market dragged on Coty’s Q3 and nine-month results, the US beauty house revealed yesterday (6 May).

In the first nine months of FY25, Asia Pacific net revenue of US$541.1 million, or 12% of Coty sales, decreased -7% on both a reported and like-for-like basis driven by lower Prestige revenues, partially offset by growth in Consumer Beauty net revenues.

Coty’s lower year-on-year net revenues in Mainland China and the regional travel retail channel continued to be impacted by the challenging market dynamics, which were partially offset by double-digit percentage growth in Asia, excluding China.

In Q3, Asia Pacific net revenue of US$159.4 million was down -5% on a reported basis largely driven by declines in Prestige net revenue in Mainland China and Asia travel retail.

We’ll bring you further details and analysis after today’s earnings call.

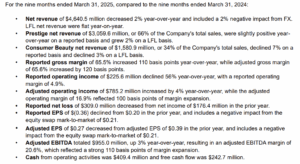

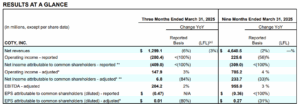

Groupwide, Coty posted a -6% year-on-year decline (reported; -3% like-for-like) in net revenues for the third quarter ended 31 March to US$1,299.1 million.

Prestige net revenue of US$829.4 million (64% of Coty sales) decreased -4% reported and -2.5% like-for-like.

A reported US$280.4 million operating loss declined sharply from reported operating income of US$77.8 million a year earlier, resulting in a reported loss margin of 21.6%.

For the first nine months revenues were down -2% (flat year-on-year) to US$4,640.5 million, including a -2% negative FX impact.

Prestige net revenue of US$3,059.6 million, or 66% of the company’s total sales, were slightly positive year-on-year on a reported basis for the first nine months and grew +2% on a like-for-like basis.

“Across economic cycles, beauty has remained resilient for decades. Even in this challenging landscape, we have significantly strengthened our strategic, operational, and financial fundamentals, driving margin expansion, stronger cash flow generation, and substantial deleveraging over the past four years,” said Coty CEO Sue Nabi.

“While we are not satisfied with our net revenue performance, Coty’s strong fundamentals, coupled with our multi-pronged attack-plan for accelerating innovation, distribution and efficiencies, gives us confidence for the years ahead.

“2025 remains a transition year for Coty. In Prestige, we are absorbing the triple-headwind of a slowing fragrance market, lapping a blockbuster innovation year, and depleting elevated retailer inventory, all of which was particularly acute in the US.

“We are laser focused on entering FY26 with alignment between sell-in and sell-out, to create a healthy baseline for growth.”

Nabi continued, “In Consumer Beauty, we have begun recalibrating our business in response to diverging market trends between cosmetics on the one hand and fragrances on the other hand, taking into account our relative strengths.

“Our goal is to strengthen our cosmetics business while making it more profitable, while in parallel over-driving our mass fragrances business where we have leadership and a strong margin profile.

“Importantly, we are in control of our destiny and are already making the changes needed to address many of these challenges, with new leadership in the US as the market has slowed in recent months, an updated organisational structure to drive faster changes and improved execution.”

More to follow after today’s earnings call. ✈