Return to 2019 revenue levels in 2023 – Dag RasmussenAsked directly when he expected Lagardère Travel Retail to return to 2019 levels – in 2023 or 2024 – Rasmussen replied without hesitation: “Total figures, 23 – that would be total figures with ups and downs depending on the countries and business lines.” Click here for more comment from today’s post-results call. |

INTERNATIONAL. Lagardère Group returned to profitability in 2021, as a much-improved performance by its travel retail arm helped drive a sharp increase in recurring group EBIT to €249 million.

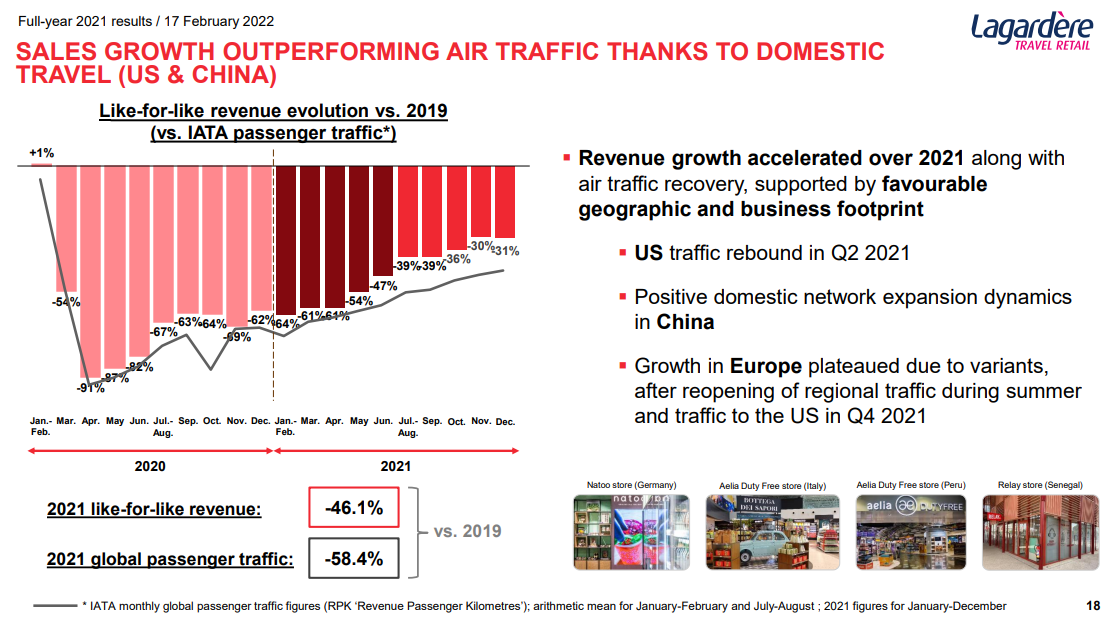

Lagardère Travel Retail (which encompasses Travel Essentials, Duty Free & Fashion and Foodservice) improved its recurring EBIT to a negative €81 million (up sharply from a thumping €353 million loss in 2020). Sales rose +34.3% on a like-for-like basis and +33.1% reported to €2,290 million – still down -46.1% on pre-pandemic (and record) 2019.

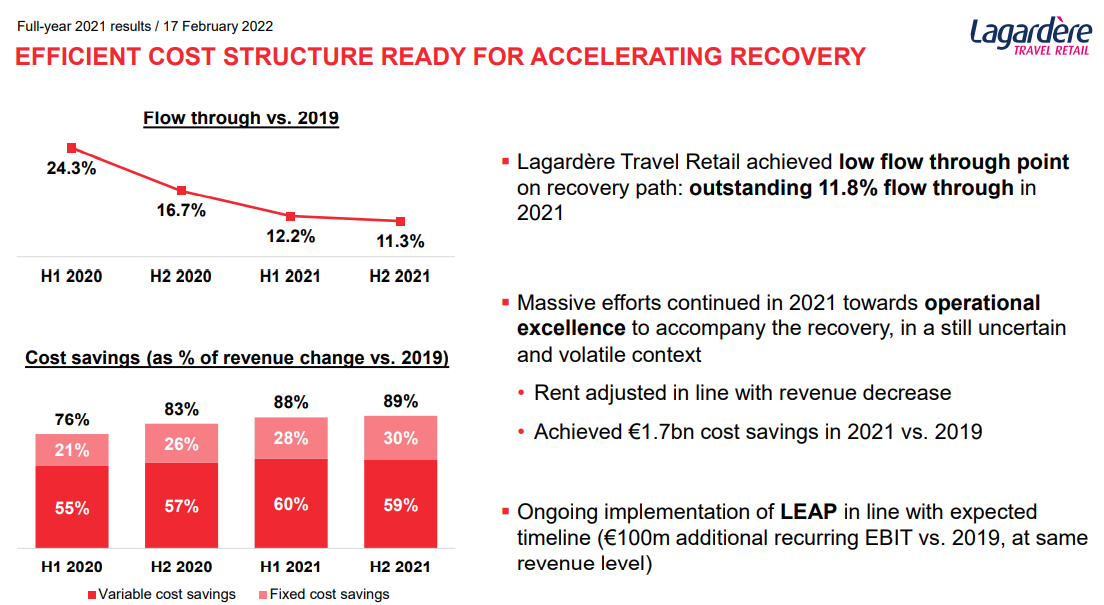

Lagardère Travel Retail reached an encouraging flow-through ratio of 11.8%, “reflecting operational excellence in a volatile environment”, the group said.

Q4 travel retail revenue totalled €749 million, leaping +97.1% as reported and 94.1% like-for-like. The difference was attributable to a €11 million positive currency effect.

Regional travel retail variations (all change percentages like-for-like)

France: Revenue for the division jumped by +25.7% year-on-year (-55.4% lower than 2019) thanks to the gradual pick-up in national and regional travel as restrictions were eased.

EMEA region (excluding France): Turnover advanced by +18.8% year-on-year (-50.5% below 2019) also under the impetus of the partial resumption of travel, led by countries with large domestic networks, especially rail stations (Romania, Czech Republic and Bulgaria).

North America: The region recorded steep revenue growth of +72.5% year-on-year (-31.7% lower than 2019), driven by the recovery in domestic air traffic which gathered pace throughout the year.

Asia Pacific: Revenue rose +28.7% year-on-year (-43.6% lower than 2019), thanks to sharp +63.4% growth in China (Hong Kong and Mainland China) lifted by consumer demand and network expansion. This more than offset the decline in sales in the Pacific region in the wake of border closures.

Improved concession terms

Commenting on the improved recurring EBIT result and flow-through ratio, Lagardère Travel Retail said: “The better-than-expected performance reflects the major efforts undertaken by the division over the period to control its costs and optimise opening hours when stores reopened.

“Costs were slashed by €1,698 million in 2021 compared to 2019. The decrease in the cost base included a €563 million reduction in fixed costs – of which €381 million relating to fixed lease payments for concessions – mainly by renegotiating terms on concessions, adapting point-of-sale operations in line with air traffic trends, adjusting payroll costs and cutting other overhead costs.

Market improving but still uncertain

Commenting on the outlook for Lagardère Travel Retail, the group said: “Trading at Lagardère Travel Retail closely mirrors trends in air passenger traffic in the different geographic areas. Due to the diversity of its footprint and operating segments, the division is well placed to benefit from the resumption of flights as and when the health situation permits.

“Although the context is broadly improving, it remains uncertain. The division will closely monitor developments in air traffic in 2022 and is confident in its ability to adapt to the environment which, although volatile, is gradually improving.

“Lagardère Travel Retail is pressing ahead with its operational excellence drive launched during the crisis, enabling the division to keep flow through in 2022 within a range of 15% to 20%, assuming higher business levels than in 2021.”

The Dag Rasmussen view – “beyond expectations” performance

Commenting on the results, Lagardère Travel Retail Chairman & CEO Dag Rasmussen said: “Unsurprisingly, COVID-19 has continued to hamper our financial performance, with a total consolidated revenue of €2,290m, down -46% on 2019.

“However, despite challenging circumstances, we have been able to mobilise our greatest strengths to deliver beyond expectations. While we are announcing a negative operational result of €81 million, this is a €272 million increase compared to 2020. This performance has been lifted by the strong rebound of large domestic markets such as the US and China, and despite the Omicron variant creating a more contrasted picture at the end of the year.

“We have reached an exceptional flow-through of 11.8%, which is testament to the outstanding efforts our teams have delivered in managing both our cost structure and the reopening of our network. Our very close partnerships with landlords have allowed us to extend a large number of contracts and to manage operations with a great balance between flexibility to adjust to landlords’ needs and our commitment to deliver the highest standards of customer service.”

Rasmussen added: “In short, our unique strategic vision and positioning, and our organisational model, have enabled us to excel in crisis management as well as we have excelled in managing years of company growth.

“2021 – Not our best but our greatest year”

“In parallel, we have been able to lay the foundations to our future growth by winning new contracts and starting new operations, notably in South America and in Africa, and by pursuing our dynamic development in China. In particular, our strategic partnership with JD.com, the Chinese ecommerce leader, is fueling further growth through investment and helping us sophisticate our approach in digitalisation, supply chain and CRM.

“This will not only benefit China but our entire organisation. Finally, 2021 has been an opportunity to make the leap in our efforts to create a more sustainable future for our industry. Details of our new CSR roadmap will be unveiled next month.

“All in all, I would say that sticking to numbers, 2021 may not have been our best year, but it has been the greatest in terms of seeing our teams go the extra mile to protect the company, consolidate our partnerships, and prepare for our stronger future.”