CHINA. The latest research conducted by Dragon Trail International, which surveyed 465 Chinese travel agents, offers a positive view about the future of China’s outbound travel market.

The findings, revealed in a webinar held this week (15 January), demonstrate strong optimism for recovery and growth in the ‘silver’ and ‘younger’ travel groups.

Market recovery expected by end of 2025

Dragon Trail International Director of Marketing and Communications Sienna Parulis-Cook began the webinar with a travel update. According to the latest Flight Master’s 2024 annual report, the number of outbound flights from China in 2024 was 580,000, 74.8% of 2019 volumes. Flights to the Middle East, Central Asia and Africa have now exceeded 2019 levels.

Parulis-Cook shared an update on significant route improvements, including China–Canada after Canada lifted restrictions at the end of last year. Chinese airlines are also dominating much of the long-haul market due to their ability to fly over Russian airspace, offering competitive travel times and costs.

Visa waiver policies and eased visa requirements have also boosted Chinese outbound tourism. Japan plans to ease visa requirements this spring and South Korea will trial a visa-free programme for Chinese group tourists later this year.

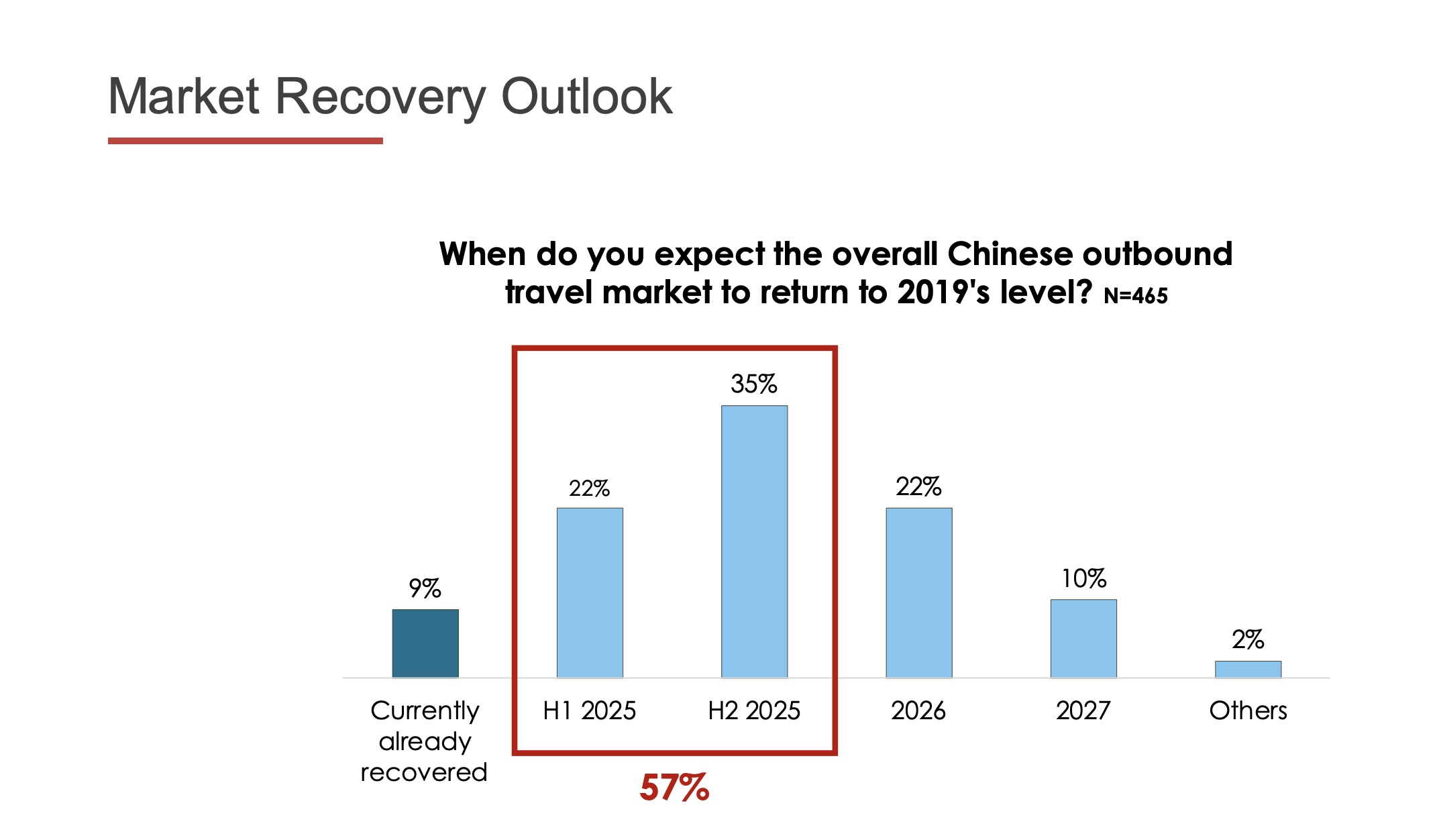

A Dragon Trail International Travel Trade survey, conducted between 9 and 16 December, reveals that 66% of travel agents are expecting Chinese outbound travel to return to pre-pandemic levels by the end of 2025.

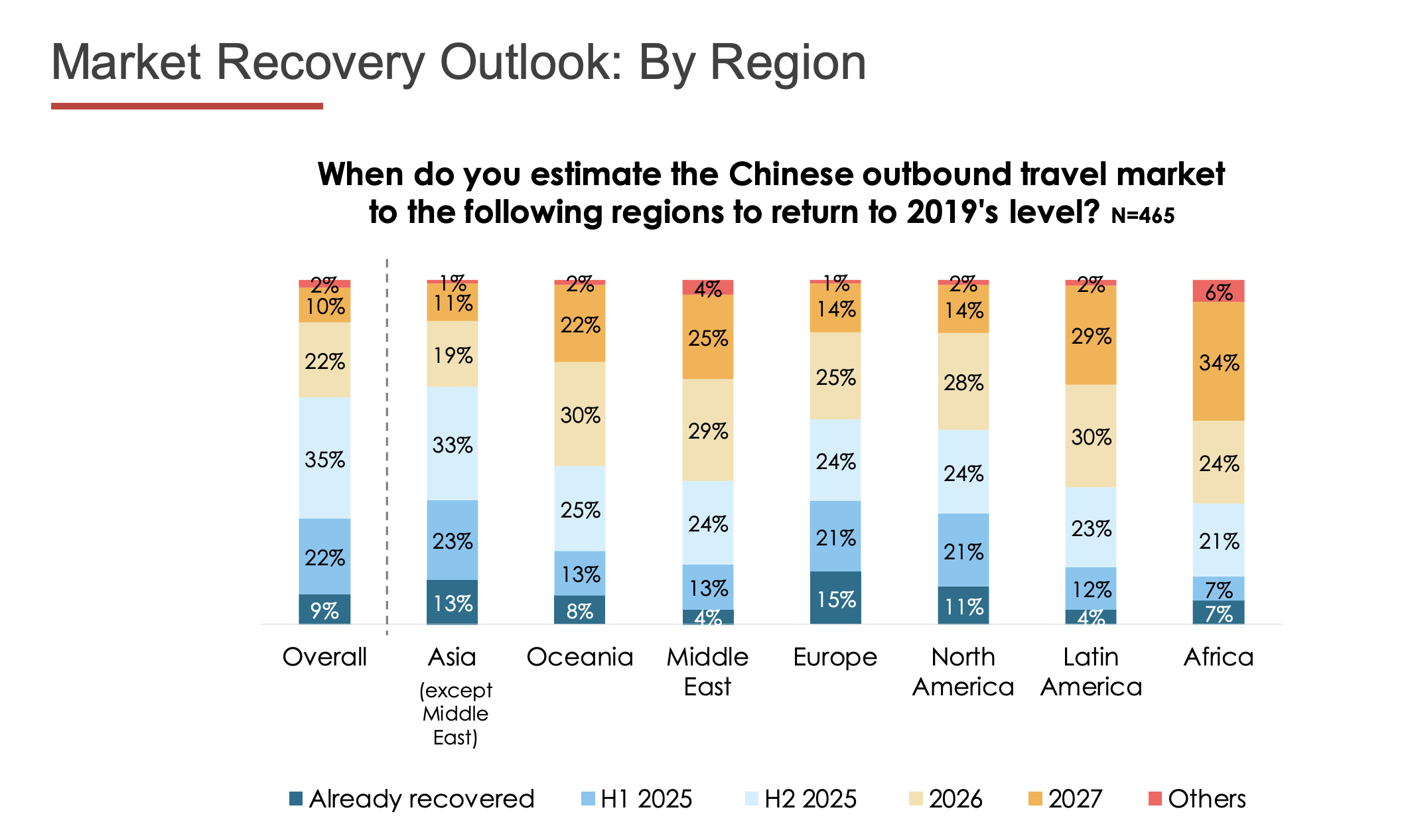

Asia is anticipated to lead the recovery due to the proximity of ky destinations and relaxed visa policies, while Europe follows with strong growth potential. However, regions such as Africa and Latin America face slower rebounds, with recovery projected beyond 2026.

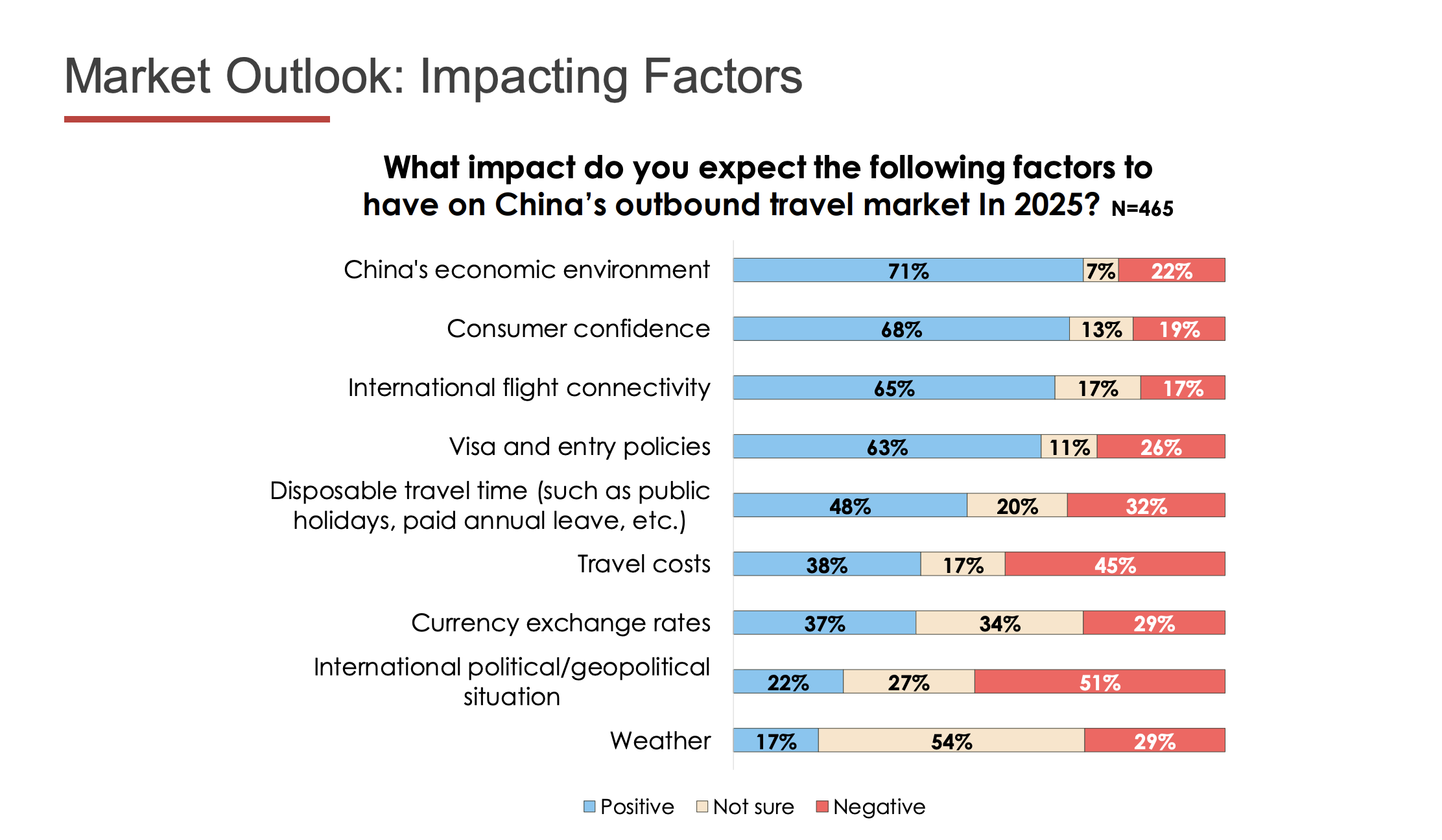

Key factors aiding recovery include China’s improved economic environment and growing consumer confidence.

Emerging travel trends: Younger and silver markets

The Travel Trade survey further reveals younger travellers (born in the 1990s and 2000s) and silver travellers (aged 50 and over) are growing segments in the Chinese outbound travel market.

Young travellers are drawn to adventure, unique experiences and high-value offerings such as cruises and island getaways, noted the report. Meanwhile, silver travellers, particularly retirees with significant pensions, prioritise comfort and cultural experiences.

Suppliers targeting these groups need tailored offerings, such as small group tours for seniors or visually appealing, social media-ready destinations for younger travellers, said Dragon Trail.

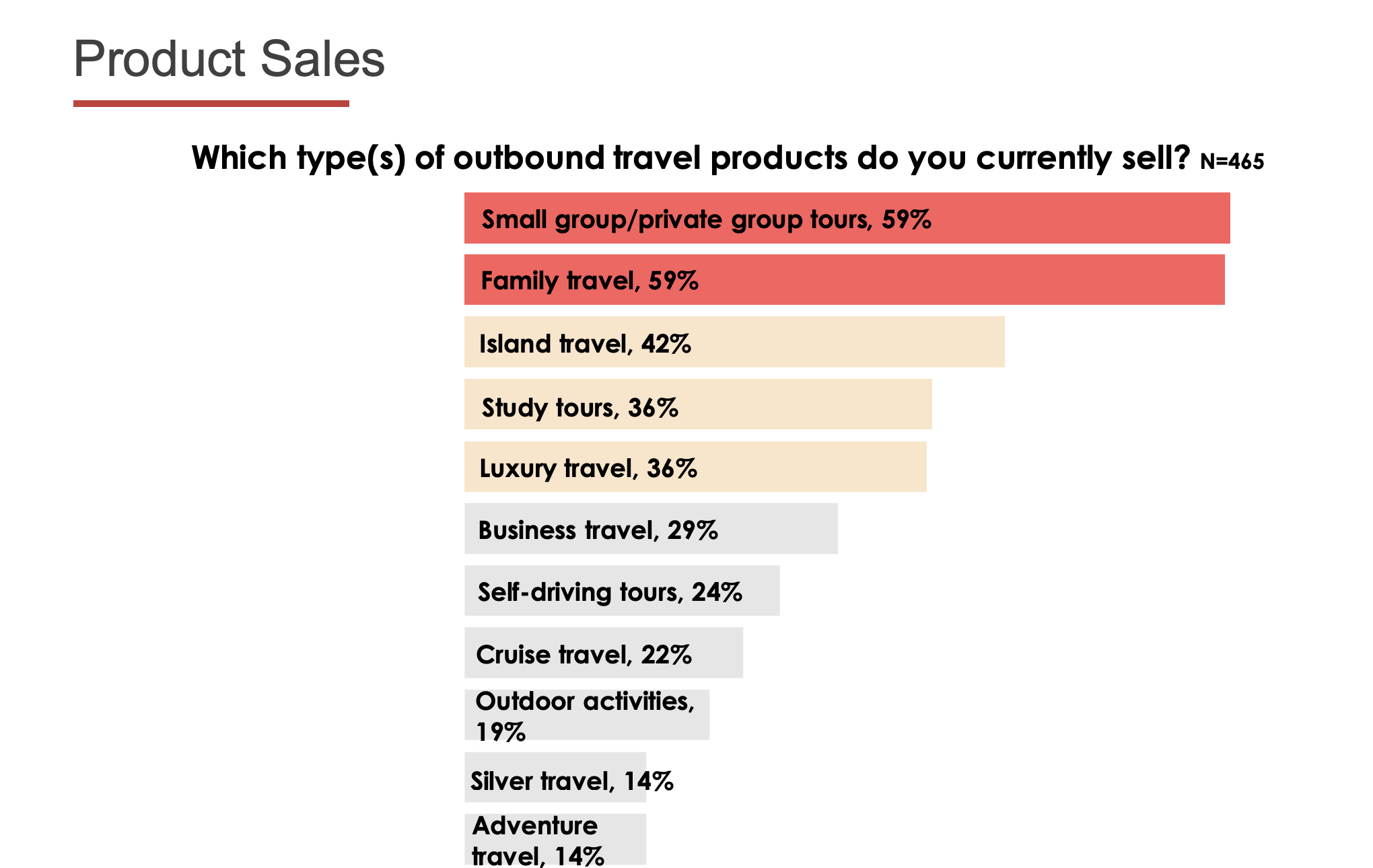

The survey also highlighted the growing popularity of specific travel products:

- Family and private tours remain the most commonly sold products.

- Island destinations, particularly in Asia Pacific, are increasingly favoured for their relaxing ambiance and scenic beauty.

- Cruise travel is gaining traction, especially among younger travellers, with rising demand for personalised and diverse itineraries.

Increased demand for B2B engagement and localised services

The Travel Trade survey also looks to understand how Chinese travel agents collaborate with destinations and suppliers to drive sales in 2025.

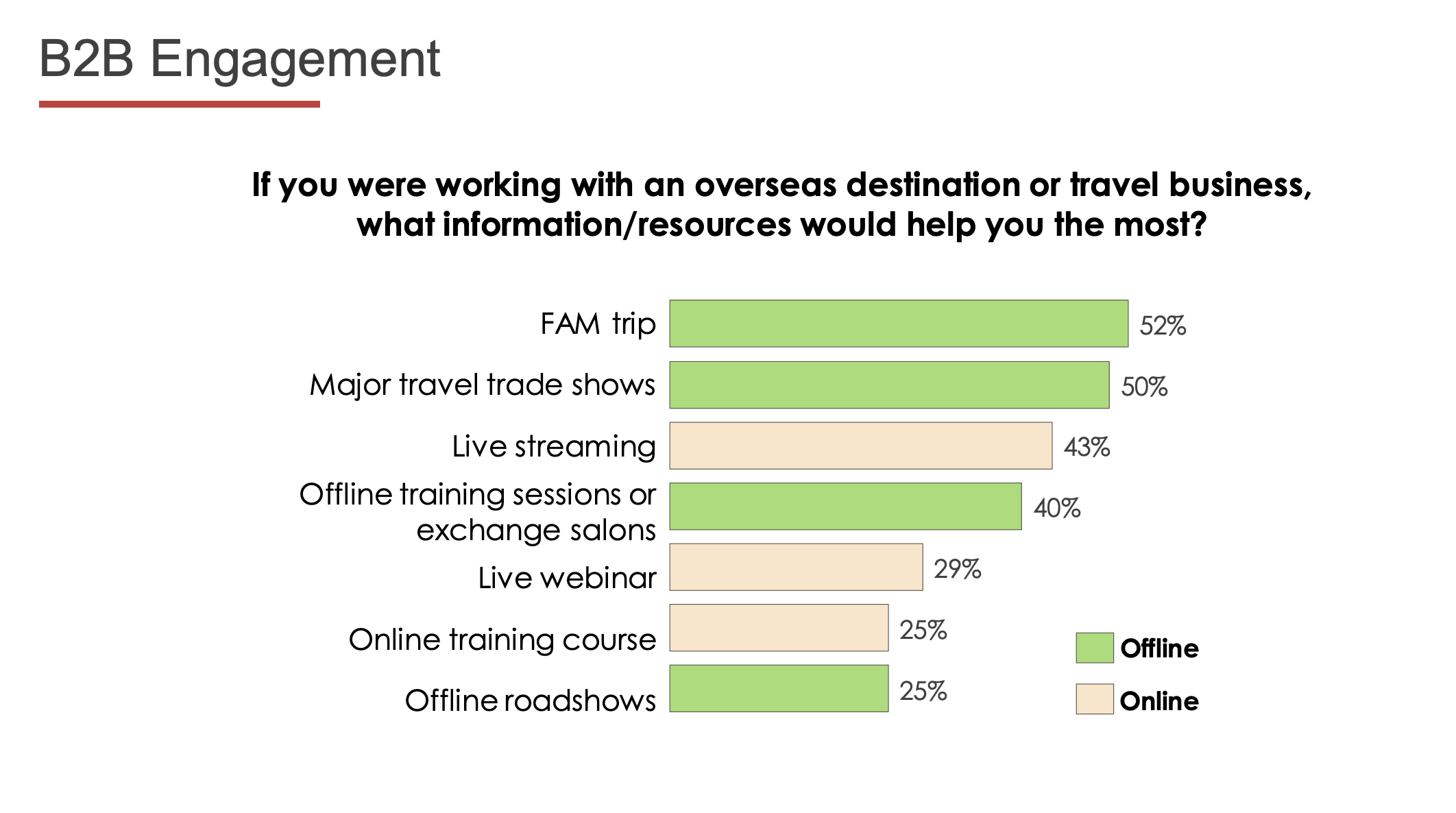

Travel agents emphasise the importance of partnerships and resources from international destinations. Preferences include first-hand FAM trips (familiarisation trips that provide education about a destination), roadshows and live-streamed events. By focusing on these preferences, travel brands can better equip agents to effectively promote their offerings.

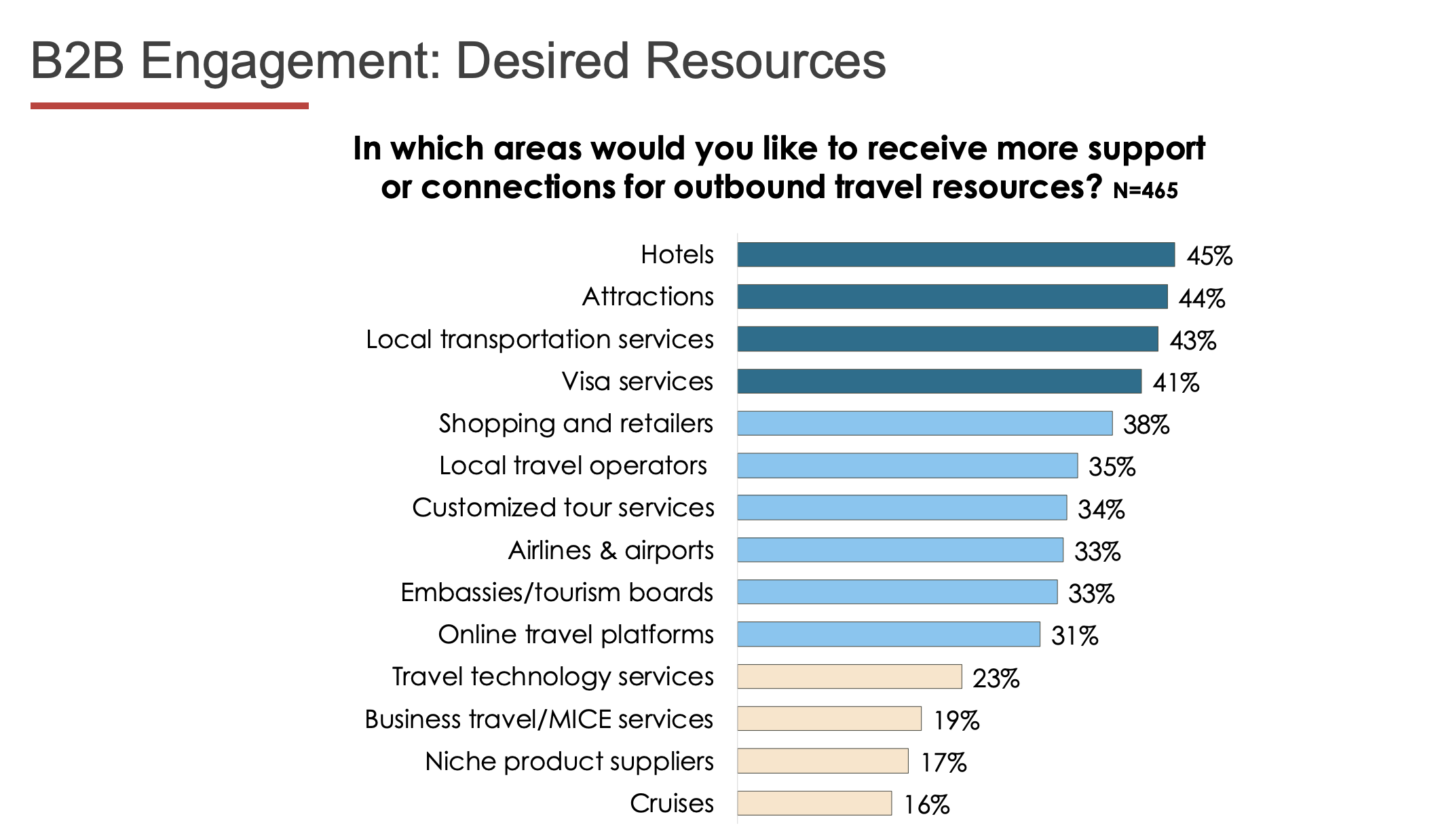

When it comes to staying informed about market trends and insights, 45% of travel agents are looking for more support or connections for outbound travel resources from hotels.

Shopping and retailers rank fifth in the list of key resources and support services (see below) among travel agents.

Travel agents were also asked what level of cooperation they would like to establish with overseas destinations or brands to help them improve outbound business. Highlighted was the need for more cooperation to develop travel products and services that align with changing market trends, including seasonal travel products, preferential prices and exclusive products, alongside smooth payment options for consumers.

Additionally, there is rising demand for services catering to specific demographics, such as young travellers and older generations. These insights underline the need for customised and responsive solutions to meet the diverse needs of today’s Chinese travellers.

You can access the full Dragon Trial webinar presentation slides here. You can also download the Dragon Trail Chinese Outbound Travel Trade Survey: January 2025 here.