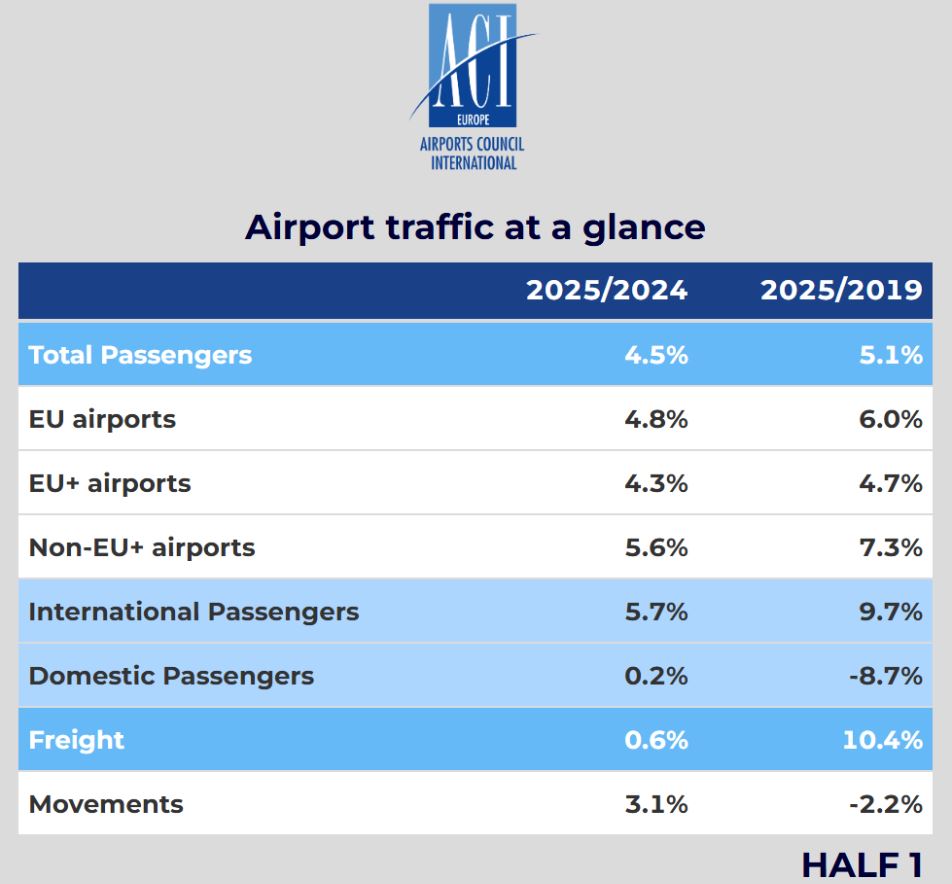

EUROPE. Airports Council International (ACI) Europe today reported a +4.5% year-on-year increase in passenger traffic across the region’s airports for the first half of 2025.

The association, which represents a network of over 600 airports, also noted a +5.1% rise compared to the same period in pre-pandemic 2019. The growth was largely driven by strong international travel demand, which climbed by +5.7%, while domestic traffic saw a modest increase of +0.2%.

The first-half figures reflect sustained air traffic growth in the first two quarters, with a +4.3% increase in Q1 followed by +4.6% rise in Q2.

ACI Europe Director General Olivier Jankovec said, “The positive performance of passenger traffic since the start of the year reflects the continued and strong resilience of demand in the context of significant supply pressures, operational disruptions, increasing geopolitical and geoeconomic tensions and renewed macro-economic uncertainties.

“All this brings renewed competitive pressures and traffic risks for airports, with much more volatile and unpredictable market dynamics where growth is no longer a given. The summer season keeps delivering for now – let’s see how the following months will be shaping up.”

The EU+ market continued to drive the recovery, with passenger traffic at airports in the bloc up by +4.3% in H1 compared to the same period last year, although results varied widely between airports in the Southeast and those in the Northwest of the bloc.

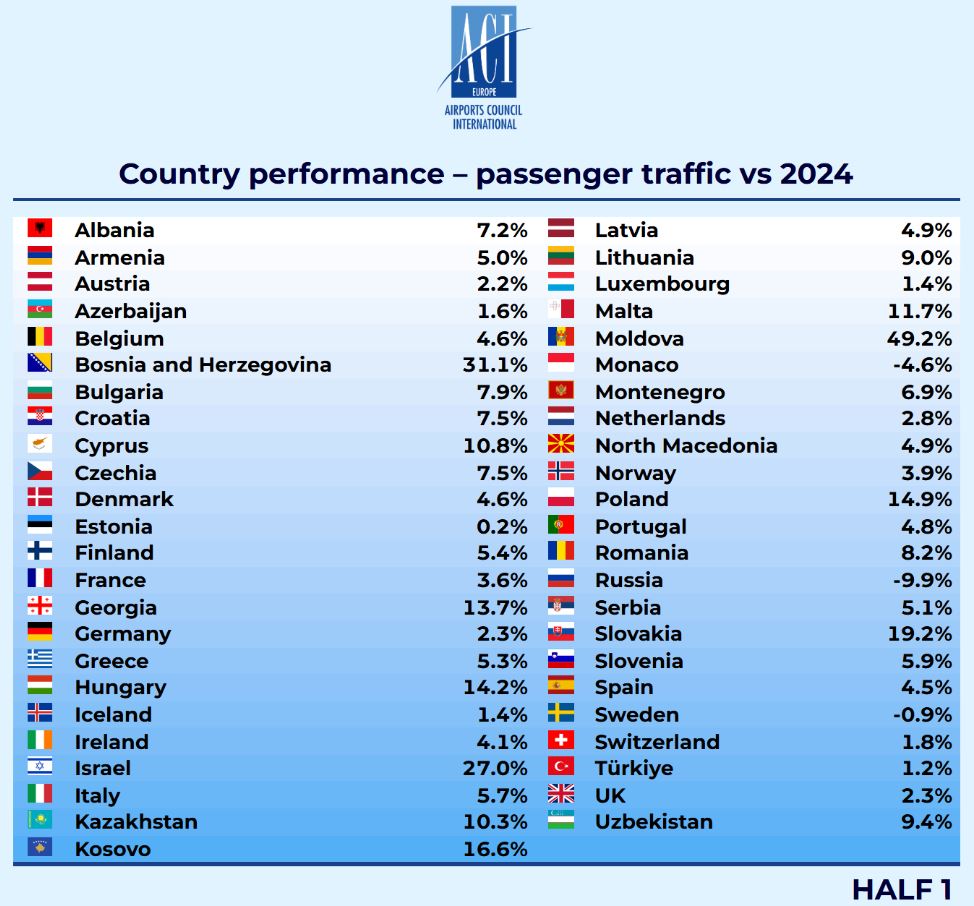

Airports in Bulgaria (+19.2%), Poland (+14.9%), Hungary (+14.2%), Malta (+11.7%) and Cyprus (+10.8%) led the growth in passenger traffic, while airports in Sweden (-0.9%), Estonia (+0.2%), Iceland (+1.4%) and Luxembourg (+1.4%) recorded minimal or negative growth.

Italy and Spain saw stronger growth in passenger traffic (+5.7% and +4.5% respectively) among the EU+’s largest markets, whereas France (+3.6%), the UK and Germany (both +2.3%) recorded below-average performances.

At airports in the rest of Europe, passenger traffic grew by +5.6%, with sharp performance contrasts underscoring the impact of geopolitical factors and varied market conditions.

This has led to remarkable passenger growth at airports in Moldova (+49.2%), Bosnia & Herzegovina (+31.1%), Israel (+27%), Kosovo (+16.6%), and Georgia (+13.7%), in contrast to the modest increases registered in the larger markets of Türkiye (+1.2%) and Azerbaijan (+1.6%).

Results by market segments

Passenger traffic at the Majors (airports serving over 40 million passengers) recorded the slowest growth in H1, rising by only +3.3% year-on-year.

The strongest growth among major airports was recorded at Istanbul Sabiha Gökçen (+11.5%) and Rome Fiumicino (+6.5%).

Notably, London Heathrow maintained its status as the busiest European airport, with 39.9 million passengers, up +0.2% year-on-year.

Istanbul ranked second to London Heathrow with 39.1 million passengers (+2.5%), followed by Paris Charles de Gaulle with 34.6 million (+4.3%), Amsterdam Schiphol at 32.7 million (+3%) and Madrid Barajas with 32.6 million (+3%).

In the Mega airports segment, traffic was up +4% year-on-year, supported by sharp increases at Milan Malpensa (+11.4%) and steady gains at Athens and Copenhagen (both +7.6%).

The strongest gains were seen in Large airports (10-25 million passengers) and medium airports (1-10 million passengers), each rising by +5.4%, driven by selective low-cost carrier expansion and continued strength of leisure and VFR demand.

Tel Aviv emerged as the fastest-growing large airport (from a crisis-hit low base), recovering by +27%, followed by Krakow (+18.7%), Budapest (+15%) and Warsaw (+13.2%).

The top-performing Medium airports included Trieste (+31.8%), Bournemouth (+24.9%), Kaunas (+20.6%), Poznan (+20%), Varna (+19.1%), Genoa (+18%), Girona (+17.1%), Memmingen (+16.4%), Wroclaw (+15.6%), Bari (+15.7%) and Cork (+14.5%).

Despite recording a +5% increase in passenger volumes in H1, Small airports (under 1 million passengers) continue to lag in recovery, with traffic levels still -32.9% below pre-pandemic performance.

Growth performance across airport groups

Passenger traffic growth in June was moderate across all airport size categories.

Airports with over 40 million passengers (Majors) posted a +2.4% increase, while those serving 25-40 million (Mega) grew +3.4%. Airports with 10-25 million passengers (Large) saw a +2.4% rise, while airports with 1-10 million passengers (Medium) recorded an increase of +4.2%. Passenger traffic at small airports (under 1 million) were up +5.2%.

Majors: Istanbul (+12.2%), Munich (+6.1%), Barcelona (+4.8%), Rome (+3.0%) and Frankfurt (+2.8%)

Mega airports: Milan (+9.5%), Copenhagen (+9.4%), Paris (+7%), Dublin (+5.8%) and Athens (+4.6%)

Large airports: Krakow (+18.1%), Warsaw (+13.3%), Almaty (+9.6%), Budapest (+9.1%) and Valencia (+9.1%)

Medium airports: Chișinău (+39.7%), Bournemouth (+29%), Varna (+25%), Trieste (+25%) and Genoa (+18.8%)

Small airports: Bucharest (+403.4%), Syros Island (+112.8%), Karlstad (+97.5%), Gyumri (+66.9%) and Volos VOL (+51.1%) ✈