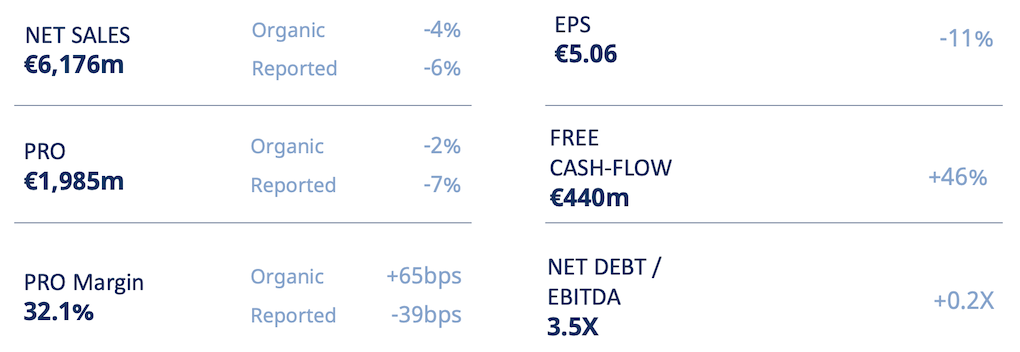

French drinks powerhouse Pernod Ricard today reported sales of €6,176 million for the first half of its financial year, down -6% year-on-year on a reported basis (-4% organic). Group share of net profit was €1,190 million, down -24%.

The Global Travel Retail division experienced a -9% decline in sales year-on-year. According to the company, growth in Europe was driven by air travel while cruises recorded positive results in the Americas.

In China, the performance was impacted by the technical suspension of the duty-free regime on Cognac, relayed to tit-for-tat anti-dumping measures (click here for our report) introduced on European brandies by China’s Ministry of Commerce in October.

This is expected to heavily affect the second half of the fiscal year unless the matter is resolved. Cognac accounts for an estimated 90% of China Duty Free Group’s liquor sales.

Additionally, the company noted weakness in South Korea, attributing this to both the political crisis and a weak macroeconomic environment.

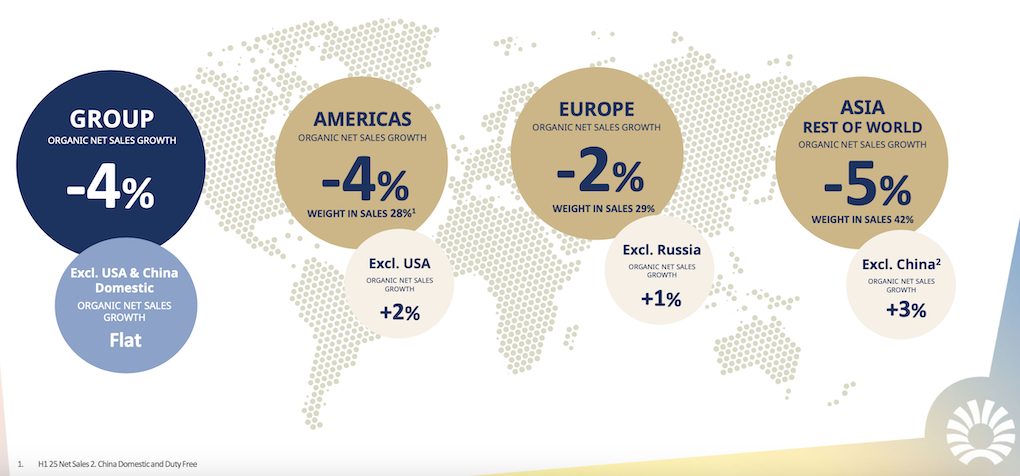

Among other key markets, sales in the Americas fell -4%, led by a -7% decline in the USA. The company noted that US sell-out dropped -6%, though brands such as Jameson are improving performance in H2.

Canada performed well, particularly with ready-to-drink (RTD) growth, while Brazil saw consumer demand recovery. Mexico remained flat but gained share in off trade.

Asia and Rest of the World sales declined -5%, with China dropping -25% with “early signs of a very soft Chinese New Year and significant decline in gifting”.

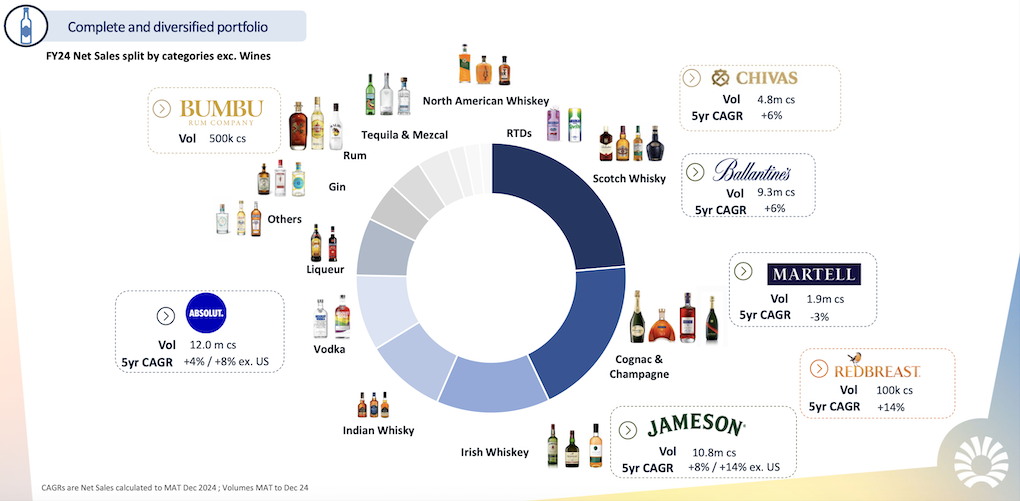

While Martell and Royal Salute struggled, premium brands such as Absolut, Olmeca and Jameson showed growth.

India saw a solid +6% increase, driven by demand for Jameson, Ballantine’s, The Glenlivet, Royal Salute and Seagram’s whiskies, with continued momentum expected in H2.

Sales in Europe fell -2% (excluding Russia: +1%), with growth in Poland, France and Ireland, while Spain saw a slight decline but gained share in off trade. Germany experienced a sharper decline but achieved share gains.

Sales of Strategic International Brands fell -6%, with Martell seeing a sharp decline, contributing to around 90% of the total group net sales drop, primarily due to challenges in China and global travel retail.

Jameson was broadly flat, with positive volumes and strong growth in India. Absolut saw growth, fuelled by a halo effect from RTDs, particularly in Europe. Scotch brands Ballantine’s and Chivas Regal performed well, showing resilience in key markets.

Pernod Ricard Chairman & CEO Alexandre Ricard remarked today during the H1 results announcement: “We have begun to receive early signs that Chinese New Year is likely to be very soft.

“In addition the challenge posed by the technical suspension of the duty-free regime on Cognac in China due to the anti-dumping measures, is still ongoing and expected to impact our second half heavily.

“Taking those impacts into account leads us to update our expectations for our top line to low single-digit decline for the full fiscal year.

“Our first-half performance is in line with our expectations, with a sequential improvement in the second quarter over the first. Q2 is down -2.5% in terms of net sales, versus -6% for Q1 marking four consecutive quarters of volume growth.

“Challenging macro-economic environment and intense geopolitical uncertainties continue to impact the spirits market, particularly the worsening context in China and travel retail Asia.

“We are confident in our strategy, operating model and the engagement of our teams around the world to deliver sustainable value growth. We’re determined to navigate these cyclical headwinds with resilience and agility.” ✈