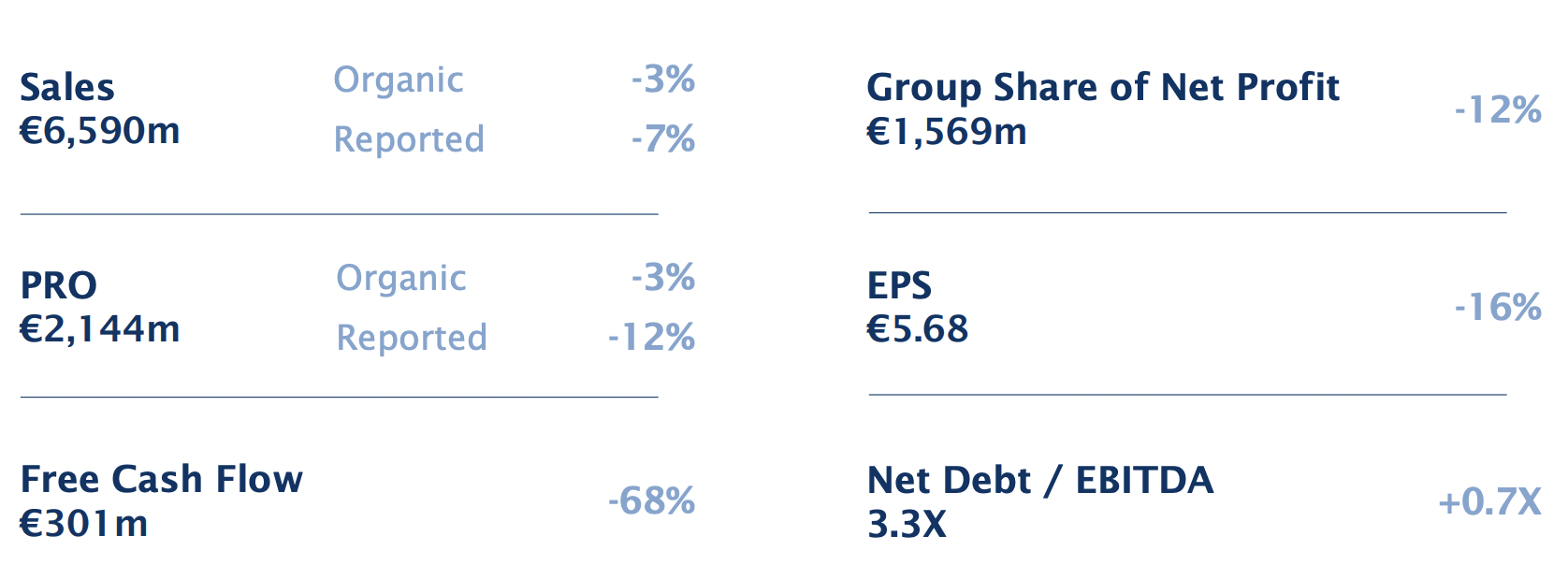

Leading drinks group Pernod Ricard today reported results for the first half of its financial year, with sales down by -7% year-on-year on a reported basis (-3% organic) to €6,590 million. Net profit fell by -12% (reported) to €1,569 million.

The Global Travel Retail division posted a -3% dip in sales year-on-year, with the company citing phasing issues between the first and second half, with strong growth forecast in the second half.

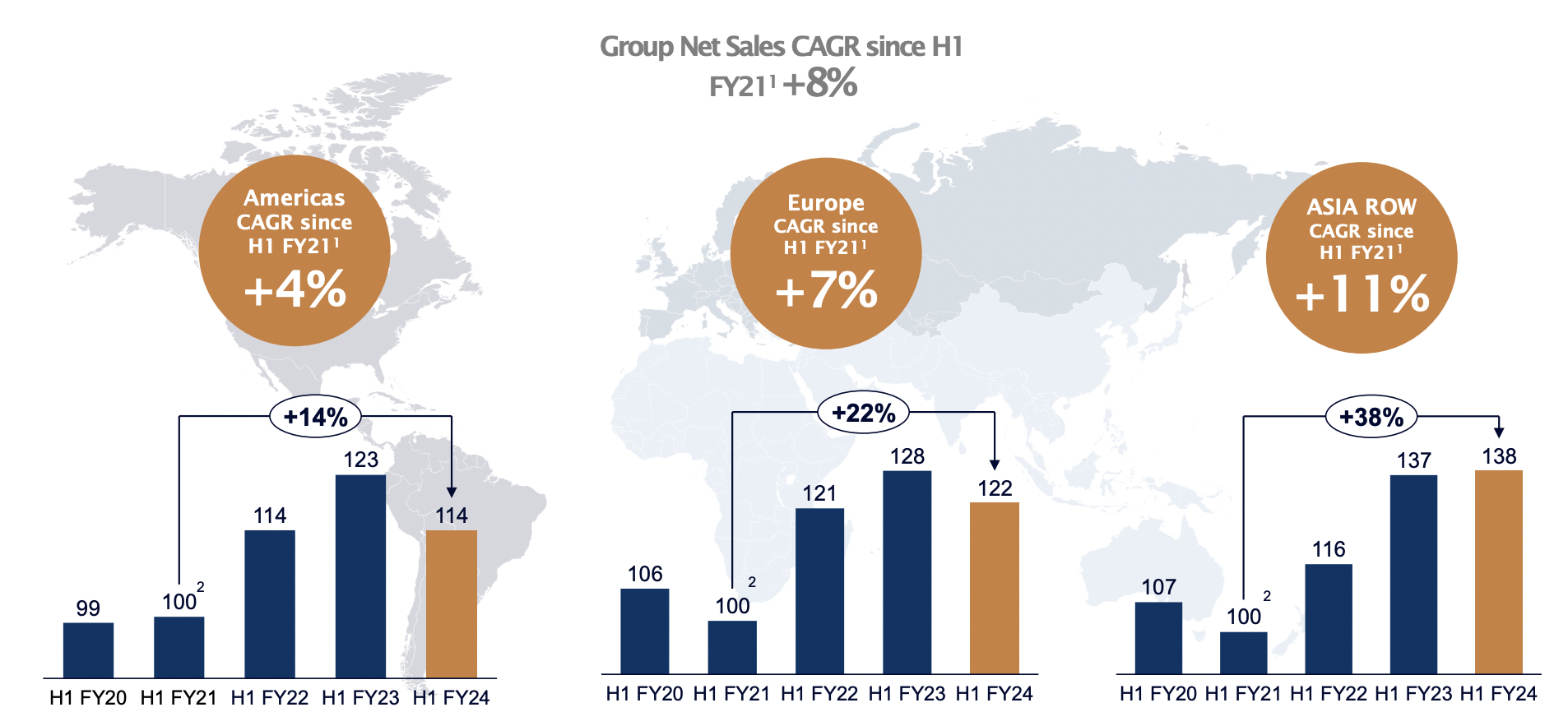

Among other key markets, sales in the Americas fell by -7%, led by the US, also at -7%. The company said that value depletions fell around -6%, due to a high comparison basis with the previous year, compounded by inventory adjustments. The group cited share gains for Jameson Original, Malibu, Kahlua, The Glenlivet, Código and Jefferson’s.

Asia-Rest of the World sales climbed by +1% year-on-year with travel retail showing growth. By key market China sales fell by -9% with Pernod Ricard highlighting “softening consumer demand in a challenging macro environment”.

Martell Noblige was “resilient”, while premium and super-premium whiskies including Chivas Regal showed growth in China. Pernod Ricard also singled out Absolut, Jameson, tequila and gin for their performances in China.

Sales in India climbed by +4% in the half, with acceleration in Q2. Strategic International Brands showed strong growth, notably Jameson, Absolut and The Glenlivet.

Europe sales fell -4% (+1% excluding Russia), with strong growth in Central and Eastern Europe led by Poland and a resilient performance in Western Europe.

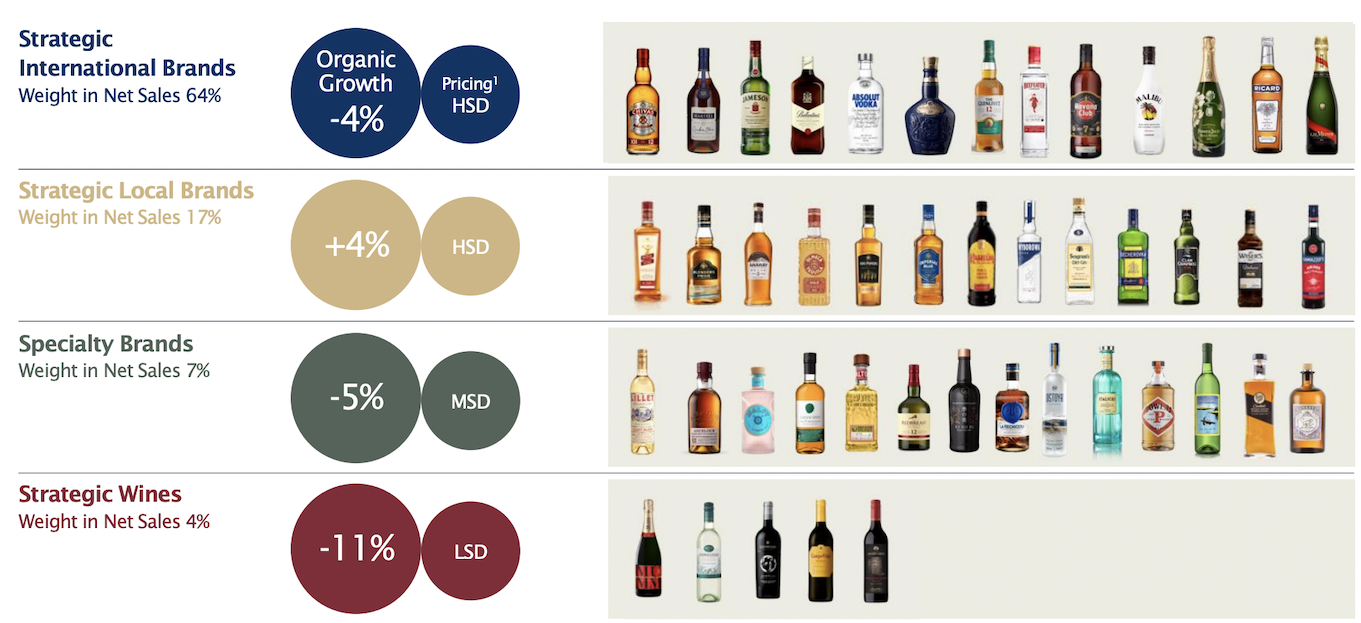

Sales of Strategic International Brands slid by -4% in the half, with good growth in Royal Salute, Havana Club and Perrier-Jouët offset by declines at Martell, Jameson, Chivas Regal and Ballantine’s due to exposure to China, USA and LATAM.

Pernod Ricard Chairman & CEO Alexandre Ricard said: “We delivered a robust performance in the first half of the year, as we confidently steer Pernod Ricard through the normalisation of the spirits market, following two years of outstanding growth.

“We achieved strong gross margin expansion [up 126 basis points -Ed] on the back of substantial pricing actions, thanks to the power of our premium portfolio. With a diversified footprint spanning mature and emerging regions and a broad presence across spirits categories, we are able to weather volatility and continue to gain share in many markets.

“I am convinced that our sound strategy, together with the dedication, agility, and exceptional engagement of all our teams around the world, will enable us to deliver our ambitions.”

Speaking later on an investors’ call, Alexandre Ricard cited four underlying factors influencing the first-half performance.

“The first is the normalisation of the spirits markets globally, particularly skewed towards the US, after three years of a super-cycle post-Covid across our industry,” he said. “The second inventory adjustment is in the US, particularly at retailer level, in a high interest rate, high cost of carry environment.”

A third factor noted Ricard, is weak consumer confidence in China in a weak macro-economic environment.

Balancing these is the fourth factor, namely strong growth in India, Asia Pacific excluding China, plus Central and Eastern Europe excluding Russia, with resilience in the key western European market.

For the full year, Pernod Ricard said it expects “dynamic” H2 net sales to improve compared to H1, with low single-digit organic operating profit growth. For the full year the group is forecasting +4% to +7% top line growth, with organic operating leverage of +50 to +60 basis points.

Asked why he remains confident of achieving mid to high single-digit sales growth over the medium term, Ricard said: “If we look at our ‘must-win markets’, the US will finally normalise. It is happening. Sell-out remains quite resilient after three years at +8% and will go to mid-single digit range.”

Of the big picture for China, he added: “Our consumer pool in China is middle class households. Our market penetration rate is still extremely low at 2%. With the macro-economic headwinds the consumer is there but is putting money in the bank rather than spending it.

“The trade has been cautious as we entered Chinese New Year. It’s too early to say we are seeing any downtrading. We see good performance in Absolut and our whiskies, good resilience in Martell Noblesse Oblige and some softness in XO. Over time we remain very confident [of high single-digit to low double-digit average growth] even if China will have some better and some worse years”.

On other key markets, he noted that the “underlying fundamentals” in India are very strong, from demographics to GDP growth, alongside urbanisation rates and the trend towards premiumisation.

For the rest of the world, he said that the “super cycle of ‘revenge conviviality’ is now behind us, and we expect resilient growth”.✈