Leading drinks company Pernod Ricard today reported full-year results to 30 June, with sales reaching €8,824 million, representing organic growth of +9.7% year-on-year. Reported sales rose by +4.5% due to an adverse foreign exchange impact from US Dollar and emerging market currencies against the Euro.

Travel retail sales fell by -40% year-on-year. The company said it continued to gain share in the channel and that sell-in grew in H2, but added that the result reflected continued subdued passenger traffic around the world.

The company also cited a “positive pricing and strong mix, thanks to better resilience of Martell and Royal Salute,” and highlighted the “continued momentum behind offshore duty free islands, mainly Hainan and Jeju”.

Among other ‘must-win’ markets, USA sales grew by +16% reaching US$2 billion, while China surged by +44% to over €1 billion. Sales in India climbed by +9% but slowed in Q4 due to the impact of COVID-19.

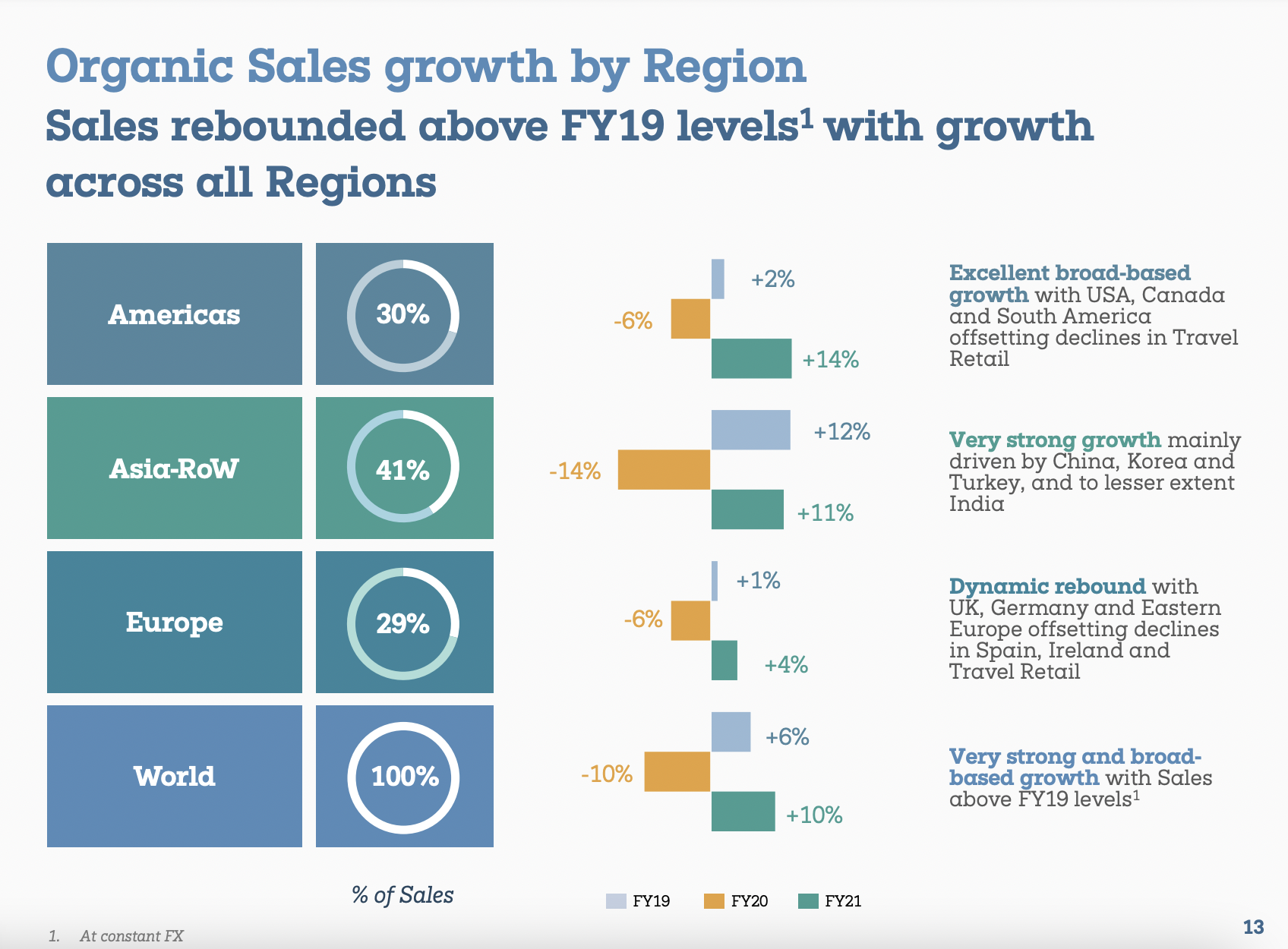

By wider region, Americas sales grew by +14%, offsetting the decline in travel retail; Asia-Rest of the World sales grew +11%, with Korea and Turkey also contributing alongside China and India. Europe sales rose by +4%, with a “dynamic rebound in the UK, Germany and Eastern Europe” offsetting declines, in Spain, Ireland and travel retail.

By category, Strategic International Brands posted +11% growth, primarily driven by Martell in China and Jameson in the USA. Martell grew by +24%, Jameson by +15%, Absolut by +4% and Scotch +6% (+16% excluding travel retail).

By category, Strategic International Brands posted +11% growth, primarily driven by Martell in China and Jameson in the USA. Martell grew by +24%, Jameson by +15%, Absolut by +4% and Scotch +6% (+16% excluding travel retail).

Strategic Local Brands posted +7% sales growth, driven by the recovery of Seagram’s Indian whiskies, Kalhua, Passport and Ramazzotti. Specialty Brands showed healthy growth of +28%, led by Lillet, Aberlour, Malfy, American whiskeys, Avion and Redbreast. The performance of Strategic Wines was stable, with Campo Viejo growth offset by the decline of Jacob’s Creek and Kenwood.

Profit from recurring operations was €2,423 million, an organic growth of +18.3% (+7.2% reported) with a strong lift in organic operating margin of +213 basis points.

Group share of net profit was €1,305 million, +297% reported, a significant increase due mainly to non-recurring items in FY20, in particular a €1 billion impairment charge.

The company said that its ‘Transform & Accelerate’ strategy launched in 2018 has driven “significant achievements” with consumer insights playing a key role.

The company said: “Pernod Ricard will continue its transformational journey to become The Conviviality Platform.”

This strategy seeks to maximise long-term value creation, with a medium-term ambition to hit +4% to +7% top-line growth; focus on price and new operational excellence initiatives; strong A&P investment set at 16% of sales and discipline on structure costs.

Chairman and Chief Executive Officer Alexandre Ricard said: “The business rebounded very strongly during FY21 to exceed FY19 levels. We expect this good sales momentum to continue in FY22 with, in particular, a very dynamic Q1.

“We will stay the strategic course, accelerating our digital transformation and our ambitious Sustainability & Responsibility roadmap. Thanks to our solid fundamentals, our teams and our brand portfolio, we are emerging from this crisis stronger.”