Moodie Davitt snapshot: Puig 2017 results – Net revenues up +8.1% to €1,935 million – Net profit jumps +47% to €228 million – Revenues grown by +28% over the past three years Source: The Moodie Davitt Report |

Spanish beauty house Puig posted a record year for net revenues and profit in 2017.

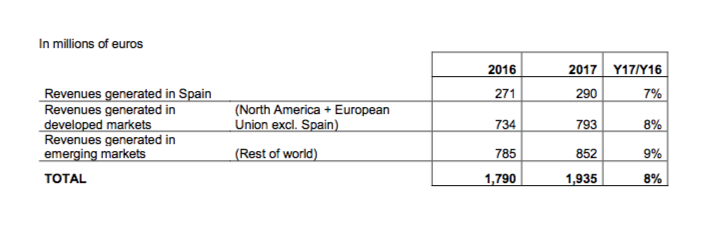

Net revenues amounted to €1,935 million, representing a +8.1% increase on a reported basis and +8.6% rise on a like-for-like and constant currency basis.

Profit before tax represented 16% of net revenues, while net income rose to €228 million, or 12% of revenues.

Revenues have grown by +28% over the past three years, an increase above the industry average and in line with the company’s plan for the period, said Puig.

The company’s goal is to generate €3 billion in annual revenue by 2025.

“Puig believes that travel retail and the Asian market will be the main drivers of sales in selective fragrances over the next ten years; they are expected to grow at twice the rate of the sector as a whole. The company has accordingly intensified its focus on its global travel retail channels,” said Puig.

15% of revenues were generated in Spain (where the company grew by +7%) and 85% in other countries. Emerging markets outside of North America and the European Union accounted for 44% of the company’s business.

Year-on-year growth was strong in the company’s main markets (Spain, USA, France and the UK). The launches of Good Girl and Prada spurred a double-digit sales increase in the USA. Good Girl by Carolina Herrera ranked among the world’s best-selling perfumes for the second year in a row.

Sales in emerging markets continued the double-digit rise recorded in previous years.

Puig is consolidating its position in the Southeast Asian market through a partnership signed with Luxasia in 2017 and in Oceania via an agreement with Trimex Pty, a subsidiary of Groupe Clarins in Australia and New Zealand.

Scandal, the first Jean Paul Gaultier perfume for women launched since Puig assumed control of the fragrances, was a major growth driver in 2017, said Puig.

Puig added that the launch of the newest men’s fragrance by Paco Rabanne, Pure XS, and the performance of Prada in its principal target markets also helped achieve ‘excellent’ overall fragrance sales.

“Puig believes that travel retail and the Asian market will be the main drivers of sales in selective fragrances over the next ten years”

Future plans

In March 2018, Christian Louboutin and Puig signed a long-term agreement focused on mutual growth in the international market for luxury beauty products. The partnership will harness the entrepreneurial, innovative and creative spirit of both companies to develop the cosmetics and fragrance business.

Puig has increased its stake in Eric Buterbaugh’s fragrance business (EB Florals) and now holds a majority share.

The company noted that revenue on a like-for-like basis is expected to rise in 2018 by approximately +5%. However, the negative impact of unfavourable exchange rates and the implementation of a new revenue recognition standard (IFRS 15) at the beginning of this year are expected to offset this growth in terms of reported figures, said Puig.

“The expectations and habits of digital consumers, social media, the evolution of distribution systems, sector consolidation, and the emergence of new niche players are transforming the sector landscape and making it necessary to view the market from a fresh perspective.

“Puig seeks to position itself as a company with a talent for creating unique experiences that set consumers dreaming, a company poised to shake up the industry with alternative business models and a portfolio of brands that redefine the sector and allow the company grow at an above average pace,” the company said.

Puig Futures

The company is in the process of launching Puig Futures, a platform conceived to enhance consumer experience, adapt brands to the new scenario and provide purchasing pathways more suitable for its sector.

Puig Futures will be active in three areas: the development of new, disruptive business models, partnerships with innovative companies, and minority investment in third-party enterprises.

Puig commented: “We are working with cutting-edge innovations in the areas of digital innovation communications, product offer, and technology and exploring new business models, drawing inspiration from the best ideas being applied in sectors similar to our own.

“The thrust of Puig Futures is focused on positioning Puig as the best collaborator in the industry, ready and willing to work with new start-ups as well as existing clients and suppliers. Our ambition is to support innovative projects with great potential with the capital, experience, and commercial opportunities required to reinvent the fragrance category together.”

Corporate Social Responsibility

In line with its latest three-year plan, Puig has met its zero-waste-to-landfill and 100% renewable electricity source targets. The company also reduced the greenhouse gas emissions generated by its factories by -20% with the objective of making these facilities carbon neutral by the end of 2020. It has also cut its overall corporate carbon footprint by -12%.

Puig continues to support social action through its Invisible Beauty programme. Run in close collaboration with Ashoka, it provides young entrepreneurs with the mentorship, training, and grants they need to promote and develop socially oriented projects

The company also continues to uphold its commitment to sustainability in five key spheres of corporate activity (Product Stewardship, Sustainable Sourcing, Responsible Logistics, Responsible Manufacturing, and Employees and Facilities) through 13 action programmes.