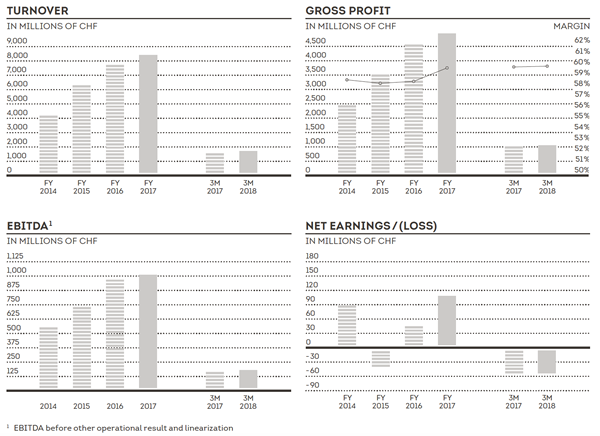

INTERNATIONAL. Travel retail sector giant Dufry today posted strong first-quarter 2018 results with turnover climbing +6.6% to CHF1,820.0 million (US$1.82 billion), driven by +7.1% organic growth.

Like-for-like growth contributed 4.9 percentage points to organic growth, while net new concessions added 2.2 percentage points – the highest quarterly contribution since 2011. Translational foreign exchange effect was -0.5% in the period, driven by the weakening US Dollar.

Dufry said that a +18.4% rise in EBITDA to CHF183.1 million (US$183 million) had been driven by the initial contributions of the company’s business operating model (BOM)/efficiency plan. These facts helped a 100-basis points improvement in EBITDA margin to 10.1%. BOM is designed to implement best practices as well as common processes and procedures across the group, generating additional efficiencies. It is expected to be completed by the end of 2018.

The previously announced share buyback programme will be launched on 11 May, Dufry said.

Organic growth continued at good levels through the first quarter to +7.1%, accelerating from the +5.7% seen in Q4 2017. The performance was broad-based, with division Eastern Europe, Middle East, Asia and Australia posting “outstanding” organic growth of +21.1%. Divisions Latin America and North America showed +9.0% and +8.4% organic growth, respectively.

Dufry Group CEO Julián Díaz commented: “The strong operational performance with an organic growth of +7.1% as well as the impact of the Business Operational Model/efficiency plan have supported the increase in profitability and the EBITDA margin in particular.

“We also saw a remarkable cash generation, although Q1 is not relevant in that respect. The strong top-line growth was generated through a combination of an overall more efficient operation, like-for-like growth, while the contribution of new concessions added to the portfolio, namely in the UK, Colombia, Mexico, the Caribbean and Asia as well as new vessels in the Dufry Cruise Services business.

“From a profitability perspective, we have started to see the first impacts from the Business Operating Model/efficiency plan implementation. Last but not least, there are also slightly over CHF10 million of savings in the financial result mainly due to the refinancing of our debt in 2017.

“Our priorities for 2018 remain intact. We will continue to focus on completing the implementation of the BOM and generating further efficiencies, while accelerating the development of our digital strategy and expanding our growth outside the airport channel. All these activities will contribute to further improve organic growth and spend per passenger, which will ultimately result in an enhanced cash generation and deleveraging of our balance sheet.

“The positive market conditions seen throughout 2017 have continued in the first months of 2018 in all divisions, with similar organic growth performance as in previous quarters, thus providing a good base for the start into the high season. We will continue to focus on the execution and development of our operational capabilities to ultimately create another long period of sustainable growth.’’

Analyst reaction: Bank of America Merrill Lynch – EBITDA up +18% and +6% ahead of consensus – “Better than expected” result due to stronger revenue growth and 70bps of operational leverage – Ahead of expectations but Q1 is the smallest quarter of the year (15% of 2017 EBITDA) and “significant headwinds” to come – Key challenges: (1) increasing concession fees; (2) negative passenger mix; and (3) increased online threat |

Store investment pays off

Dufry continued improving and enlarging its operations. In the first quarter, the company refurbished 7,100sq m and plans for a further makeover of some 41,000sq m through the balance of 2018. The company also opened and expanded some 4,500sq m of gross retail space and has signed contracts for opening a further 13,900sq m in 2018/19.

Robust regional results

Southern Europe and Africa turnover grew by +11.2% to CHF321.1 million. Organic growth was +3.7%. France, Malta and Africa achieved double-digit growth, the latter following a recovery in tourist numbers in the region, especially in Morocco. Italy and Greece also performed well, Dufry said. Performance in Spain was “slightly positive” against very strong comparables last year.

UK and Central Europe turnover grew marginally to CHF397.4 million from CHF384.2 million in the previous year. Organic growth in the division was -1.4%, impacted by the closing of the Geneva Airport business on 2 October 2017. Operations in the UK grew mid-single digits as did Finland. Sweden and Switzerland (excluding Geneva) also had positive performances.

Eastern Europe, Middle East, Asia and Australia turnover increased to CHF256.5 million against CHF219.8 million last year. Organic growth was +21.1% and followed the positive momentum seen in Q4 2017.

In the Middle East, Jordan, Kuwait and Sharjah grew double digits. In Asia, most operations performed well, including South Korea, Indonesia, Macau and Cambodia. In Australia, sales grew double digits after the renovation and implementation of the new generation store at Melbourne Airport.

Latin America turnover grew to CHF408.1 million from CHF 400.2 million one year earlier and organic growth reached +9.0%. Mexico and the Caribbean operations performed very well generally, Dufry said, marked by double-digit growth in several locations.

South America also reported a growth acceleration, with Ecuador and Peru ranking best and Brazil delivering a good performance, the company noted.

The cruise retail business, an increasing priority for Dufry, delivered strong double-digit growth driven by a combination of like-for-like improvement and new project wins. North America turnover reached CHF404.4 million compared to CHF392.1 million in the first quarter of 2017. Organic growth was +8.4%, as a result of a solid performance in the USA and Canada across both duty free and duty paid businesses.

Seasonal influences

Dufry noted that it has a distinctly seasonal business. As most of its businesses are located in the Northern hemisphere, the third quarter has the highest passenger flows. Consequently, the first quarter is the least important period of the year for turnover, profitability and free cash flow, which is typically negative.

In 2017, the first quarter accounted for 20% of turnover and 15% of EBITDA.

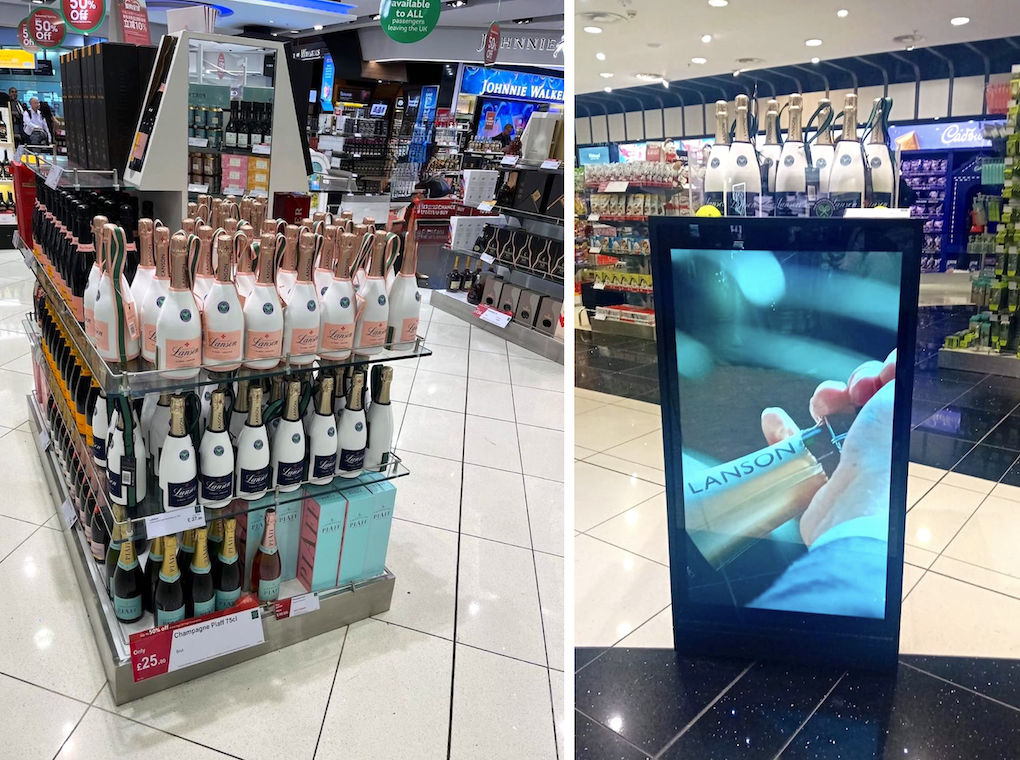

Gross margin improved by 30 basis points to 59.9% in Q1 2018 from 59.6% in the previous year. The improvement was driven by improved terms with suppliers and increased promotional activities with brand partners.

Selling expenses also improved by 20 basis points, driven by lower concession fees as a result of changes in mix and contract renegotiations. Personnel expenses and general expenses improved by 10 and 30 basis points respectively when measured as percentage of turnover.