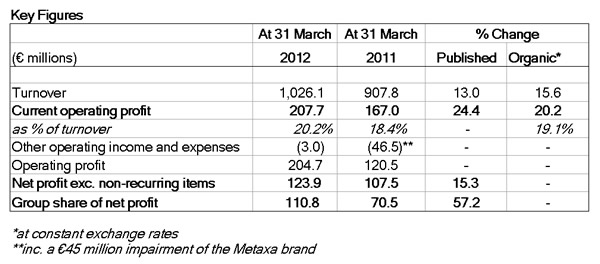

Rémy Martin Cognac turned in a stellar travel retail performance amid glowing results for Rémy Cointreau, whose turnover for the year ended 31 March 2012 grew +13% (+15.6% organic) to €1,026.1 million.

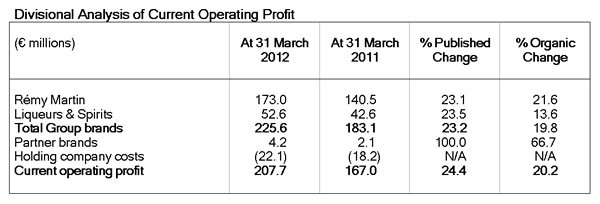

Current operating profit rose by +24.4% to €207.7 million, while the current operating margin, which included a further increase in marketing investment, was 20.2%.

|

All regions reported growth, with double-digit growth in Asia Pacific and the US. Europe was driven by Western Europe and Russia.

Net profit, excluding non-recurring items, was €123.9 million, an increase of +15.3% compared with the previous year.

|

Rémy Martin – The brand reported a solid +21.9% increase in turnover to €592.5 million and a +23.1% rise in current operating profit to €173.0 million, under the combined effect of price increases and the continued move of Cognacs upmarket, particularly in Asia. The US, Travel Retail and Russia also participated in this substantial growth. There was a further improvement in the operating margin to 29.2% (28.9% in the previous year), despite another increase in marketing investment this year.

Liqueurs & Spirits – Overall turnover for this division rose +3.8% to €215.8 million, a good performance given the fact that Europe, where economies have experienced mixed fortunes, is the activity’s primary market. Cointreau and Mount Gay Rum both reported growth in their key markets. Metaxa enjoyed renewed growth following two years of decline, on the back of weak comparatives marked by the Greek crisis. Current operating profit grew by +23.5% to €52.6 million. The operating margin also rose to 24.4%, with on-going strong marketing investment to support key brands.

Partner brands – Turnover was €217.8 million, an increase of +1.9%, with an operating profit of €4.2 million. This division, which now includes the distribution of Piper-Heidsieck and Charles Heidsieck* Champagnes, is driven by positive business activity, primarily in the US and in Travel Retail.

*On 8 July 2011, Rémy Cointreau transferred its Champagne division to the EPI Group for an enterprise value of €412 million. Rémy Cointreau and EPI have concluded a global distribution agreement for the Piper-Heidsieck, Charles Heidsieck and Piper Sonoma brands.

“The momentum recorded throughout the 2011/12 financial year, despite an uncertain economic and monetary environment in Europe, demonstrates that Rémy Cointreau is in a good position to continue to grow its brands. The Group will therefore remain true to its value strategy whilst considering potential growth opportunities,” the company said in a statement.

[houseAd4]