SWITZERLAND. Luxury goods group Richemont saw off inflationary pressures and repeated temporary store closures due to the pandemic to grow sales by +46% year-on-year in the 12 months ending 31 March 2022.

Revenue at the Swiss group – whose high-end brands include Cartier, Chloé, Dunhill, IWC Schaffhausen Montblanc, Vacheron Constantin and Van Cleef & Arpels – hit an all-time high of €19.2 billion. Even on a two-year comparison (versus pre-pandemic FY19/20) growth was +35%. Profitability also crossed the €2 billion mark to €2.08 billion, a year-on-year rise of +61%.

Richemont Chairman Johann Rupert commented: “The strong sales, profit and cash flows confirm the strong appeal of our Maisons and relevance of our long-term strategy.”

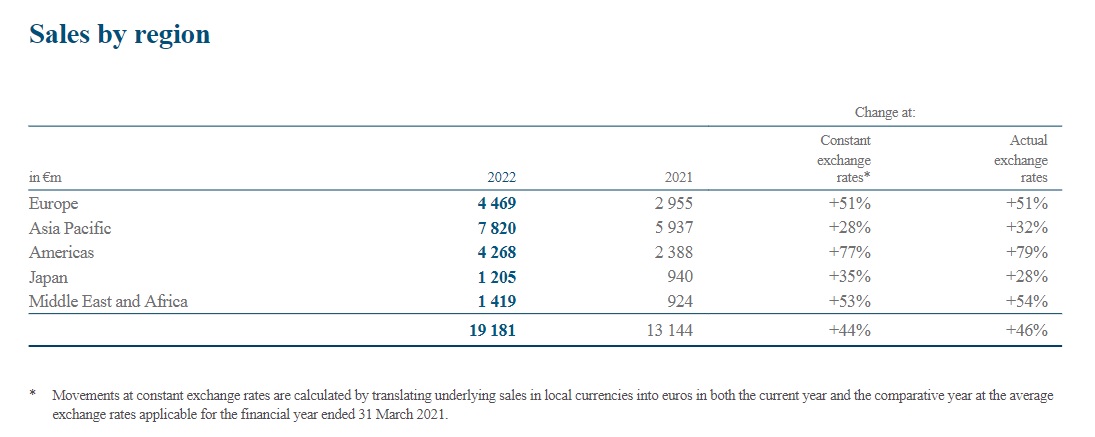

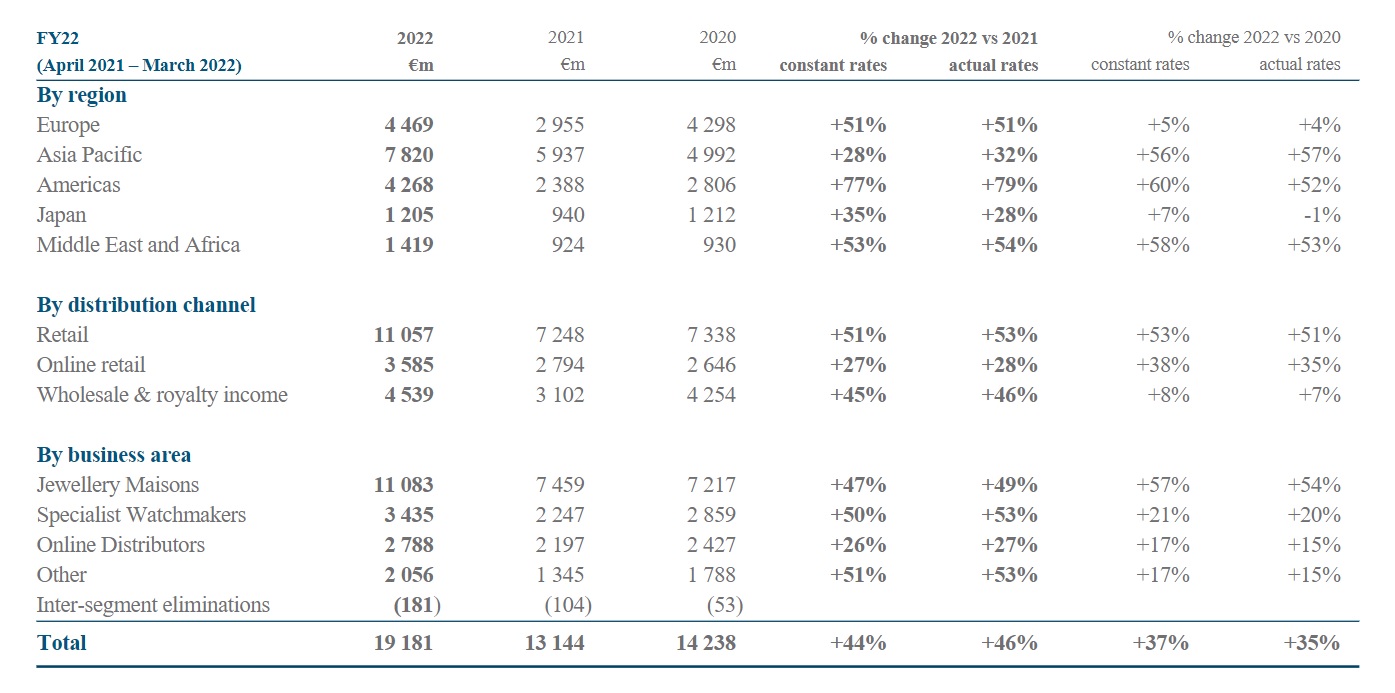

At constant exchange rates, all Maisons, channels and regions achieved double-digit growth, led by retail (+51%) and the Americas (+77%). Sales in the largest region of Asia Pacific – which contributed 41% of group revenue – were more subdued at +28%. In a statement, Richemont said: “Recent localised Covid-related lockdowns, particularly in China, led to temporary boutique closures in March, negatively impacting an otherwise strong quarter.” Mainland China sales grew by +20% compared to the prior year.

Sales in the largest region of Asia Pacific – which contributed 41% of group revenue – were more subdued at +28%. In a statement, Richemont said: “Recent localised Covid-related lockdowns, particularly in China, led to temporary boutique closures in March, negatively impacting an otherwise strong quarter.” Mainland China sales grew by +20% compared to the prior year.

Soft tourism-related business

The strength of the Americas on both a one-year and two-year comparative basis (+77% and +60% respectively) means that the region now stands almost on par with Europe with sales of €4.27 billion versus Europe’s €4.47 billion.

Rupert said: “The strong European client base more than offset subdued inbound tourism, leading to a 51% sales increase.” Meanwhile in the Middle East and Africa, a similar lift enabled the region to surpass Japan (up +35%) as Richemont’s fourth-largest market. Japan, which contributed 6% of group sales, has been on a slow recovery as international travel to the country, and related travel retail and tourist sales, have been soft.

Among Richemont’s key brands in the duty free channel is Montblanc but the company said that “lacklustre travel retail continued to weigh on the Maison’s performance”.

On the plus side, Belgian luxury leather goods house Delvaux – claimed to be the inventor of the modern handbag – has entered Shinsegae Gangnam in Seoul, South Korea. The brand was bought for €178 million by Richemont in June 2021 and, since consolidation into the company’s ‘Other’ division from 1 July, 2021 it has contributed €102 million to the top line.

Direct-to-consumer business is rising

Sales at Richemont are becoming more concentrated on direct-to-consumer business which now accounts for 76% of group sales across directly-operated stores and online retail channels.

Rupert said: “We have improved insight into client profiles, allowing us to better meet expectations, nurture closer relationships and optimise supply chain management. While wholesale recovered from last year, direct-to-client sales rose by double digits compared to both the prior year and on a two-year comparative basis.”

Among Richemont’s business segments of Jewellery, Specialist Watchmakers, Online Distributors, and Other, the biggest – jewellery with €11.08 billion in sales – stands out for being +57% ahead of 2019/20; the rest are between +17-21% ahead.

On sustainability, Richemont is removing polyvinyl chloride (PVC) from its products and packaging and expects to achieve this objective by December. The company has been rated among the top 2% of companies for ESG by Sustainalytics, just behind Hermès International and Kering, but ahead of LVMH.

Outlook

Richemont has suspended operations in Ukraine and Russia which “somewhat impacted” sales, but the company had a €5.3 billion net cash position at the end of March, a useful buffer in what are expected to volatile times ahead.

Rupert commented: “Even if the worst of Covid is hopefully behind us, we face a global environment which is the most unsettled we have experienced for a number of years. We can take comfort from the strength of our Maisons as well as their relatively balanced geographic spread.”