SWITZERLAND. Luxury goods group Richemont posted a +6% year-on-year rise in sales (at actual exchange rates, +12% constant) for the first half of the fiscal year to €10.22 billion (US$10.9 billion).

Operating profit reached €2.7 billion, down by -2% at actual exchange rates (+15% constant) with a 26.0% operating margin (28.5% at constant exchange rates, a 90 basis-point increase)

The company, whose high-end brands include Cartier, Chloé, Dunhill, IWC Schaffhausen Montblanc, Vacheron Constantin and Van Cleef & Arpels, described a strong underlying performance “notwithstanding uncertain macroeconomic and geopolitical environments, demanding comparatives and significant adverse foreign currency movements”.

Richemont Chairman Johann Rupert said: “The ongoing focus on enhancing the desirability of our Maisons, promoting direct-to-client engagement, nurturing our domestic clienteles and reinforcing the agility and excellence of our operations has strengthened the group and reinforced its resilience.”

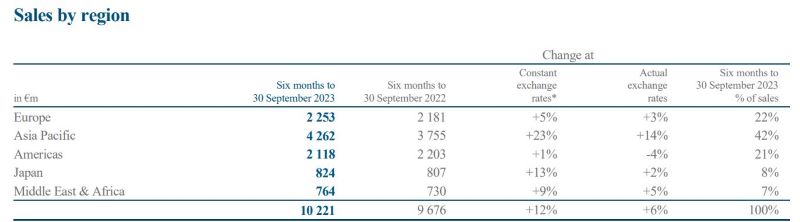

At constant exchange rates, almost all regions and distribution channels delivered positive performance, led by Asia Pacific (+23%) and retail (+16%).

The strong sales growth in the largest region of Asia Pacific – which contributed 42% of group revenue – was boosted by the increase in travel demand in Mainland China, Hong Kong and Macau after pandemic restrictions were lifted earlier in the year. These three markets contributed a combined sales increase of +34%.

“The double-digit half year sales increase at constant exchange rates reflected a very strong first quarter and softer second quarter, up +5% at constant exchange rates, highlighting the resilience of our Maisons in a challenging environment,” said CFO Burkhart Grund during an earnings calls.

“Q2 sales were impacted by organic growth softening to high single digit in Asia Pacific and decreasing by -1% in Europe. At actual exchange rates, the second quarter sales were down -2%.

“The strongest regional growth was in Asia Pacific, fuelled by the removal of COVID-related restrictions at the start of the year and the related resumption of travel by the Chinese clientele.”

Grund highlighted a +34% sales increase in Mainland China, Hong Kong and Macau as having driven the half-year performance. This followed the scrapping of the COVID constraints and increasing travel flows across these three markets. Other regional locations to show strong growth included Taiwan, Thailand and Australia while other markets had varied and somewhat more muted performances.

Rupert said: “Growth was led by Asia Pacific with sales up by +14% following the reopening of China, Jewellery Maisons and the retail channel which, together with the online retail channel, contributed 74% of group sales.”

Sales in the Americas were down by -4% due to lower wholesale revenues and a relatively weak US dollar over the period.

Europe maintained positive growth, with sales slightly up by +3% despite the demanding comparatives (+45%).

In Japan, sales growth also slowed, up by just +2%, when compared to the +66% recorded in the prior-year period. The results reflect the continued rebound in tourist arrivals, notably from Mainland China, partly favoured by the drop in the value of the Yen.

The sales increase in Richemont’s retail channel aligned with the growth across all business areas and regions. The channel incorporates sales from the group’s directly operated stores, generating 69% of group sales, up from 67% in the prior-year period.

The top-contributing business segment was the Jewellery Maisons, with a +10% sales increase compared to the prior-year period, while sales at the Specialist Watchmakers were -3% lower.

Sales in the ‘Other’ business area, including Watchfinder, slid by -1%, while sales in fashion & accessories Maisons were broadly in line with the prior-year period, driven by retail and particularly strong performances at Alaïa, Delvaux and Peter Millar, which offset the slowdown at some other Maisons.

Looking ahead, Rupert said: “The period under review started strongly, beyond our expectations. However, growth eased in the second quarter as inflationary pressure, slowing economic growth and geopolitical tensions began to affect customer sentiment, compounded by strong comparatives.

“Consequently, we have seen a broad-based normalisation of market growth expectations across the industry. The positive news is that a soft-landing scenario seems to be prevailing in major economies with still higher growth expected from China, which should benefit from stimulus measures.

“We have further reinforced the breadth and depth of the skillset both on our Senior Executive Committee and the Board. Our Maisons have continued to enhance their desirability and capabilities and increase proximity with their clients. Financial discipline has been maintained enabling targeted investments and a further strengthening of our operations.” ✈