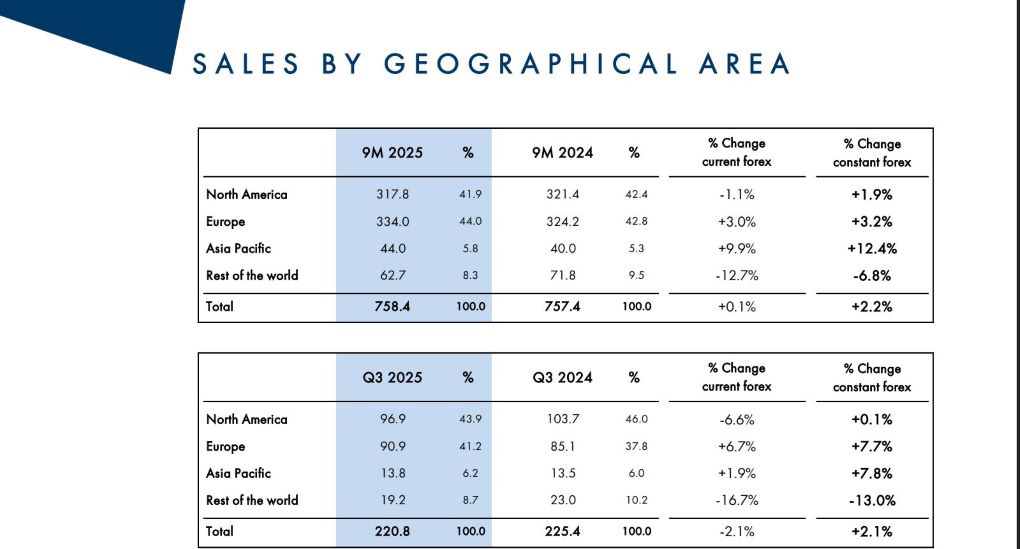

Eyewear group Safilo reported net sales of €220.8 million in the third quarter, up +2.1% year-on-year at constant exchange rates (down -2.1% at current rates).

In preliminary results released yesterday (4 November), the company attributed the steady performance to sustained demand for its contemporary and lifestyle brands, which helped offset the impact of a challenging macroeconomic environment and persistent foreign exchange pressures.

However, the further depreciation of the US dollar against the euro weighed on reported figures.

Prescription frames continued to expand across all regions, with sunglasses driving recovery in Europe amid stronger sell-through.

Key brands, including Carrera, David Beckham, Marc Jacobs, BOSS, Kate Spade and Carolina Herrera were the top performers, highlighting the appeal of Safilo’s lifestyle-driven portfolio.

During the three-month period, Safilo posted gross profit of €131.7 million, down -1.2% year-on-year. Gross margin, however, improved by 60 basis points to 59.7% from 59.1%.

Adjusted EBITDA grew strongly, rising +24.3% to €22.1 million, with the margin increasing from 7.9% to 10.0%, up 210 basis points.

Safilo Chief Executive Officer Angelo Trocchia commented, “In the third quarter, we confirmed the solidity of our results, with steady top-line growth and further strengthening of both margins and cash generation.

“While the period was penalised by intensified forex headwinds, the strength of our contemporary and lifestyle brands supported a resilient sales increase of +2.1%, broadly in line with our first-half performance.”

Improved profitability and stronger margins helped sustain Safilo’s growth trend over the first nine months, with net sales reaching €758.4 million, a +2.2% increase at constant exchange rates. Gross margin climbed to +60.6%, an increase of 90 basis points, while the adjusted EBITDA margin rose to +11.1%, up 110 basis points year-on-year.

Performance by region

Trocchia continued, “Our diversified geographical footprint enabled us to offset a flat trend in North America with a high single-digit upside in Europe while, in emerging markets, continued growth in Asia Pacific helped mitigate softness in the Rest of the World.

“In the quarter, our operations continued to face pressure from tariffs. Yet the effectiveness of our mitigation actions, together with favourable price/mix dynamics and the gradual normalisation of logistics and marketing costs, led to a year-on-year improvement in gross margin, and a significant increase in our adjusted EBITDA margin to 10% of sales.”

In North America, sales were flat compared to the same period last year at constant exchange rates. However, at current exchange rates, revenue declined -6.6% due to the sharp depreciation of the US dollar against the euro.

US performance showed contrasting trends. Smith delivered strong direct-to-consumer growth in the sports segment, though sales to physical stores were constrained by delayed shipments from China.

In the eyewear category, wholesale revenue grew at a mid-single-digit rate, supported by solid demand from chains and independent opticians, with key brands including Tommy Hilfiger, Marc Jacobs, BOSS, Kate Spade and David Beckham driving the momentum.

In the first nine months, North American revenue totalled €317.8 million, up +1.9% at constant exchange rates (-1.1% current exchange rates).

In Europe, Q3 sales increased +7.7% at constant exchange rates (+6.7% current exchange rates), fuelled by continued strength in prescription frames, improved sunglasses sales in markets such as Italy and favourable timing of deliveries.

Demand from independent opticians and retail chains remained solid, further supported by greater use of the You&Safilo BtB platform.

Carrera, David Beckham, Marc Jacobs, Tommy Hilfiger, BOSS and Carolina Herrera were among the top-performing brands, while France delivered the strongest growth, thanks to an expanding customer base and strong results from both global names and strong local performers, such as Isabel Marant.

Europe generated €334 million in sales in the first nine months, rising +3.2% at constant exchange rates (+3% at current exchange rates).

The positive momentum extended to Asia Pacific, where Q3 sales reached €13.8 million, rising +7.8% at constant exchange rates (+1.9% at current rates).

Growth was supported by solid distributor performance and strong sales in Australia, driven in part by Carrera’s continued brand-building efforts and the successful launch of its Women’s collection early in 2025, further bolstered by Smith’s growth in the market.

For the first nine months, sales in Asia Pacific totalled €44 million, up +12.4% at constant exchange rates (+9.9% at current rates).

Sales in the Rest of the World softened, with Q3 revenue declining to €19.2 million, down -13% at constant exchange rates (-16.7% at current rates), due to ongoing challenges in India and a difficult market environment for Middle Eastern distributors.

Despite regional headwinds, Mexico delivered strong growth, backed by steady demand from independent opticians. Strong contributions from Tommy Hilfiger, BOSS and David Beckham helped ease pressure from weaker markets. ✈