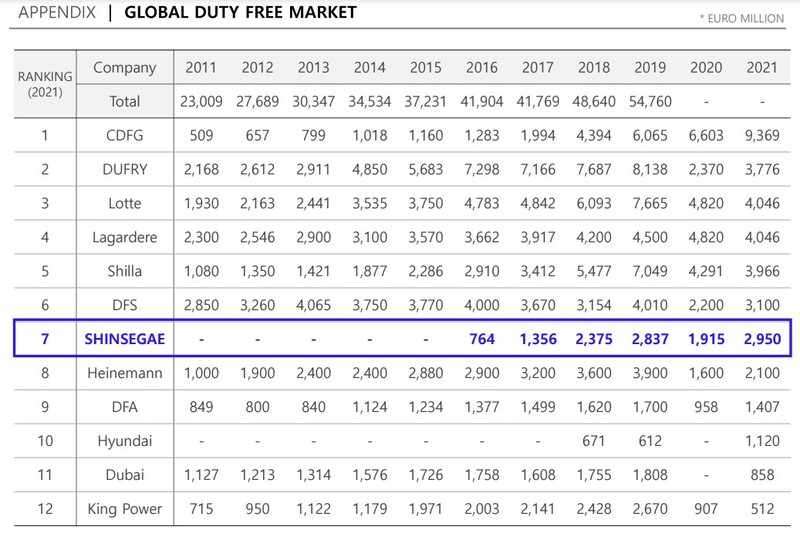

SOUTH KOREA. Latest financial results from the country’s number three and four duty free retailers, Shinsegae Duty Free and Hyundai Duty Free, mirror those of rival The Shilla Duty Free, in showing sharp declines in Q2 and H1 sales but much-enhanced profits.

The inverse relationship is due to lower daigou-related commission payments, following well-documented Korean Customs Service pressure on the unofficial channel since late 2022.

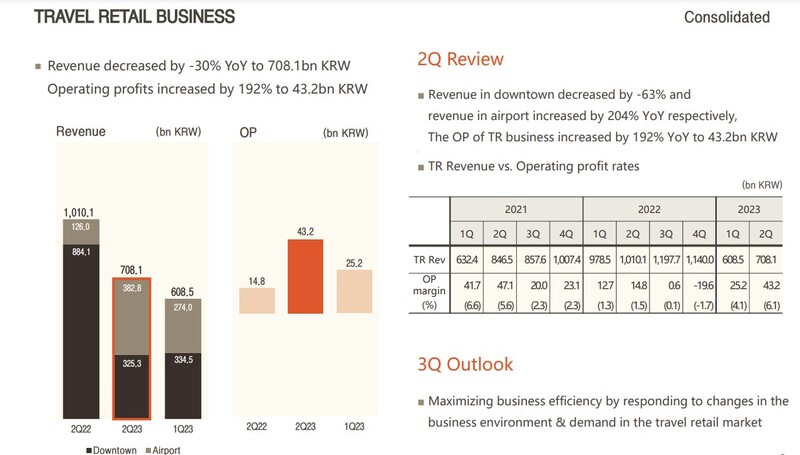

As reported, The Shilla Duty Free’s parent company Hotel Shilla’s second-quarter travel retail revenues decreased by -30% year-on-year to KRW708.1 billion (US$553.6 million). However, operating profits shot up by +192% to KRW43.2 billion (US$33.8 million).

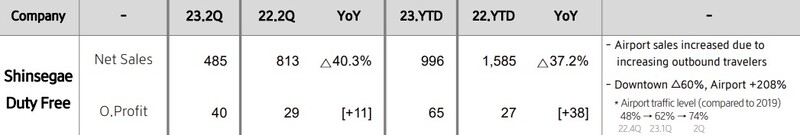

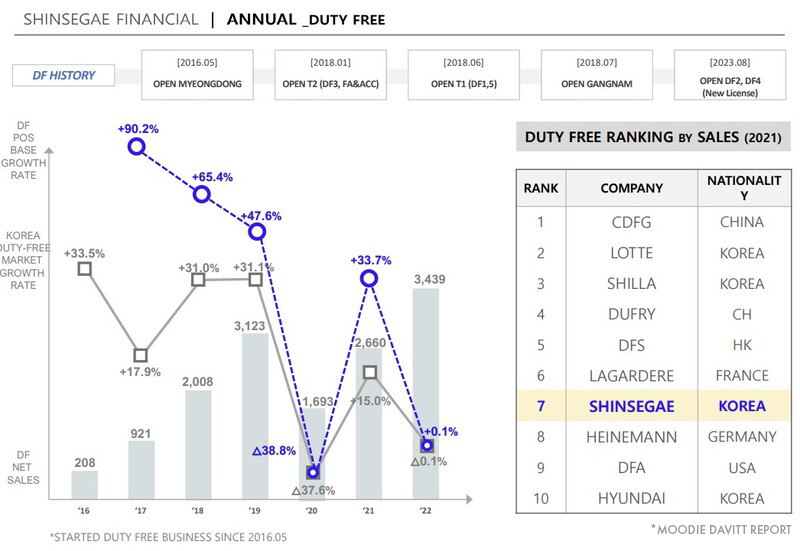

Powerful retail group Shinsegae reported this month that first-half net sales at Shinsegae Duty Free fell -37.2% year-on-year to KRW996 billion (US$752 million). However, operating profit rose by KRW38 billion (US$28.7 million) to KRW65 billion (US$49.1 million).

Shinsegae attributed the drop in revenue to a “change in sales method in duty free” – corporate talk to the structural changes referred to earlier – and the rise in profit to “stabilisation of business”.

In Q2, net sales fell -40.3% to KRW485 billion (US$366.1 million) while operating profit improved by KRW11 billion (US$8.3 million) year-on-year to KRW40 billion (US$30.2 million).

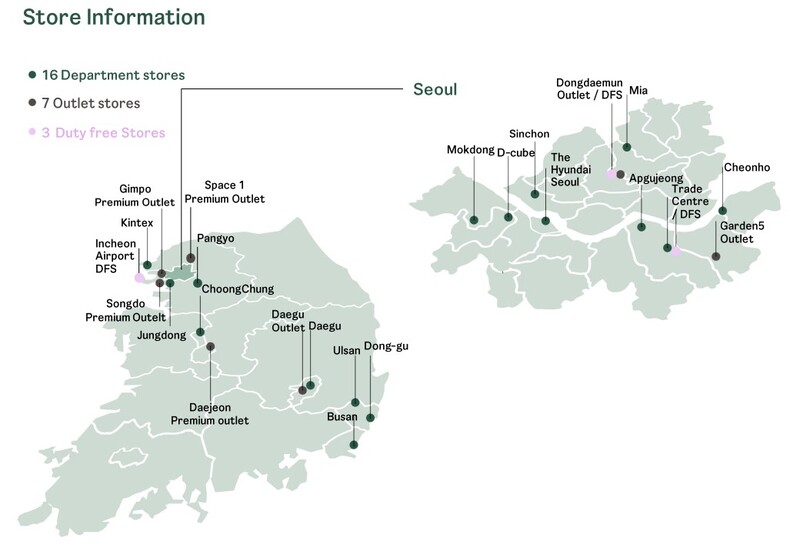

Shinsegae said airport sales grew due to increased outbound passenger traffic. Downtown sales (mostly daigou in 2022) fell -60% year-on-year in the first half but airport sales rose by +208%.

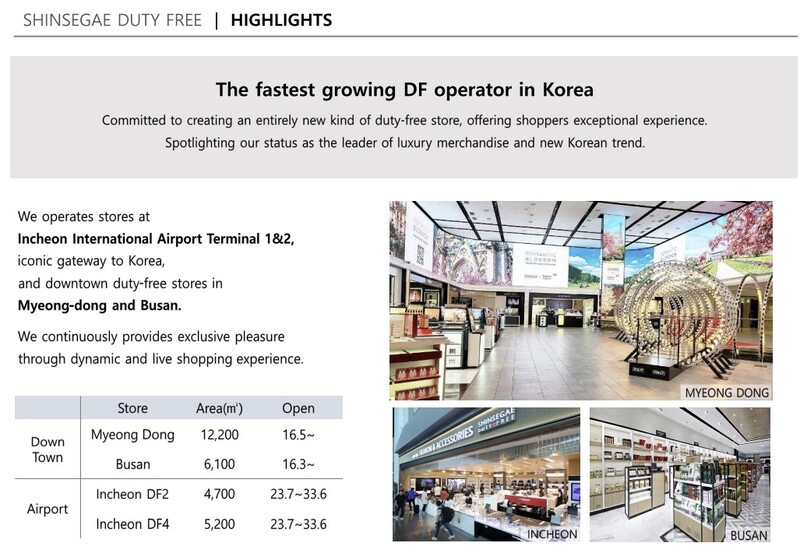

Incheon International Airport traffic levels compared to 2019 rose from just 48% in the final quarter of 2022 to 62% in Q1 2023 and 74% in Q2. Those are particularly important numbers, for as reported Shinsegae Duty Free was awarded two key Incheon concessions (DF2 perfume & cosmetics and liquor & tobacco; and DF4 fashion and luxury) earlier this year. These kicked off in July.

As indicated earlier and shown in the table below, The Shilla Duty Free’s Q2 performance graphically reflected the changing Korean travel retail landscape, the world’s largest duty free market.

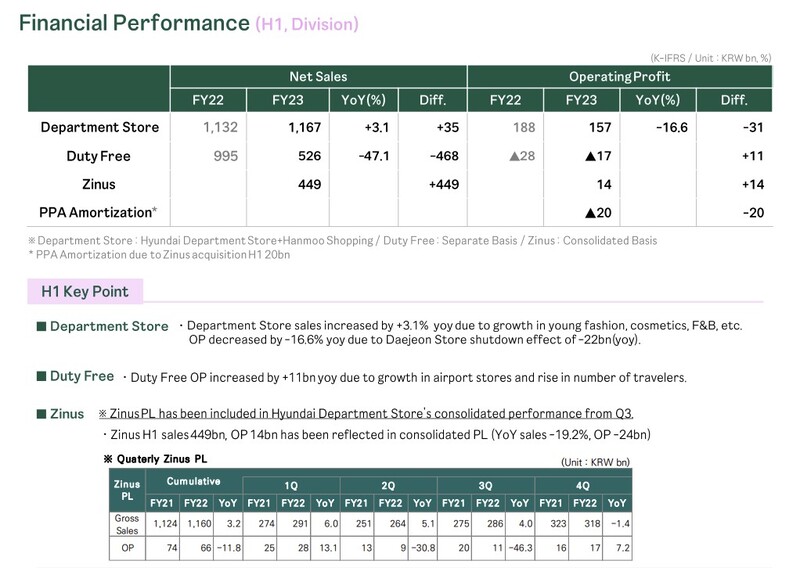

Hyundai Duty posts lowest quarterly operating loss in history

Rival Hyundai Department Store Duty Free (Hyundai Duty Free) generated sales net sales of KRW526 billion (US$397.1 million) in H1, down -47.1% year on year. But once more operating profit went in the opposite direction, improving by KRW11 billion (US$8.3 million) to a loss of KRW17 billion (US$12.8 million).

The group attributed the boost in operating profit to growth in airport stores and the rise in the number of travellers.

For Q2, duty free sales tumbled -65.9% year-on-year or KRW376 billion (US$283.9 million) to KRW194 billion (US$146.5 million) but operating profit surged by KRW13 billion (US$9.8 million) to a loss of just KRW1 billion (figures rounded) or US$755,000 – Hyundai Department Store Duty Free’s lowest quarterly operating loss since it began trading in Samseong-Dong, Seoul on 1 November 2018.

The group noted that continuing from Q1, controlling of promotion fees prompted sales (gross) to decrease by -25% year-on-year. Despite this, sales, growth and airport duty free stores and improved cost structure led to an operating loss of KRW0.8 billion, an improvement of KRW13 billion year on year.

Hyundai Duty Free opened its new DF 5 concessions at Incheon International Airport on 1 July (Terminal 2) and 1 August (Terminal 1), respectively.✈