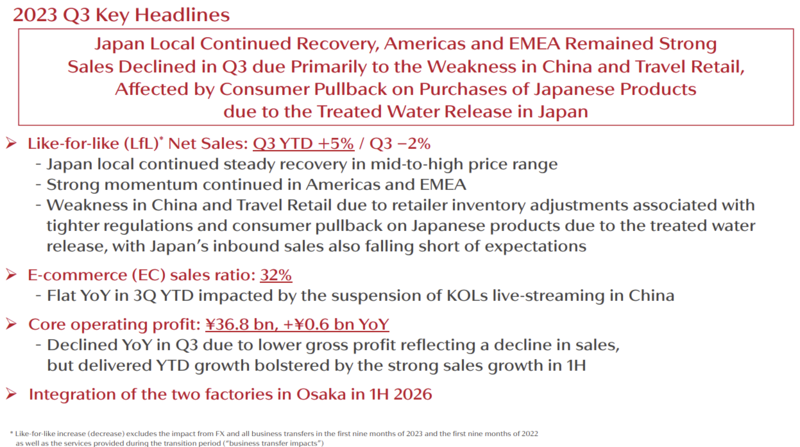

Shiseido’s Q3 travel retail sales were severely impacted by retailer inventory adjustments associated with tighter daigou-related regulations in Hainan and South Korea.

The Japanese beauty products house was also affected in the key China market (both in travel retail and domestically) by consumer pullback on Japanese products due to the controversial treated water release from the earthquake- and tsunami-damaged Fukushima Daiichi nuclear power plant. The release began in August and will continue for decades.

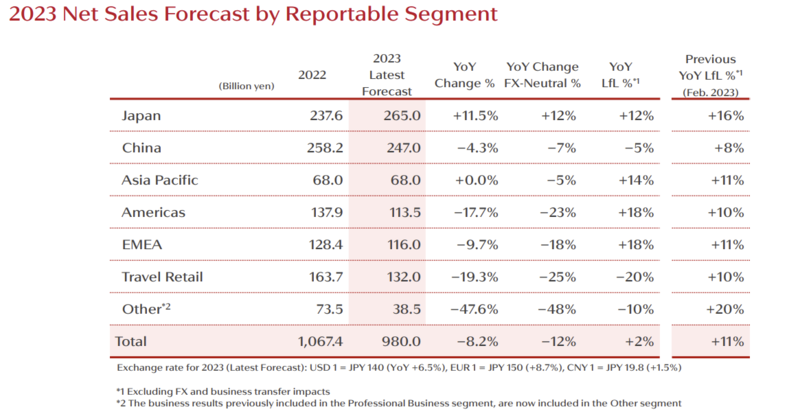

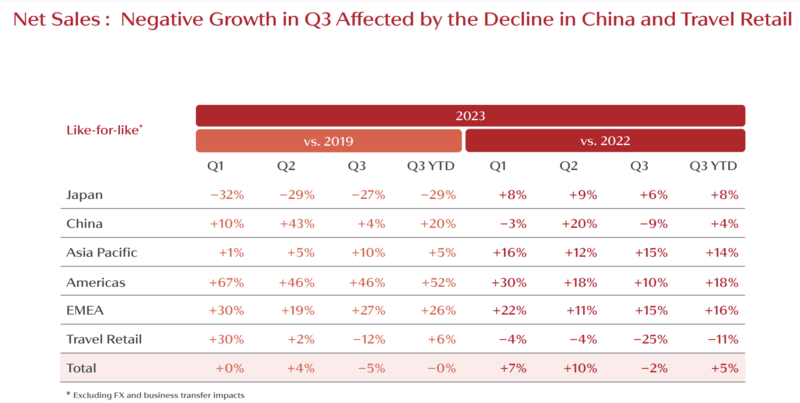

Travel retail revenues plunged -25% year-on-year in the quarter and by -11% for the first nine months.

Compared to pre-pandemic 2019, travel retail sales were down -12% in Q3 but up +6% for the first nine months.

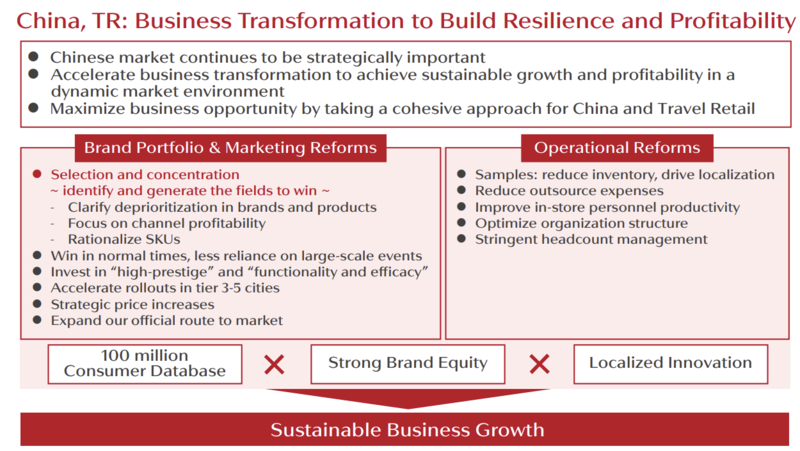

More positively the group highlighted “steady optimisation of inventory levels” in Hainan and South Korea. As reported, both key North Asian markets have been hit this year by crackdowns on daigou trading which led to inventory overstocking among retailers and resultant sharp sell-in declines.

In Hainan province, Shiseido expects inventory to be normalised by the end Q1 2024 with a similar result in the Republic of Korea by the end of this year. The group also predicted “market normalisation” from [traditional] tourist activity resumption in North Asia.

Underlining the key strategic importance of the Chinese market, Shiseido pledged to maximise the business opportunity by taking a cohesive approach for China and travel retail.

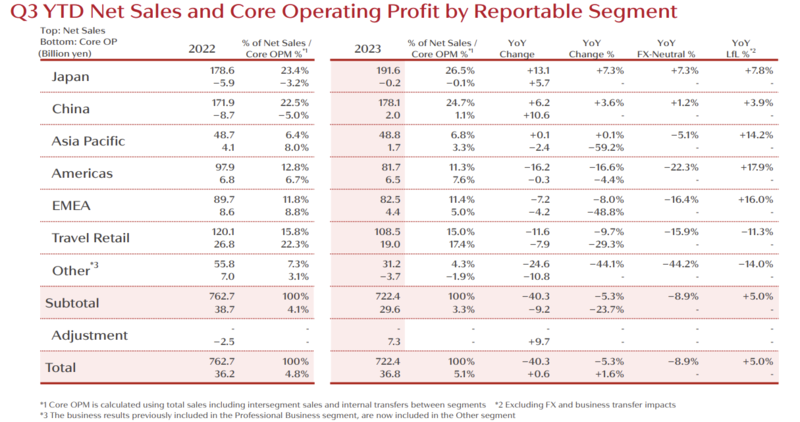

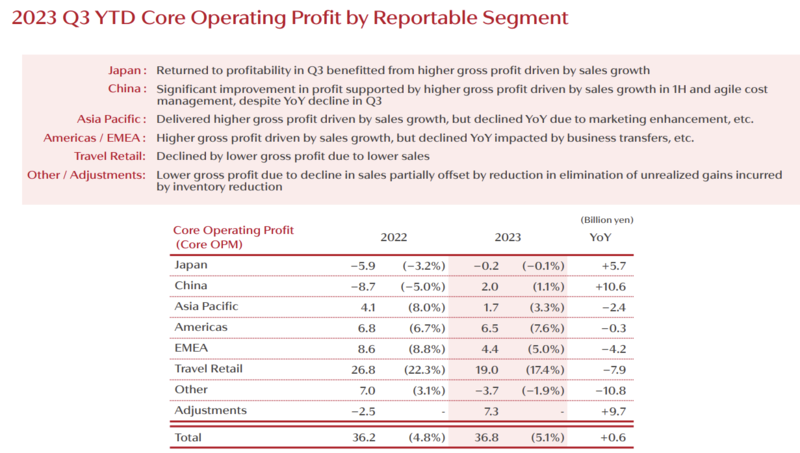

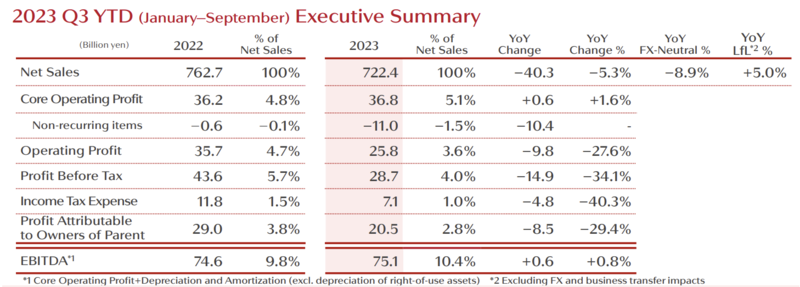

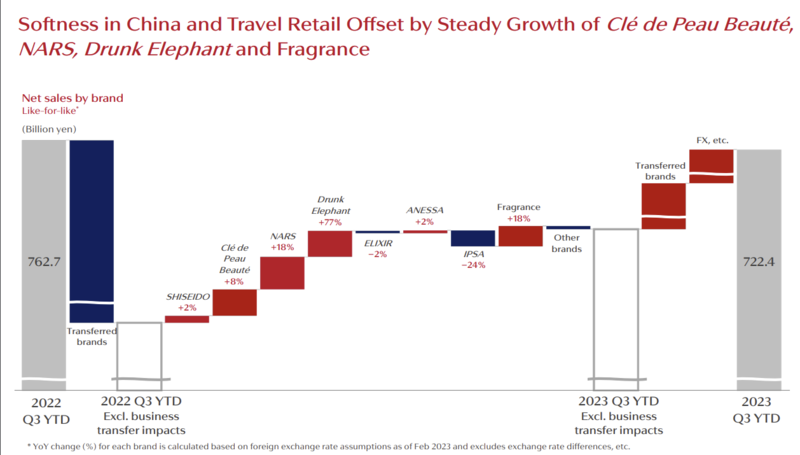

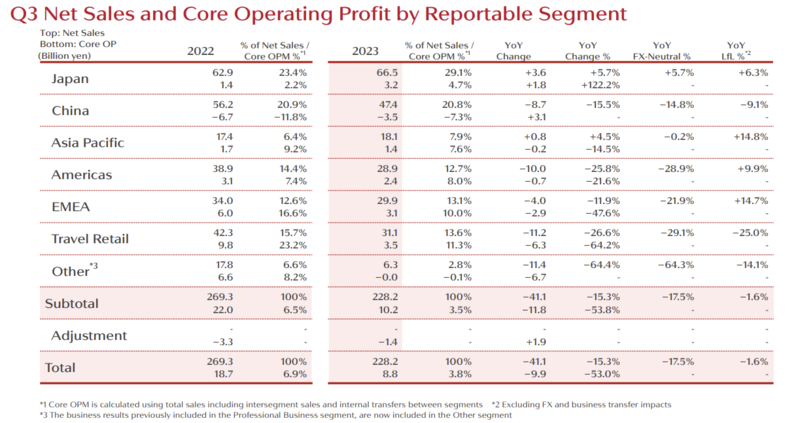

Groupwide net sales fell -2% year-on-year in the quarter but rose +5% for the first nine months to ¥722.4 billion (US$4.8 billion).

Operating profit for the nine months fell -27.6% to ¥25.8 billion (US$171.3 million).

Softness in China and travel retail was offset by the steady growth of Clé de Peau Beauté, NARS, Drunk Elephant and the group’s fragrance business.

Shiseido’s home market of Japan grew strongly in July and August, driven by a rebound in inbound tourism before slowing down in September.

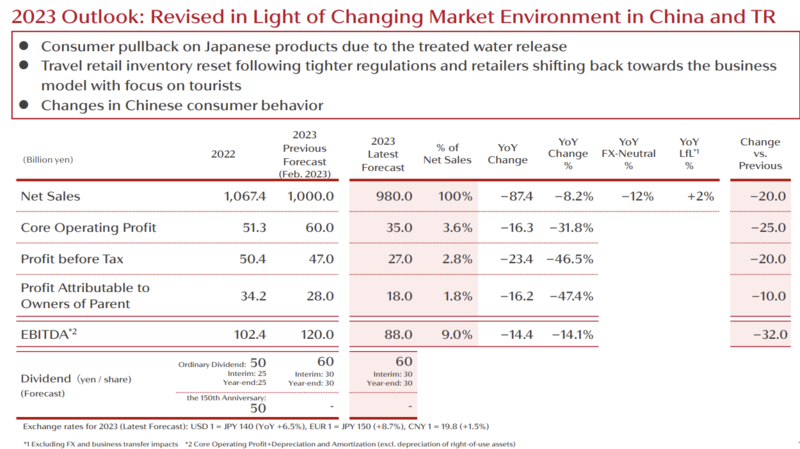

Revised outlook

Shiseido revised its full-year outlook, including for travel retail (see chart below), based on the triple effect of the water release issue, the travel retail inventory ‘reset’ and changes in Chinese consumer behaviour.

The group pledged to “win in China” to accelerate global growth, via a combination of the China local market and Asia travel retail. ✈