SOUTH KOREA. The Board of Audit and Inspection’s (BAI) accusation this week that Korea Customs Service (KCS) unfairly interfered and discriminated against Lotte Duty Free in the assessment of downtown duty free licences has prompted an official prosecutors’ investigation.

As reported yesterday, the BIA alleges that Lotte Duty Free parent Hotel Lotte Co was awarded “unfair” grades in the July 2015 and November 2015 licence bids.

The former resulted in a licence victory for Hanwha Galleria while the latter led to the shock loss of Lotte Duty Free World Tower’s licence to sector newcomer Doosan Group (now trading as Doota Duty Free).

Lotte was forced to close its World Tower duty free operation, despite having just invested US$256 million on a widely acclaimed store rejuvenation.

“The government went so far as manipulating the industry on top of imposing regulations, but it might have ended up slaughtering the cash cows” – The Dong-a Ilbo

The World Tower store ranked as Korea’s third-biggest duty free door with sales of KRW611 billion (US$518 million) in 2015. The retailer eventually won its World Tower licence back in December 2016 following a successful bid for one of three new Seoul five-year downtown duty free permits.

The store reopened on 5 January, 193 days after closure. The company projects sales of KW1.2 trillion (just over US$1 billion) in 2017.

As revealed yesterday, Lotte Duty Free is not issuing a formal statement but a source told The Moodie Davitt Report that company employees “were in a state of despondency” having learned that the closure of the World Tower store was due to “official misconduct”. At an executive board meeting yesterday in Seoul a heated discussion took place concerning the damage caused by the 2015 licence loss. No conclusion was reached as to remedies because the official investigation continues, the source said.

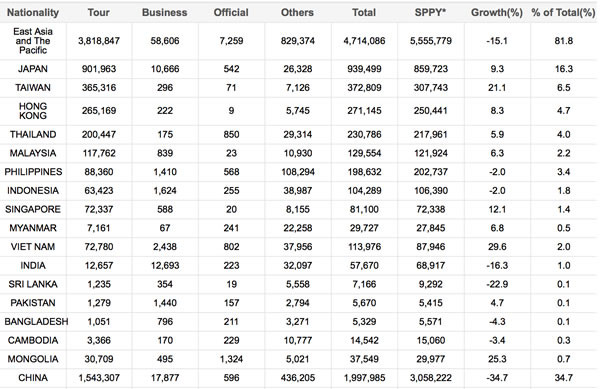

Chickens come home to roost – but no more golden eggs Critics of the Korean licensing system, including The Moodie Davitt Report, spoke out in 2015 and 2016 against the proliferation of duty free licences and the lack of transparency over awards. The Moodie Davitt Report appeared at a National Assembly hearing in February 2016 and warned that such a scenario left the sector deeply vulnerable in the event of a downturn. That downturn transpired with a vengeance this year due to the row between South Korea and China over President Park’s decision to deploy the US-led Terminal High Altitude Area Defense (THAAD) system. The deployment (on Lotte land) has led to a disastrous fall in Chinese tourism to South Korea, with year-on-year visitor numbers falling by -40%, 66.6% and -64.1% in March, April and May, respectively. Chinese tourists represented almost one in every two visitors last year and generated some 70% of Korean duty free sales. In a January 2017 article, the highly influential Chosun Daily drew a parallel between current market conditions and the then-booming but Japanese-dominated Korean duty free market of 1984-1988. In that period Japanese arrivals rose by +94% to 1,112,000, earning the duty free industry the sobriquet of ‘the goose that lays the golden eggs’. A proliferation of licences led to 29 stores being open, far in excess of the necessary capacity. When the Japanese bubble economy burst in 1990, many stores were forced to close as tourist arrivals and spending slumped. Interviewed for the report, and asked if the Korean duty free industry was indeed a goose that lays golden eggs, The Moodie Davitt Report Founder & Chairman Martin Moodie said, “If there ever was such an egg, it cracked long ago.” He noted: “The proliferation of duty free licences in Korea was based on the perception that it is an industry full of easy and rich pickings. The reality is that excessive competition in the market has simply driven up the cost of business (especially with tour agency commissions) and left too many players fighting over a pot that is frighteningly vulnerable to a downturn in Chinese tourism.” Footnote: We hate to say “We told you so” but… “We told you so.” As the old adage has it, the chickens have come home to roost. But this time they will not be laying any golden eggs. |

Mirae Asset Daewoo Equity Analyst (Cosmetics, Household goods, DFS) Regina Hahm, one of the most astute observers of Korean travel retail, welcomed the latest developments. “I’m happy to finally see the industry shows a clear signal of normalisation,” she told The Moodie Davitt Report. “It’s been so painful to see the duty free industry being destroyed by political anomalies.

“The findings are exactly what we have argued against [in terms of] the KCS’s suspicious decisions since 2015.”

Ms Hahm said it remains to be seen whether any material legal action will be taken against KCS executives or any licensing decisions overturned. She noted that Hotel Shilla’s (The Shilla Duty Free parent) share price rose +7.8% on the news yesterday.

Korean media The Dong-a Ilbo pulled no punches in a hard-hitting editorial today about the debacle. “Duty free shops were a big cash cow business in the past. They earned huge profits by banking on Chinese tourists, who would spend lavishly. But some companies jumped into the industry belatedly, unprepared, and suffered losses,” it wrote.

“Those companies acquired licences as a result of the Korea Customs Service’s manipulation of their evaluation scores in 2015.

“As China’s boycott of South Korean products, that followed the deployment of the THAAD anti-missile system in the South, further aggravated their troubles, duty free shops have now become loss-making business rather than a cash cow industry.

“Despite the fiasco, the government failed to forecast the future and issued additional four licences to intra-city duty free shops last year. The government went so far as manipulating the industry on top of imposing regulations, but it might have ended up slaughtering the cash cows.”