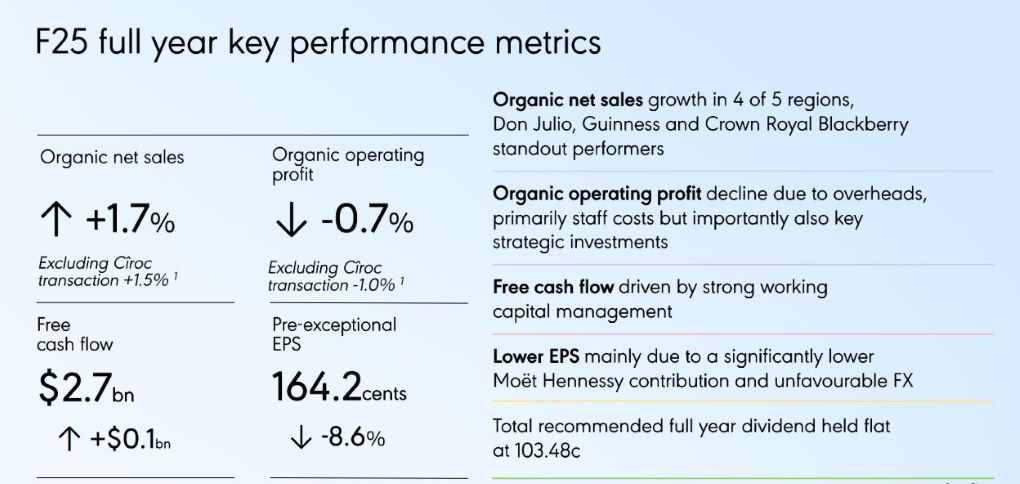

Leading drinks group Diageo has today reported a -0.1% year-on-year decline in net sales to US$20.2 billion for the fiscal year ended 30 June 2025. Operating profit fell sharply by -27.8% to US$4.34 billion.

Organic net sales grew +1.7%, adding US$338 million, reflecting the strength of Diageo’s portfolio and diversified market presence. However, this growth was offset by continued macroeconomic headwinds, including soft demand in travel retail and China.

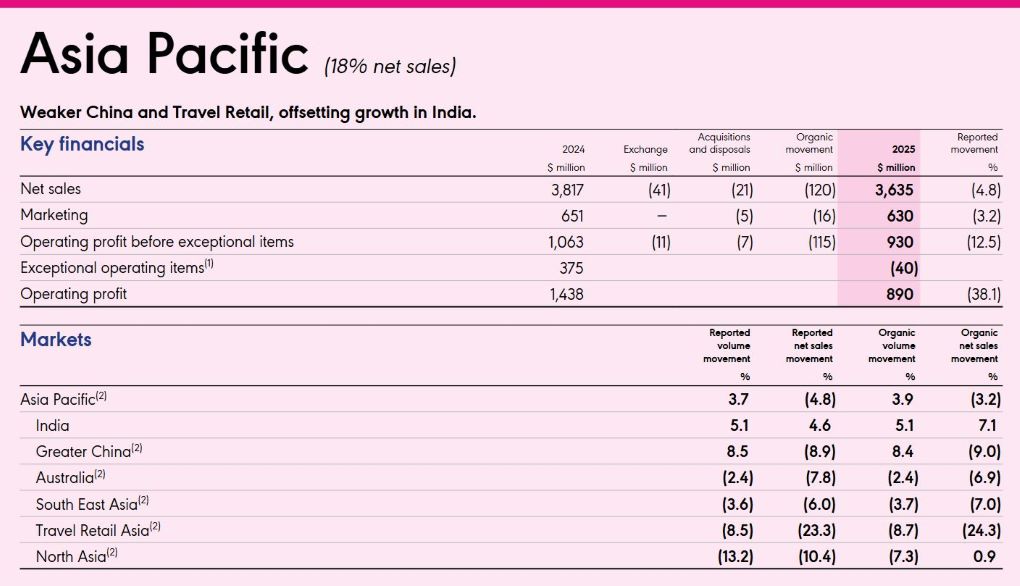

Travel Retail Asia posted a -24.3% decline in net sales, driven by subdued demand and ongoing retail inventory destocking. Despite the weak performance, the channel gained share, supported by strong sales of Johnnie Walker and Don Julio.

While organic growth remained positive, the company’s profitability was weighed down by exceptional costs, unfavourable foreign exchange and a decline in organic operating margin. Net profit dropped -39.1% to US$2.54 billion.

Diageo Interim Chief Executive Officer Nik Jhangiani said, “I am pleased to report on our fiscal 2025 results, which in a challenging year, were in line with our guidance. We delivered +1.7% organic net sales growth reflecting the strength of our portfolio and our diversified footprint.”

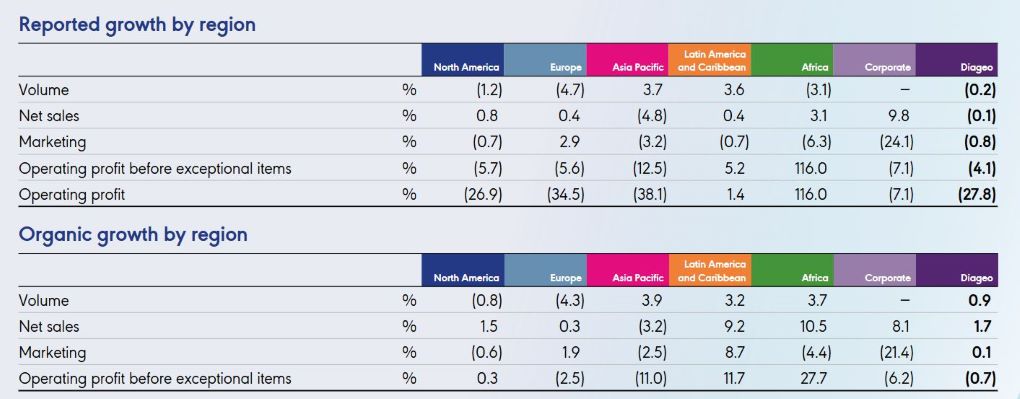

Across its global markets, the company reported mixed performance.

North America, accounting for 39% of Diageo’s net sales, posted a +0.8% increase in net sales, with +1.5% organic growth boosted by US Spirits and Diageo Beer Company, offset by the Cîroc transaction and weaker performance in Canada.

In Europe, organic net sales edged up +0.3%, with reported net sales up +0.4%. Strong performance in Türkiye, Great Britain and Ireland was balanced by weaker trends in Northern and Southern Europe.

Reported net sales in Asia Pacific fell -4.8%, with organic sales down -3.2% due to China and Southeast Asia weakness, travel retail pressure and the transition to a licence brewing model for Guinness in Australia and New Zealand.

India posted +7.1% net sales growth driven by strong volume gains in the Prestige & Above segment and favourable price/mix, while Greater China declined -9% amid ongoing macroeconomic conditions.

Latin America and the Caribbean delivered +9.2% organic net sales growth, supported by +3.2% volume growth and +6% price/mix, though reported net sales rose just +0.4% due to adverse currency impacts.

Organic growth in Africa accelerated to +10.5%, driven by strong performance across all key markets, including sharp increases in Ghana, South Africa and Tanzania. Reported net sales grew +3.1% due to reclassification as a result of a route-to-market change.

By category, Scotch maintained robust performance, delivering organic net sales growth of +22%.

Tequila remained a key growth driver, rising +13%, though the category showed signs of slowing after stronger gains in earlier periods.

Vodka returned to positive territory, up +8% after a period of decline, while Canadian whisky showed steady gains, growing +7%.

Rum, liqueurs and gin also returned to growth with increases of +5%, +5% and +4%, respectively.

IMFL whisky continued to perform well with +4%, while Chinese white spirits and US whiskey posted steady gains of +3% and +2%, respectively.

Jhangiani continued, “While we are encouraged by areas of progress and the standout performance from Don Julio, Guinness and Crown Royal Blackberry, there is clearly much more to do across our broader portfolio and brands.

“We recognise the need to drive meaningful growth opportunities in an evolving TBA landscape, and we are sharpening our strategy to accelerate growth.”

Looking ahead, organic net sales growth in 2026 is projected to remain consistent with fiscal 2025 levels, amid ongoing market headwinds, with performance expected to strengthen in the second half following a slight decline in the first. ✈