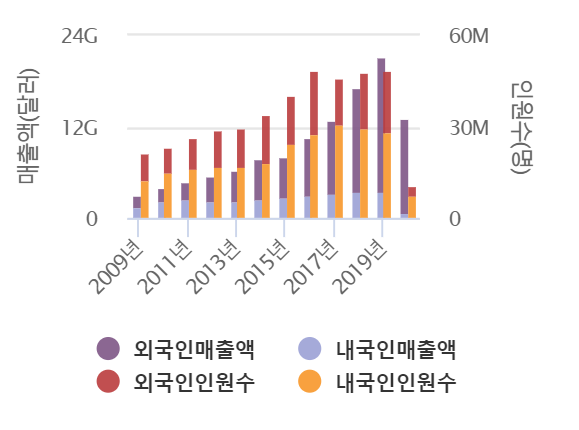

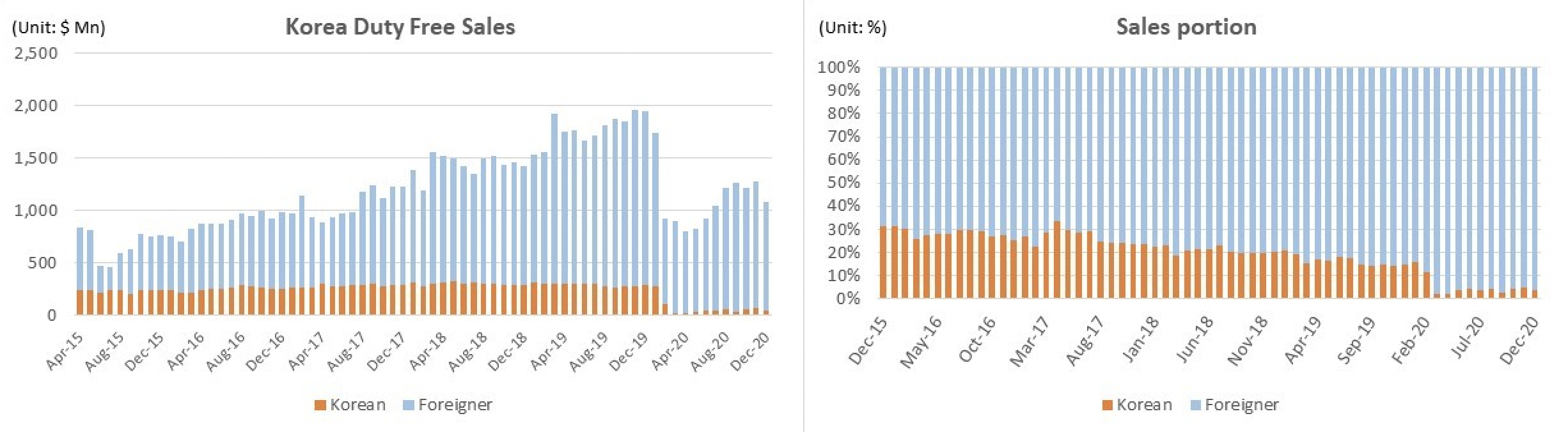

SOUTH KOREA. The South Korean duty free market – historically the world’s biggest – declined by -38% year-on-year in 2020 to around US$13.2 billion, according to the Korea Duty Free Shops Association.

The slump was driven by the COVID-19 pandemic which prompted a collapse in passenger traffic.

Foreigners – almost all Chinese daigou traders – accounted for 94% of sales, but 30% of customers, underlining the daigou effect.

The Korea Herald noted that the pandemic had made it impossible for small-scale Chinese vendors, traditionally Korea retailers’ major customers, to visit the country. Instead, large-scale buying groups dominated the market.

Sales dipped month-on-month in December to just under US$1.1 billion (US$1.04 billion of it to foreigners), from US$1.27 billion in November. (See below for more details on December performance plus commentary).

The Korea Herald quoted The Moodie Davitt Report, which said that the pandemic “upended the global duty free landscape last year” as Chinese industry players made big strides iin Hainan due to the enhancement of China’s offshore duty free shopping policy.

It quoted Moodie Davitt Business Intelligence figures (below) which showed that China Duty Free Group had grown to become the world’s top travel retailer by sales, up from fifth place a year earlier.

As seen in the Hotel Shilla results published today, the market’s large-scale daigou trade has helped shore up what would otherwise have been a wretched 2021. But all retailers are watching events in Shenzhen anxiously, where a major crackdown by the Chinese authorities on unregulated daigou imports (since the COVID-19 pandemic, the major route to market for goods from Korea) seems set to stop large orders from getting into the country before the all-important Chinese New Year. We will bring you more on that breaking story soon.

December performance and analysis

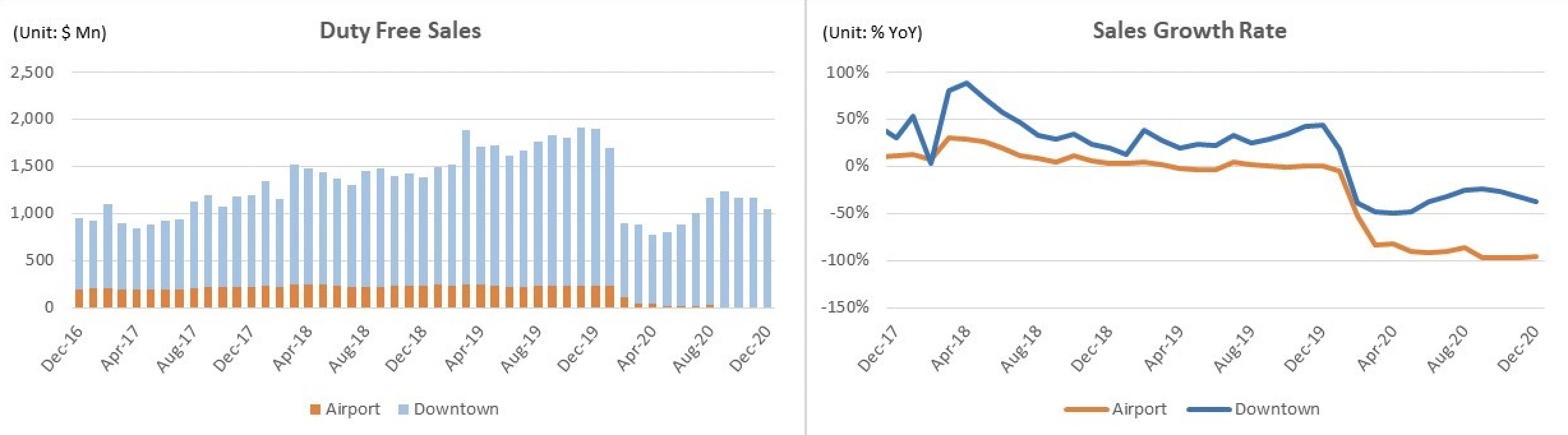

Duty free sales in South Korea slid by -44% year-on-year in December to US$1,039 million, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung.

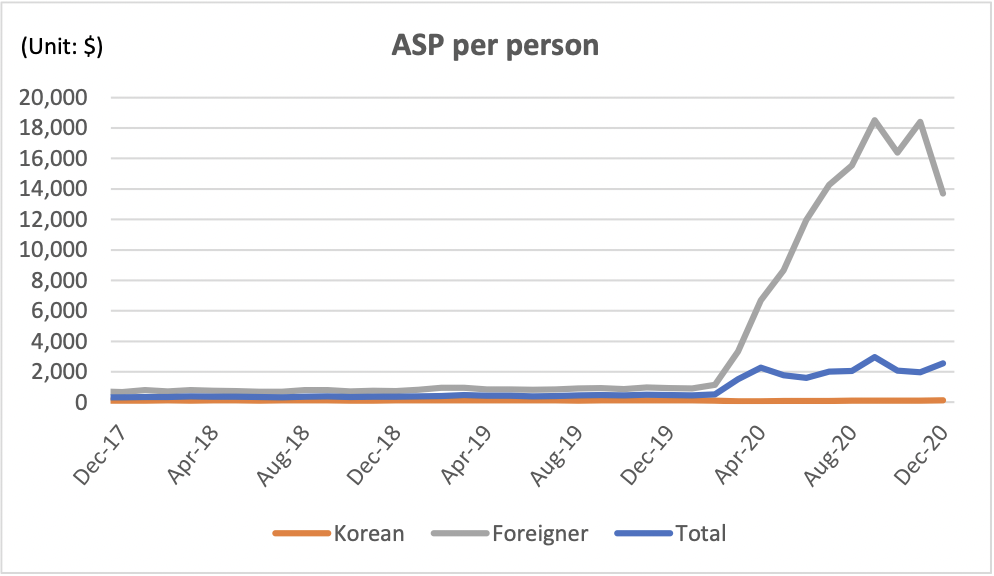

Average spend per foreign customer increased by +1,367% year-on-year in the month to US$13,698, down from the +1,818% year-on-year average monthly growth rate recorded in the last three months from September to November.

Overall sales to foreigners fell -37% year-on-year while those to Koreans decreased -85% year-on-year.

Downtown duty free fared better than the total market with sales down by -38% year-on-year and airport sales -96% year-on-year. Sales to foreigners in downtown duty free declined by -32% year-on-year compared to total sales (all channels) to foreigners that declined by -37% year-on-year.

The duty free market sales declined by -15% month-on-month in December, recording the worst month-on-month growth performance since April (month-on-month growth rate by month: Jan -10%, Feb -47%, Mar -3%, Apr -10%, May +3%, Jun +11%, Jul +13%, Aug 17%, Sep +4%, Oct -4%, Nov +5%, Dec -15%).

According to various stakeholders in the travel retail industry, Korea’s sales decline in December was because of 1) key brands scaling back best-selling product allocation and moving it to other locations, 2) the rapid increase in the value of the Korean Won hit purchasing power among daigou and 3) a new record wave of COVID-19 infections in Korea.

The Korean Won strengthened against the US Dollar throughout Q4 2020 (breaking the US$1/KRW1,100 barrier for the first time since June 2018) and hurt the purchasing power of daigou merchants. While the Chinese Yuan also gained against the dollar, the Korean Won has outperformed this to squeeze daigou purchases.

Korean retailers usually enhance promotions, discounts and commission rates to ensure daigou price arbitrage but with daigou-related commissions at significantly heightened levels they were unable to repeat traditional practices to scale.

The rise in COVID cases subdued retail sales activity in Korea – department store sales dropped by -16.9% year-on-year, registering the worst monthly performance since March (-40.4% YoY), illustrating the difficult trading environment in the month.

As reported, informed observers are also deeply concerned about the potential for a prolonged crackdown by Chinese authorities on daigou imports to the Mainland through Shenzhen (ex-Hong Kong). While there have many periodic crackdowns in the past, the latest – a major swoop on Mingtong Digital City Market in Shenzhen’s Futian district last month – has particularly alarmed Korean retailers and sector investors. Sources say the market is being heavily policed to stop the unofficial business in advance of the peak Chinese New Year period.

The crackdown on Ming Tong Digital City Market has spread to other shopping centres in the Shenzhen city area and Customs inspections against suspect wholesale goods has heightened. According to a Ming Tong Market and Shopping Association announcement on 22 January, no unregistered business entity can now trade large quantities of duty free goods without paying taxes. Ming Tong Digital City Market is closed from 1 to 28 February.

Despite the crackdown, leading retailers that The Moodie Davitt Report has spoken to suggests there was little change in sales and daigou orders in January.

Retailer A: “Duty free sales in January are like December. We are hoping for a slight uptick to sales in February. The Ming Tong Digital City Market crackdown was more about enforcement against daigou resellers that were unregistered and not paying taxes. We do not have any reason to believe it was a comprehensive crackdown against daigou generally. Ming Tong is just one route into China among many others and this is much like the beginning of 2019 when customs enforcement resulted in daigou increasing their reach in all parts of China. The larger corporate daigou merchants that make up the main customer base in Korea have enough operating leverage to register, pay taxes and keep a healthy profit.”

Retailer B: “Sales in January increased compared to December. We expect sales to decline slightly after Chinese New Year but pick up pace after March. The key to Korea’s duty free market has more to do with Chinese appetite for cosmetics products and Korea still offers the most in volume at attractive prices. Cosmetic exports to China from Korea grew by triple-digits lately (+140% year-on-year in January) and China’s cosmetics market continues to grow and remains robust.

Retailer C: “January sales are like December. The last three days have shown an increase in sales. Sales performance relies on the availability of best-selling products. Channel checks through agencies in Korea suggest inventories are higher than usual for most of the major guest daigou but this is normal ahead of a major shopping festival event. While there are concerns that inventory stock depletion will be slow this year our brand partners suggest demand is robust in China. We are eyeing the developments and will communicate with our brand partners to help the industry past these difficult times.”