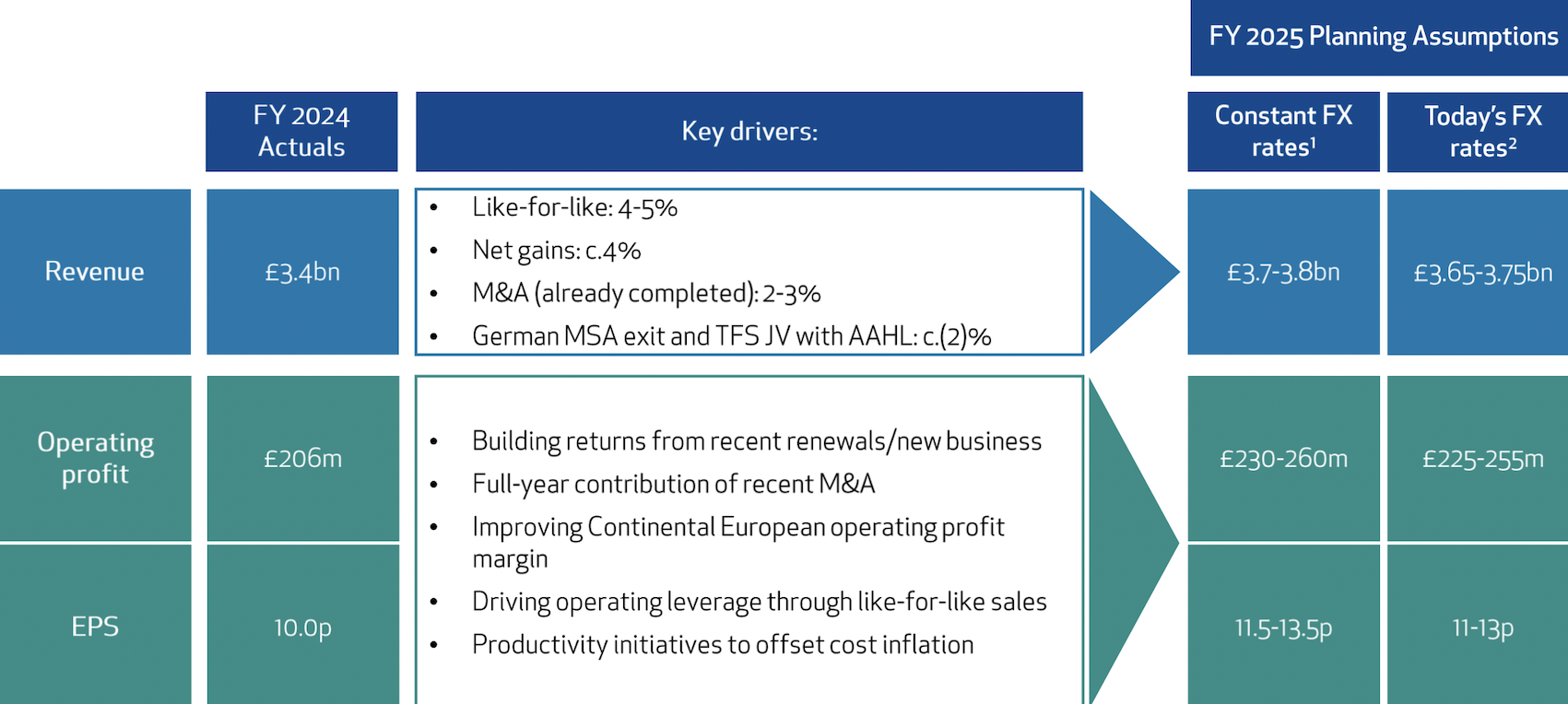

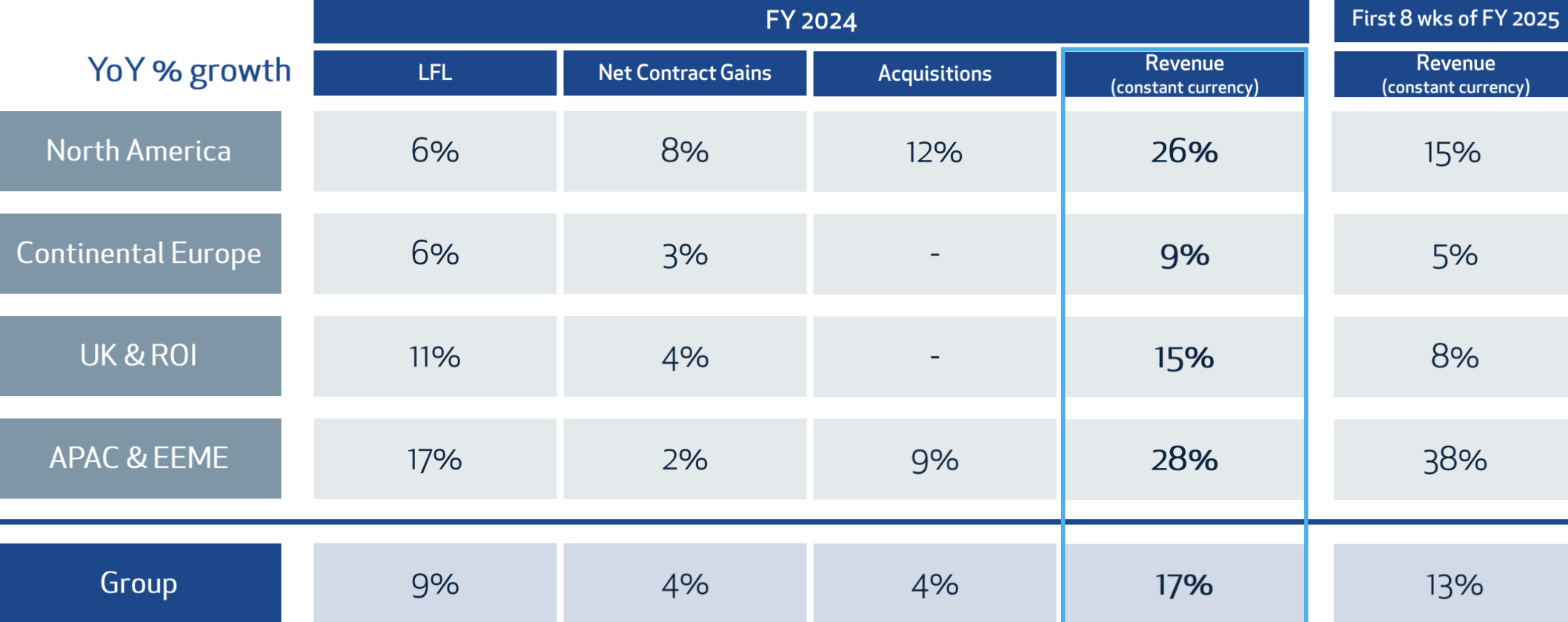

UK/INTERNATIONAL. Global travel food services group SSP today announced full-year results to 30 September, with revenue of £3.4 billion (US$4.32 billion) up +14% (+17% at constant exchange rates), including like-for-like growth of 9%.

Operating profit climbed +26% on a reported basis and +32% on a constant currency basis to £206 million (US$261 million), with EBITDA +28% at £343 million (US$435 million) and pre-tax profits rising +35% (at constant rates) to £119 million (US$151 million).

In other news announced today, SSP joint venture Travel Food Services has established an updated joint venture with Adani Airport Holdings Limited (AAHL), in which TFS will hold around a 25% share. The alliance will manage restaurant and lounge operations at Mumbai International Airport, and has secured contracts in other AAHL-operated airports, namely Ahmedabad, Guwahati, Jaipur, Lucknow and Trivandrum. More below.

Key highlights of the group performance in FY24 included:

- Good performances in North America, UK and APAC & EEME, benefiting from strong sales growth and operating margin improvements year-on-year;

- A “disappointing performance” in Continental Europe with operating profit hit by slow recovery and strikes in the rail sector, weak Motorway Service Area trading in Germany, the scale of the renewal programme and operational execution, including related to the Olympics;

- The impact of one off trading headwinds, principally in Continental Europe, mitigated by non-recurring benefits, including client compensation;

- Integration of recent acquisitions is progressing in line with expectations, said SSP;

- Entry into new markets, with new contracts in Saudi Arabia and New Zealand; new business in Sofia, Bulgaria; start of a previously announced JV with Taurus Gemilang in Indonesia (post year-end).

The company said that the strong performance had been sustained in the early weeks of the new financial year with sales growth of +13% and like-for-like sales growth of +5% (first eight weeks).

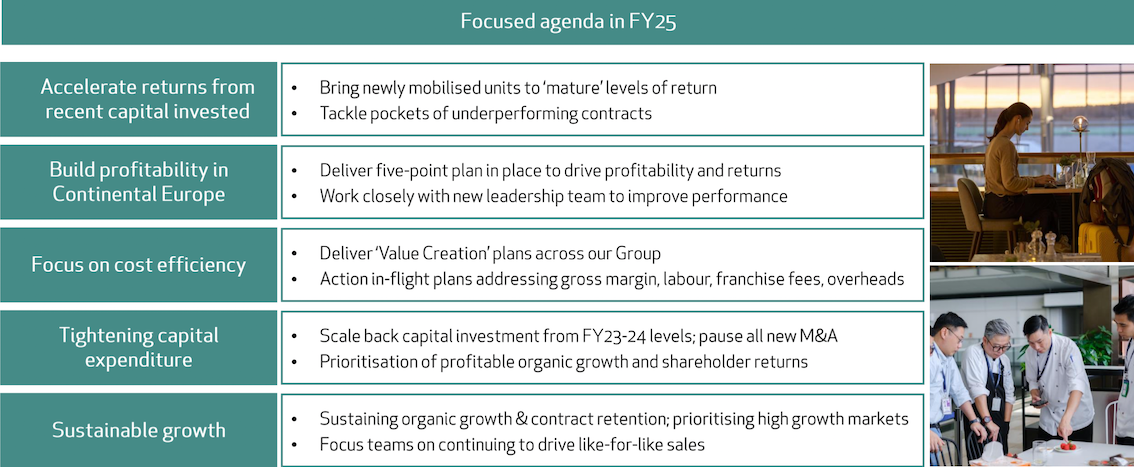

For 2025, SSP planning assumptions are for revenues of £3.7-3.8 billion, operating profit of £230-260 million (both on a constant currency basis); planning for FY25 earnings per share of between 11-13p at today’s FX rates (11.5-13.5p on a constant currency basis).

The group also said that a profit recovery plan is underway for Continental Europe. It aims to build regional operating profit margin from 1.5% to about 3% in FY25, rising to around 5% in the medium term.

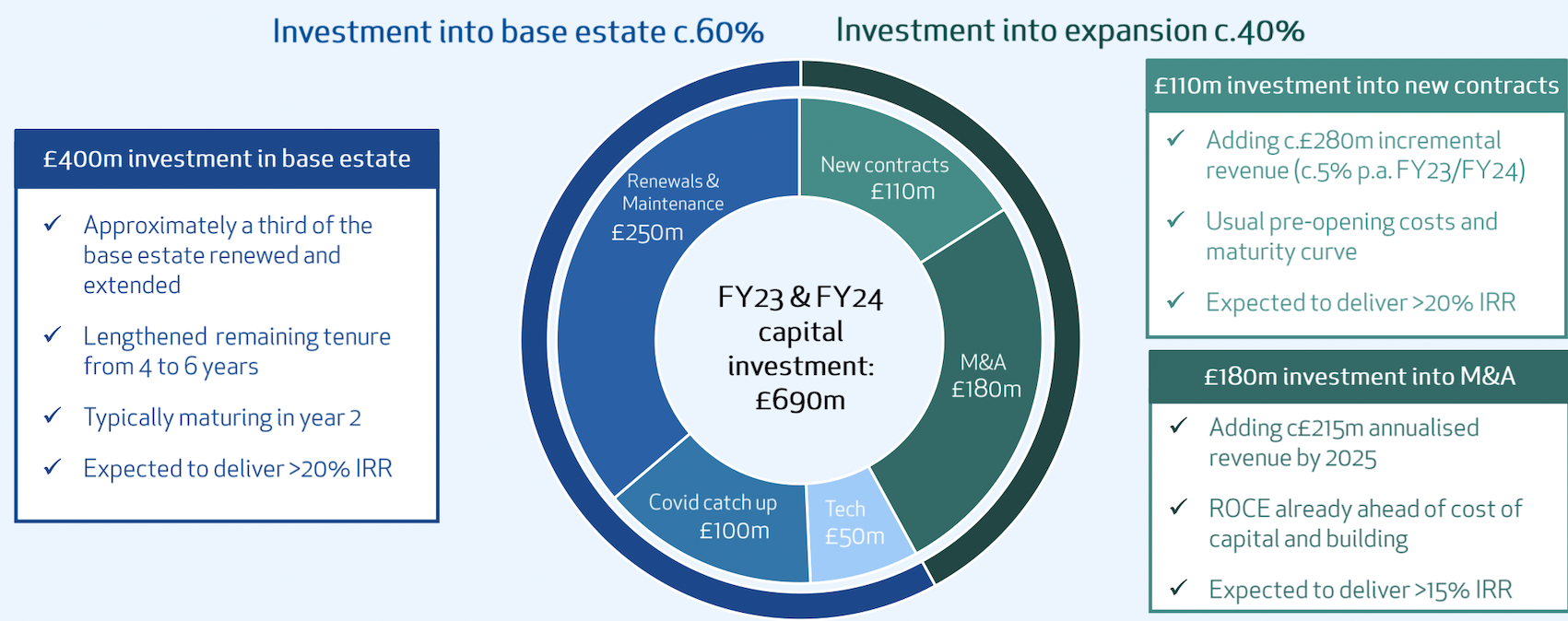

SSP said it is also seeking to deliver returns from a wide-scale £690 million investment programme over the last two years, with capital investment in FY25 reducing to £230-240 million.

Group CEO Patrick Coveney emphasised the strong second half in particular, adding, “SSP has strong fundamentals and benefits from the global travel market’s sustained long-term growth trends. This was clearly visible in the FY24 performance in three of our four regional markets. However, Continental Europe performed below our expectations, which in turn impacted Group EPS and free cash flow.”

Speaking to The Moodie Davitt Report this morning, he said: “Overall the group is trading well, with our like-for-like revenues up +9%, earnings up +40% and delivery of good cash flow, especially in the second half, with our leverage lowered substantially.

“Three of our four business units performed very positively across all of the key metrics. We had a tough year, based mainly around the impact of macroeconomic factors, in Continental Europe, led by Germany and France, plus Scandinavia.

“The share of air in those markets overall is lower than elsewhere, at less than half, with more motorway and rail. We have also had a higher proportion of renewals and extensions in those markets in 2023 and 2024 than anywhere else so the scale of refurbishment has also held the business back. We are putting in place measures to drive growth in that region.”

With a new CEO, Satya Menard, in place for Continental Europe, SSP said the regional recovery plan includes an intensified focus on optimising the performance of the many new and refurbished units opened this year, tackling loss-making and low-margin units; a more streamlined management structure and lower cost operating model; actions to reduce the cost base through the optimisation of menu and ranges, labour costs, overheads plus digital solutions.

It also noted a plan for “disciplined management” of the German motorways business ahead of its contracted exit by 2026, with 50% of the sites to be exited in H1 FY25 and actions to minimise losses from remaining operating units. SSP said it would also enhance the focus on driving like-for-like sales across the business through enhanced customer offers, particularly in rail.

The company also said is continuing to benefit from younger people prioritising spend on experiences over material items. The Taylor Swift tour this year was an example, said SSP, and created long-tail effects on tour destinations where fans decided to holiday after attending the concert. Across Sweden and Australia, SSP witnessed an uplift of around +20% in sales in its units as a result of tour concerts which took place in Stockholm, Sydney and Melbourne.

Commenting on the expanded TFS/Adani Airports agreement, SSP highlighted the importance of India as its second largest market by unit numbers, with TFS representing c.60% of APAC & EEME regional operating profit.

The new deal builds on a previous JV with AAHL in Mumbai, in which TFS held a 44% share (compared to 25% now).

SSP said: “TFS’ partnership with AAHL in the new JV, albeit at a lower share than the previous joint venture with AAHL, is expected to facilitate greater access to the wider growth opportunity as the Indian aviation market continues to rapidly expand.”

Given TFS’ shareholding in the new JV, SSP no longer controls or consolidates these operations in its reported financial results (effective since 1 June 2024). The impact is an annualised operating profit reduction of £17 million, but with the resulting impact on net income being offset by a corresponding reduction in annualised post-tax minority interest of £10 million and an increase in annualised associate income of about £2 million, said SSP.

Coveney told The Moodie Davitt Report: “First the change has no impact on our earnings overall this year. Also, we extend the scope of our business to six airports plus we have a broader F&B and lounge participation in India through the footprint. And finally, under the new contract we can look at our presence at these locations in decades, not years.”

Summarising the outlook, Coveney said: “It is really about integrating and embedding new business, ensuring that we place the customer first with strong, relevant propositions and that the investments we have made deliver for customers and our shareholders. We will focus heavily on the high-growth markets of the Americas, Asia Pacific, Middle East, as these also deliver higher returns for us.”

North American and APAC & EEME markets now represent about 40% of group sales and 60% of operating profit.

To illustrate recent progression, SSP said it now operates in 53 of top 200 busiest airports in North America, up from 37 at the end of FY22. In further expanding the APAC & EEME footprint, new market entries include New Zealand (Christchurch Airport) and Saudi Arabia (Riyadh and Jeddah airports.

Other key agreements in FY24 included the acquisition of the ARE business in Australia, adding more than 60 outlets across seven airports. Post year-end, SSP also completed an agreement to create a new joint venture with Indonesian food & beverage business Taurus Gemilang – marking its entry into the country.

Note: The Moodie Davitt Report publishes the FAB Newsletter, which features highlights of openings, events and campaigns from around the world of airport and travel dining.

Please email Kristyn@MoodieDavittReport.com for your complimentary subscription.