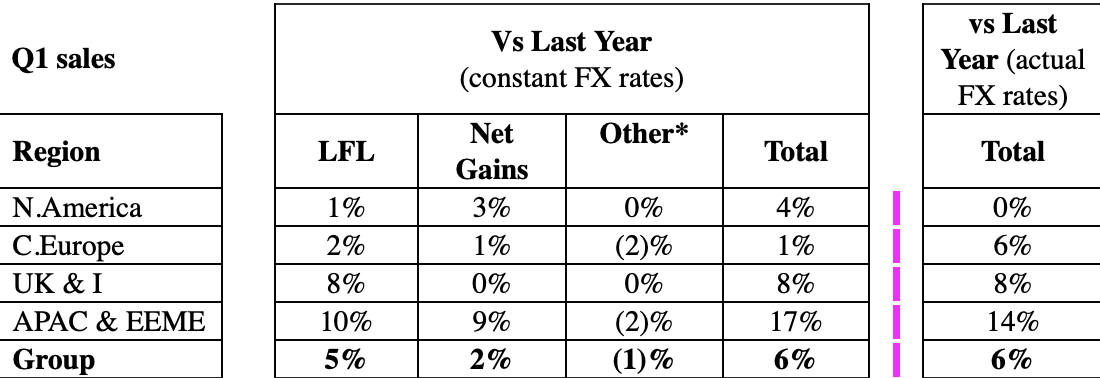

UK. Leading travel dining services company SSP Group today issued a trading update for its first quarter to 31 December, with sales climbing +6% year-on-year in the period and +5% on a like-for-like (LFL) basis.

In North America, sales grew by +4% year-on-year (on a constant currency basis). This was driven mainly by net gains as the company extended share within the 57 airports in which it operates.

Seasonal fluctuations and the US government shutdown created some LFL volatility during the quarter, SSP noted.

In Continental Europe, sales grew +1% year-on-year (on a constant currency basis), reflecting +2% LFL sales growth despite weak consumer sentiment and lower spend levels in several markets. This particularly affected the rail business, which is subject to a wide-ranging review, as previously announced.

In the UK & Ireland, sales rose by +8% year-on-year (on a constant currency basis), with sustained strong LFL sales.

A statement said, “We were pleased by our performance in Air and in our M&S estate (across both Air and Rail). More broadly, we are seeing the benefits of a strengthened customer proposition as a result of our refresh and renewal programmes.”

In APAC and EEME, sales grew by +17% year-on-year (on a constant currency basis), with the strengthened LFL sales growth quarter-on-quarter (Q1 FY26 LFL was +10% vs Q4 FY25 LFL at +6%) benefiting from “a more normalised air capacity” in India. Trading also reflected strong net gains across this higher margin region as well as sustained strong LFL growth in Australia.

SSP Group CEO Patrick Coveney said: “We have made a good start to the financial year, with LFL sales growth of +5% in the first quarter. We are on track against our ‘Focus 26’ operational plan with a range of programmes underway to deliver sustained improvements in profitability, cash and returns on capital. Given this momentum, we remain confident in our prospects for the balance of FY26 and beyond.”

SSP has also completed £24 million of the £100 million share buyback initiated in October 2025. Its full-year guidance remains unchanged.