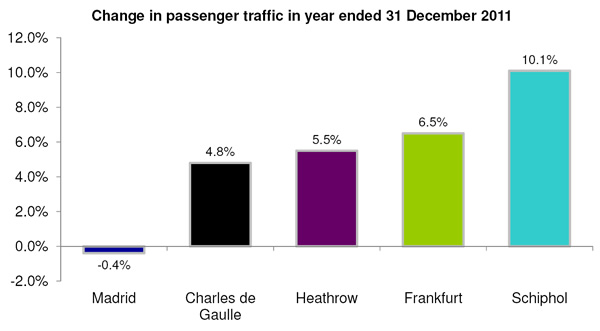

UK. BAA (SP) Ltd, the parent company of London Heathrow and Stansted airports, today revealed a strong set of year-end figures for 2011, with the key figure of net retail income (NRI) per passenger climbing by +5.5% to £5.58.

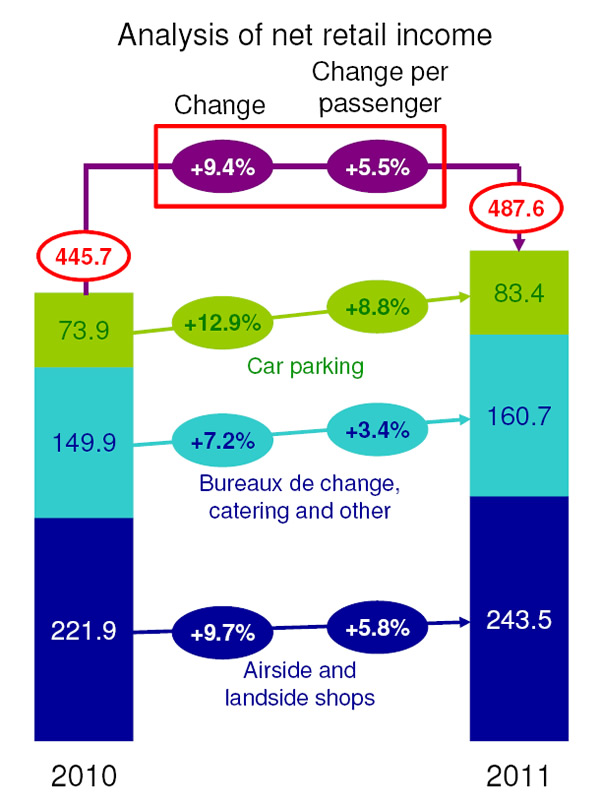

Gross retail income increased by +8.9% to £518.6 million (2010: £476.3 million) and total net retail income grew by +9.4% to £487.6 million (2010: £445.7 million).

At Heathrow, gross retail income increased +10.7% to £435.4 million (2010: £393.2 million) and NRI per passenger increased +5.3% to £5.95 (2010: £5.64). The performance was led by duty and tax-free, airside specialist shops, catering and car parking.

|

The company said: “The strong in-terminal performance has been delivered whilst undertaking a major refurbishment of Terminal 3’s retail facilities where disruption was at its height during the summer months. Year-on-year trading performance also benefited from a further shift in passenger mix from domestic to international passengers.”

A healthy performance in duty and tax free partly reflects the new walk-through area in the World Duty Free store in Terminal 3 and extension of the store in Terminal 5, BAA (SP) noted. In airside specialist shops, trading in the luxury segment has remained “robust” in recent months despite the more cautious macroeconomic environment, it said.

Catering had a buoyant year reflecting a rebalancing of the portfolio towards premium outlets, added the company, alongside enhanced contractual terms and focus on the speed of service. Strength in car parking reflected increased usage, tariff increases and strength in premium services (short stay, business and valet parking services).

Stansted’s gross retail income increased +0.1% to £83.2 million (2010: £83.1 million), described as “a good performance given passenger trends,” which meant that NRI per passenger increased +3.4% to £4.16 (2010: £4.02).

Growth in Stansted’s retail income reflects performance particularly in car parking due to achieving higher yields per user with bureaux de change and advertising also supporting the recent positive retail performance. But these improvements were partially offset by reductions elsewhere, particularly in duty and tax free.

|

Passenger numbers for the year at the two airports hit 87.4 million, up by +3.7%.

Group revenue was £2.28 billion, up by +9.9% year-on-year, with adjusted EBITDA up by +17.1% to £1.13 billion. Pre-tax losses improved from £316 million in 2010 to £255.8 million.

BAA Chief Executive Colin Matthews said: “BAA delivered a strong operational performance in 2011 with record traffic levels and high service standards at Heathrow. Last year saw Heathrow’s best punctuality performance in over a decade and the international (ACI-organised) Airport Service Quality passenger survey showed that 70% of Heathrow’s passengers rated their experience as “˜Excellent’ or “˜Very Good’, compared with just 41% when the Ferrovial-led consortium bought BAA in 2006. We continued to invest significantly in further improving our airports during 2011, particularly on the new Heathrow Terminal 2.

“The group’s financial position has been strengthened with £3 billion in new financing completed in the last 12 months and we have fully repaid our £4.4 billion bank bridge loan nearly two years early. We are pleased that the UK Government recognised the importance of a successful hub airport to UK

economic growth in its Autumn statement. All potential solutions to the UK’s lack of hub airport capacity have their pros and cons and all should be on the table to ensure the right solution is found for both the short and long term.”

|

|