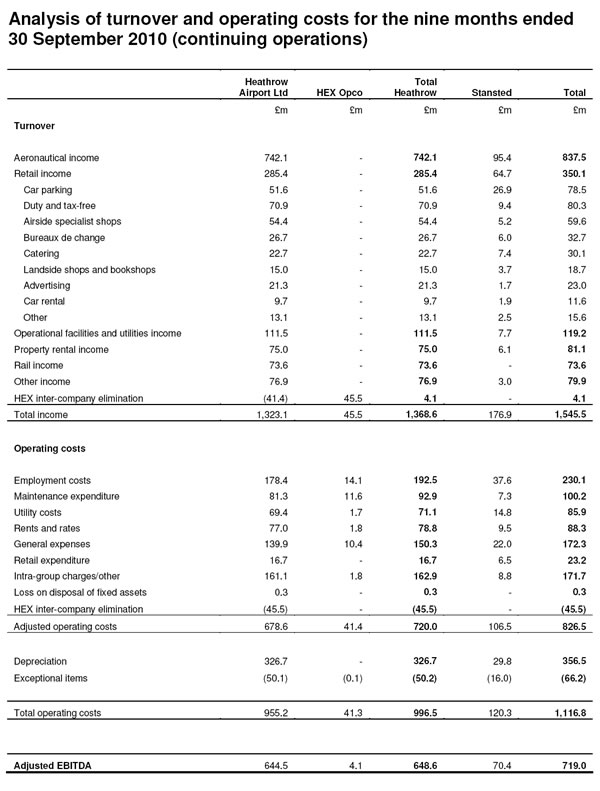

UK. BAA (SP), which owns the two London airports of Heathrow and Stansted, has posted a solid revenue increase of +4.4% (to £1.54 billion) for the first nine months of 2010, a performance buoyed by healthy growth in retailing.

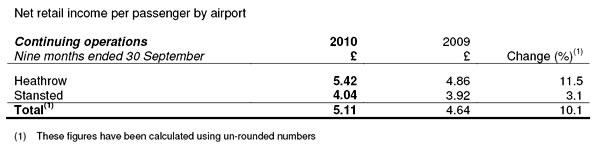

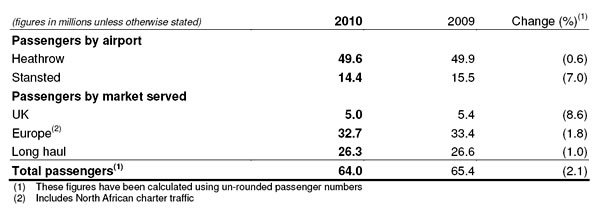

Gross retail income grew by +6% to £350.1 million year-on-year. Net retail income (NRI) increased by +7.9% to £326.9 million and NRI per passenger climbed by +10.1% to £5.11, with passenger numbers in the period slipping -2.1% to 64 million at the two airports.

|

NRI per passenger was driven by the strong performance of Heathrow, where the figure climbed by +11.5% to £5.42. At Stansted NRI per passenger hit £4.04, up by +3.1%.

BAA (SP) noted: At Heathrow, gross retail income increased +9.8% to £285.4 million (2009: £260.0 million) and NRI per passenger increased +11.5% to £5.42 (2009: £4.86). Most areas of the retail business performed well, with the main growth driver being airside specialist shops.

“There have also been increasing signs of recovery in car parking following the recent period of weakness and this feature contributed to the slight acceleration in growth in Heathrow’s NRI per passenger in the third quarter of 2010.

“Heathrow’s continued strong retail performance reflects the increase in the proportion of higher spending origin and destination passengers. This benefits both the in-terminal and car parking elements of retail income. The performance also reflects the greater numbers of passengers utilizing Terminal 4 following relocation of airlines prior to Terminal 2’s closure who are benefiting from its upgraded retail facilities completed as part of the terminal’s recent refurbishment.

“Further, growth in passenger spend has been particularly strong in the luxury segment of Heathrow’s airside retail outlets.”

Stansted’s gross retail income declined -4.1% to £64.7 million (2009: £67.5 million), which was hailed as “a resilient performance” given passenger trends.

|

The growth in Stansted’s NRI per passenger reflects particularly performance in airside specialist shops and catering with net car parking income per passenger stabilising after a significant period of weakness.

The disruption caused by volcanic ash and airline industrial action in 2010 is estimated to have affected gross and net retail income by £8.4 million.

At the two airports combined, duty and tax free sales were £80.3 million in the nine months, compared to £74.2 million a year ago, a rise of +8.2%.

Overall for BAA (SP), adjusted EBITDA (the figures are for continuing operations only) rose by +8.4% to £719 million.

BAA CEO Colin Matthews said: “BAA has delivered good results and we have strengthened our financial position through refinancing of nearly £2 billion of debt. Passenger growth at Heathrow is encouraging and improving customer service has contributed to strong commercial revenue.

“The outlook for the remaining months of the year is positive and we will continue to focus on raising customer service standards. Our capital investment programme remains one of the largest of its kind in Europe, and will support the UK economy as the pressure on public sector spending increases.”

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |