|

INTERNATIONAL. A strong performance from the Travel Retail & Duty Free division was the highlight of Autogrill Group’s 2012 performance, as total consolidated revenues hit €6 billion for the first time.

|

“As far as international growth is concerned, we will be focusing on new markets with high development potential. But the structural changes seen on European motorways are leading us to rethink these operations.“ |

Gianmario Tondato CEO Autogrill |

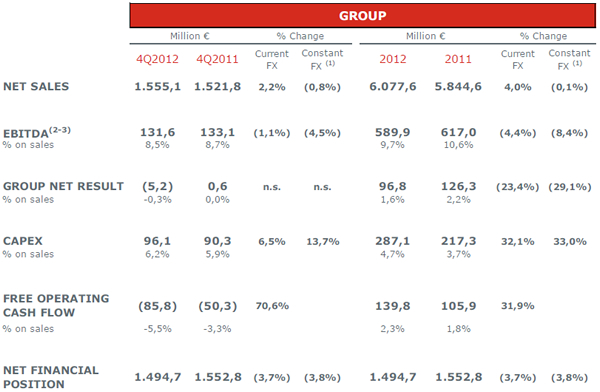

Group revenues were €6,077.6 million, up by +4% at current exchange rates (down -0.1% at constant exchange rates). Consolidated Ebitda hit €589.9 million, down -4.4% at current exchange rates (-8.4% at constant exchange rates). Net profits for the group were €96.8 million against €126.3 million in 2011 (which included €8 million of non-recurring income from the disposal of the Flight business).

Travel Retail revenues were up +10% at current exchange rates (up +5.2% at constant exchange rates), a trend that the sector had already seen throughout 2011. Food & Beverage sales rose slightly on 2011 (+1.3%) at current exchange rates but were down -2.4% at constant exchange rates.

Autogrill CEO Gianmario Tondato Da Ruos said: “Our strategy is based on strengthening our airport business, developing new business in emerging economies and restructuring operations in the motorway channel.”

He added: “Regarding Travel Retail, winning the Spanish airport tenders has given the group one of the longest contract portfolios in the sector, and marked the further strengthening of this business and a vital step that allowed us to launch a feasibility study on the separation of the two business areas [retail and F&B -Ed]. The transaction would enable both businesses to pursue their own strategies in order to realise their intrinsic value. Food & Beverage could pursue growth opportunities in new markets and steer itself more rapidly towards the airport and railway station channels; Travel Retail, on the other hand, will be able to concentrate on new business development to gain greater critical mass.”

He concluded by noting that “as far as international growth is concerned, we will be focusing on new markets with high development potential. On the other hand, the structural changes seen on European motorways are leading us to rethink these operations, especially in Italy where the impact on group sales is destined to diminish even further.”

The company noted “two distinct trends” in the channels where it operates. It said: “There was growth in airport sales, driven by good performance by Travel Retail in all countries and by F&B in North America. But there was

weakness in the motorway channel in Europe. In Italy in particular, the recession led to a record reduction in

lightweight traffic, a heavier than expected fall in traffic and caused a drastic contraction in traveller

spending.”

2012 revenues

As noted, the group closed the year with consolidated revenues of €6,077.6 million, up +4% (down -0.1% at constant exchange rates) on 2011.

|

The performance of the Travel Retail business (up +10%; up +5.2% at constant exchange rates), especially in

the UK, Latin America and the Middle East, was a major contributor to growth in sales. Other positive factors were the performance of the Food & Beverage business in North American airports, which offset the contraction of the sector in Europe, and movements in the exchange rates of the currencies in the main countries where the group operates, and the depreciation of the Euro against the Dollar and Sterling in particular.

Ebitda

Consolidated Ebitda amounted to €589.9 million, down -4.4% (down -8.4% at constant exchange rates) on the

€617 million posted in 2011. The result includes a €9.9 million re-organisation charge referring mainly to the Food & Beverage sector. The ratio of Ebitda to revenues moved from 10.6% in 2011 to 9.7% in 2012. Food &

Beverage margins were penalised by a contraction in sales in Europe that inflated the impact of fixed costs.

The double-digit increase in Travel Retail margins, on the other hand, was due to the favourable mix of sales

by type of product and, in European airports, by the higher impact of passengers to non-European destinations.

Ebit

The operating result was €251.9 million, down -16.9% (down -21.1% at constant exchange rates) on 2011, after amortization, depreciation and impairment of €321.3 million (€314 million in the previous period). In 2012, there was also a €16.7 million writedown of goodwill attaching to the Spanish F&B business due to the contraction in motorway sales in that country.

Group net profits

Net profits amounted to €96.8 million, down on the previous year’s figure of €126.3 million, which included €8 million of non-recurring income from the disposal of the Flight business.

The net financial position at 31 December 2012 was €1,494.7 million, a €58.1 million improvement on 31 December 2011.

Q4 2012

Consolidated revenues in Q4 2012 reached €1,555.1 million, up +2.2% (down -0.8% at constant exchange

rates) on the same period in 2011. Growth in Travel Retail & Duty Free sales (up +5.4%; up +1.4% at constant exchange rates) compensated for the substantially flat Food & Beverage business, up +0.8% (down -1.8% at constant exchange rates).

Ebitda amounted to €131.6 million (down -1.1%; down -4.5% at constant exchange rates) against the same period in 2011. A €5 million re-organisation charge for the Food & Beverage sector was taken in the fourth quarter. The Ebitda margin was 8.5% against 8.7% in Q4 2011. The operating result was €21.3 million against €37 million in 2011.

Food & Beverage in 2012

Food & Beverage revenues reached €4,075.6 million, up +1.3% (down -2.4% at constant exchange rates) on 2011. Revenues produced by subsidiary HMSHost were up +1.9%. Comparable sales in US airports (up +5.3%) grew faster than passenger traffic (up +0.8%) thanks to the increase in numbers of transactions and average spend. Positive results were also seen on American motorways (up +5.8% on a comparable basis) against a +0.8% increase in traffic. Revenues in Italy were down -9.4%, with like-for-like sales on motorways down -10.5% against a negative -7.1% trend in traffic compounded by a marked lowering of travellers’ propensity to spend.

|

The F&B performance by division broken down |

Other European countries saw good results in airports (up +2.7% at constant exchange rates; up +4.2% at current exchange rates) and railway stations, while total sales were down -3.4% at constant exchange rates (down -2.8% at current exchange rates) having been penalised by the performance in the motorway channel, down -7.7% (down -7.4% at current exchange rates) due to the contraction in traffic and the closure of a number of points of sale.

Ebitda in F&B amounted to €356.1 million, down -14% (-17.8% at constant exchange rates) on the €413.9 million posted in 2011. The Ebitda margin dropped from 10.3% to 8.7% reflecting, in Europe, the higher impact of fixed costs caused by falling sales and, in North America, the start-up costs of many points of sale renovated after the winning of concessions over the previous two years, inflationary pressure on food raw materials and rising labour costs.

|

Net capital expenditure amounted to €252.6 million against €190.8 million in 2011 and was focused mainly on US airports (Atlanta, Phoenix, Las Vegas and Salt Lake City in particular) and locations on the Pennsylvania

Turnpike.

Travel Retail & Duty Free

Travel Retail & Duty Free generated revenues of €2,002 million, up +10% (up +5.2% at constant exchange rates) on €1,820.8 million in 2011.

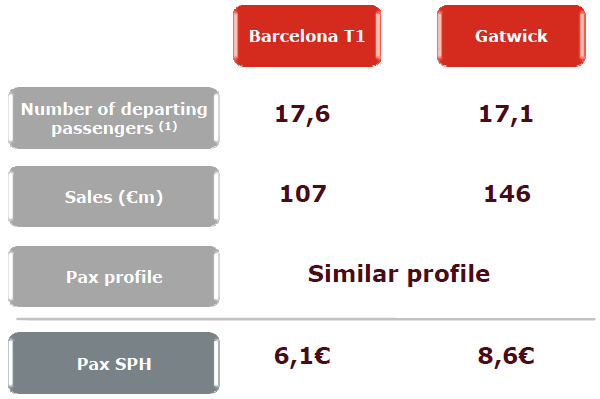

Sales in UK airports were up +4.5% against a +1.2% increase in passenger flows. The result was driven by Heathrow, where revenues (£372.2 million) rose +4.2% against +0.9% growth in traffic, as well as Manchester and Gatwick. These three airports together produce over 70% of the group’s sales in that country.

|

Travel Retail & Duty Free in detail |

Despite the -13% contraction in traffic, sales in Spanish airports were up +2.3%, driven by the performance at Barcelona (up +11.9%) where passenger traffic grew +2.2%. At Madrid, the closure of Spanair, strikes by Iberia personnel and the general weakness in domestic traffic caused a -4.5% contraction in revenues, a loss that Autorgill said was “limited” when compared to the -9% contraction in traffic at the airport.

As in the rest of Spain, Madrid too benefited from a substantial rise in per passenger spending, said the company.

|

Rest of the world revenues were up +16.1% (up +9.7% at constant exchange rates), with double-digit growth in nearly all geographical regions. A particularly good performance at Vancouver Airport reflected new connections with Asia, said the company.

|

Ebitda in this division was up +14.9% (up +11.1% at constant exchange rates) to reach €262.3 million. The Ebitda margin continued to improve on 2011, rising from 12.5% to 13.1% thanks to a favourable

sales mix in terms of product types and to the higher impact in European airports of passengers travelling to

non-European destinations.

Net capital expenditure amounted to €28.3 million against €18.6 million in 2011 and referred mainly to Gatwick,

Vancouver and airports in Jordan.

|

Benchmarking Barcelona T1 and Gatwick |

Outlook for 2013

The first two months of 2013 saw a continuation of the previous year’s trend, characterised by an airport channel “more dynamic than motorways in an extremely weak economic scenario in most countries in the Eurozone”.

Group sales in the first eight weeks of 2013 were up +1.1%, with both sectors showing growth. There was a

slight increase (+0.5%) in Food & Beverage sales thanks to good performance in North American airports that offset the persistent weakness of the Italian motorway channel.

There was a more marked improvement in Travel Retail sales (up +2.6%), which outperformed traffic.

Autogrill said: “With this scenario, the strategic guidelines for 2013 must be based on cash flow generation and the implementation of new business development activities. Objectives in the two sectors will be specific to the differing dynamics that characterise them: in Food & Beverage, the drive to improve operating efficiency and review the business model will continue, while in Travel Retail there will be a strong focus on projects under the contract renewals in Spain.”

[houseAd5]