AMERICAS. The 2018 Summit of the Americas concluded its Executive Conference sessions by focusing on regional traffic data, passenger demographic trends and insights from a Duty Free World Council (DFWC) study.

ASUTIL Secretary General José Luis Donagaray introduced the first session, which examined air traffic forecasts in the Americas until 2023.

IATA Director Travel Intelligence Charles de Gheldere outlined regional air traffic forecast data, compiled in partnership with travel retail research company m1nd-set.

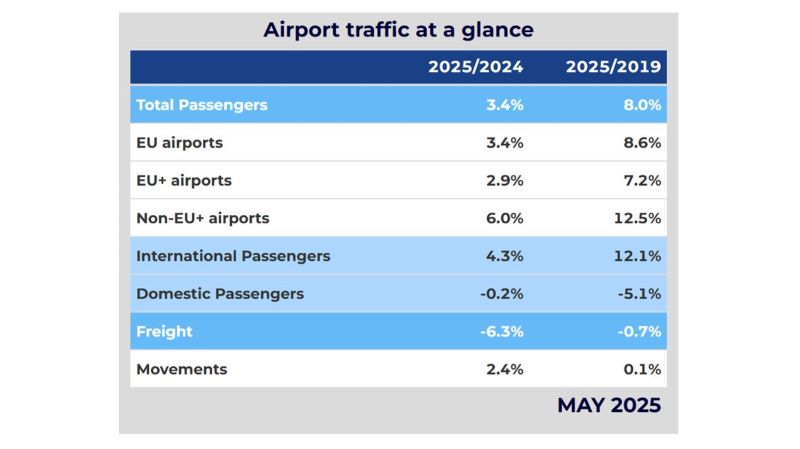

Global airline passenger traffic grew +8% in 2017 – the highest growth rate in the past ten years, supported by a strong global economy and relatively low fuel costs and fares, according to de Gheldere.

“The Americas also did well with around +7% growth and 452.17 million international passengers in 2017,” he added. More than half of those passengers were in North America, with the rest distributed across the region. In the next 12 months, regional traffic is expected to grow +4%.

In terms of demographics, Canadians were the top nationality measured by international travel in the region. Airports with the highest international traffic were New York John F. Kennedy, Toronto Pearson, Los Angeles, Miami and Cancún airports.

In terms of demographics, Canadians were the top nationality measured by international travel in the region. Airports with the highest international traffic were New York John F. Kennedy, Toronto Pearson, Los Angeles, Miami and Cancún airports.

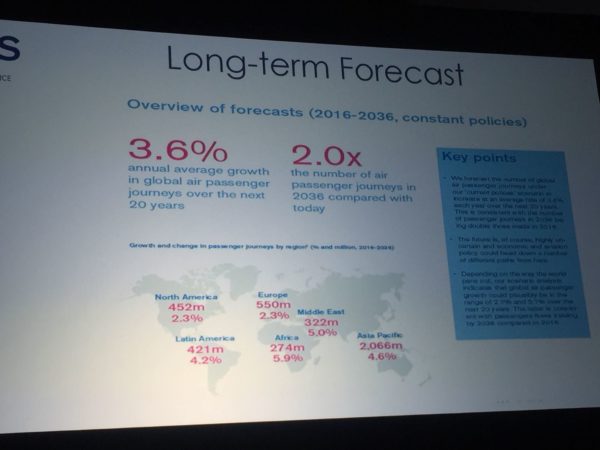

The long-term forecast for global air passenger traffic is for annual average growth of +3.6% over the next 20 years. The number of passengers is expected to double by 2036, de Gheldere added. Chinese travellers

Chinese travellers

Chinese travellers represent 20% of global travel retail sales and continue to present a huge opportunity for the industry, said m1nd-set Owner and CEO Peter Mohn. He outlined insights on Chinese travellers and their expectations of travel retail when travelling to the Americas.

The Americas still represents a region of opportunity for travel retailers targeting Chinese: only around 8% of outbound travel from China is to the Americas, 74% of visitors travel to the USA, or around 2.77 million in 2017. By contrast, around 80% of Chinese travellers stay within Asia Pacific, with 9% heading to Europe.

Los Angeles and Toronto are the top airports welcoming Chinese travellers in North America, while Mexico is the top destination in Latin America.

Mohn presented further details on the shopping behaviour of Chinese passengers when travelling in the Americas based on his company’s B1S (Business Intelligence Service).

Figures for Chinese passenger footfall, purchase and conversion are 57%, 40% and 70% respectively – the latter a particularly high number compared to other passengers in the region, said m1nd-set.

On average they visited 3.7 categories – again higher than any other nationality. Around 71% of Chinese travellers planned their visit to duty free with perfumes & cosmetics and alcohol being the top category choices. Confectionery was the top category for impulse purchases.

The key drivers of purchases were: good value; a clear price advantage; products that can’t be found at home and special promotions.

Mohn reinforced the importance of communicating effectively with Chinese travellers before they come to the airport because of their tendency to plan duty free shopping in advance.

Mohn reinforced the importance of communicating effectively with Chinese travellers before they come to the airport because of their tendency to plan duty free shopping in advance.

Economic impact study

Duty Free World Council (DFWC) President Frank O’Connell presented preliminary figures from a new study: The Economic Impact of Duty Free and Travel Retail in the Americas (to be finalised in coming weeks).

The study is part of a series of regional DFWC reports that will provide a sense of the economic impact of the business – in terms of social and employment contribution and GDP. “These are vitally important facts to know when influencing governments and regulators,” said O’Connell. “These are the figures they respond to.”

According to 2016 data, the total value of the travel retail business in the Americas was around US$13 billion – 17% of global sales. The aviation channel (airports and inflight) generated US$6.6 billion in 2016; US$1.8 in the USA and Canada and US$4.8 billion in Latin America and the Caribbean.

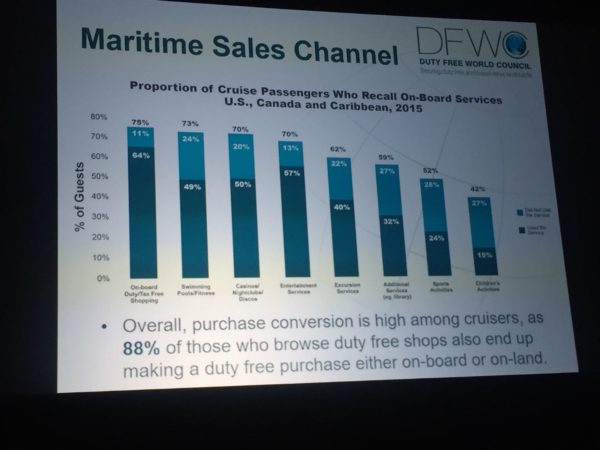

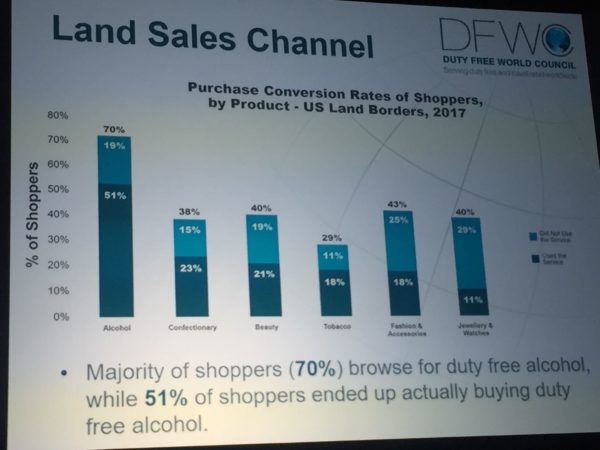

O’Connell provided further data on the maritime and land duty free sales channels (see tables below).

To date, the study has found that the total economic impact of the industry in the Americas amounts to 111,800 jobs and a GDP contribution of around US$10 billion.

To date, the study has found that the total economic impact of the industry in the Americas amounts to 111,800 jobs and a GDP contribution of around US$10 billion.

“The industry is supporting a significant number of jobs. It is a healthy figure when you’re talking to governments.

“In summary, our industry contributes to economic prosperity in the region, particularly in areas where there is low employment or a lack of quality employment,” concluded O’Connell. IAADFS President & CEO Michael Payne closed the inaugural Summit of the Americas by thanking key sponsors of the event. “We look forward to seeing you next year in our new location at the Hyatt in Orlando.”

IAADFS President & CEO Michael Payne closed the inaugural Summit of the Americas by thanking key sponsors of the event. “We look forward to seeing you next year in our new location at the Hyatt in Orlando.”