US. Private Equity Sycamore Partners has acquired a 55% majority interest in Victoria’s Secret.

The move is part of a ‘transformative transaction’ that will deliver long-term value to L Brands shareholders, said the company.

The transaction looks to position Bath & Body Works as a standalone public company and turn Victoria’s Secret Lingerie, Victoria’s Secret Beauty and Pink into a privately-held entity with a renewed focus on reinvigorating its business.

Victoria’s Secret has been under fire in recent years after controversies regarding its now cancelled Victoria’s Secret fashion show came to light. In addition to this, fan favour has also moved to lingerie and lifestyle brands with more inclusive messaging.

The deal was approved by a unanimous vote of L Brands Board of Directors and was led by a transaction committee helmed by independent directors Allan Tessler and Sarah Nash. Under the agreement, Victoria’s Secret was valued at US$1.1 billion and will become a separate entity from L Brands. The lingerie brand will become a privately-held company majority-owned by Sycamore Partners.

Sycamore Partners will purchase a 55% interest in Victoria’s Secret for US$525 million; while L Brands will retain a 45% stake to allow its stakeholders to participate in the brand’s upside potential. L Brands intends to use the proceeds of the transaction— along with US$500 million in excess balance sheet cash — to reduce debt.

L Brands Founder, Chairman and Chief Executive Officer Leslie Wexner will also be stepping down as Chairman of the Board of L Brands upon the close of the transaction. He will remain a member of the Board as Chairman Emeritus.

“We believe the separation of Victoria’s Secret Lingerie, Victoria’s Secret Beauty, and Pink into a privately held company provides the best path to restoring these businesses to their historic levels of profitability and growth” — L Brands Chairman and Chief Executive Officer Leslie Wexner

“We believe this structure will allow Bath & Body Works — which represents the vast majority of 2019 consolidated operating income — to continue to achieve strong growth and receive its appropriate market valuation. The transaction will also allow the company to reduce debt,” said Wexner. “We believe the separation of Victoria’s Secret Lingerie, Victoria’s Secret Beauty and Pink into a privately held company provides the best path to restoring these businesses to their historic levels of profitability and growth.”

Wexner added, “Sycamore, which has deep experience in the retail industry and a superior track record of success, will bring a fresh perspective and greater focus to the business. We believe that, as a private company, Victoria’s Secret will be better able to focus on longer-term results. We are pleased that, by retaining a significant ownership stake, our shareholders will have the ability to meaningfully participate in the upside potential of these iconic brands.”

Lead Independent Board Director Allan Tessler commented, “The Board undertook a comprehensive review of a broad range of options to best position its brands for long-term success and drive shareholder value.

“As the Board and its advisers explored these potential alternatives, we received valuable input from a number of shareholders, and we greatly appreciate their support. We are confident that this transformative transaction is the best path forward to strengthen our iconic brands and deliver enhanced value to all L Brands shareholders.”

Commenting on Wexner’s departure, Tessler said: “Les Wexner is a retail legend who has built incredible brands that are household names around the globe. His leadership through this transition exemplifies his commitment to further growth of Bath & Body Works and Victoria’s Secret and driving overall shareholder value.”

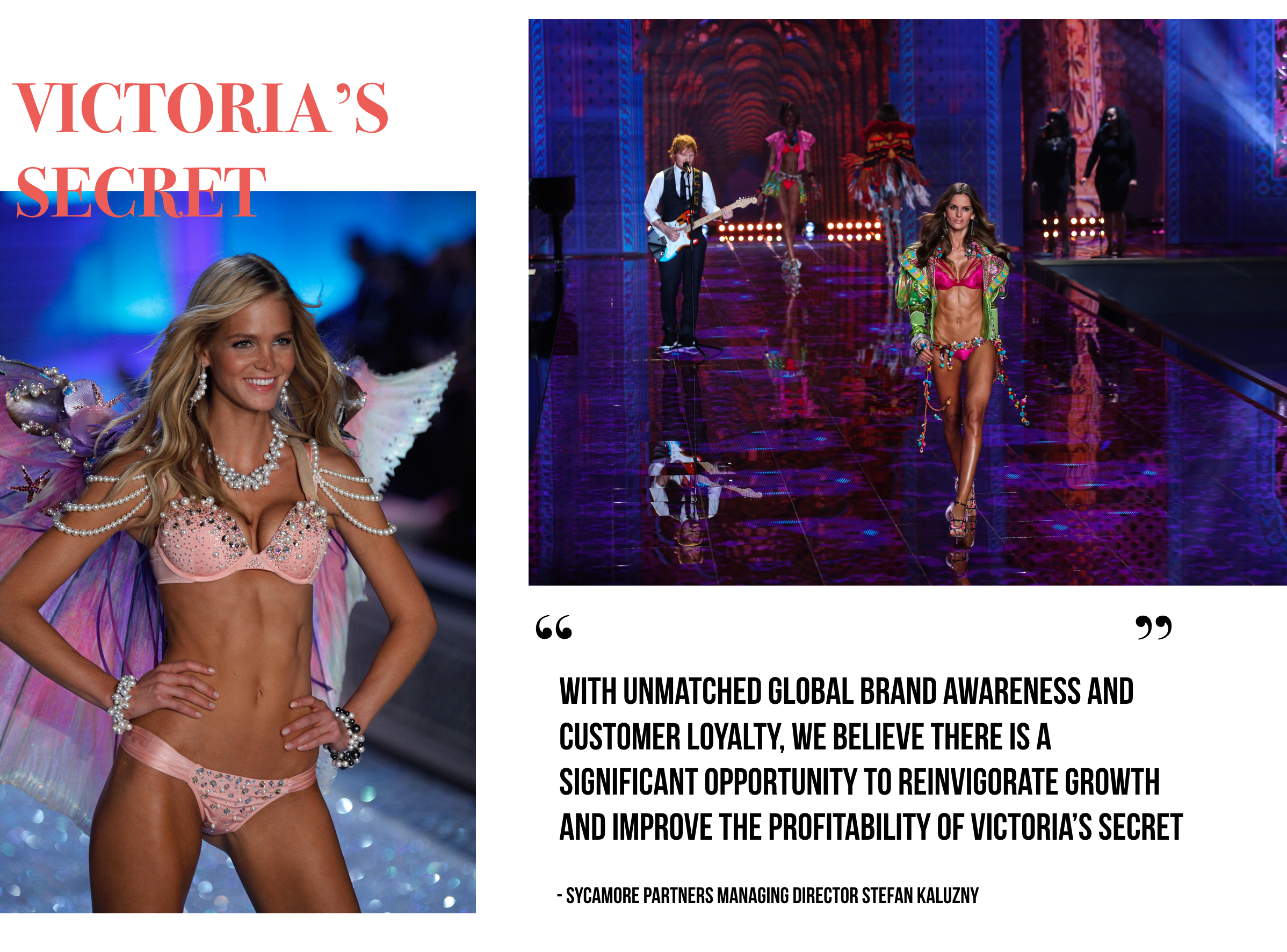

Sycamore Partners Managing Director Stefan Kaluzny commented, “We have long had great respect and admiration for L Brands and its success in building a world-class portfolio of lingerie and beauty brands.”

“With unmatched global brand awareness and customer loyalty, we believe there is a significant opportunity to reinvigorate growth and improve the profitability of Victoria’s Secret. We look forward to partnering with the leadership team to pursue these objectives,” Kaluzny added.

The Sycamore Partners transaction also effected key leadership changes within Bath and Body Works. Bath & Body Works Chief Executive Officer Nick Coe has been appointed to the new role of Bath & Body Works Vice Chairman of Brand Strategy and New Ventures. In his new position, he is responsible for the business’s strategic positioning, product development, and new ventures and acquisitions.

At the close of the transaction, Bath & Body Works Chief Operating Officer Andrew Meslow will also be promoted to the role of Bath & Body Works Chief Executive Officer.

Wexner commented on the leadership changes at Bath & Body Works, “For nearly nine years, Nick and Andrew have been a powerful combination, driving the Bath & Body Works brand to more than US$ 5 billion in sales with best-in-class profitability. Management and the Board have been engaged in thoughtful discussions over the past few years to develop a succession plan that leverages the unique partnership established by Nick and Andrew to advance the long-term, strategic direction of the brand.”

“We are pleased to name Andrew as CEO of Bath & Body Works and have Nick step into this new, more focused role as the team propels the brand and business forward.”