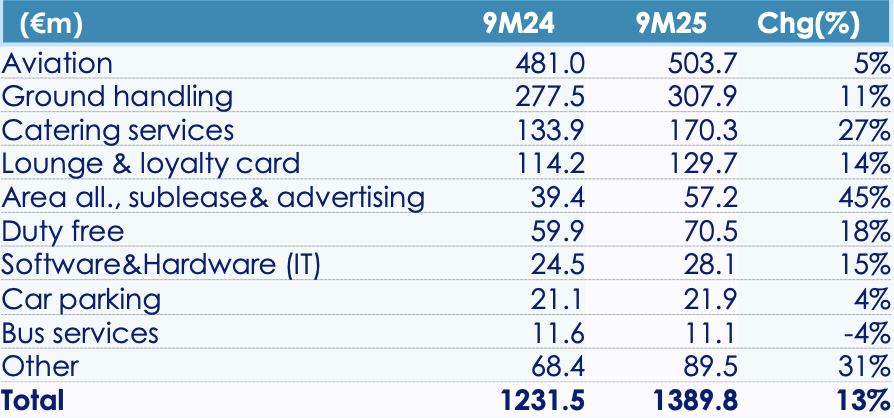

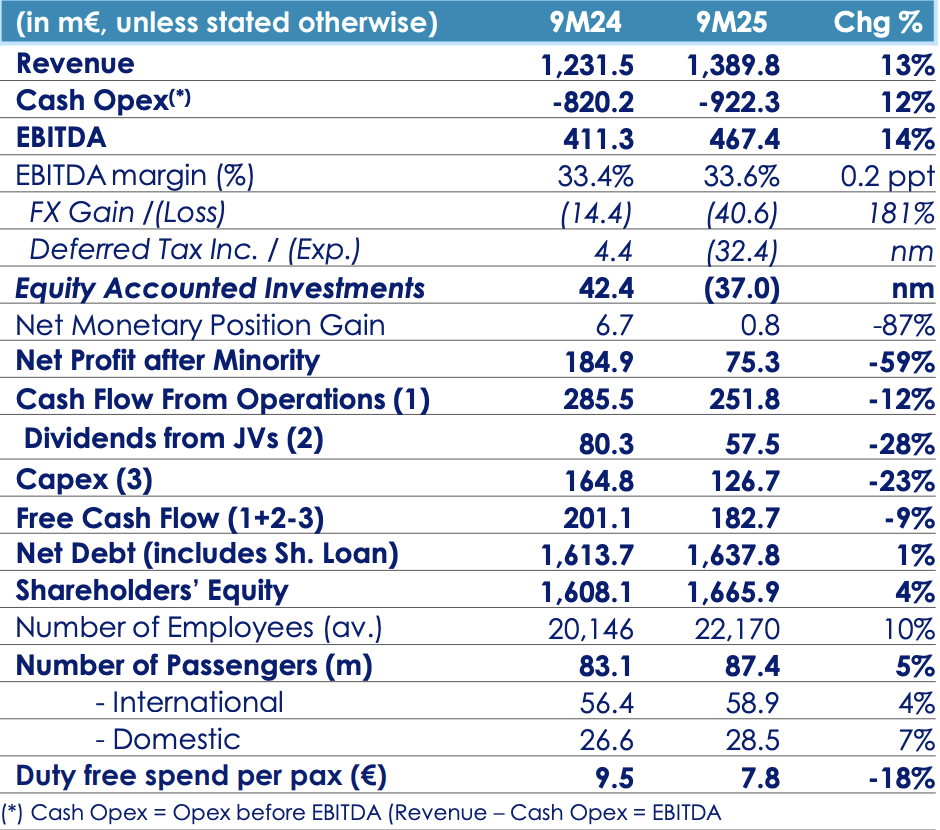

TÜRKİYE. TAV Airports, a division of Groupe ADP, posted a +13% year-on-year increase in nine-month revenue to €1,390 million. EBITDA rose +14% to €467 million in the period, with net profits €75 million, a fall of -59% ascribed to deferred tax and foreign exchange impacts.

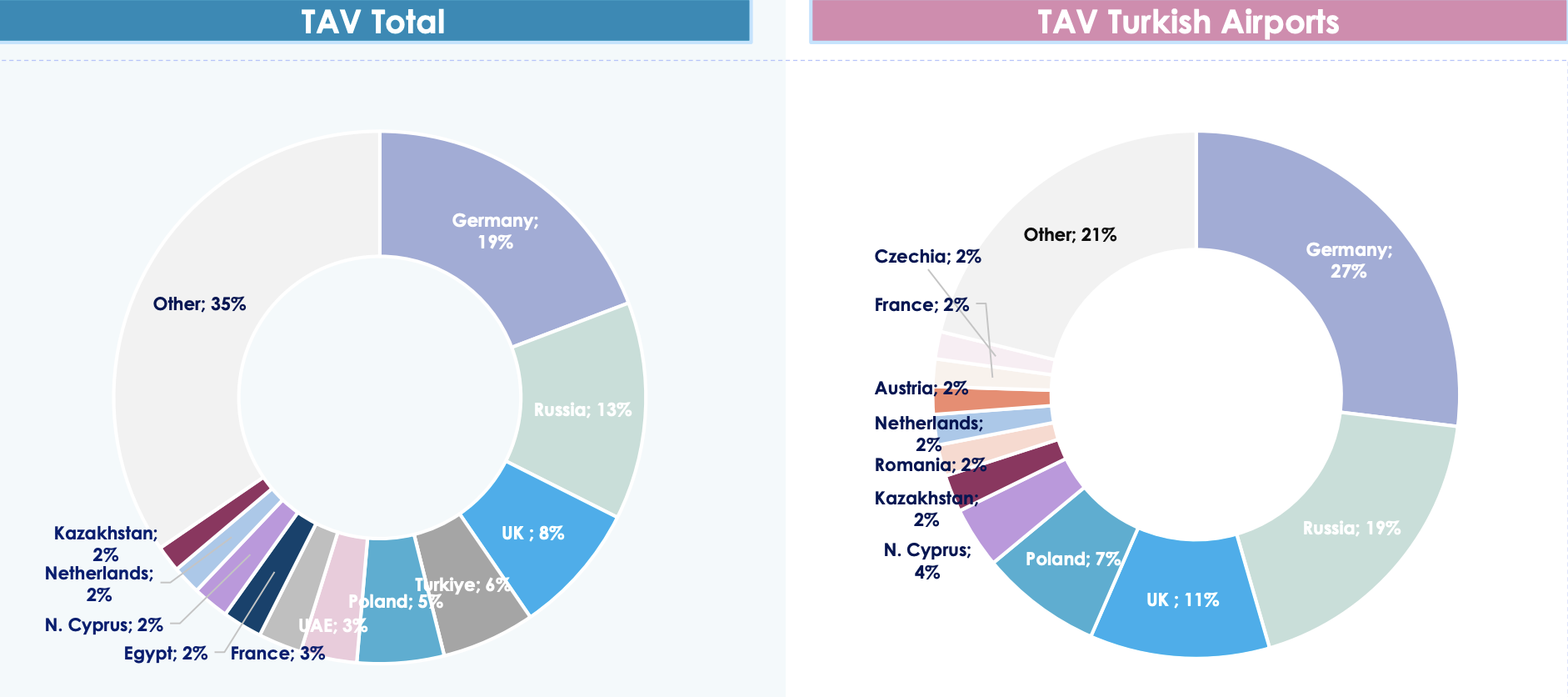

Across the network, passenger traffic climbed +5% year-on-year to €87.4 million.

CEO Serkan Kaptan said, “During the first nine months of 2025, we sustained positive momentum across our portfolio despite a mixed macro backdrop.

“International passenger traffic increased by +4%, supported by strong performance in the majority of our assets.

“While Antalya Airport experienced softer international traffic growth – reflecting the strong Lira and certain geopolitical factors – our consolidated financial performance remained robust.”

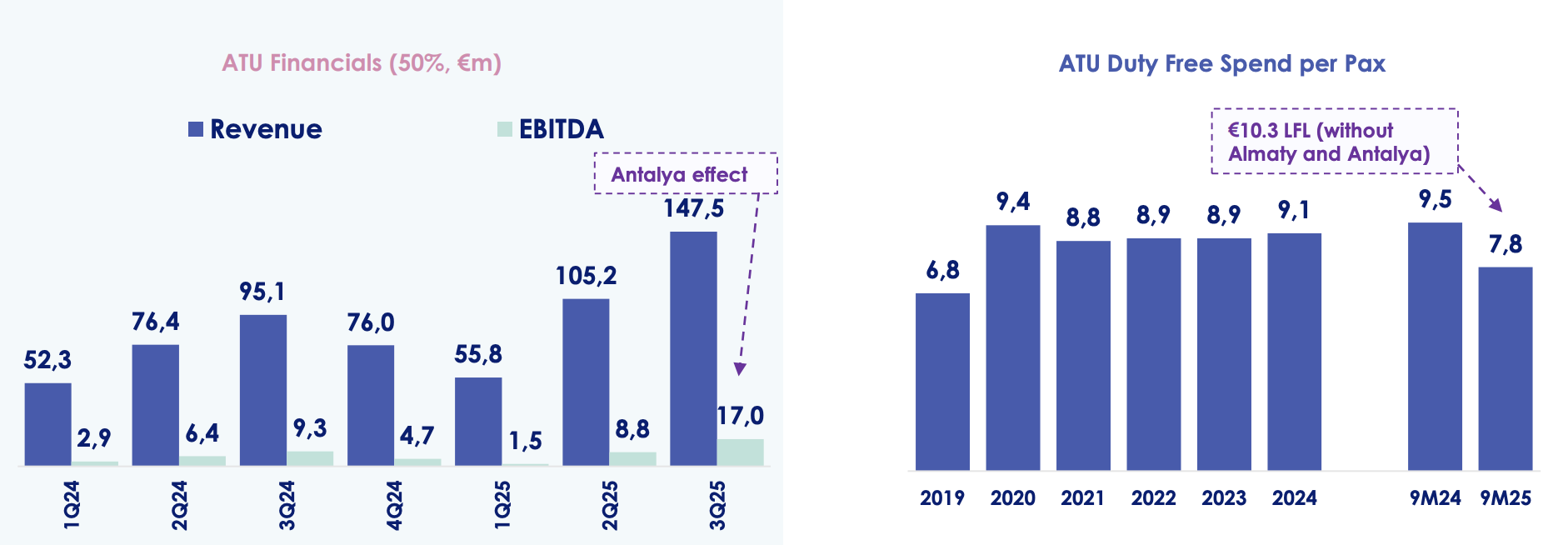

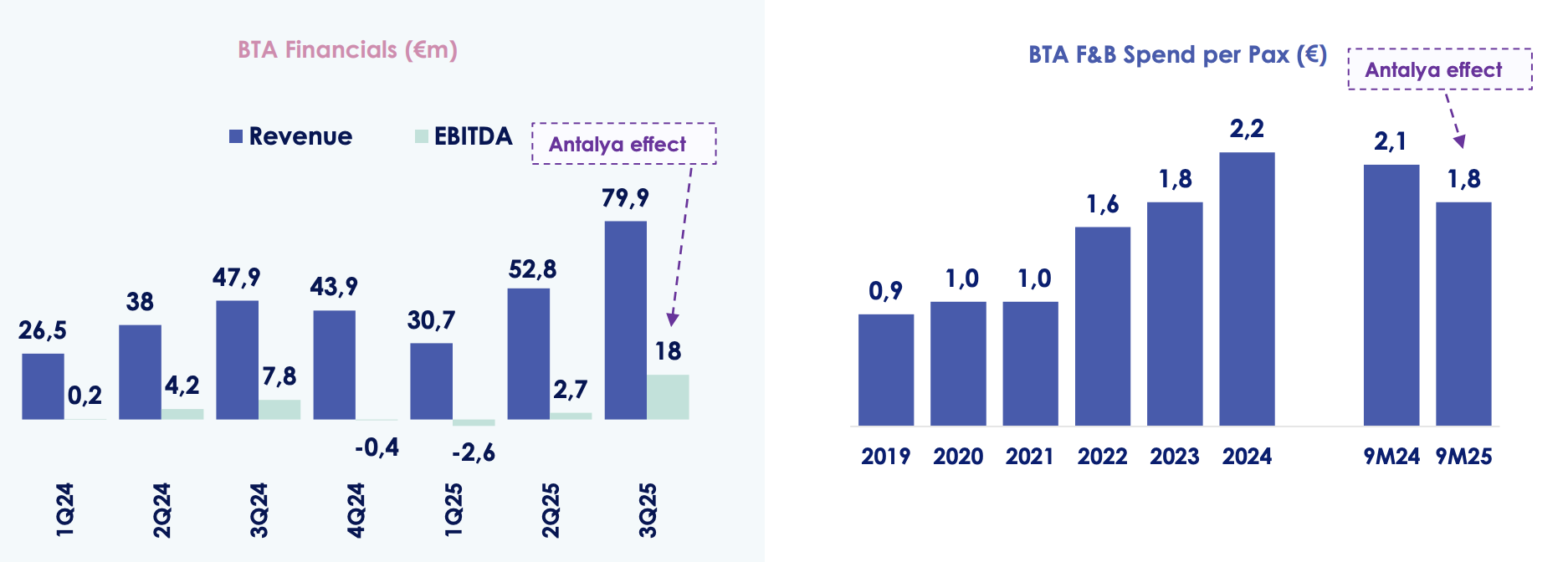

Within key commercial sectors, duty-free income (led by ATU Duty Free, owned under a partnership between TAV Airports and Gebr. Heinemann) climbed +18% to €70.5 million, with food & beverage revenue (through BTA Catering) up +27% to €170.3 million.

However, SPP in duty free alone fell -18% to €7.80, with a dilutive impact from the openings in Almaty and Antalya, both still in ramp-up phases. Like-for-like SPP without Almaty and Antalya in the nine months was €10.30, up +9% on the same period last year.

Income from lounges and Primeclass services (principally handled by TAV Operation Services (OS)) grew +14% to €129.7 million.

Revenue growth overall remained above traffic growth due to the opening of TAV subsidiary BTA’s food & beverage operations at Antalya Airport, a new airport concession in Ankara, price increases, the unveiling of new commercial areas in Almaty, growth in TAV OS and a new TAV Tech project in Qatar.

Among key network highlights, said Kaptan, was the “elevation of duty free, food & beverage and lounge offerings” at Antalya Airport. “The commercial ramp up continues, with additional fashion, speciality retail and restaurant openings underway.”

At Ankara Airport the first full quarter (in Q3) under a new 25-year concession “delivered a strong boost to both revenue and EBITDA. Ongoing international traffic growth, supported by low-cost carriers, is expected to further underpin profitability,” he added.

At Almaty Airport, a recently launched investment plan worth €315 million in total, is on target for completion by the end of 2027.

In Madinah, construction of a new international terminal has begun, with TAV holding a 26% stake in the operating JV. This project is expected to complete by 2028.

In Georgia, added Kaptan, “we are in advanced discussions with the local authority regarding a concession extension to 2031. The discussion includes an investment to increase capacity to 10 million passengers and an update to commercial terms.” ✈