AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity chain, considers the prospects for a revived retail and F&B scene in major Australia and New Zealand airports. These are two nations which appear to have handled the COVID-19 situation with far greater efficiency than the vast majority of other countries, and there is talk of restrictions on domestic travel being relaxed there in the coming months. Here, Favotto offers some words of caution.

AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity chain, considers the prospects for a revived retail and F&B scene in major Australia and New Zealand airports. These are two nations which appear to have handled the COVID-19 situation with far greater efficiency than the vast majority of other countries, and there is talk of restrictions on domestic travel being relaxed there in the coming months. Here, Favotto offers some words of caution.

In the Roman legions, mutiny in the ranks was “resolved” by decimation – where one in every ten men was killed based on random selection – by their comrades. The more modern usage of the word decimation however means the opposite, where the majority of a population is killed or destroyed. So, it not without hyperbole that I say that travel retail stores across Australia and New Zealand have been decimated by the COVID-19 crisis.

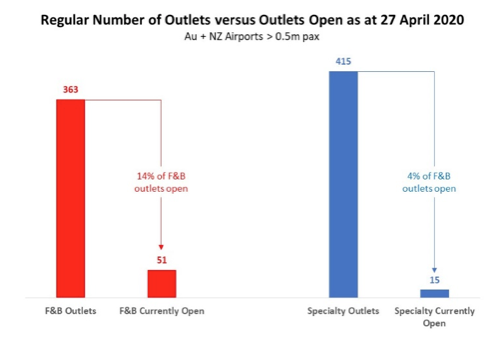

In a snapshot analysis undertaken by my consultancy, The Mercurius Group, we found that across 27 airports with more than 0.5 million annual passengers (19 in Australia and eight in New Zealand), only 8.5% of travel retail outlets – across duty free, specialty, F&B and services – were open as of 27 April.

While this may be unsurprising considering that both countries have closed their international borders (and in Australia’s case, also closed state borders), the sheer scale of the carnage caused by COVID-19 is shocking when seen in cold hard numbers.

Just two months ago, these 27 airports had a total of 778 travel retail outlets operating. As of 27 April, only 66 are open for business. The remaining stores are shuttered for an indefinite period.

While there is some unofficial chatter about relaxing restrictions on domestic traffic in the coming months, most pundits predict that the majority of international borders will remain shut for the rest of 2020. Even talk about a trans-Tasman bubble, where international travel between the two COVID-19 free countries is allowed, seems many months away as governments wait to see if the relaxation of physical distancing measures and the onset of the southern hemisphere winter causes a second wave of infection.

Even if domestic traffic is allowed, an additional complication is Virgin Australia, Australia’s second-largest domestic carrier. Despite illustrious airline industry ownership (Virgin is currently owned by Etihad 20%, Singapore Airlines 20%, Chinese airline group HNA 20%, top 500 Chinese company Nanshan 20% and Sir Richard Branson’s Virgin Group 10%), Virgin Australia was placed into administration recently.

The administrator, led by Vaughan Strawbridge of Top 4 accounting firm Deloitte, is currently seeking new ownership arrangements and investment or will put the company into insolvency.

To paraphrase Napoleon, an army moves only as fast as its slowest soldiers march.

Either way, Virgin Australia is likely to be a shadow of the airline it was and will likely pull back from many of the regional and tourist-driven routes it was famous for serving – all of which plays nicely into the hands of Qantas which has not shown in the past any unwillingness to take advantage of any (even temporary) disruption to the competitive landscape.

So we might be stuck with 66 out of 778 travel retail outlets open for a while.

The impact of the widespread shutdown is weighing more heavily on the duty free and specialty sectors, where just 4% of outlets – just 15 out of 415 stores – are open. Around 60% of the stores still open are chemist/pharmacy outlets, perhaps not surprising during a health crisis.

In F&B, 14% of outlets – some 51 stores – are open. Still not many, but not as bad as duty free/specialty. Typically, most of those still open are smaller café-style outlets although there are quick-service-restaurants open at some of the bigger airports.

The impact of the COVID-19 crisis is being felt much more acutely in New Zealand than Australia with just 1.7% of outlets open compared to 10.5% in Australia (simple average of 8.5%).

There are several reasons for this – a smaller market, the nature of the lockdown is more severe in New Zealand than in its near neighbour and certain airports in Australia retain some intra-state and mining related traffic (with mining being designated as an essential service).

In both countries, travel retailers have been hit hard and are fighting for their very survival. Not all are expected to survive – especially in the specialty arena where an explosion of fashion and accessories outlets in recent years appears to be have been set back some years.

Relatively generous wage subsidy arrangements provided by both governments have eased the pressure somewhat, but that assistance is time limited and unlikely to be extended materially (with both governments taking on unprecedented amounts of debt).

And of course, there are vigorous conversations going on between airports and retailers about Minimum Annual Gauranatee (MAG) and rental arrangements with various solutions being proposed and debated across the industry.

These are regardless of the existence or otherwise of force majeure clauses within concession agreements (see two previous articles by The Analyst on why COVID-19 may result in force majeure agreements being widely introduced into concession agreements in the long-term interests of airports and retailers – see article 1 here and article 2 here).

While both Australia and New Zealand appear to be coming out of the COVID-19 crisis better and more quickly than some other countries, this is both a blessing and a curse. A blessing in the sense of materially fewer deaths per head of population than elsewhere. But a curse in the sense that while the health crisis may be under control, back-to-normal for air travel, particularly international travel, still seems a long way away as COVID-19 rages across the globe. To paraphrase Napoleon, an army moves only as fast as its slowest soldiers march.

Frustratingly for countries such as Australia and New Zealand, which have made great strides in managing COVID-19, this means that international borders will only reopen when countries that have been the slowest to manage COVID-19 get their house in order. This could take a while.

The health situation might be drastically improved in both countries but for travel retailers in Australia and New Zealand, the crisis is anything but over.

*About Ivo Favotto

Ivo Favotto has a long and distinguished record in the airport and travel retail sectors. A trained economist, he entered the airports/infrastructure sector with Australia’s Federal Airports Corporation in 1992 as GM – Planning & Economics.

He later built a highly successful international airports/infrastructure consulting practice, working with three firms – Bach Consulting, Arthur Andersen and URS Corp – and advising many of the world’s leading airports, governments and investors in the areas of retail planning, master planning and privatisation/transaction support.

In 1998 he established the market-leading Airport Retail Study, selling it to Moodie International so he could join The Nuance Group (now owned by Dufry) as Executive Vice President – Strategy & Business Development in Zürich. He later returned to his native Australia as Director – Sydney Airport before being named Executive General Manager of Duty Free & Luxury, Pacific for Lagardère Travel Retail.

Favotto has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies.

Favotto has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies.

Contact: Tel: +61 423 564 057; E-mail: ifavotto@themercuriusgroup.com; Website: www.themercuriusgroup.com