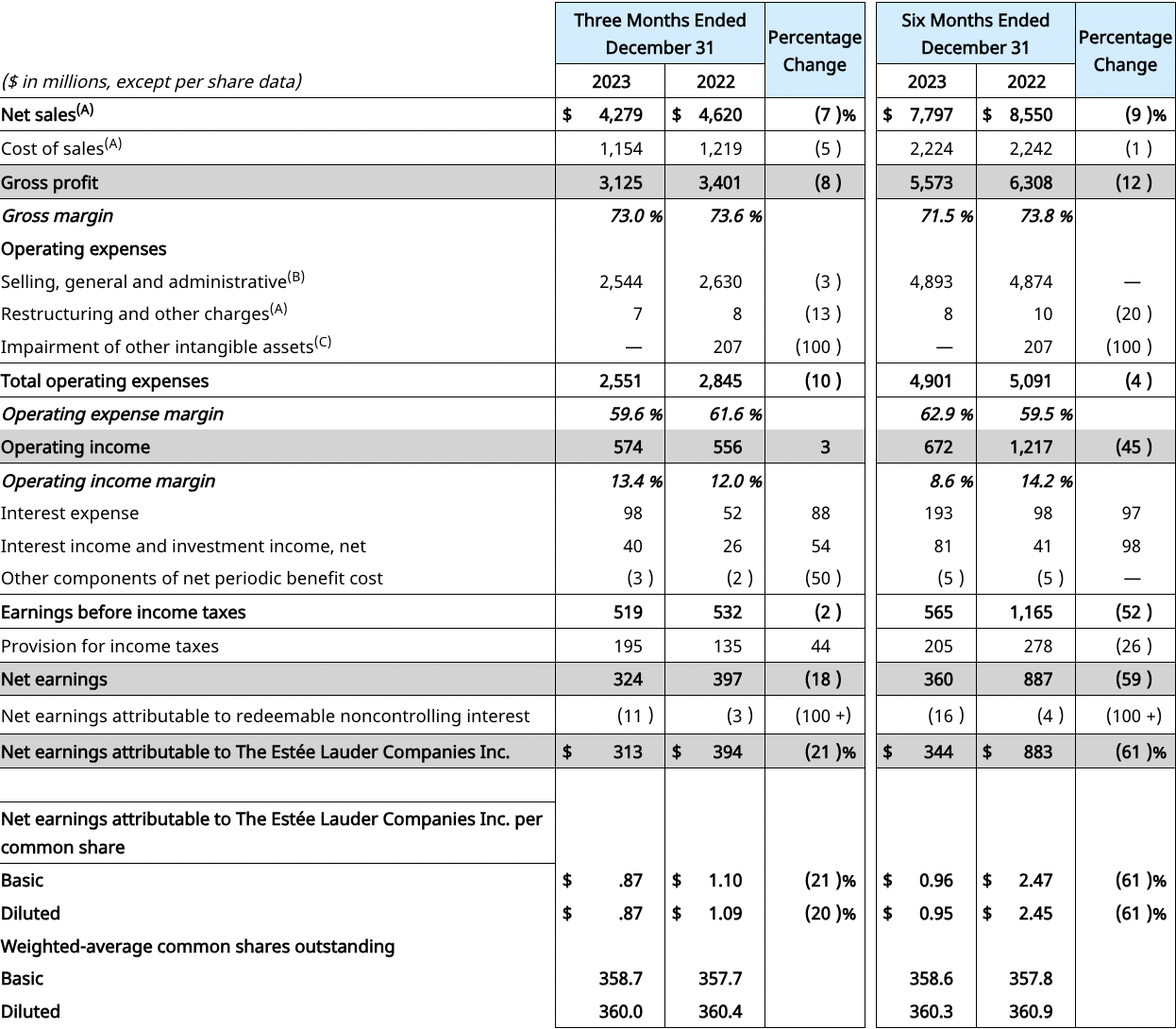

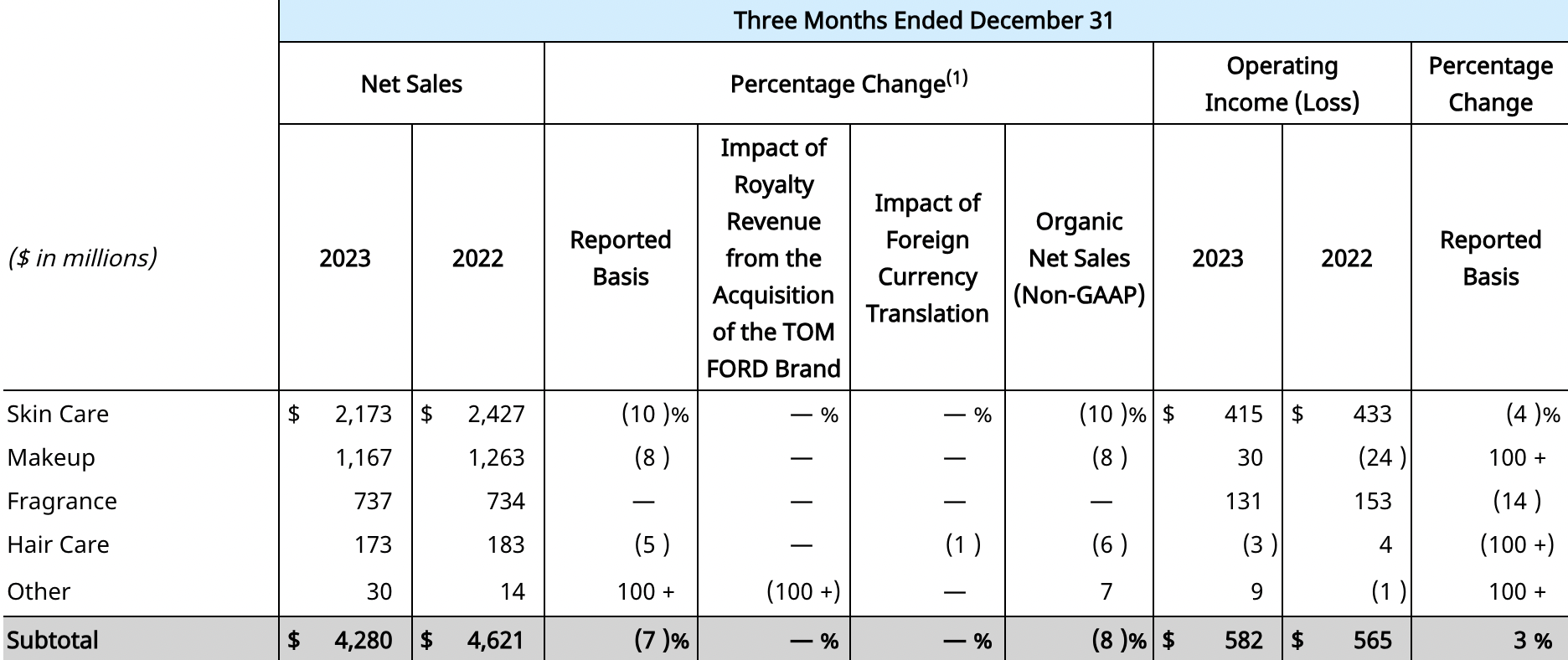

The Estée Lauder Companies today reported net sales of US$4.28 billion for its second quarter ended 31 December, down by -7% year-on-year. Organic net sales fell -8%, reflecting “the expected challenges in Asia travel retail as well as softness in prestige beauty in Mainland China”, the company said.

The decrease also reflects a -1% headwind due to business disruptions in Israel and other parts of the Middle East. Partially offsetting these pressures, organic net sales grew in several markets in Asia Pacific and Europe, the Middle East & Africa, as well as in Latin America.

Net earnings of US$313 million were down by -21% year-on-year.

President & CEO Fabrizio Freda said: “For the second quarter of fiscal 2024, we delivered our organic sales outlook and exceeded expectations for profitability. The Ordinary and La Mer in Skin Care, Clinique in Makeup, and Le Labo and Jo Malone London in Fragrance performed strongly.

“Many developed and emerging markets around the world continued to grow organically and at retail. While Mainland China and Asia travel retail declined, our retail sales trended ahead of organic sales, and these businesses are poised to return to organic sales growth in the second half.”

Freda added: “We made progress in the first half across several strategic priorities, including reducing inventory in the trade of Asia travel retail, improving working capital, realising higher levels of net pricing, and managing expenses with discipline.

“We are, encouragingly, at an inflection point. In the second half of fiscal 2024, we are positioned to return to strong organic sales growth and expand our profitability from the first half. Moreover, today we have announced that we are further expanding our Profit Recovery Plan, which benefits fiscal years 2025 and 2026, to include a restructuring programme. We believe this now-larger plan will better position the company to restore stronger, and more sustainable, profitability while also supporting sales growth acceleration and increasing agility and speed-to-market.”

Skincare net sales declined -10%, reflecting a decrease in the company’s Asia travel retail business primarily due to actions by the company and its retailers to reset retailer inventory levels [mainly in Hainan and South Korea]. The decrease also reflected changes in government and retailer policies related to “unstructured market activity”

This includes “the response to changes in government and retailer policies in the second half of fiscal 2023 related to unstructured market activity [a reference to the crackdown on daigou activity out of the same two key North Asian markets noted above –Ed] and lower conversion of travellers to consumers”.

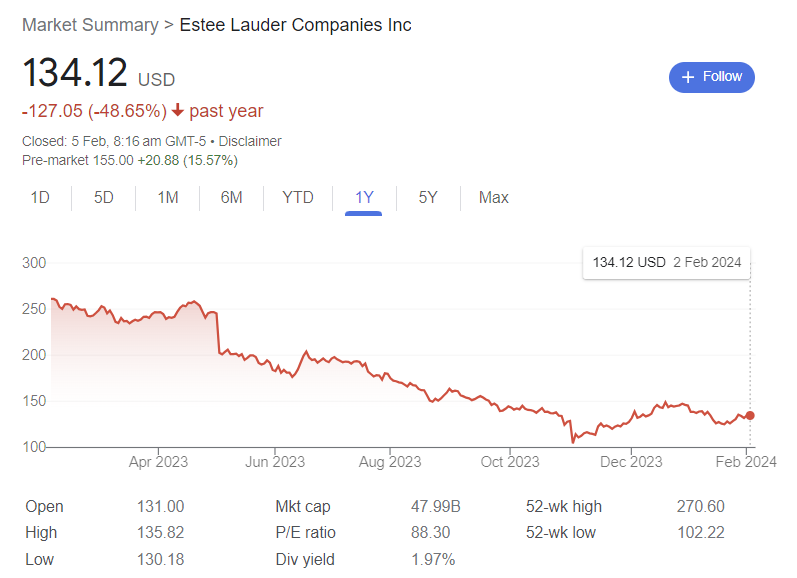

Travel retail headwinds but “we remain buy rated” – Goldman Sachs Equity Research Goldman Sachs Equity Research said The Estée Lauder Companies’ Q2 performance saw a sharp sequential improvement in gross margin driving an EPS (earnings per share) beat. This was coupled with revenue marginally ahead of the FactSet consensus estimate (US and China were soft while EMEA/global travel retail was less bad than expected), the firm said. “All-in, results were mixed but the outlook reaffirms management’s expectation for a sharp 2H inflection, while the bolstered productivity program supports medium-term EPS expectations. “Most investors we speak with were cautious going into the event and expected a more negative guidance revision; we expect the stock to trade higher in this context.” Given its historically high internal share, travel retail sales came under particular scrutiny with the firm noting the double-digit increase in sales through the channel. Asia Pacific came in below expectations with organic sales growth of -7.0% (vs. Goldman Sachs/consensus -2.0%/-4.0%) as declines in Mainland China more than offset gains in Hong Kong. Goldman Sachs remains Buy rated on EL with a 12-month price target of US$141. Key risks to both rating and price target include a more protracted-than-expected recovery in Asia travel retail sales, a “slower-for-longer” performance of its US business, weaker-than-expected ongoing growth in Mainland China and/or greater cost to compete in China than Goldman Sachs currently assumes in its model. |

The decline also reflected the impact of softness in prestige beauty in Mainland China, including lower sales during the 11.11 Global Shopping Festival.

Skincare operating income decreased, primarily reflecting the decline in net sales, partially offset by the previous year period other intangible asset impairment of US$100 million relating to Dr.Jart+ and disciplined expense management.

Makeup net sales declined -8%, primarily reflecting challenges in Asia travel retail business noted above. This hit the MAC and Estée Lauder brands, though Clinique delivered strong double-digit net sales growth.

Makeup operating results increased, primarily reflecting previous other intangible asset impairments relating to Too Faced and Smashbox, combined, of US$107 million, and disciplined expense management, partially offset by the decrease in net sales.

Fragrance net sales were flat, as increases from luxury brands Le Labo and Jo Malone London were offset by a decline from Estée Lauder. Net sales from Le Labo grew strong double digits, primarily due to robust consumer demand for the brand’s hero product franchises, such as Santal 33 and Another 13, its City Exclusives collection and strong holiday performance.

In Asia Pacific, net sales more than doubled, benefiting from targeted expanded consumer reach, including in Mainland China, Thailand and Malaysia.

Jo Malone London net sales increased, owing to strong holiday offerings and social media activations, with net sales in the Americas up by double digits, and Asia Pacific by high-single-digits.

Fragrance operating income declined, primarily driven by strategic investments to support growth, including for the holiday period.

Haircare net sales decreased -6%, primarily driven by Aveda reflecting softness in North America, with operating results also down.

By region, net sales slipped -1% in the Americas, reflecting a decline in North America, partially offset by double-digit growth in Latin America.

In Europe, the Middle East and Africa, net sales fell by -14%, mainly due to the decline in Asia travel retail and a -2% impact from business disruptions in Israel and other parts of the Middle East. Travel retail net sales decreased double digits, mainly due to the drive to reset retailer inventory levels.

Operating income decreased in the region, driven by the decline in net sales, partially offset by US$85 million of lower inter-company royalty expenses due to the decline in income from the travel retail business and lower cost of sales.

In Asia Pacific, net sales decreased -7%, driven by the challenges in Mainland China noted above, partially offset by growth across several other markets, led by Hong Kong SAR. Net sales in Hong Kong increased strong double digits, with the business benefiting from the reopening of borders and the corresponding resumption of travel, which boosted brick-and-mortar store traffic.

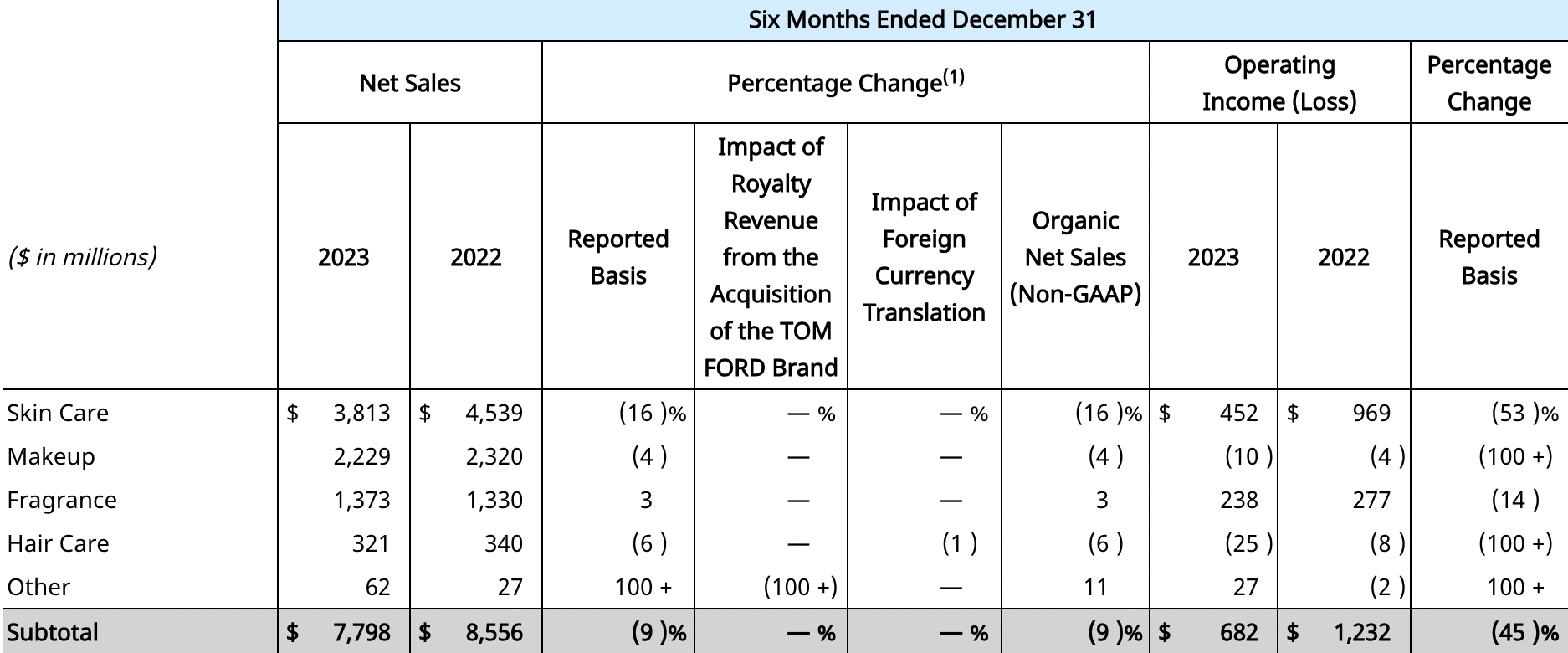

For the six months ended 31 December, the company reported net sales of US$7.8 billion, a -9% decrease compared with the same period a year earlier. Organic net sales decreased -9%, primarily driven by Asia travel retail and Mainland China.

Net earnings reached US$344 million, less than half the figure of the same period a year earlier.

For the full financial year, the company is forecasting reported and organic net sales to range between a decrease of -1% to an increase of +1% year-on-year. ✈