|

“The majority of retailers are almost wholly dependent on impulse sales but unfortunately such sales are the most sensitive to any restrictions to the customers’ money, time or opportunity“ |

Nigel Dolby Founder and Managing Director Dolby Consulting |

INTERNATIONAL. The Moodie Report is pleased to feature a regular new column from Dolby Consulting Founder and Managing Director Nigel Dolby. His column will be serialised both on our website and in our regular Digital Print Edition.

Nigel will also be speaking at The ACI Airport Business & Trinity Forum in Macau this September.

The views expressed are Nigel Dolby’s and not necessarily those of the Publisher. But we welcome his challenging, at times provocative, approach and we encourage reader feedback on his views.

COLUMN 3 – THREE STEPS TO COMMERCIALITY

In my previous columns we have discussed my supposition that the industry is losing US$40 billion per annum in retail and food & beverage sales as a result of airports and airport shopping not being commercial environments.

[Click on the following link to access earlier columns:)

Column 1 – Tough questions for tough times

Before we go on to discuss the specific issues impacting on airport shopping let’s finish off examining the basics of customers and sales in order to understand what is actually happening in our departure lounges and landside shopping areas.

What Do Customers Need to Spend Money – And Why Do They Spend It?

The 3 “˜Musts’

Before a customer can buy anything there are three things that they must have:

• Money – to spend

• Opportunity – something to spend their money on

• Time – in which to spend their money.

If any one of these three “˜musts’ is missing it is physically impossible for a customer to make purchases. Likewise, if any of the three “˜musts’ is limited or restricted in any way the value of the customer’s spending will be limited or restricted.

The 3 “˜Spending Drivers’

Once a customer has money, opportunity and time they can potentially make purchases. The driver or motivation behind their purchase will then be one of three things:

• A need

• A want

• A desire (or “˜impulse’)

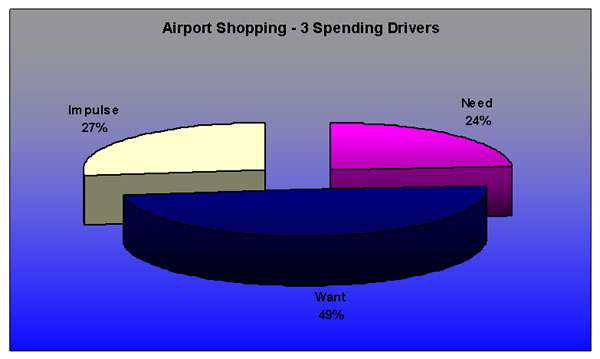

The following chart shows the proportion of downtown retail spending that is attributable to each of the three spending drivers.

|

There is an element of subjectivity in relation to whether someone makes a purchase because they “˜need to’ or “˜want to’.

For example: My wife will insist that she needs to buy another handbag while I would argue (and lose) that she does not need to buy it – she just wants to buy it.

Because of this subjectivity “˜need’ and “˜want’ are often discussed as a combination known as “˜considered’ purchases.

What can be seen in the above chart is that 21% of all sales are considered purchases (need & want) and 79% are generated through impulse.

Impulse purchases can be broadly described as being anything you buy which you did not specifically set out to buy or anything you spend over and above what you intended to spend.

In simple terms they are non-essential or additional purchases.

The majority of retailers survive and are almost wholly dependent on Impulse sales but unfortunately such sales are the most sensitive to any restrictions to the customers’ money, time or opportunity.

When, for example, the customers’ money is restricted (as it is for many during economic downturns, such as we are currently experiencing) it is impulse purchases that are affected first. Many retailers are currently suffering not because customers have completely stopped spending money but because the customers’ impulse purchases have reduced.

Impulse purchases are not only the most sensitive to the “˜3 musts’ but they are also the most difficult to achieve. Fulfilling considered purchases is relatively simple. If you have got it and the price is right then the customer is likely to buy it – because they need it or they want it.

Stimulating impulse sales is not so straightforward. Store design and layout, marketing, brand awareness, product range, merchandising, pricing portfolio and even product adjacencies are all just some examples of what has to be considered in order to stimulate impulse sales.

Unfortunately however, ticking all the boxes for the 3 “˜musts’ and having a store that delivers excellent retailing standards and presentation is still not enough to optimise impulse purchases – because on top of this the customer has to browse.

“˜Browse’ is such an innocuous, dull and nondescript word – but do not let this fool you. Browsing is required or involved in around 90% of every single purchase that is ever made and there is far more to this word than first appears.

|

“Airport customers are primarily just buying what they need or want and are not being inspired, motivated or enticed into making purchases on impulse as often or as successfully as they are downtown“ |

Nigel Dolby Founder and Managing Director Dolby Consulting |

Browsing requires that the customer has time in which to look around, to touch and feel the products and to experience the width and depth of the offer.

Browsing also requires a relaxed frame of mind so the customers are open and receptive to be influenced by the stores sales techniques, merchandising and other drivers of spend. Most importantly, browsing is a voluntary act by people who chose to be there because they have an interest in the store and its products. As such each is a genuine prospective customer who can be enticed into making an impulse purchase if the retailer and its retailing standards are good enough.

Someone with five minutes to spare who looks round a store for something to do is not browsing. This is called killing time and generating sales from this category of visitor is exponentially more difficult than enticing someone who is browsing in to making a purchase.

Airport Shopping – The 3 Spending Drivers

The majority of retailers rely on impulse purchases because such purchases represent 79% of all sales turnover. Impulse purchases do not just occur by chance but require a whole host of boxes to be ticked, such as:

• The customer has to have the “˜3 musts’ and

• be relaxed and comfortable and

• be able to browse and

• have a genuine interest in the store/product and

• have chosen to or been motivated to visit. And then:

• The environment has to be conducive to relaxing customers to facilitate browsing

• The environment or store has to deliver all the basics (clean, tidy, comfortable)

•The store has to deliver excellent standards of commercial retailing to create the “˜need’ (range, presentation, pricing, merchandising)

Ticking all of these boxes are the foundations for a retailer, business or facility being truly “˜commercial’.

If any of these boxes are not ticked then impulse purchases will not be maximised and the retailer simply will not achieve their sales potential.

So what does all of this mean to airport owners, retailers, restaurateurs and brand owners? We saw in the previous chart how 79% of all non-airport retail sales are generated by impulse so it is important to look at how airport shopping compares.

|

Based on research and data from over 300,000 global customers the above chart shows the proportion of airport purchases attributable to each of the three drivers. What can be seen is 73% of all purchases are “˜considered’ with only 27% being driven by impulse.

Airport retailers are primarily no different to the majority of downtown retailers – i.e. their success or failure will be achieved through the amount of money customers spend on non-essential or additional purchases.

However, this research shows that airport customers are primarily just buying what they need or want and are not being inspired, motivated or enticed into making purchases on impulse as often or as successfully as they are downtown.

The dynamic that can be seen in the above chart is perfectly normal and acceptable for the likes of a convenience store, newsagent or basic food & beverage provider as their offer fits with and is often specifically developed for “˜Grab & Go’ purchases.

So let’s recap on what we have discussed so far in these introductory articles to establish the current situation for airport shopping.

• Downtown customers decide to go shopping though personal choice. Airport customers have to be exposed to the commercial offer as part of the process to fulfil their primary objective of catching their flight.

• The proliferation of airport shopping malls has been driven by the airport and its retailers’ desire to make money – and not because the customer demands to go shopping at the airport.

• The customer (if given the choice) would rather not to have time to spend in the departure lounge and would prefer to depart on their journey in the shortest possible time.

Therefore:

Airport shopping is trying to create a demand for shopping as oppose to fulfilling a demand for shopping.

Creating a demand for shopping is fundamentally and materially more difficult than fulfilling a demand for shopping and doing so with airline passengers who would rather not be there in the first place is more difficult still.

Achieving this requires the airport and its retail/restaurant partners to successfully complete 3 Steps.

Step 1

Before the customer can spend any money in the airport, the very bare minimum they need is:

1. The 3 Musts – Money, Opportunity and Time.

Step 2

If these are in place you can then move on to the next step. Creating a demand by its very nature requires the customer to spend on impulse and make non-essential purchases. In order to stimulate impulse purchases the environment has to ensure:

2. The customer is relaxed and comfortable and able to browse.

Step 3

Once the customer has the “˜3 musts’ and they are in the right mindset you can then move on to step 3 in generating impulse purchases;

3. The stores have to deliver excellent standards of commercial retailing.

Basically, creating a demand or inspiring, motivating or driving airline passengers to spend money that they did not set out to spend not only requires the basics to be in place but also requires a high level of commercial sophistication throughout the whole airport environment.

And so to the endemic problem that is resulting, I contend, in around US$40 billion of turnover being lost per annum (and that’s before the impact of the global economic climate).

Airports are not commercially sophisticated environments!

It is however much – much worse than this…

100% of airports fail to achieve or optimise Step 1

100% of airports fail to achieve Step 2

70% of airports fail to achieve Step 3

As a result it could be argued that our airport departure lounges and commercial facilities are little more than large convenience stores in which 73% of all purchases are because the customer needs or wants to buy something.

But our commercial facilities are not just full of convenience retailers purveying convenience products.

Duty free, speciality retailing and speciality catering in the airport will never get close to its potential if we fail to achieve these 3 Steps and fail to deliver commercially sophisticated environments in which airline passengers are inspired and motivated to spend their money.

So let’s remind ourselves of something:

Airports, their retail and food & beverage partners, and the brand owners want and need airport customers to spend as much money as possible in the airport stores and commercial facilities.

The reality, though, is that customers do not spend as much as they possibly could and they never will unless we get back to the basics of what being “˜COMMERCIAL’ is really all about.

[Coming up in my next column: A Recession in Time]

|

PREVIOUS NIGEL DOLBY COLUMNS

COLUMN 1 – TOUGH QUESTIONS FOR TOUGH TIMES – 19/03/09

COLUMN 2 – BACK TO BASICS – 19/03/09

[comments]