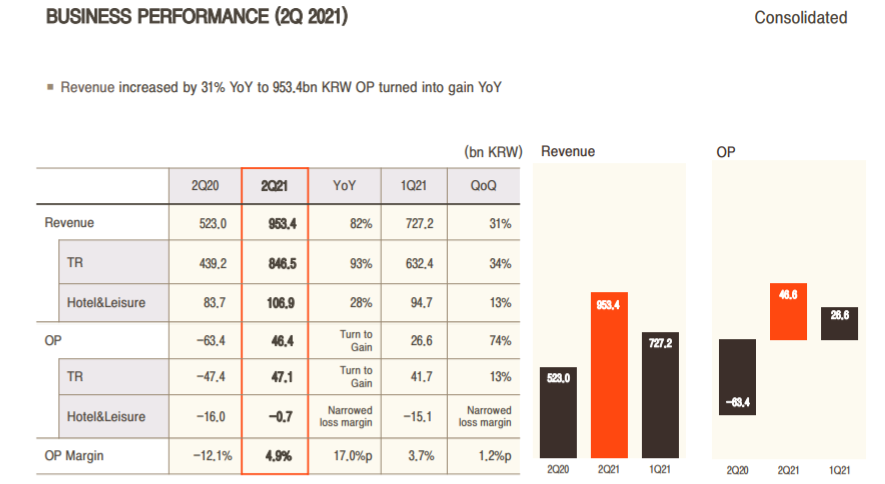

SOUTH KOREA. An improved travel retail performance helped Hotel Shilla, parent company of The Shilla Duty Free, to post a Q2 consolidated operating profit of KRW46.4 billion (US$40.4 million), well ahead of consensus (KRW37.2 billion/US$33.4 million).

Downtown duty free operations continued to record stronger-than-expected growth, with sales surging +96% year-on-year from a very low, COVID-devastated base and +38% quarter-on-quarter to KRW772.9 billion (US$672.5 million), driven by small-scale Chinese daigou business. Revenue from airport shop sales rose +61% year-on-year.

Travel retail operating profits turned from a loss of KR47.4 billion (US$41.2 million) in the same quarter last year to a gain of KRW47.1 billion (US$41 million) this time.

Commenting on the Q3 outlook for travel retail, Hotel Shilla said that it would focus on overcoming the effects of COVID-19 and improving profitability by responding proactively and promptly to changes in the business environment.

In a note published in Business Korea,KB Securities Analyst Shinay Park estimated operating earnings by business channels at +KRW36.7 billion (US$31.9 million) from Korean downtown duty free shops, +KRW7.4 billion (US$6.4 million) from Koreas airport stores and +KRW2.9 billion (US$2.5 million) from overseas airport duty free shops. The hotel/leisure business posted a –KRW0.7 billion loss.

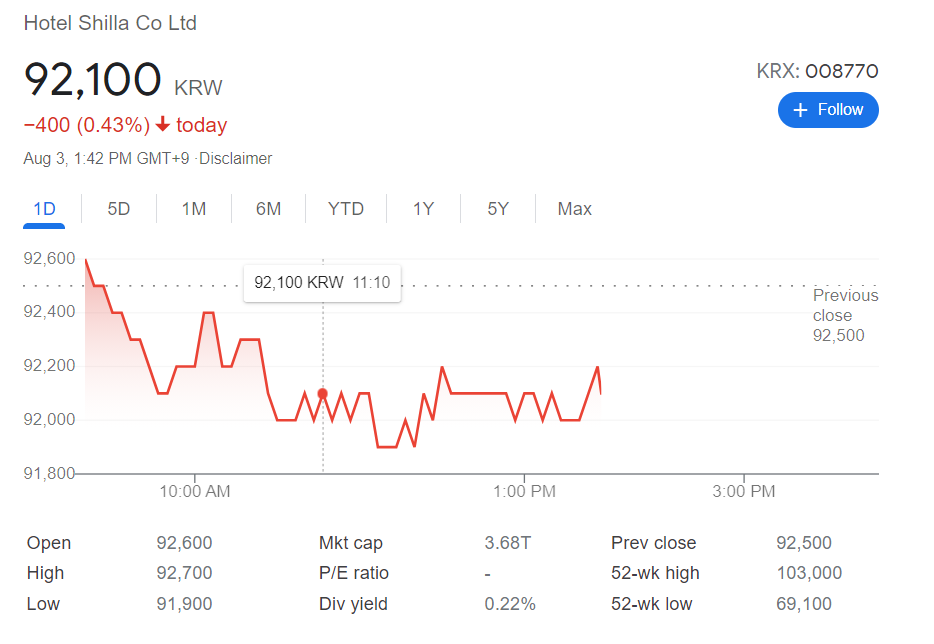

KB Securities maintained a BUY rating (target price KRW120,00), saying that the stock’s recent correction should be seen as a buying opportunity

Justifying that view, Park wrote: “Revenue/OP have been improving QoQ since bottoming out in 2Q20. Tourist revenue is expected to normalise as domestic/overseas vaccination rates continue rising and travel becomes easier (removal of quarantine requirements).”

Park also predicted that a rebound in daigou demand ahead of major Chinese events (Mid-Autumn Festival in September, National Day in October, Singles’ Day in November) would help the all-important Korean downtown duty free sector rebound after the June-July low season .

“For downtown DFS, Hotel Shilla focused more on profitability than on sales in 1H21,” Park wrote. “Nevertheless, it achieved strong revenue growth relative to peers thanks to its superior capability in attracting small-scale daigou.

“Downtown DFS OPM remains at around 5% because of efforts to reduce the sales proportion of low-margin products and raise the sales proportion of small-scale daigou (relatively low commissions).”

The analyst also projected a second-half improvement in airport traffic mainly in Singapore and Hong Kong.