Prologue: It is now more than six and a half years since Japanese beauty house Shiseido created a unified travel retail division for its cosmetics and fragrances business. The formation of that division – Shiseido Travel Retail – marked a key step in Shiseido Group’s Vision 2020 corporate strategy, spearheaded by CEO Masahiko Uotani. It saw the unification of the Japanese group’s cosmetics-led Shiseido business in travel retail, with that of the designer fragrance house Beauté Prestige International, a subsidiary since 1990.

The division, like its mother company, has come a long way since. Despite encountering the most sustained and severe crisis in travel retail history, Shiseido Travel Retail is in tip-top shape, confident about and committed to the channel as The Moodie Davitt Report Founder & Chairman Martin Moodie discovered when he caught up with Shiseido Travel Retail President & CEO Philippe Lesné and Vice President Strategic Marketing Siv Chao during the recent TFWA World Exibition in Cannes.

Let’s start with a big picture view. Travel retail is emerging from the most severe and sustained crisis in its 75-year history. How do you assess the state of health in the sector overall, for beauty in general and of course for Shiseido in particular?

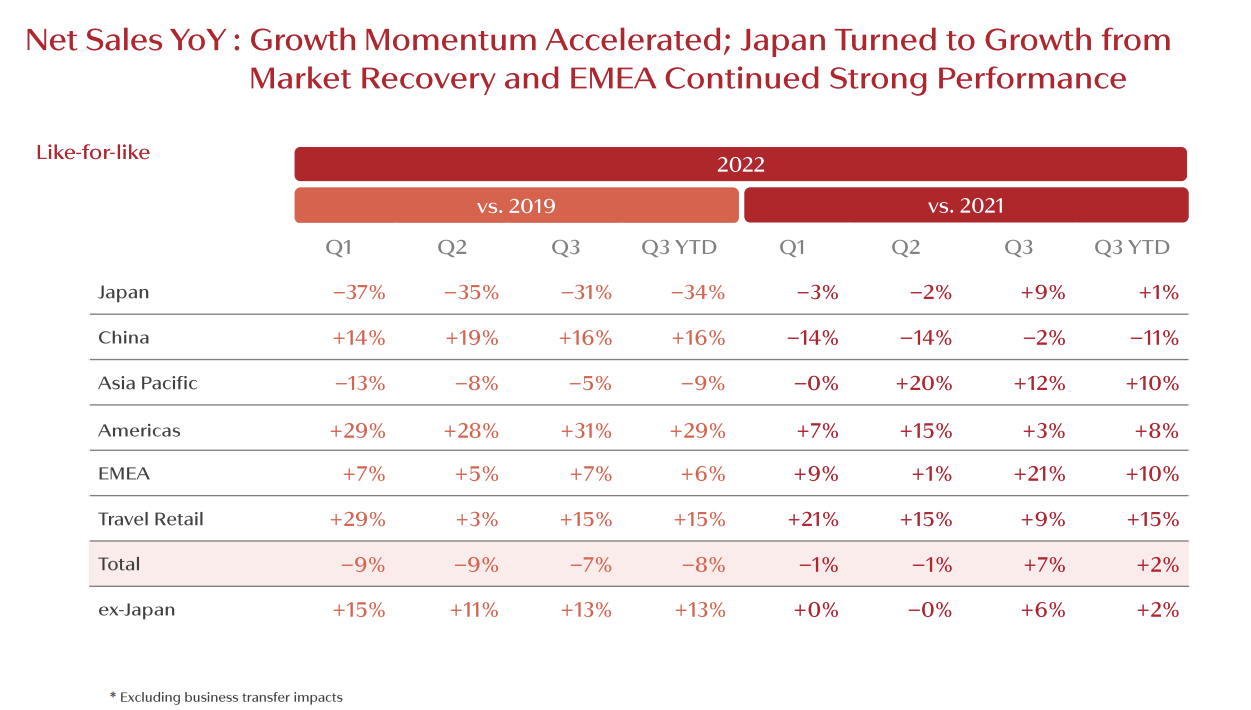

Philippe Lesné: We have seen an overall strong recovery of our travel retail business. We have surpassed our 2019 sales, back in 2021, and that is all thanks to Asia, specifically China, and very specifically Hainan.

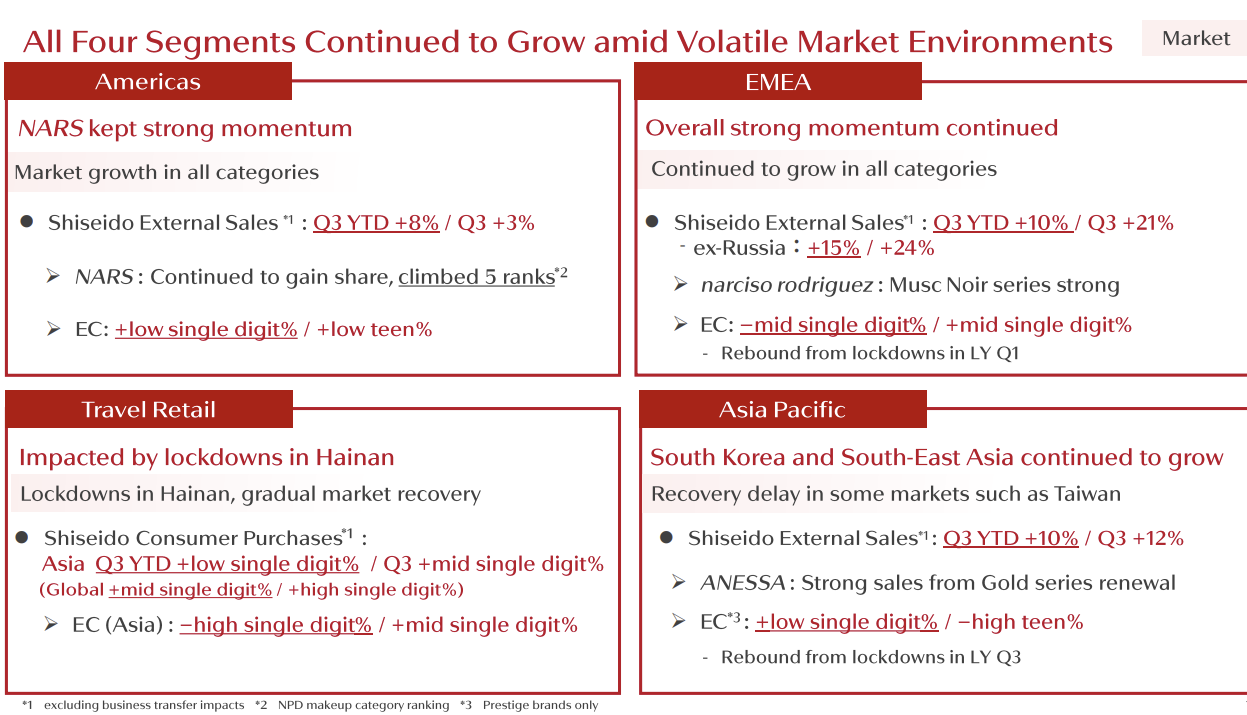

Travel retail Asia has been our growth driver as always and we are now seeing, over the past nine to twelve months, a pretty steady growth in travel retail West – EMEA and Americas. So things are definitely improving overall.

Specifically in Asia, Southeast Asia has been doing quite well rebounding from the beginning of the year and we are now hoping that North Asia – with Japan, South Korea and at some point, China – will also improve.

In South Korea, we are hoping that there will be a lot more FITs traveling to Korea. I understand with the new measures in place, I think it should be the case in the near future. Korea and Japan are still very attractive to FITs – and so are key to our business.

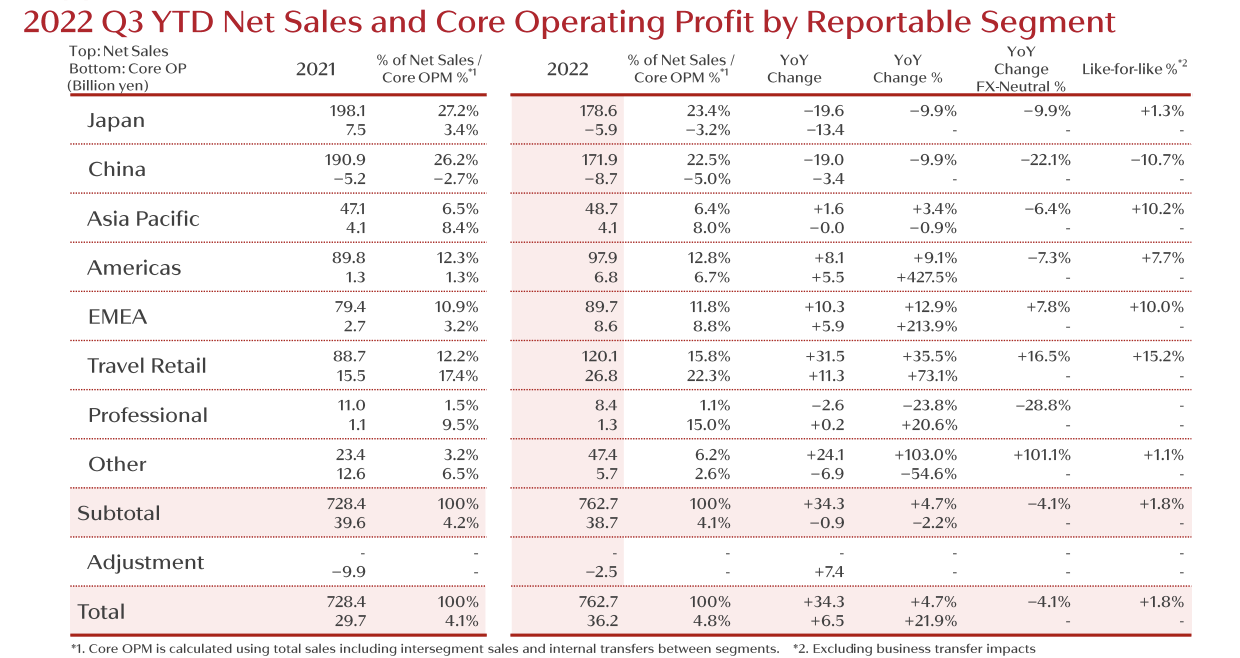

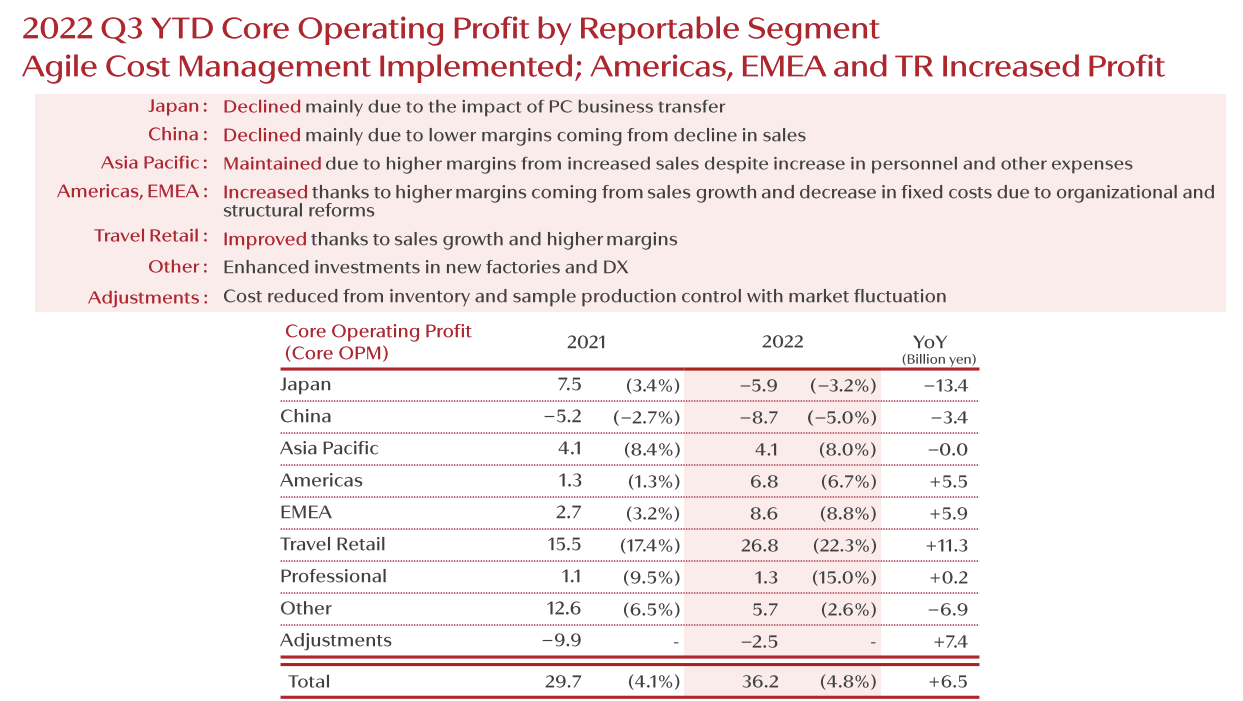

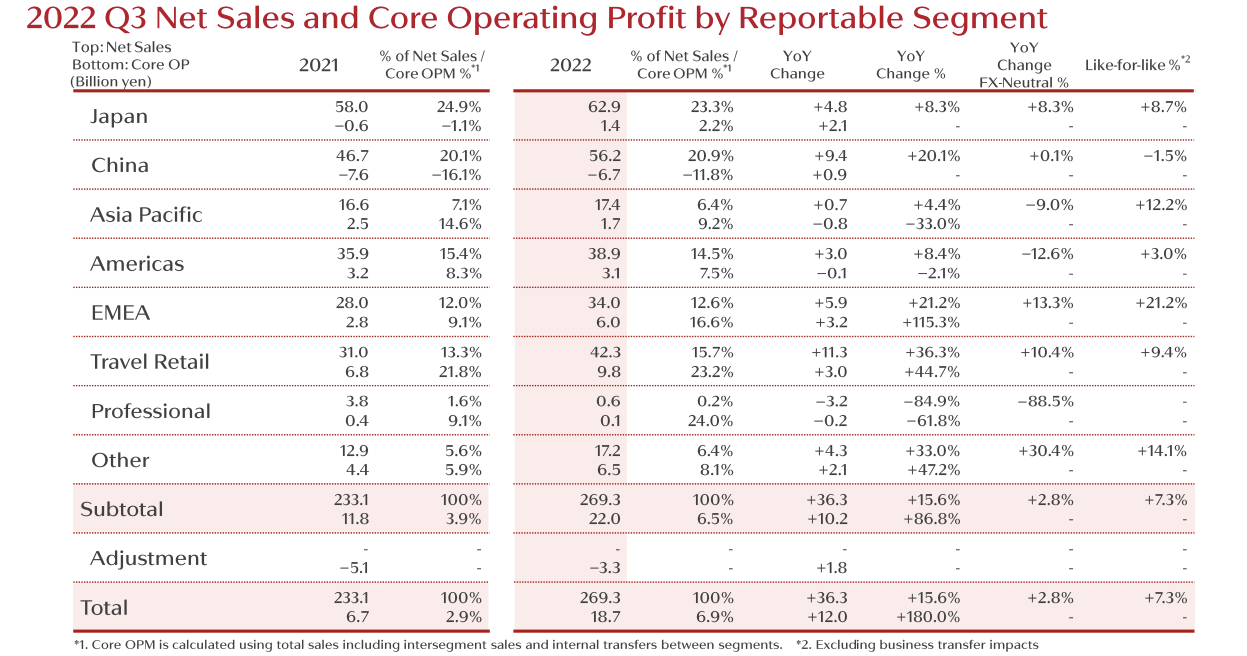

We reported a positive performance in the first half of 2022, continuing strong with double-digit growth versus the same period last year (2021) and before the pandemic (2019). The key factors that have driven our first-half performance include strong sales growth of Shiseido, Clé de Peau Beauté, IPSA, and NARS; continued investment in skin beauty brands; and building stronger relationships with key retail partners.

We have also become the third largest region for the Group, after China and Japan. We now represent more than 15% of the overall Group’s net sales, versus a low single-digit percentage when the travel-retail business was formed in 2015.

Things are now looking brighter for 2023 onwards, although there is still a lot of uncertainty, but I think the worst is behind us now.

Have you been surprised by the speed and vigour of the rebound?

Philippe Lesné: I would say yes and no; we understood that travellers would be keen to travel again as soon as they were able to.

We are very present in Asia, and the recovery has not been as fast as we hoped for. But looking at our fast recovery in the West, there is definitely room for optimism.

In the West it has really been a V-shaped recovery – so much so that some airports have had some difficulty coping with the volume of passengers. It is an ongoing process; things take time because the impact has been so great for so long. I am not surprised to see travel resurging but it has truly been faster than the industry as a whole expected.

Given the many pressures facing the world at large – inflation key among them; the Russia/Ukraine crisis; severe supply chain issues and more, how is your view of 2023 prospects for the channel?

Philippe Lesné: The supply chain clearly is a challenge, especially in the fragrance category. Prior to COVID, the biggest challenge [for the supply chain] was in skincare, so as a Group we have invested $US1.2 billion in three state-of-art manufacturing facilities in Japan and so we are now fully prepared. For fragrances, it is difficult to secure some of the components, so I would say that it is more challenging than it is in skincare right now.

As the pandemic eases, the recovery of travel is also being impacted by the global rise in inflation – this is being driven by conflict, supply of energy and resources, and a strong labour market. The effect of inflation is that travellers are becoming more cost conscious, so we seek to continue creating innovations that enrich people’s lives with health, beauty and happiness.

Looking ahead to 2023, we hope to continue our steady recovery in Travel Retail Americas and Travel Retail EMEA business, and to see continued growth in Travel Retail Asia.

Until the recent August/September blip, Hainan has been a beacon of light through the crisis and a clear focus for Shiseido. How have you been performing in this key market, the recent closures aside, and how do you see its future given the likelihood of a return to outbound travel by the Chinese in some meaningful way in 2023?

Philippe Lesné: It is definitely going to remain a key driver for our business. We have seen throughout the pandemic that Chinese travellers have visited Hainan a lot more than before and just last year we had double the sales versus the prior year (2021 vs 2020). This was driven by brand Shiseido, Clé de Peau Beauté, IPSA and NARS.

Going forward, it may be difficult to replicate this type of big numbers, but Hainan has been a top priority for us. We have expanded the number of brands that are featured in Hainan through the introduction of The Ginza, increased the number of our counters, and focused all of our online and offline activations in Hainan – so I would say it has been a great success.

We have had to cope with store closures during 2022 due to COVID, but overall we remain confident in Hainan’s future and look forward to collaborating with CDF on its upcoming tourism projects and retail developments.

Do you see Hainan holding its place as the Chinese start to travel again?

Philippe Lesné: Actually I do, because there are still many travellers who want to visit Hainan for the first time. It is very convenient, so I would think it is going to hold [its place] but some travellers may wish to explore other parts of the world again. So it think there is definitely room for both. I am optimistic for the mid- to long-term – I expect some international travel to start some time in 2023, then we can get to a point when we can become a little less obsessed with the very short term.

There has been so much built already on the island and there are so many more projects coming Hainan’s way – so we are very much confident about its future.

How has the pandemic changed Shiseido Travel Retail’s view of the channel? Any key learnings from the crisis?

Philippe Lesné: The past two years have created a lot of uncertainty. As such, the industry has shown that it can be agile – to expect the unexpected and to be ready to adapt our businesses swiftly to any circumstances that arise.

We have had the opportunity to rethink our fundamentals, and one of the key outcomes has been the acceleration of digital and ecommerce. It was always meant to be; the pandemic has just been a true accelerator of this. We pivoted in that sense to be a lot readier, and I think when things fully reopen, we should be in a much better position to leverage further on this.

The pandemic has also reinforced the value of investing in our strengths and capabilities. Our close partnerships with travel retailers have been the bedrock of our success in the channel, and we remain committed to inspiring consumers through experiences that drive traffic and sales to our retailer partners. We have also continued investing in our prestige brands, skin beauty, our people, and consumer experiences to ensure that we were well-placed to benefit from the rapid rebound in travel.

What are the biggest challenges facing the business going forward? And opportunities?

Philippe Lesné: One of the biggest challenges we face in travel retail remains the uncertainty around Chinese travel due to the ongoing COVID-19 pandemic – this covers both domestic travel to Hainan and the prospect of future international travel.

Our response has been rooted in Shiseido Travel Retail’s digital strategy, where we have had to think outside of the box to continue engaging with Chinese travellers despite the restrictions. By accelerating the creation of digital experiences for travellers, we have been able to elevate our digital engagement to new heights through the launch of initiatives such as the NONSTOP NARS Virtual Animation and the Shiseido WeChat mini program.

With the reopening of travel, we look forward to a continued growth momentum. Our priorities center on exposing our brands to travellers as they return. We hope to achieve this by showcasing our new skin beauty brands in the channel, developing innovative consumer engagement experiences, and tapping new digital frontiers, such as the metaverse, in cooperation with key partners.

This year is a particularly important one for Shiseido as the Group celebrates its 150th anniversary. You have come a long, long way from that first Western-style pharmacy in Ginza. Tell us how you have been celebrating the moment in travel retail.

Philippe Lesné: Yes, this year is our 150th anniversary, so it is a big one and I think very few companies can celebrate such an anniversary milestone. Among the other companies in the world at a similar age, quite a number of them are Japanese interestingly so yes, it is a big year for us and we take this opportunity to reaffirm our commitment to our corporate mission: Beauty Innovations for a Better World.

We are celebrating in many ways. With our consumers we have a global campaign “From life comes beauty” for our flagship brand Shiseido, including the launch of some limited editions in travel retail, and we celebrate with our people, and we celebrate with the trade here in Cannes.

We are excited to be back again in Cannes. It has been a while; last year it was just the European team, because we felt it was important for us to maintain some presence, but unfortunately no-one from Asia. So we are back now with a full global team.

Our return to Cannes in this special year is a fantastic opportunity to reconnect with so many familiar faces and friends in the industry to foster closer industry collaboration and celebrate our partnerships with renewed appreciation – this underlines our very strong commitment to the travel retail channel.

{Click on the YouTube icon for a recap of Shiseido’s presence at the TFWA World Exhibition in October}

We are now focusing on 2030, that is our new long-term goal – our goal is to become the world’s no.1 skin beauty company by 2030 with annual revenue of JPY2 trillion (US$14.6 billion) as a Group. Travel retail will definitely have a big role to play in this. It’s a vision based on mainly organic growth with some acquisitions.

The pandemic has accelerated the advance of digitalisation in the world, across age groups and nationalities. Tell us about Shiseido’s digital advancement and where your priorities lie going forward as both a digital and physical player in travel retail.

Siv Chao: I think the acceleration of digital happened for many types of industries across ages and profiles, and for Shiseido we had already started our digital acceleration before COVID.

We have made advancements in elevating the travel retail shopping experience and creating fun and memorable moments for consumers, and digital has been key to helping us achieve this – whether it is through digital marketing to better reach our consumers or using digital technologies to drive engagement.

But COVID has forced us to go faster. What we have discovered throughout this pandemic is that people were on their phones and screens a lot more, and it gave us the opportunity to capture traveklers at every touchpoint – pre-trip especially, during their trip or post-trip – and provide an immersive end-to-end experience, driving traffic and sales to our retailer partners. I think this is going to be the new norm.

With China for instance, before COVID, 66% of travellers were already checking their phones and websites pre-trip, but even more so now. It is an opportunity to reach new consumers, because when you only have physical counters, those consumers that know your brand may go there – but those who do not, we wouldn’t know what the chances are of them visiting the counter. So for us, it’s a fantastic opportunity to reach new consumers.

With the help of consumer insights, we have developed digital campaigns and activations to generate leads, increase awareness and drive seamless online-to-offline (O2O) engagements with travellers. Such activations have also allowed us to create a deeper connection with them and offer another level of brand engagement that goes beyond traditional physical or digital retail.

{Shiseido Travel Retail recently partnered with China Duty Free Group to unveil six new boutiques at the magnificent, newly opened cdf Haikou International Duty Free Shopping Complex in Hainan, China. The boutiques were designed to showcase Shiseido Travel Retail’s powerful portfolio of brands, its Omotenashi (Japanese hospitality) spirit and its ‘Beauty Innovations for a Better World’ mission.}

We have introduced the NONSTOP NARS virtual animation, creating an engaging pre-trip experience where people can have their own avatar and then visit different ‘rooms’ to explore NARS products, KOL information, and many other things. It is a great experience for them to get to know NARS better. So far, out of all the visitors, 40% are new to NARS, so we haven’t created a new consumer completely, but in terms of awareness and brand perception as the fashion makeup brand, I think this is where we are headed to.

We have also recently launched with CDFG a WeChat mini program offering an end-to-end journey where people can discover the brand Shiseido to coincide with our 150th anniversary. On the mini program, travelers can access different types of information, products, TREX, KOL reviews and tutorials, and also buy from CDFG directly. So, it’s a complete end-to-end initiative, while you have an experience you can also do your online shopping.

So that’s new in fact to travel retail, but for us a fantastic opportunity to not only enhance our strategy but also have a better understanding of our consumers, such as what they are looking for and what their expectations are, so we have this data to better strategize our marketing plan.

Coming from a marketing position for so long, my dream is always to reach new consumers – and of course to keep our consumer base – but now with digital acceleration and a dedicated strategy, we can reach the consumers we want. But to be able to do so, we must have the right content and use the right tools to reach them.

Hainan is definitely a place where people do not just shop as an experience; it is an island where people enjoy themselves and they are in a state of pleasure. For us, it is very important to invest in Hainan to keep the brand image of our portfolio and provide unique experiences – and this begins from the pre-trip stage when they go on their phones and continues when they reach there and go to our counter.

What we are moving towards, as the new norm, is to build an end-to-end consumer journey in everything, and provide not just innovative products, but also pleasure, and really travelling with them from the very beginning. The key is to make them dream before they reach the counter.

Let’s talk brands. The Group now has a 19-brand strong portfolio, including prestige names such as Shiseido, Clé de Peau Beauté, IPSA, Drunk Elephant and NARS; newcomers such as Serge Lutens, Sidekick and beauty supplements brand INRYU – all showcased at the Hainan Expo earlier this year. How do you manage an increasingly broad portfolio in travel retail? Skincare/skin beauty are clearly at the centre of your activities. Any key highlights and areas of focus in 2022 to date and in 2023 that you would like to comment on?

Philippe Lesné: Shiseido Travel Retail is committed to providing Beauty Innovations for a Better World for travellers around the world through best-in-class retail, customer service excellence and close partnerships with our retailers.

In terms of the category, we are focusing on skin beauty as a whole, and specifically premium skincare, and the two pillar brands are brand Shiseido and Clé de Peau Beauté. With that in mind, we are also introducing new brands to meet ever-evolving consumer demands. For example, we have Drunk Elephant, a biocompatible brand using unharmful ingredients; IPSA, a brand that values co-creation; and BAUM, a natural brand using extracts from the trees.

We also have NARS and our fragrance brands, which remain important to us. Yes, indeed we have quite a number of brands addressing different segments, consumers and geographies. As you know with COVID, as a Group we took the opportunity to transform ourselves, so we have divested a number of brands which were no longer strategic to us. And from there, we are focusing on growth again and will enrich the portfolio as we go along.

We have also strengthened our production capacity with the Innovation Center – it is a major investment and, with the new factories in Japan, we are prepared to grow fast again.

Siv Chao: In terms of the portfolio, we are growing more and more, and the strategy to be the number one in skin beauty is a clear guiding vision from the Group. I have been in the company for one year now, so I see how things are moving and what is very interesting is if you look at The Ginza, IPSA and Baum, those three brands are unique in everything – formulas, universe, brand concept, DNA – and that is really Shiseido Group’s strength, which is introducing new brands that are completely different and disruptive to the market.

Those brands, also including Drunk Elephant, are what we call the new-generation skincare brands which address different types of consumers. And today’s consumers are much more knowledgeable than the consumers ten years ago when we had only the core brands – the consumers now have questions, they have access to everything on their phones and they want to make sure that the ingredients are safe and can learn about the brand’s sustainability commitments.

So when we launch new brands it is really with that spirit of launching the right brands to meet the people’s expectations, and not just for the sake of launching, in terms of number. You won’t find any equivalent or any benchmark to our brands – in fact, they are all unique, and I think that is the beauty of Shiseido – we always bring a unique experience. Looking ahead to 2023, we will keep pushing those new brands that will become our next pillars.

Philippe, do you think the Trinity concept has got stronger throughout the pandemic?

Philippe Lesné: I think so. It has given everyone an opportunity to look at things from a different perspective and find solutions together, so I think every part of the Trinity has tried to adjust and find real solutions – from the operator side to the vendor side. All in all, while it has been very difficult, I think that most actors have prevailed. Without collaboration, I don’t think this would have been possible.

Any overall message to the industry?

Philippe Lesné: Our return to the TFWA World Exhibition is an important step towards building a stronger future with our partners and stakeholders, and we look forward to finally reconnecting with them in person, as well as fostering new relationships. We believe in meaningful partnership-building and our goal, as always, is to collaborate and find effective ways to grow our businesses together for the benefit of the industry.

Collaboration is key. It is very important in the good times, and I would say it is crucial in bad times. We are in this together and that really is the only way we can get through it – with collaboration and partnerships. Looking at the entire process, this has given us an opportunity to show that partnerships matter a lot to us, and we have worked together as best as we could to find solutions together.