INTERNATIONAL. The Trinity Initiative, a project designed to help plot the future commercial, consumer and contractual landscape of the airport retail world, culminated in a compelling session at the Virtual Travel Retail Expo Knowledge Hub on Thursday.

As reported, The Trinity Initiative was launched in April by The Moodie Davitt Report with the cooperation of a range of senior industry stakeholders and in association with leading international management consultancy Bain & Company.

This session, as with previous webinars, featured Mauro Anastasi, a Partner with Bain & Company Italy and Jack MacGowan, Director at Castlepole Consulting and former CEO of Irish state-owned Aer Rianta International. MacGowan works closely with Bain & Company.

The key final broad recommendations – which will be followed up with a definitive White Paper – point to potential solutions to industry challenges of passenger penetration through improved knowledge of the consumer; more flexibility and adaptability; data-driven commercial strategies led by dynamic pricing, AI promotion planning and leveraging CRM to unlock customer value; adopting an omnichannel travel retail-tailored strategy; and a rethinking of contract structures.

Anastasi and MacGowan analysed each of these areas in detail, and presented key data on the current situation faced by the travel retail industry along with predictions on spending recovery going forward.

MacGowan said that the airport retail industry can “come out of this [the COVID-19 situation] bigger and stronger, but we will have to do things very differently. And over the next few years, we’re going to find out how good we are at change. The next few years will be defining.”

He said that prior to COVID, “everything looked great for the airport retail industry at the superficial level”, driven by air traffic growth, but, digging deeper, the reality was that a relative decline was already in progress. Penetration numbers were falling, leading to questions on the relevancy of travel retail’s offer.

For the customers who fly regularly, travel retail, to some extent, remains as relevant to them as it always was. But newer customers are coming in, and they see the channel in a different way – and for many it is not as compelling.

Presenting the outlook of a full recovery of traffic and retail spending by 2025, MacGowan stressed the importance of having a vision for when the full upswing arrives. By that year, Bain & Company predicts that Generation X and Generation Y will account for over half of air passengers. But what air travellers want now and what they will be willing to buy in five years may have radically changed, noted the authors.

In addition, the rise of online purchasing has changed the consumer landscape forever. Illustrating the accelerated rise of ecommerce, Anastasi and MacGowan gave the example of the US, where online shopping’s market share is now 26%, growing from 15-16% pre-COVID.

MacGowan said: “The uncomfortable truth is that the people who are not buying in airports, are at the gate on their phone making purchases; the travel retailer is not making any money out of them. This is a huge channel threat and it needs to be handled.”

Other headwinds identified included the shift expected of some Chinese luxury shopping spend moving out of airports and back to China itself, as a result of COVID-19 and the rise of ecommerce. MacGowan said we may see growth as high as 20-22% CAGR in the next ten years from Chinese consumers, but a lot of that will be switched back to purchases inside China.

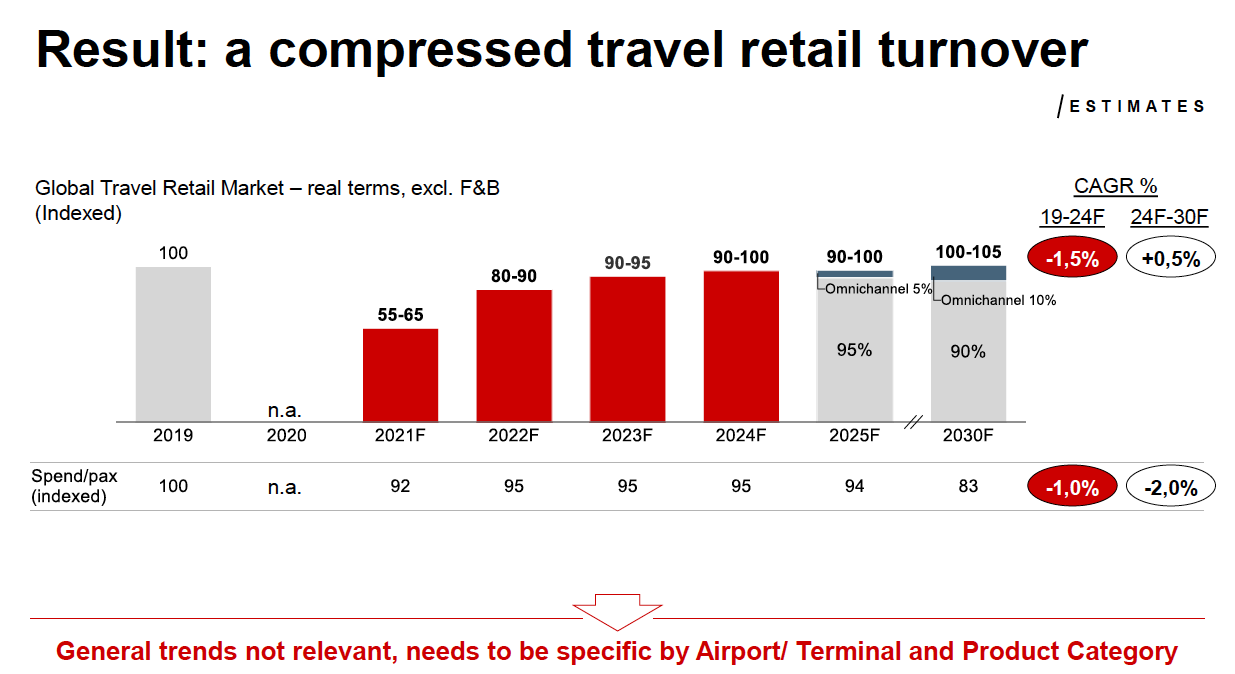

Bain & Company’s research – compiled using traffic expectations and modelling – predicts that travel retail turnover could rebound to between 55-65% next year, compared to 2019, to 80-90% in 2022, 90-95% in 2023, and rising to 90-100% by 2024.

The latter figure is expected to be repeated in 2025, but by then the industry may be seeing “leakage” to omnichannel of a predicted 5% of turnover. By 2030, that figure could rise to about 10%, according to the research.

Reduced profitability in the travel retail industry is another factor to watch in the coming years, as advised by Bain & Company in a previous webinar. Under the Bain & Company simulation, store EBITDAR is expected to provide a profit of 20-30% next year against 2019 levels, recovering to 65-75% in 2022 and 70-80% in 2023.

“Over the next few years, we’re going to find out how good we are at change. The next few years will be defining.” – Castlepole Consulting Director Jack MacGowan

The next 18-24 months are crucial, and the authors said that it is vital that airports and retailers work together closely to mitigate negative impacts. Summarising, MacGowan said: “We do believe that it is a difficult scenario, but the fundamentals of the industry are actually very bright, and indeed a lot more bright than some of the other retail channels that we see around us.”

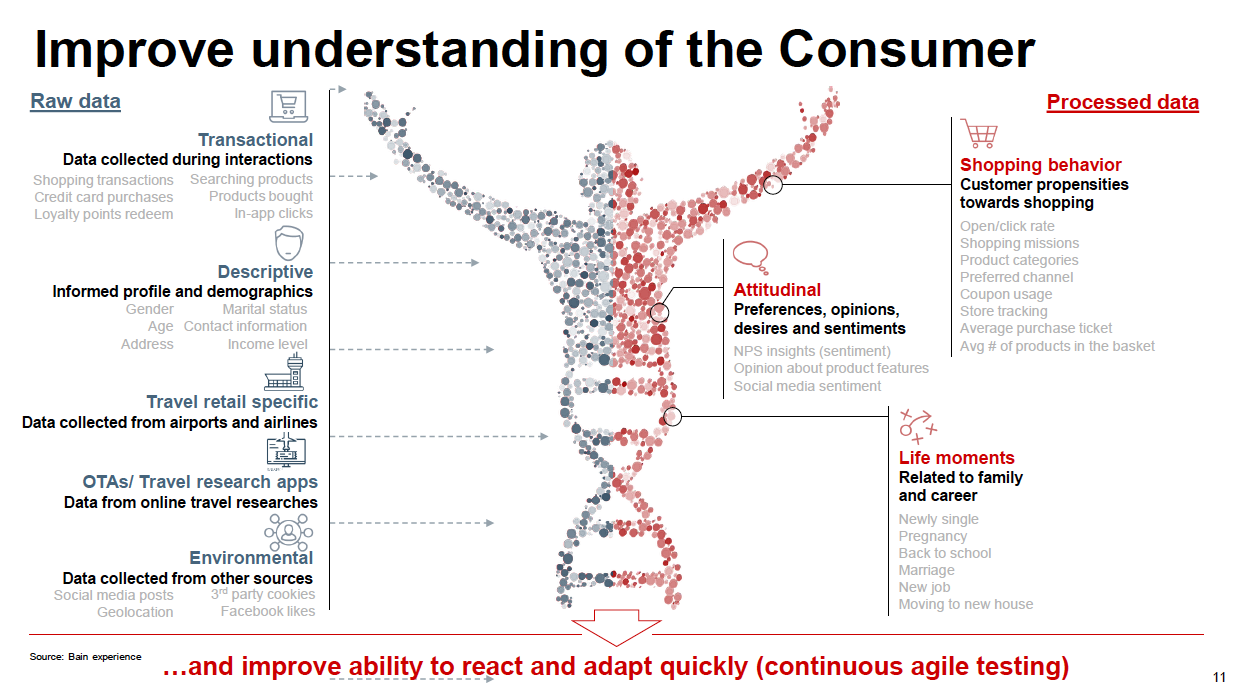

In a fascinating breakdown, the low penetration in air passenger spending was highlighted, with the conclusion that just 10-20% of passengers could be considered “unique shoppers”. MacGowan noted that at least 80% of people are not spending anything during their average 75 minutes of airside time. “We have to improve understanding of these potential consumers, a drum that has been beaten all week [at the Virtual Expo], and for the last decade.”

One key to understanding the consumer lies in data which is not currently shared with airports and retailers, held by outside sources. MacGowan said: “My feeling on this is that with a more structured partnership approach between airports and retailers, they can approach the Facebooks, Googles and airlines in this world in a far more positive and constructive way [to get access to that data]. Out of that we’re going to find many, many ways to be more relevant to customers.”

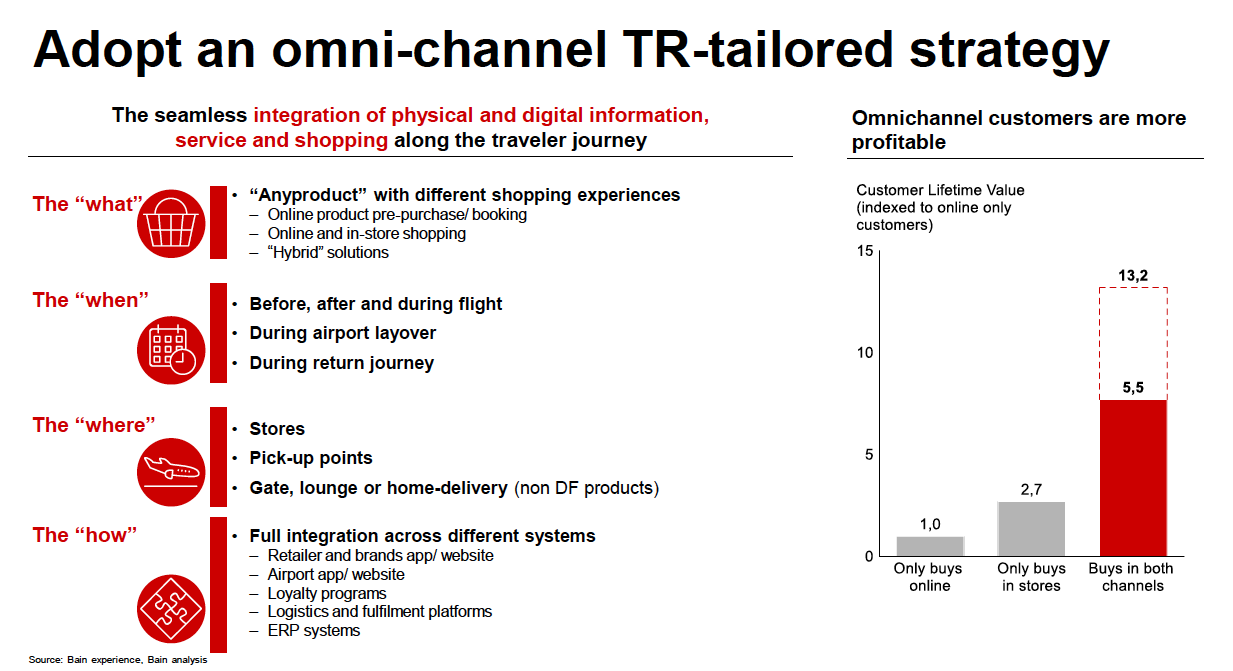

Anastasi detailed how leveraging CRM could unlock customer value and advocated an omnichannel travel retail-tailored strategy which encompasses a seamless integration of physical and digital information, service and shopping along the traveller journey.

Whilst acknowledging few in the travel retail industry will have the ability to make capital investments in the next five to ten years, Anastasi suggested than any available capex needs to shift away from being spent on physical stores to IT, digital and supply chain areas. He said: “It’s difficult to move the capex needle. But the moment you do it, you get significant results.”

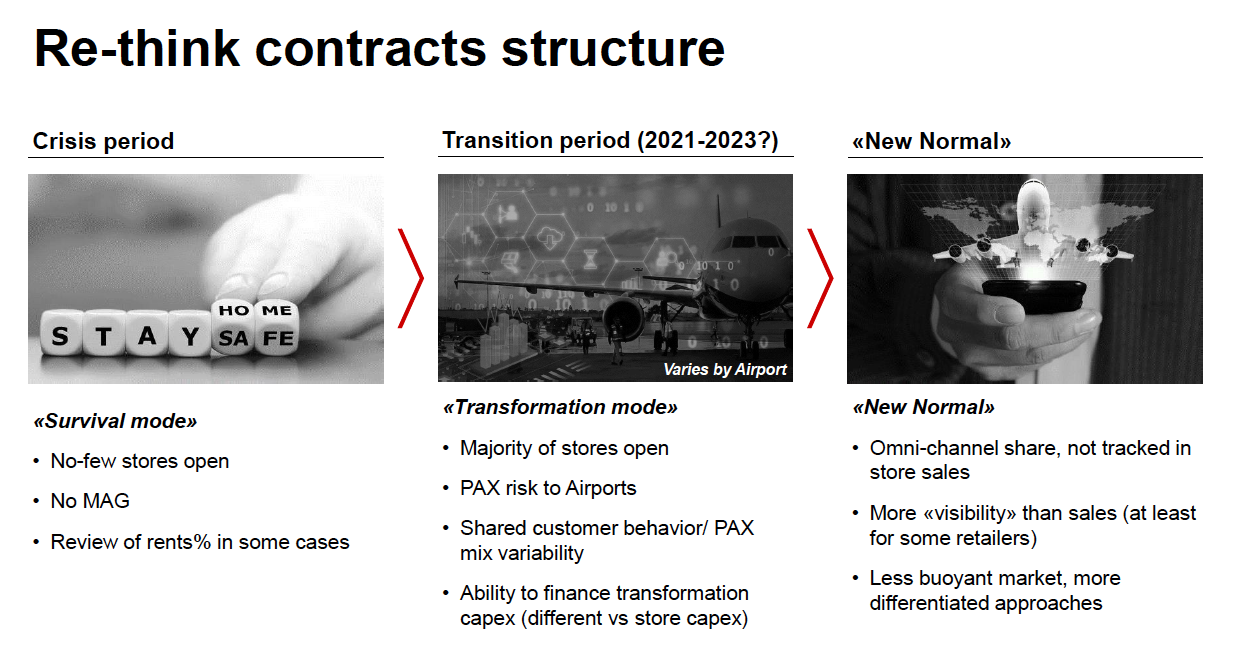

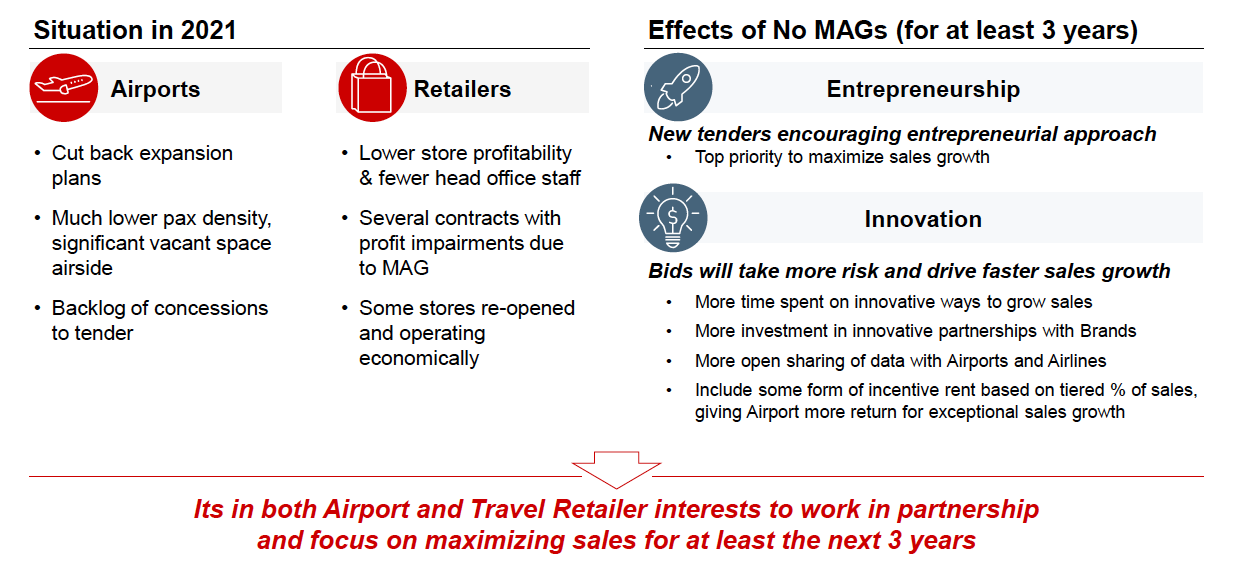

MacGowan also summarised the Trinity Initiative’s proposals for rethinking of airport-retailer contract structures, and explained how the Minimum Annual Guarantee (MAG) has evolved over the decades. However, he questioned whether it is fit for purpose in its general present form.

He said: “For most airports in the world yield maximisation per square metre is not the current objective, the objective is to get traffic back into the airport, and to get sales going again. Before, airports were maximising yield from space and retailers were trying to maximise margins. But we have a lot of dead space at the moment. And we need to make those thriving, high density shopping malls again.”

MacGowan said that airports and retailers must focus on a common and aligned objective. He continued: “And we see that if you put that as your first objective, things change. So a bid tender document can have a large number of those MAG rules removed, there can instead be innovative ways to incentivise bidders to come up with ideas for maximising sales.

“This means we won’t have lawyers and accountants dominating airport/retailer meetings and process control meetings – instead you want to have creative people in there saying ‘here are 50 ways that we can drive sales here’.

“There will be a lot more behaviour that is encouraged to drive sales to try new things, to be more innovative. And if that requires the sharing of data and it requires better and more innovative partnerships with brands so be it.”

MacGowan – who said there is still a role for a MAG-type or a fixed rent structure in the longer term – stated his belief that airports have a duty, under the present circumstances, to create the environment for this more creative and more sales-driven behaviour. He said: “I think if retailers and airports can work on that, together, they will do more positive things in the next three years than ever before, because they are aligned.”