At 15% of global duty-free sales, tobacco & reduced-risk products represent a vital segment of the business for Lagardère Travel Retail. Director of Negotiations and Category Management – Tobacco Cécile Carenton explains how the category is trending today, and what dynamics will lead its future growth. This article first appeared in a special supplement to The Moodie Davitt November Magazine. Click here for more (page 5).

The Moodie Davitt Report: Tell us please how you see the prospects for the tobacco & reduced risk products category today? What factors are influencing performance and what factors will influence the future?

Cécile Carenton: Sales of traditional tobacco products, including cigarettes, are on a positive trend thanks to price savings in key markets, and to exclusive formats and brand extensions that have proved attractive to customers.

The development of new reduced-risk products has allowed us to diversify the product offer and respond to the needs of customers who are looking for alternatives to traditional products.

Government policies on tobacco and public health will continue to influence the progress of the sector, and it is impossible to ignore the fact that the consumption of traditional tobacco items on domestic markets is declining. We will continue to work with our supplier partners to ensure our offer reflects current trends and meets the expectations of all our customers.

Can you elaborate on the strategy for this business – does it drive footfall and conversion? And how important is it as a proportion of sales globally?

The sector is currently enjoying strong growth and represents over 15% of sales in duty free, driven by the factors mentioned above.

We foresee tobacco continuing to play an important role as a footfall driver, with a price saving that serves to reassure customers about the good value they get when shopping in duty free.

We will continue to position the tobacco sector as a destination category, but always while respecting the regulations that are in place wherever we operate. These regulations vary considerably from market to market and our efforts to drive the category must take them into account.

What more can you do with brand owners to lift the category’s voice and develop the offer? How are supply partners investing in this sector to help engagement?

We are very encouraged by the work being done by our supplier partners to develop products that are adapted to new consumer needs.

The tobacco and reduced-risk sector is especially fast-moving and the brands are investing significantly to diversify the offer.

Although we face the usual challenges of space availability and, occasionally, regulatory restrictions, we are working hand in hand with our partners to refresh our range and ensure it is relevant to travellers of all ages and origins.

How do you see the evolution of reduced-risk products within the mix? Do these represent the long-term future and how can you build that business?

We have to be realistic about the immediate short term; traditional products continue to represent by far the greater part of total tobacco/nicotine sales, and as such they remain a key focus for us.

However, we welcome the development of RRPs and recognise that these products will represent an increasing share of the total sector. Suppliers are investing significantly in these products and we welcome their commitment to growing this sector.

It is worth noting that not all jurisdictions include RRPs in their list of excisable products, meaning that in some places these products are not part of the duty-free regime. Clarification of the regulations surrounding these products would help ensure their wider availability in duty free and help fulfil the sector’s potential.

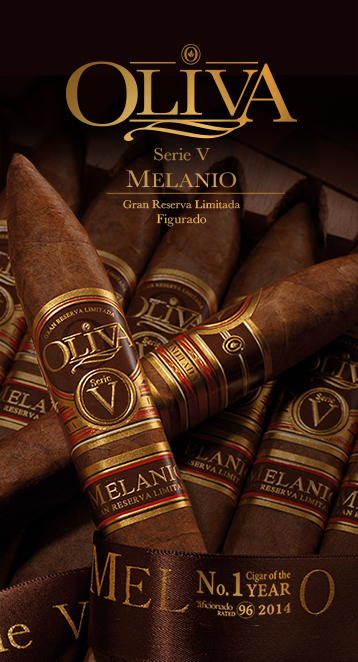

What role do cigars plays in the business today? How do you see the positioning and outlook for this segment?

Cigars are an important part of the mix and help to elevate the entire product offer in duty free. The current availability of Cuban cigars continues to be limited and these brands are especially sought after. Brands such as Davidoff have been very successful in filling that gap and providing high-quality alternatives.

The demand for cigars in duty free remains strong, but the restricted availability of the big Cuban brands means that we cannot meet that demand in all our locations. We have every confidence that the sector will continue to play an important role in the overall mix.

What do you see as the big category opportunity or opportunities across tobacco & RRP products?

There will clearly be a gradual shift towards reduced-risk products in duty free, a process that is only just beginning to be felt in our stores.

Our challenge will be to ensure we accompany our customers as they make this shift. That will require investment in staff and dedicated training, and we will work closely with our brand partners on this.

As a responsible retailer we will continue to work within the regulatory framework to ensure tobacco products and RRPs are available to adult travellers, according to the laws in place wherever we operate. That commitment will continue to guide our approach to this category in future. ✈