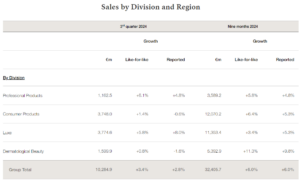

French beauty house L’Oréal saw Q3 sales growth slow to +2.8% year-on-year (reported, +3.4% like-for-like) to €10,284.9 million (US$11,105.5 million) amid tough trading conditions in China, including Hainan offshore duty-free. Nine-month revenues for the period ended 30 September increased +6% to €32,405.7 million (US$34,991.2 million).

L’Oréal Luxe, the group’s biggest division in domestic and travel retail sales, grew strongly globally (up +8% in Q3 and +5.3% for the nine months), while outperforming a continued decline in the key markets of Mainland China and North Asia travel retail.

Sales in North Asia contracted -3.5% for the nine months and -4.4% in Q3. In Mainland China, the beauty market – already negative in the second quarter – continued to deteriorate, impacted by low consumer confidence.

Hainan sell-out challenges remain

L’Oréal said North Asia travel retail returned to growth in Q3 but sell-out in Hainan in particular remained under pressure. In Japan, the group outperformed a dynamic market, boosted by both locals and tourists and became the number one foreign house in beauty.

Speaking during an earnings call, CEO Nicolas Hieronimus commented: “The worse than expected turbulences were in North Asia. In the Chinese ecosystem, markets turned even more negative, particularly in luxury, both in the domestic market and in travel retail where traffic did not convert into purchases. We were encouraged recently by the government’s stimulus measures and hope that they will result in a gradual pick-up in consumer confidence.”

Earlier, in the company’s earnings statement Hieronimus said: “We delivered solid growth of +6% in the first nine months, well-balanced between value and volume, despite multiple turbulences that have negatively impacted our third quarter.

“As anticipated, global beauty market growth has been normalising throughout the year. In the developed markets, this has been driven by a gradual easing in pricing after two years of strong inflation; despite that, underlying market trends remain robust in Europe and North America – as well as in emerging markets.

“Overall, the beauty category continues to grow, including in units, demonstrating once again its resilience and long-term potential. L’Oréal continues to outperform thanks to our innovation power, the agility of our teams and our capacity to reallocate our resources towards new growth engines.

“In a context that continues to be marked by economic and geopolitical uncertainties, we remain confident to achieve another year of growth in sales and operating profit and are preparing our own beauty stimulus plan for 2025.”

Asked on the earnings call how he saw market growth in Mainland China and Hainan offshore duty-free, Hieronimus replied: “It’s broadly consistent, whether it’s in Hainan or Mainland China… our estimation is that the market was overall slightly positive in Q1, then moved to a mid-single-digit negative in Q2 and a higher mid-single-digit drop in Q3.

“And within that, the part of the market that dropped the most in Q3 was the luxury part, which was negative mid-teens. So that’s really the overall trend of the Chinese market. The only sector that was slightly positive in Q3 was mass markets, where there was a number of consumers probably shifting from luxury to some of these brands.”

North Asia travel retail ‘reset’ taking longer than expected

Regarding Hainan offshore duty-free, Hieronimus said: “We have the confirmation of what we announced and discussed during the half-year call… sell-outs remain [down] in the minor 30s in Hainan.

“So there’s a lot of traffic, a lot of tourists. There were a lot of tourists during Golden Week, but they do not convert to our categories or any other, by the way. So it remains very negative on a year that was negative again.

“So really this reset of the travel retail market in Asia is taking longer than we hoped. That’s why I was talking about unexpected turbulences, because this is one that I was hoping to improve over the summer.”

Pressed for more precise numbers on L’Oréal’s performance in Mainland China and Asia travel retail, Hieronimus declined to offer more details but noted: “We’re gaining share in travel retail, but it doesn’t mean anything because we’re gaining share on a very negative market.” ✈