Introduction: Yilin Wang, from Paris-based boutique consultancy Yilin Consulting, presented a webinar on 20 January called ‘Re-Engaging Chinese FIT Travellers in 2026’.

The online event, hosted by Campus Online, explored how brands and retailers can recalibrate their China strategies for a Chinese FIT (Free Independent Travellers)-led market, moving beyond pre-pandemic thinking.

Chinese FIT represents a fast-growing segment of younger, affluent outbound tourists, predominantly Millennials and Gen Z. These travellers favour flexible, self-directed travel over traditional group tours. They plan journeys digitally with a focus on experiences, cultural immersion, local discovery and personalised activities.

For them, shopping is increasingly integrated as part of the overall travel experience rather than its primary driver.

Yilin Consulting is a boutique consultancy specialising in helping travel retail brands and retailers engage the new generation of Chinese outbound travellers. Its focus lies in converting independent, experience-driven travellers through targeted omnichannel engagement and frontline cultural training.

Link, See, Engage: a framework for the new Chinese outbound era

Wang structured the session around Yilin Consulting’s three-step Masterclass LINXY framework, which comprises three pillars: Link, See, Engage.

“Our philosophy is embodied by Link, See, Engage. Link means authentically connecting with Chinese customers; See means understanding their evolving needs; Engage means responding with culturally precise experiences.”

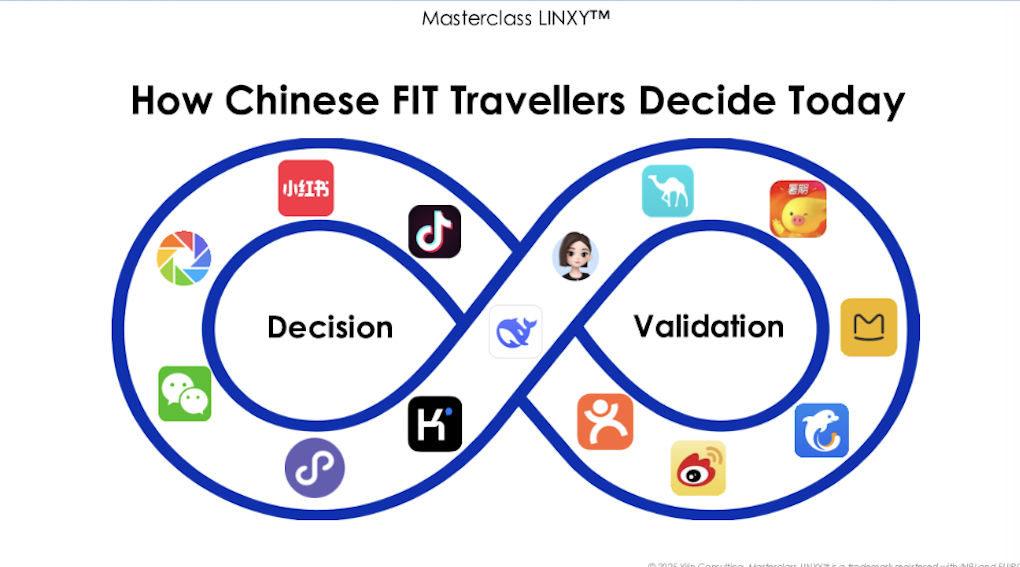

The framework is designed to move beyond traditional linear marketing funnels. It reflects a decision-making process shaped by digital platforms, peer validation and trust-based content loops, Wang said.

China outbound travel recovering, but not returning to old ways

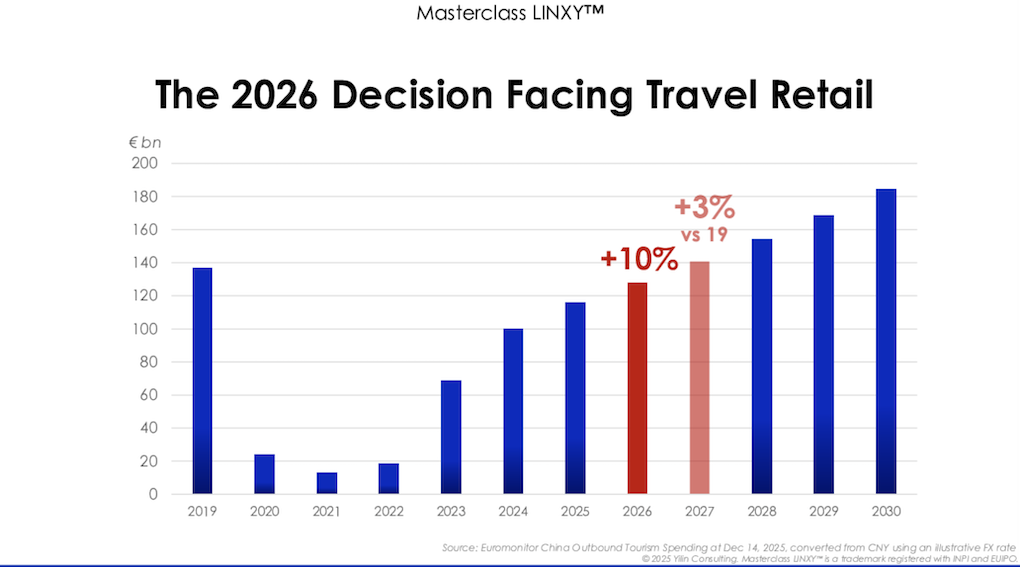

Wang shared a positive outlook on Chinese outbound travel. She said: “Euromonitor’s latest projections on China’s outbound tourism spending, which includes hotels, flights, accommodation and duty-free shopping, show year-on-year growth of +10% in 2026 compared to 2025. However, this is still around -7% below the 2019 pre-pandemic benchmark.

“By 2027, there is a further projected +10% increase versus 2026, and for the first time spending is expected to exceed 2019 levels by approximately 3%.”

She added: “This confirms that Chinese travellers are back and returning to Europe and spending globally. The real question is no longer if they return, but how they choose where to spend their time and money. The danger is assuming that recovery equals a return to old retail rules. Today’s traveller does not look like the traveller of 2019.”

Wang outlined four defining characteristics of China’s duty-free ecosystem that can be adopted by Western retailers. She said, “Before discussing Chinese traveller behaviour in European travel retail, we need to understand what they are accustomed to when shopping duty free in China.

“First of all, retail is theatrical in China travel retail,” Wang explained. “Brands create immersive stages where customers gather, play, and win products. This scale and experiential setup are now the norm, especially in premium shopping destinations such as the cdf Sanya International Duty Free Shopping Complex in Haitang Bay and other downtown duty-free locations in Hainan.

“Second is policy change,” she added. “Since 1 November 2025, Chinese travellers can pre-purchase duty-free products online and collect them upon return to China. This has significantly reshaped the Chinese travel retail landscape.”

As reported in the first month following the customs closure of the Hainan Free Trade Port, the island’s offshore duty-free market has delivered impressive results. According to Haikou Customs, from 18 December (the day of the change) to 18 January, Hainan’s offshore duty-free sales reached CNY5.02 billion (US$720 million), up +46.8% year-on-year. The number of shoppers rose to +29.7% to 772,000 and a total of 3.621 million duty-free items were purchased, representing a +14.3% year-on-year gain.

“Third, pricing and availability. Duty-free discounts are available year-round online on platforms such as Xiaohongshu. The livestream price is often lower than the official duty-free price, even for new product launches from top skincare brands. Competition is extremely intense.”

Wang continued: “Fourth is accessibility and personal service. Brand ambassadors are reachable online with instant replies. Their contact details are publicly shared through official accounts, and Xiaohongshu functions as an online concierge used for appointment booking, product checks and direct brand communication. This is the baseline experience Chinese consumers are used to when shopping duty free in China.”

The new Chinese FIT traveller

Wang identified independent FITs as the dominant demographic for Chinese travellers in 2026. She explained: “Looking at 2025 data, we see a shift in traveller profiles. FITs are now the global norm and make up around 70-73% of Chinese outbound travellers under 45. These travellers are digital natives; everything is planned on mobile, through China’s digital ecosystem.”

Wang classified four emerging Chinese FIT archetypes: Value Optimisers, Quality Upgraders, Experience Explorers and Trend Explorers.

“Value Optimisers seek bundles and tax refunds, while Quality Upgraders look for niche, local brands,” Wang explained. “Experience Explorers seek authentic markets and neighbourhood culture, while Trend Explorers chase what is fashionable right now.”

According to Wang, Xiaohongshu, WeChat, online travel agencies and peer content play a key role in influencing the purchase decisions of Chinese FIT travellers, which no longer follow a linear path. “Trust is central. Traditional marketing funnels are less predictive. Attention is fragmented and information sources are diverse.”

Executing LINXY in 2026

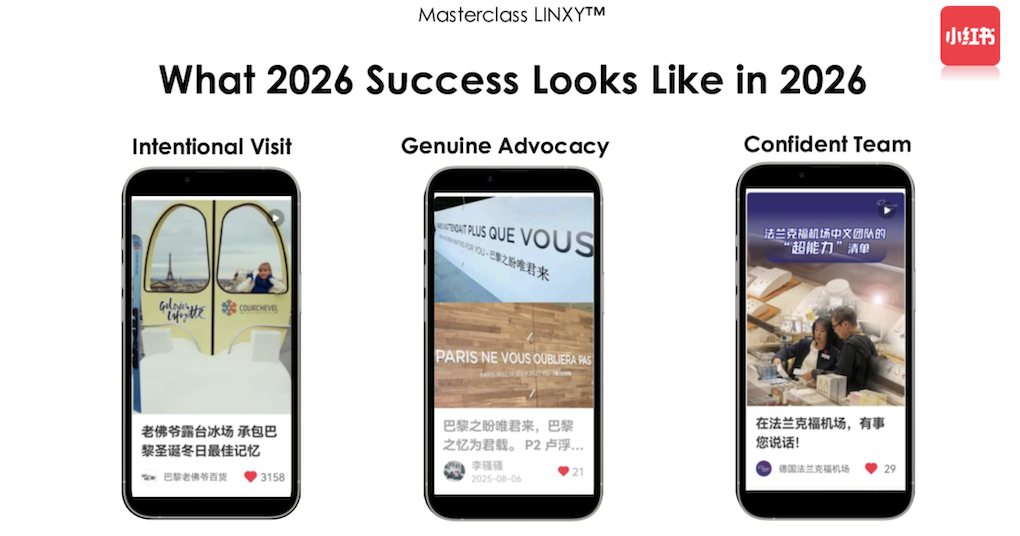

Talking about how brands and retailers can execute the LINYX system in 2026, Wang said: “These three phases form one integrated system. Link happens before the journey, via platforms such as Xiaohongshu, WeChat and Douyin. Link creates intention through cultural resonance.

“See creates memory through meaningful experience. It happens during the journey, through visibility, storytelling and emotional connection. Engage converts through human connection, advocacy and confidence. This is where conversion occurs – across downtown stores, airports and arrival locations.” ✈