Yilin Watch: The Xiaohongshu Report is published in exclusive association with The Moodie Davitt Report

Introduction: Yilin Consulting is an acclaimed boutique consultancy based in Paris, specialising in helping travel retail brands and retailers engage the new generation of Chinese outbound travellers. Its focus lies in converting independent, experience-driven travellers through targeted omnichannel engagement and frontline cultural training.

Today, as part of our unrivalled coverage of the Chinese travel retail market at home and abroad, The Moodie Davitt Report is proud to bring you the third edition of our exclusive column in partnership with Yilin Consulting Founder Yilin Wang – Yilin Watch: The Xiaohongshu Report

Prologue: Yilin Watch: The New Chinese Traveller Paradox

Our third edition of Yilin Watch: The Xiaohongshu Report covers how Paris Aéroport, Galeries Lafayette and La Vallée Village adapted their Xiaohongshu strategies during China’s Golden Week to engage today’s value-driven Chinese travellers.

This October marked an exceptional Golden Week, as an eight-day holiday merging China’s National Day (1 October) and the Mid-Autumn Festival (6 October) – fuelled record-breaking travel.

Chinese Mainland residents made 9.165 million inbound and outbound trips (+9.6% year-on-year), reaching their highest level since before the COVID-19 pandemic.

Yet behind the full flights and crowded boutiques lies a growing concern: average spending per Chinese traveller declined slightly (-0.5% vs 2024*), signaling a shift in confidence rather than demand.

Today’s Chinese traveller is discerning, value-driven, and digitally decisive, making purchase decisions long before they land.

For global travel retail, the message is clear: The commercial battle has moved from the shop floor to the smartphone screen – weeks in advance.

In this third edition of Yilin Watch – The Xiaohongshu Report, we spotlight three key Parisian players in the travel retail value chain – Paris Aéroport, Galeries Lafayette, and La Vallée Village – to analyse how each of them leveraged Xiaohongshu to pre-board China’s most influential travellers during the longest Golden Week since the pandemic.

This analysis covers activity on Xiaohongshu between 25 September and 15 October 2025.

*China’s Ministry of Culture and Tourism figure. Includes both domestic and outbound Chinese tourists with calculation reported by Reuters.

Our Analytical Framework

We use Yilin Consulting’s analytical framework, LINXY – ‘Link, See, Engage’ – to decode how each player connected with Chinese travellers during Golden Week. Through this lens, we compare and illustrate the Xiaohongshu strategies of three key accounts across every stage of engagement.

Link: The Content Landscape

During October’s Golden Week, these three key Parisian retail players adopted distinct content strategies on Xiaohongshu to connect with Chinese travellers. Their tone and format varied but the mission was shared: to stay visible, relevant and commercially resonant when travel excitement was at its peak.

Paris Aéroport published four posts with a focus on creating a welcoming atmosphere, led by authentic video interviews with Chinese travellers. These were complemented by a UnionPay promotion and one SEC campaign encouraging user participation.

Galeries Lafayette also published four posts, executing a dual approach. Two posts highlighted its dedicated in-store Golden Week campaign and payment offers, while the other two leveraged high-impact KOL collaborations under the reality show ‘Paris Partner (巴黎合伙人)’ initiative.

La Vallée Village delivered the most comprehensive content plan, with eleven posts in total. Its high-volume mix spotlighted brand-specific offers and a high-engagement SEC campaign – both amplified by a full-funnel paid media strategy that maximised reach across Xiaohongshu’s ecosystem (main story continues below our reader communication that follows).

See: Decoding Content Strategy

Paris Aéroport: The Welcoming Host

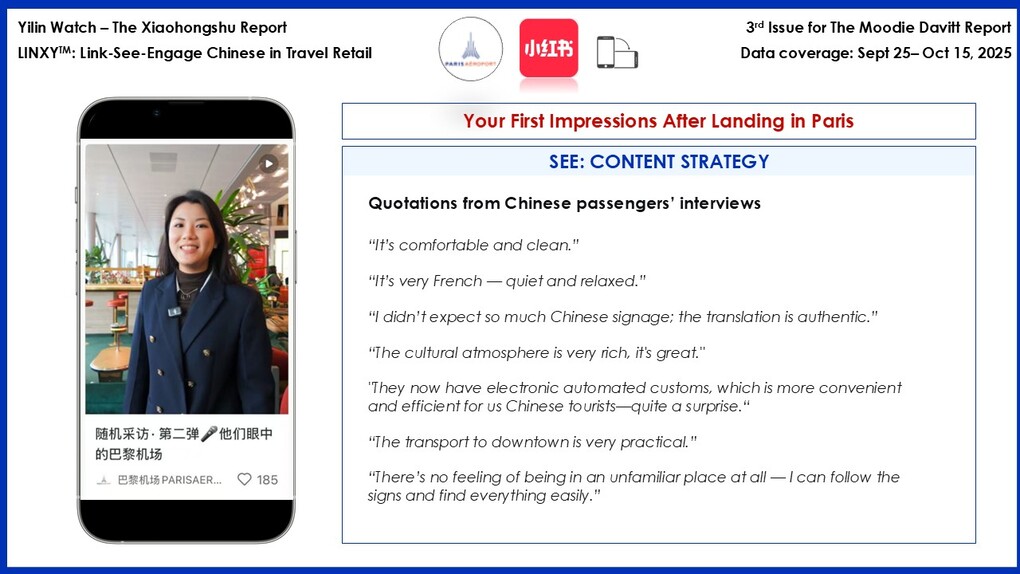

Paris Aéroport deployed a powerful tool of soft-power marketing during Golden Week, publishing four posts designed to make Chinese travellers feel at home from the moment they landed. Two short videos — themed ‘Chinese Travellers’ First Impressions After Landing in Paris’ – i.e. let authentic passenger voices tell the story.

The series addressed common travel anxieties — confusion, discomfort, and language barriers — showing how clear Chinese signage, fluent translations, and smooth transport links made the arrival experience effortless.

Click here for the post and video link

Two complementary posts invited users to share their own airport experiences under a hashtag campaign and promoted UnionPay offers tailored to Chinese visitors.

This real-time, service-oriented storytelling built early trust and positioned Charles de Gaulles Airport (CDG) as the first friendly face of Paris.

Galeries Lafayette: Cultural Pride Meets Commerce

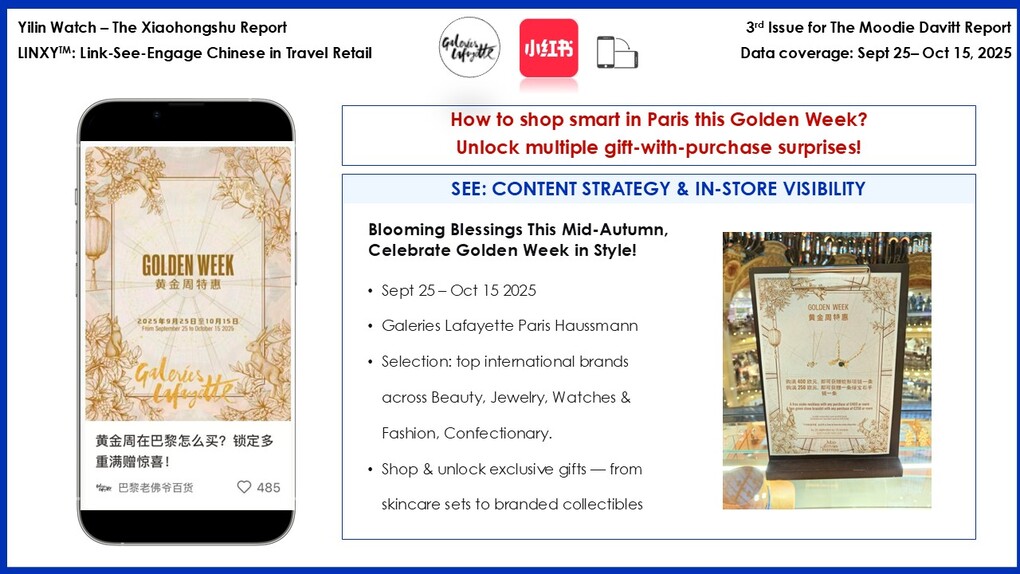

Galeries Lafayette Paris Haussmann adopted a dual strategy for Golden Week — blending online-to-offline activation with influencer firepower, balancing practicality with cultural appeal.

The department store published four posts on Xiaohongshu: two highlighted its Golden Week in-store campaign and multi-payment offers. The content focused on accessible yet niche luxury brands spanning watches & jewellery, leather goods, fashion, beauty and confectionery — all presented with gift-with-purchase offers in a visually rich 14-page carousel. This curated mix positioned Galeries Lafayette as premium yet personable — iconic go-to destination that understands its Chinese clientele.

In-store displays mirrored the Xiaohongshu visuals, creating a consistent echo between online communication and offline presence.

Click here for the post link

Click here for the video link

The other two posts leveraged high-impact KOL collaborations under the Paris Partners collaborations under the ‘Paris Partners (巴黎合伙人)’ — a reality-show series filmed in Paris featuring Gen-Z Chinese creators building a pop-up beauty business from scratch.

At the heart of the collaboration was Austin Li (Li Jiaqi) — China’s No. 1 cosmetics livestreamer, known as ‘The Lipstick King’ and He Wenjie, the Chinese singer who rose to fame through a French-language singing competition.

Together they spotlighted YAN Lab, a rising C-beauty brand that staged a one-day pop-up inside the Haussmann flagship, symbolising the meeting of Chinese innovation and Parisian retail heritage.

Click here for the post link

Click here for the video link

The two influencer-led posts generated over 2,200 engagements and triggered organic traffic driven by China Pride — celebrating Chinese brands ‘making it’ in Paris.

By combining commerce and culture, Galeries Lafayette turned Parisian heritage into a modern dialogue with China’s new generation of travellers.

La Vallée Village – Turning Digital Momentum into Footfall

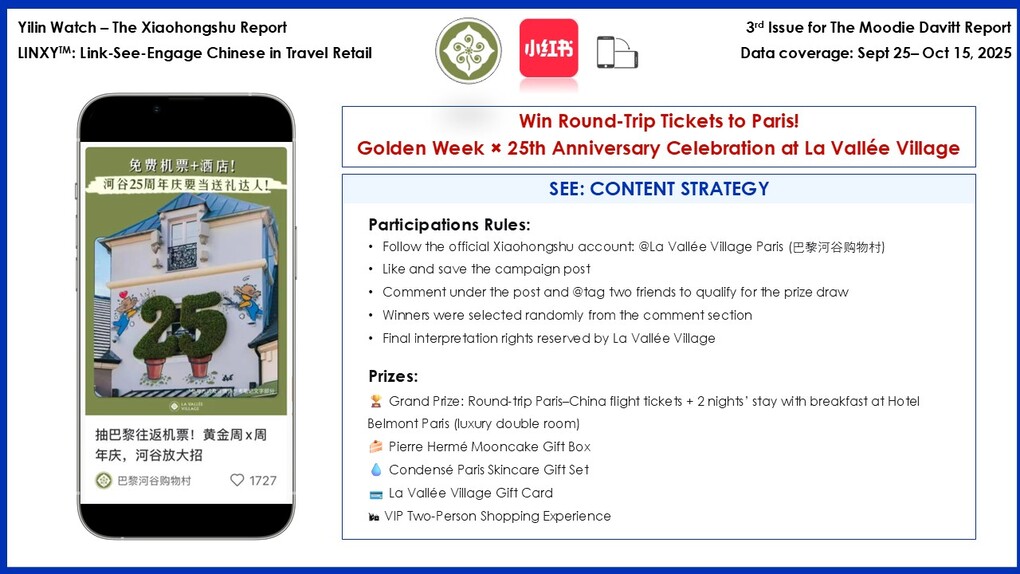

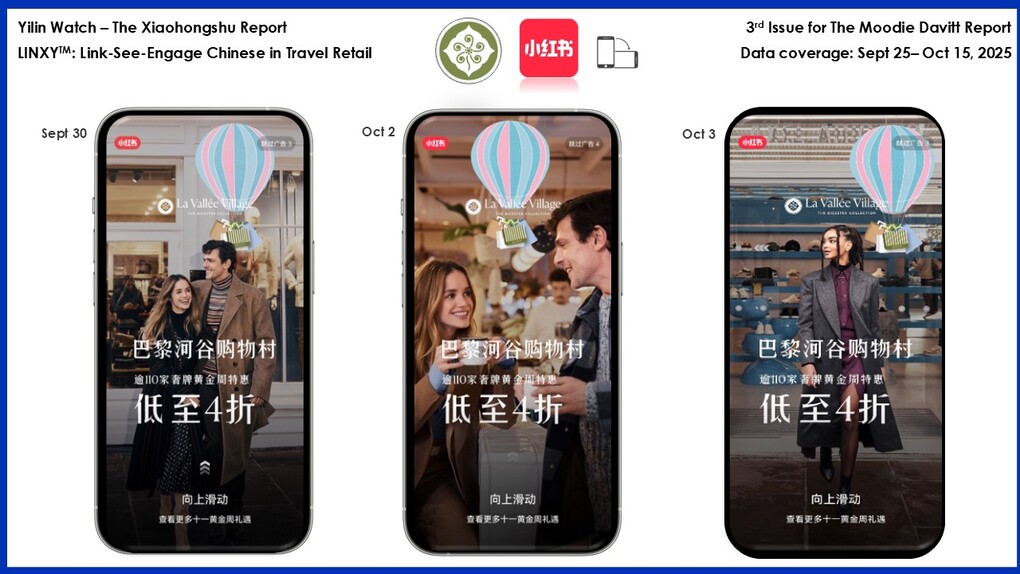

Among the three Parisian players, La Vallée Village took the most expansive digital approach during Golden Week, deploying 11 posts to sustain visibility and drive visits. Its content mix blended brand storytelling with commercial clarity: seven posts spotlighted boutique offers, two showcased a high-engagement Save–Engage–Comment (SEC) campaign, and others detailed payment and membership benefits tailored for Chinese visitors.

The SEC campaign, marking La Vallée Village’s 25th anniversary, invited users to participate in a giveaway featuring premium rewards — from round-trip Paris–China flight tickets and stays at Hotel Belmont Paris, to Pierre Hermé mooncakes and gift cards. This interactive, aspirational format sparked lively participation, with Chinese users flooding the comments to share excitement and tag friends.

Click here for the post link

Click here for the video link

Beyond organic activity, La Vallée Village boosted its presence through geolocalised Open App Ads and Sponsored Ads on Xiaohongshu’s Discovery Page — turning awareness into measurable traffic from Paris’s city center.

Through its energetic, digital-first presence, La Vallée Village positioned itself as the smart luxury destination for both tourists and local Chinese residents in France.

Engage: Audience Engagement Insights

Paris Aéroport: Trust Earned, Details Missed

Positive side: Posts featuring airport staff and real travellers drew heartfelt appreciation. Many commenters praised how “friendly and patient” the employees were, noting that “some even spoke a little Chinese.” Others applauded the signage and service improvements, saying “it’s easy to find everything” and “Paris Airport feels welcoming.” Several users even commented that they were “looking forward to experiencing it in person.”

Negative side:Some pointed out operational gaps — long customs queues, slow baggage claims, and the absence of hot water stations, a standard amenity in Chinese airports. The airport’s SEC-style hashtag campaign failed to gain traction; without a clear reward, the comment area remained empty.

Insight: Authenticity earned affection, but comfort details still define satisfaction.

Galeries Lafayette: Pride Drives Traffic, Clarity Converts

Positive side: Posts from the “Paris Partners” received the highest engagement of all — over 2200 interactions — fulfilling their traffic-driving role and sparking national pride. Audiences celebrated Chinese beauty brands gaining visibility overseas and asked for “more Chinese brands to join.”

Golden Week in-store offer post and payment benefits posts (UnionPay, Alipay, WeChat Pay) also performed well, generating in total +1300 engagements, demonstrating clear commercial relevance.

Negative side: Many comments revealed confusion about redemption mechanics and payment overlaps. “Where can I find this counter?” “How do I redeem the gift?” “Which brands are included?”

Insight: Emotion brought traffic; clarity closes the sale.

La Vallée Village: Active Engagement, Operational Gaps

Positive side: Thanks to the attractive prizes, the outlet’s SEC campaign generated high participation. Commenters described their entries in long, detailed posts — showcasing a playful, engaged community. Commercial posts with clear discounts and limited-time offers also performed well, achieving high save and share rates.

Negative side: Some travellers expressed frustration about unclear instructions of payment promotions and the lack of visible on-site communication. Several mentioned that staff were unaware of the online brands offer, while others struggled to find where to claim GWP. Brand-only posts had lower engagement as users prioritised practical information.

Insight: Gamification won attention, but execution consistency remains the missing link.

Engage:Overall Reflection

The Engage phase exposed one common thread across Paris’ retail trinity:

Online emotion can ignite curiosity — but only operational precision can sustain confidence. Xiaohongshu has become not just a marketing platform; it’s a real-time feedback mirror reflecting how Chinese travellers perceive brand readiness, empathy, and service quality.

The Yilin Takeaway

From Paris’ retail ‘Trinity’ — Paris Aéroport, Galeries Lafayette, and La Vallée Village — three truths emerge about engaging Chinese travellers in 2025: the digital journey begins earlier, emotions convert better than discounts, and execution excellence remains the ultimate differentiator.

1. Visibility Now Starts Weeks Before Arrival

Chinese travellers no longer discover brands at the point of sale — they pre-decide on Xiaohongshu. Airports, retailers, and outlets that communicate before departure earn mindshare when travel excitement is highest. Paris Aéroport’s ‘First Impressions’ videos prove that trust is built in-feed, not at check-in.

Action: Invest in ‘pre-boarding content’: authentic, localised stories released two to three weeks before peak travel waves.

2. Cultural Empathy Outperforms Commercial Noise

In a cautious spending cycle, emotional relevance drives conversion more powerfully than discounts. Galeries Lafayette’s collaboration with top-tier livestreamer and KOLs tapped into China Pride, validating Chinese creativity abroad and transforming a retail promotion into a cultural moment.

Action: Replace one-way promotion with cultural storytelling that reflects pride, belonging, and authenticity.

3. Execution Is the Final Conversion Point

Digital engagement only pays off when the physical experience delivers. Across all three players, comments repeatedly revealed confusion about redemption mechanics, campaign visibility, and staff awareness. The opportunity lies in synchronizing online and offline.

Action: Brief, train, and empower store teams to speak the same campaign language as the brand’s Xiaohongshu posts.

Conclusion

In the new travel retail reality, conversion starts on Xiaohongshu — and finishes in the human touch. To win the discerning Chinese spender, brands must Link early, See deeply, and Engage flawlessly.

The next wave of Chinese travellers is already choosing where to spend — long before they travel.

For EMEA travel retailers and brands, the question is no longer if to act, but how fast.

Yilin Consulting helps you decode Xiaohongshu’s fast-evolving ecosystem — transforming visibility into conversion, and engagement into measurable sales.

To discuss your 2026 Chinese traveller strategy, contact: yilinwang@yilinconsulting.com

Yilin Wang | Founder & CEO, Yilin Consulting

Previously on Yilin Watch: The Xiaohongshu Report

Edition 2: Yilin Watch: The Xiaohongshu Report – Focus on Qatar Airways, Cathay Pacific and All Nippon Airways

Edition 1: Announcing a key new editorial column – Yilin Watch: The Xiaohongshu Report