Yilin Watch: The Xiaohongshu Report is published in exclusive association with The Moodie Davitt Report

Introduction: Yilin Consulting is an acclaimed boutique consultancy based in Paris, specialising in helping travel retail brands and retailers engage the new generation of Chinese outbound travellers. Its focus lies in converting independent, experience-driven travellers through targeted omnichannel engagement and frontline cultural training.

Today, as part of our unrivalled coverage of the Chinese travel retail market at home and abroad, The Moodie Davitt Report is proud to bring you the fifth edition of our exclusive column in partnership with Yilin Consulting Founder Yilin Wang – Yilin Watch: The Xiaohongshu Report.

Prologue: Winter Celebration Under Pressure

Year-end is the most densely packed communication window in the travel retail calendar.

From Christmas and New Year in the West to the long runway toward Chinese New Year in the East, brands, retailers and airports compete simultaneously for attention, relevance and conversion, often using similar festive codes, familiar visuals and well-worn seasonal language.

The result? Saturation. And in a saturated environment, a simple question emerges: how do you stand out when everyone is speaking at the same time?

This Winter Celebration series of Yilin Watch: The Xiaohongshu Report therefore unfolds across two dedicated editions.

• Edition 5 focuses on Christmas and New Year, covering Xiaohongshu activity from 1 December 2025 to 4 January 2026.

• Edition 6 shifts the lens one month ahead of Chinese New Year, analysing content published from 5 January to mid-February 2026.

In each edition, we deliberately place West and East side by side – not to compare cultural celebrations, but to observe how travel retail Xiaohongshu official accounts navigate festive saturation. And, more importantly, how they choose between atmosphere, usefulness and activation when attention is most fragmented.

In this fifth edition of Yilin Watch – The Xiaohongshu Report, we spotlight three players across two continents — London Heathrow Airport x World Duty Free, Frankfurt Airport × Heinemann Duty Free, and Shinsegae Duty Free — to decode how each party leveraged Xiaohongshu during the Western festive window, and what their strategies reveal about engaging Chinese travellers when the noise is at its loudest.

Link: The Content Landscape

During the Winter Celebration period, three travel retail players adopted markedly different approaches to Xiaohongshu – varying not just in volume but in strategic intent.

London Heathrow Airport published 14 posts over five weeks, keeping a steady rhythm of 2-3 posts per week. Activity clearly concentrated around Christmas, with engagement peaking on 24 December, when two posts outperformed the rest – one featuring an institutional season’s greeting video from World Duty Free.

Interaction was stronger before Christmas than after, indicating that Heathrow’s audience engages most actively during the anticipatory phase of festive travel. During this period, Xiaohongshu was used mainly to reinforce festive atmosphere and retail brand presence, while providing practical travel guidance for the holiday rush.

Frankfurt Airport took a more selective stance, publishing eight posts over the same period, averaging one to two posts per week. Yet reduced volume did not translate into weaker visibility.

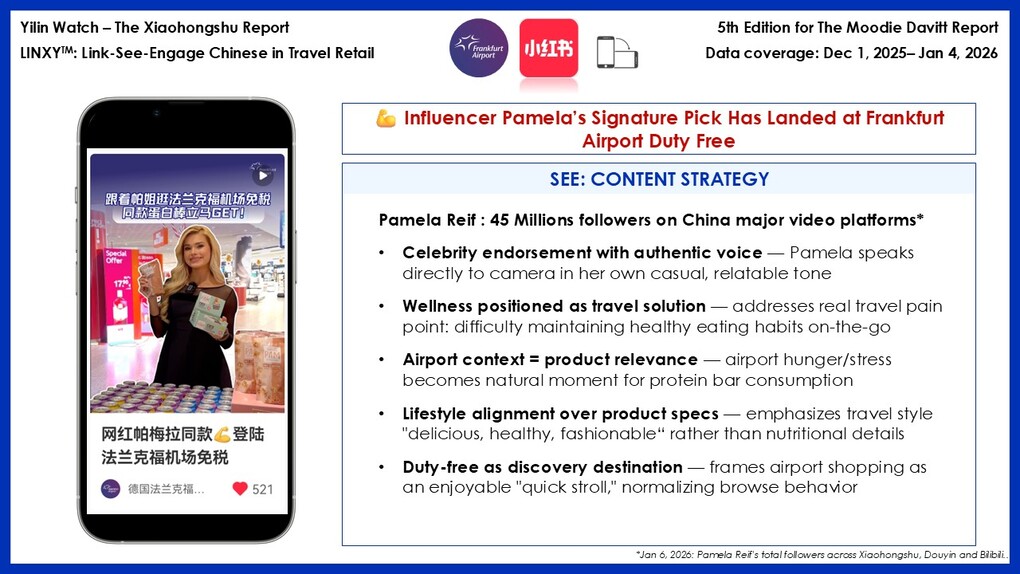

Several posts stood out for their clear practical value, becoming reference content for travellers. One post, in particular, drew strong attention: it featured Pamela Reif, the well-known German fitness coach with 45 million followers across major Chinese video platforms (Xiaohongshu, Douyin and Bilibili as at 1 January 2026), introducing her Protein Bar at a Heinemann Duty Free store. The format tapped into wellness consumption trends and sparked visible enthusiasm in the comments.

Overall, Frankfurt Airport used Xiaohongshu more as a targeted information and service touchpoint during complex travel moments, rather than as a purely festive showcase.

Shinsegae Duty Free operated at an entirely different pace. The account published 19 posts over the period, nearly four per week, with posting frequency intensifying around key Chinese commercial moments.

This sustained rhythm reflects a clear choice. For Shinsegae, the festive season isn’t a branding exercise – it’s a primary commercial activation window.

Xiaohongshu isn’t positioned as a mood board. It’s a pre-trip shopping interface and planning platform, built around transparent pricing, structured promotions, membership guides and beauty category dominance. The message is direct: come to plan, compare and interact – not just to browse.

Three players. Three rhythms. Three strategic bets on how to win attention when the calendar is crowded.

See: Decoding Content Strategy

London Heathrow Airport: The British Festivity

Heathrow’s winter content strategy is built around a clear narrative: the British Christmas, experienced through the airport.

Across the period, eight posts focused on travel and airport experience – Christmas travel tips, festive terminal atmospheres, airport shopping moments, free kids’ menus and concierge-style service cues. Three posts leaned into emotional reflection, centred on year-end wrap-ups and New Year wishes. One post functioned as a self-referential annual recap, highlighting the account’s star posts of the account from 2025.

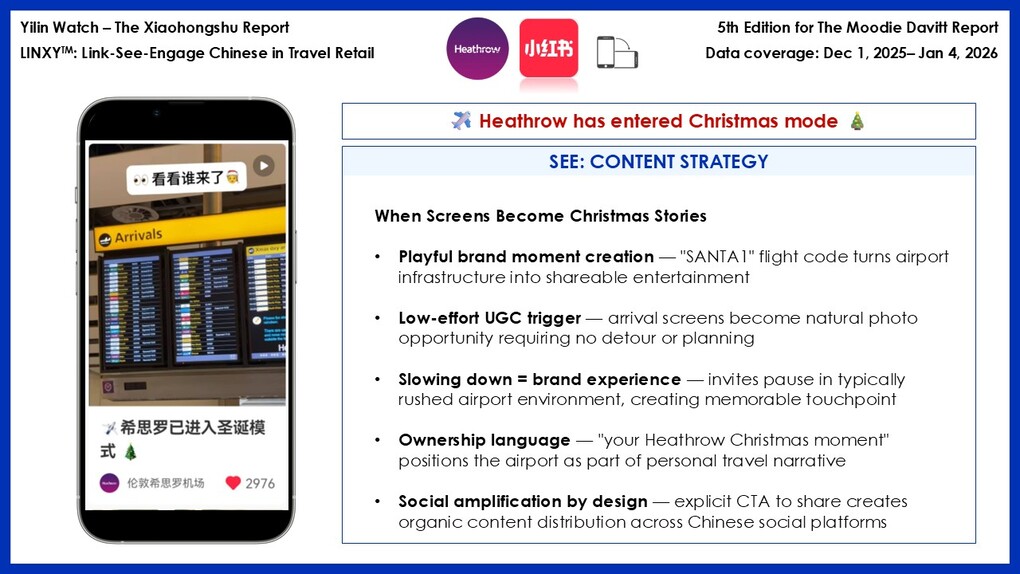

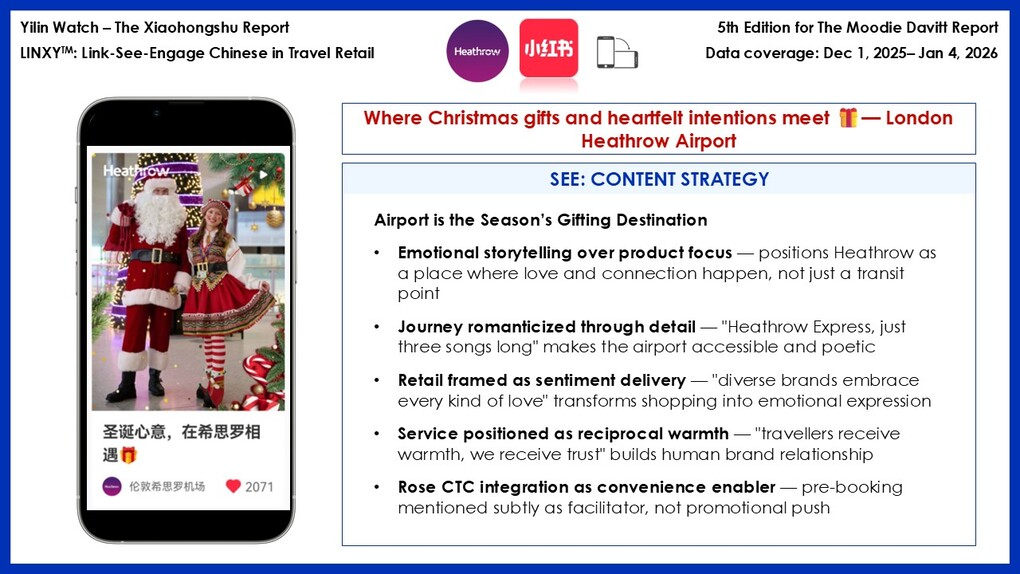

Visually and tonally, Heathrow excels at expressing a distinct sense of place. Two standout posts on 24 December brought the festive narrative to its peak, capturing the magic of British Christmas ambiance at the moment of highest emotional receptivity.

Click here for the video link

Click here for the video link

By expressing a distinct sense of place – warm lighting, recognisable British festive codes, and emotionally resonant storytelling – Heathrow positions the airport as a welcoming, culturally grounded gateway during a high-emotion travel season. The content is polished, consistent and designed to make Chinese travellers feel the warmth of a British winter welcome before they arrive or as they depart.

However, while festive storytelling is strong, practical decision support remains secondary. Operational information is present, but not always structured in a way that supports pre-trip shopping planning, limiting Xiaohongshu’s role as a true purchase-oriented tool during this period.

Frankfurt Airport × Heinemann Duty Free: When Usefulness Outperforms Festivity

Frankfurt’s winter content strategy took a fundamentally different direction, prioritising practical value over festive atmosphere – and achieving a more balanced editorial mix as a result.

The account published approximately equal parts utility content, retail innovation and festive ambience. Yet engagement patterns reveal a clear hierarchy: usefulness and targeted retail storytelling decisively outperformed seasonal atmosphere.

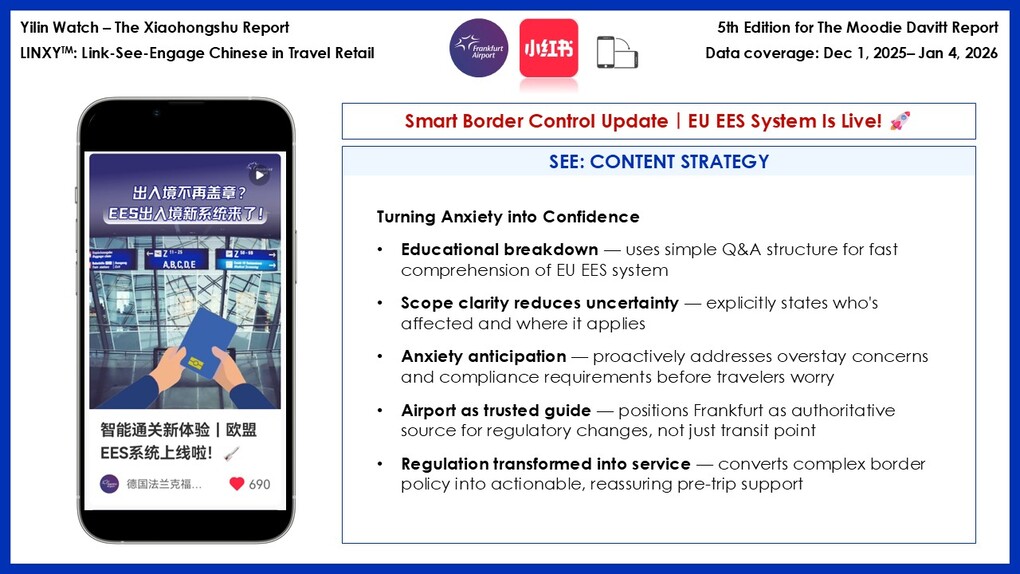

Two posts stood out as the period’s strongest performers. A video explaining Entry/Exit System (EES, the recently introduced digital border control for non-EU nationals entering the Schengen Area) border control procedures, supported by clear Chinese subtitles, became the most engaged post – demonstrating that when content directly addresses high-stakes traveller concerns, Xiaohongshu can drive significant organic traffic to the account.

The format reduced a complex, anxiety-inducing process into clear, actionable guidance, earning trust through precision.

Click here for the video link

A product-focused post announcing the arrival of Pamela Reif’s protein bar at Heinemann Duty Free achieved similarly strong traction. This wasn’t traditional duty-free messaging – it was wellness-adjacent retail positioned for health-conscious travellers.

Introduced by ‘Sister Pamela’ (帕姐)herself, with a narrative strongly linked to healthy-eating during travel, this post sparked visible enthusiasm, particularly among Chinese travellers who prioritise wellness during travel.

Click here for the video link

In stark contrast, posts centred on German Christmas ambience – festive markets, seasonal greetings, year-end reflections – generated noticeably lower interaction.

This performance gap reveals a critical insight: festive mood is good, but travel convenience and authentic destination offers are better. During festive periods, relevance and clarity can outperform atmosphere, particularly among Chinese FIT travellers seeking reassurance and efficiency.

Frankfurt’s strength lies in this balance: leaning into operational clarity and strategic retail storytelling while maintaining festive presence, transforming Xiaohongshu into a decision-support tool when travellers need it most.

Shinsegae Duty Free: From Content Feed to Pre-Trip Shopping Interface

South Korean travel retailer Shinsegae Duty Free’s approach to the festive period is decisively information-led, with emotion playing a deliberately secondary role.

The account functions as a digital shopping interface and pre-trip purchase planning tool, wrapped in a mix of fun, youthful K-culture energy and cosy winter offer atmosphere.

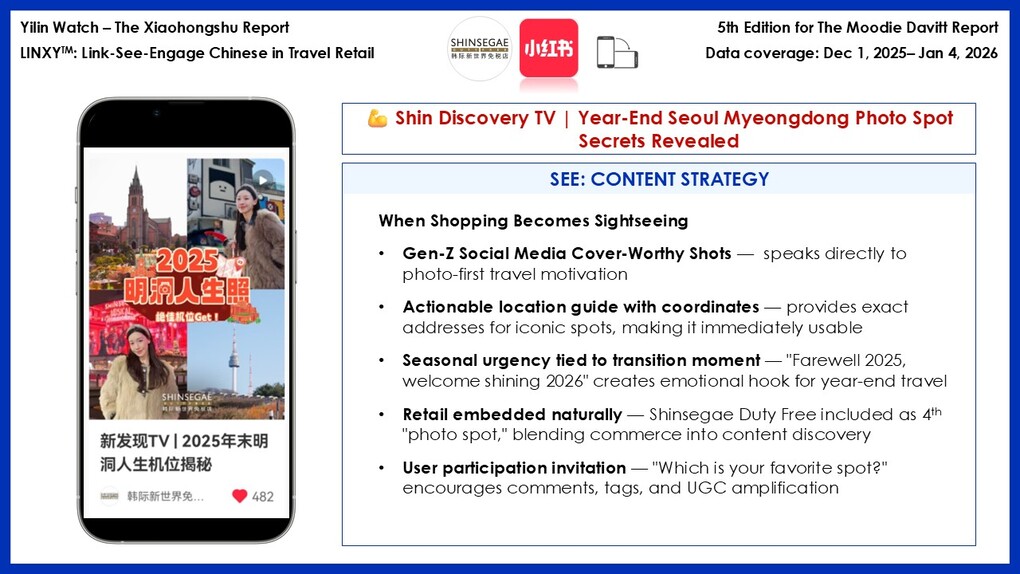

Beauty – particularly K-Beauty – dominates the feed, with products systematically displayed alongside clear USD and RMB pricing, reducing friction in pre-departure comparison. This is complemented by membership guides, flash sales and local fashion highlights. The most popular video post targets Gen-Z travellers directly, inviting them to discover lucky travel locations for 2026 by showcasing all the most Instagrammable moments and spots in one shareable format.

Click here for the video link

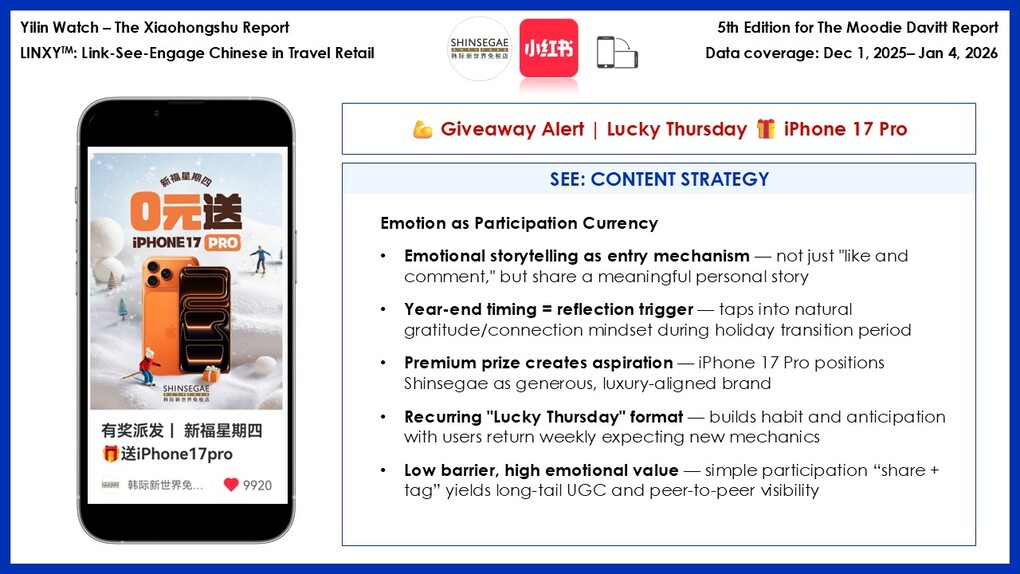

The account’s defining feature, however, is its continuous promotional architecture. Weekly ‘Lucky Thursday’ (新福星期四) activations, red-packet campaigns and headline giveaways – including a zero-cost iPhone 17 Pro draw – transform the feed into a recurring destination. Engagement peaks consistently around these mechanics, with the strongest post exceeding 30,000 total interactions.

Click here for the video link

Notably, festive storytelling itself remains restrained. Christmas and New Year appear only as contextual cues, while shopping planning, value clarity and participation incentives remain firmly in focus. Where Heathrow built atmosphere and Frankfurt provided reassurance, Shinsegae engineered conversion. The account transforms Xiaohongshu into a living shopping environment where festive timing amplifies commercial intent rather than diluting it.

Three accounts. Three roles for Xiaohongshu during festive saturation.

Heathrow positioned the platform as an emotional anchor – building brand warmth through cultural storytelling. Frankfurt turned it into a functional guide – earning trust through operational clarity and wellness-oriented retail innovation. Shinsegae Duty Free transformed it into a commerce engine – converting attention into pre-trip purchase intent through transparent pricing and engineered participation.

The content strategies reveal a fundamental choice: atmosphere, usefulness or activation. During Winter Celebration, each approach found its audience. But engagement patterns suggest a clear direction: when festive noise is loudest, clarity and utility tend to break through more effectively than mood alone.

Engage: Audience Engagement Insights

Content strategies reveal intent. Audience engagement reveals impact. Across the three accounts, the comments sections tell vastly different stories about what Chinese travellers sought – and found – during the Winter Celebration period.

London Heathrow Airport: Positive Sentiment, Limited Decision Signals

Audience interaction during the period is predominantly emotional. The most-commented post – the Christmas arrival board featuring Santa’s flight path – generated over 4,000 total engagements, with users actively tagging contacts and posting Flightradar screenshots of Santa’s journey.

The playful, festive mood resonated strongly. Users responded warmly to the Christmas magic, with many expressing anticipation about experiencing the airport’s festive atmosphere in person. Direct benefits like free kids’ menus also attracted visible attention from family travellers.

However, action-oriented engagement remains limited. Practical questions – overnight terminal options, transfer logistics, service clarity – appear occasionally but often go unanswered, weakening the platform’s credibility as a travel-service support channel.

One post about ‘Christmas gifting offering list in Heathrow is ready’ created unintended confusion. The promotional language led some users to assume it was a giveaway rather than a shopping guide. Comments such as “I thought this was free for me” and “I thought it was a lucky draw” reveal how unclear framing can limit engagement, discouraging users from swiping through to the end.

One notable exception stands out: a sensitive complaint regarding airport staff behaviour received a prompt, empathetic response inviting private follow-up. This moment reinforces Heathrow’s ability to act as a human, responsible brand when reputational stakes are high.

Yet beyond this intervention, the comment sections remain relatively quiet – high saves but few comments – with limited signals of concrete pre-trip planning or airport retail intent. Overall, during the Winter Celebration period, Heathrow’s Xiaohongshu presence functions primarily as a brand-linking and image-building platform, rather than a fully activated pre-engagement or decision-making space. Warmth and atmosphere resonate – but conversion signals remain elusive.

Frankfurt Airport × Heinemann Duty Free: Community Management as Trust Infrastructure

Audience engagement on the Frankfurt account was distinctly practical and intent-driven. Comments largely addressed operational questions related to border procedures, airport navigation and transit logistics – reflecting genuine pre-trip needs rather than emotional reactions.

What sets Frankfurt apart is the consistency and quality of its responses. Nearly all practical queries received timely, precise answers, transforming the comments section into a credible service layer rather than a symbolic engagement space. This level of community management significantly enhances trust and positions the account as a dependable travel service reference point.

While explicit retail intent remains limited, the Pamela Reif post signals meaningful opportunity. With around 600 total engagements, the post stood out through Pamela’s personal presence and her travel wellness storyline. Yet the comment section remained relatively quiet, indicating untapped potential – retail activation could bridge the gap between curiosity and purchase intent, but that conversion layer is not yet built.

Overall, Frankfurt’s Xiaohongshu presence during the Winter Celebration period demonstrates that impact does not require volume. With focused content, wellness-oriented KOL storytelling and responsive community management, the account succeeds in turning Xiaohongshu into a trusted decision-support platform – even amid festive noise.

Shinsegae Duty Free: Participation Engineered at Scale

Engagement on Shinsegae Duty Free’s Xiaohongshu account is designed, not incidental – and frictionless clarity is what makes it work.

Every product featured comes with transparent US$ and RMB pricing, eliminating pre-trip comparison friction. Users respond with visible appreciation: “太详细了” (“So detailed”), “必须支持,收藏起来” (“Must support this, saving it”).

When discounts are significant — particularly flash sales — comment sections flood with purchase intent: “太划算了吧” (“This is such a great deal”), “年末这波福利太懂了” (“They really understand what we need at year-end”). Clarity and value drive conversion.

Beyond transparency, engagement is structurally engineered. Lucky Thursday giveaways and red-packet campaigns generate hundreds of comments per post, with users creating long-tail content, tagging travel companions and sending New Year wishes.

Crucially, this activity is tightly governed. Clear participation rules, interaction limits (maximum three comments per post) and monthly leaderboards ensure a clean, credible engagement environment – rewarding meaningful interaction rather than sheer volume.

The result is a platform that goes beyond visibility. Xiaohongshu becomes a live, pre-trip decision-making space where users actively plan purchases, benchmark value and emotionally commit to Shinsegae Duty Free well before travel. For EMEA travel retailers, Shinsegae offers a key lesson that festive relevance depends on precision pricing, disciplined promotion and scalable engagement mechanics – not atmosphere alone.

Three accounts. Three engagement outcomes.

Heathrow generated sentiment but limited intent. Frankfurt built trust through responsive service but left retail potential untapped. Shinsegae engineered commitment by designing participation architecture that converts curiosity into pre-trip purchase planning.

The engagement patterns reveal a clear principle: during festive saturation, designed interaction outperforms organic sentiment. Comments sections are not vanity metrics — they are conversion infrastructure. And the brands that govern them strategically are the ones that capture Chinese travellers weeks before they board.

The Yilin Takeaway

1. Festive Presence Alone No Longer Differentiates

Seasonal celebratory language and traditional shopping lists no longer guarantee engagement when everyone deploys them simultaneously.

What differentiates performance is the role Xiaohongshu plays. Where it remains a sense of place channel reinforcing destination atmosphere, engagement stays emotional but shallow. Where it becomes a service layer addressing traveller concerns, trust deepens. Where it transforms into a customer-centric shopping interface delivering clear, direct value, genuine engagement accelerates – and conversion follows.

Heathrow built sentiment. Frankfurt earned trust. Shinsegae engineered commitment.

Action: Define Xiaohongshu’s strategic role before designing your festive editorial calendar. The next wave – Chinese New Year, the Year of the Horse – is weeks away. Clarity now determines impact then.

2. Usefulness Is the Most Underrated Festive Asset

The strongest engagement consistently came from content that reduces uncertainty: border procedures, pricing transparency, wellness products and shopping guides.

During festive periods, Chinese FIT travellers don’t disengage from rational planning – they accelerate it. Frankfurt’s EES explainer and Pamela Reif post outperformed Christmas content.

Shinsegae Duty Free’s transparent pricing drove visible purchase intent. The pattern is clear: festive storytelling attracts attention, but utility earns trust and enables conversion.

Action: Position Xiaohongshu as a pre-trip service provider. Invest in operational clarity, pricing transparency and product availability. When travel anxiety is removed, shopping intent strengthens.

3. Turn Engagement into Organic Traffic with Incentives

For China’s younger generation, shopping is entertainment – even gamification. The comment section, when structured with clear rules, incentives and governance, becomes a self-sustaining traffic engine that benefits both account and audience.

Shinsegae Duty Free’s Lucky Thursday format and interaction governance created credible participation that rewards quality over volume, transforming casual browsers into committed shoppers. Accounts with engagement infrastructure convert attention into commitment.

Action: Build engagement as year-round infrastructure, not seasonal improvisation. Define participation mechanics, train community managers with response protocols, establish recurring formats and measure engagement quality – not just volume.

Conclusion

Festive is good. Utility is better. Frictionless is best.

The year-end festive season is particularly revealing of Xiaohongshu’s critical role in pre-trip decision-making for today’s Chinese FIT travellers – rational in their spending yet active in securing good deals, seeking reliable service and real support when travelling abroad, wellness-conscious, curious and emotionally receptive during winter journeys.

In several weeks, many will travel to or from China for family reunion during Year of the Horse holidays. Are you ready to leverage Xiaohongshu as your dialogue channel with them?

In travel retail, the journey begins long before take-off. Winter simply reveals who prepared for it.

[At Yilin Consulting, we help EMEA travel retailers turn festive noise into strategic clarity — transforming messages and promotions into bespoke experiences, activation moments and in-store service protocols built for Chinese travellers who plan digitally and convert emotionally.

To discuss your 2026 Chinese New Year strategy, contact: yilinwang@yilinconsulting.com

Yilin Wang | Founder & CEO, Yilin Consulting]

Previously on Yilin Watch: The Xiaohongshu Report

Edition 2: Yilin Watch: The Xiaohongshu Report – Focus on Qatar Airways, Cathay Pacific and All Nippon Airways

Edition 1: Announcing a key new editorial column – Yilin Watch: The Xiaohongshu Report