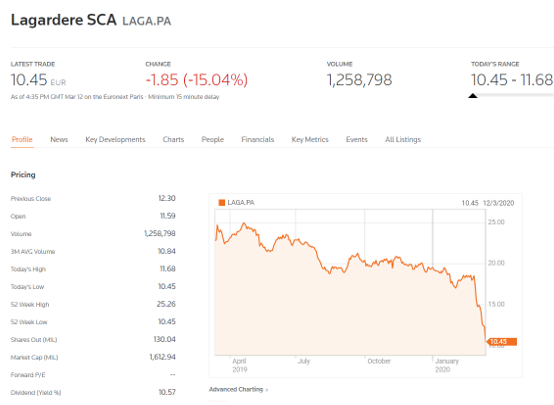

INTERNATIONAL. One of the most traumatic 24-hour periods in travel retail history has seen sector leader Dufry’s share price slump -41.2% despite announcing a solid set of 2019 results; peers Lagardère and Autogrill tumble -15.04% and -21.07%, respectively; and US President Donald Trump shut the country’s door on 26 Schengen countries.

The carnage didn’t end there. US trade association Airports Council International – North America warned that airports would lose at least US$3.7 billion because of a COVID-19-driven steep decline in air travel (and that pre-dated the Trump announcement). And Viking Cruises suspended operations of all river and ocean cruises until 30 April with immediate effect.

With stock markets around the world crashing to depths last seen in the Asian economic crisis of 2008 and 2009, and passenger traffic in freefall, almost no sector of travel retail is being left untouched. The US stock market fell almost -10%, the worst day since the crash of 1987 and the fifth-largest daily decline on record. Other travel stocks unravelled: United Airlines fell by -25%, British Airways and IAG by -11%.With the World Health Organization having this week declared COVID-19 a pandemic, these are unprecedented days for the travel retail, tourism and aviation sectors.

Dufry Group CEO Julián Díaz had the difficult job yesterday of presenting analysts and investors with a twin scenario – a decent set of 2019 results and an outlook for 2020 that looks more uncertain by the day. During a post-result investors call, the seasoned veteran made multiple references to previous crises (SARS, Gulf Wars, Asian economic crisis) and how the sector had bounced back quickly and strongly. The same would happen again, he insisted, and Dufry was neither in danger of breaching its covenants nor of running into liquidity problems.

Díaz mounted a stirring case. And he had a right to. After all, the retailer had just revealed an impressively robust 2019 performance and he, more than most, knows about the speed and strength of travel market rebounds. But the markets were unconvinced and even from the time the earning calls began, company stock plunged further into the kind of territory not seen since the dark days of 2009, when the share price hit CHF17.7.

As the sector leader – and with a widely exposed global footprint – it’s little surprise that Dufry took the biggest hit among its peers. But it wasn’t alone. As mentioned, Lagardère SCA, parent to Lagardère Travel Retail, drifted alarmingly while Autogrill – mainly focused on the traditionally more resilient F&B sector – also suffered.

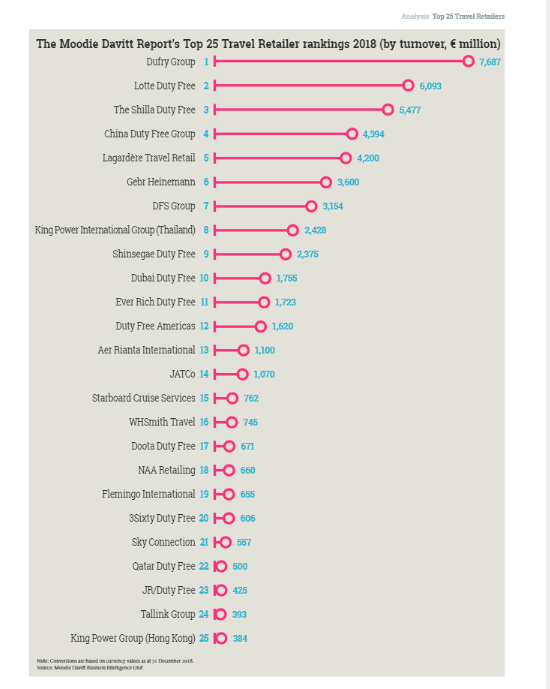

So what does this all spell for the travel retail sector? While the world is being turned upside down, who will emerge from the carnage most intact? Here’s a quick look at the industry’s top players, based on The Moodie Davitt Report Top 25 Travel Retailers ranking.

Dufry: You had to feel for CEO Julián Díaz as he delivered a perfectly acceptable set of 2019 results knowing that almost all those on the earnings call only wanted to know about what came next – i.e. how Dufry would/could handle the COVID-19 crisis. Pair a global pandemic with a global retailer and you potentially have a perfect storm. Dufry is well-managed at the top and can weather it. But unlike private companies, a listed player has also to cope with market sentiment. And as yesterday’s extraordinary collapse of the company’s share price (which had recovered by +4.35% by 11.40 CET today) showed, that sentiment is currently highly unfavourable.

Dufry: You had to feel for CEO Julián Díaz as he delivered a perfectly acceptable set of 2019 results knowing that almost all those on the earnings call only wanted to know about what came next – i.e. how Dufry would/could handle the COVID-19 crisis. Pair a global pandemic with a global retailer and you potentially have a perfect storm. Dufry is well-managed at the top and can weather it. But unlike private companies, a listed player has also to cope with market sentiment. And as yesterday’s extraordinary collapse of the company’s share price (which had recovered by +4.35% by 11.40 CET today) showed, that sentiment is currently highly unfavourable.

What does all that mean for a sector leader? A takeover target? Unlikely unless things get much worse. A hunkering down till the storm passes? Dufry management will follow the latter path. Geographic diversity normally equates to insulation but COVID-19 has hit hard just about everywhere and Asia, the most likely early recovery zone, is not Dufry’s strongest suit. Díaz is right, better days will come. But for now it is raining hard and he and his team would dearly love the weather to improve fast.

Lotte Duty Free: Hugely powerful at home but with a relatively small global footprint. And given that its home town strength is so overwhelmingly reliant on one nationality (the Chinese) and that airport business almost represents a licence to lose money, the Korean powerhouse simply must bolster its highly profitable downtown business with a greater presence overseas. Despite its numerous troubles (some self-inflicted) over recent years, Lotte remains a class act, particularly in social media and ecommerce. But it needs to accelerate its international growth. With a group IPO beckoning, a travel retail sector market bloodbath may be just the right time. JR/Duty Free was the first international acquisition. There will be others.

The Shilla Duty Free: Lotte’s arch rival has thus far proven much more successful on the international stage with big gains in Hong Kong and Changi. But post-crisis and post yet another lesson in the country’s over-reliance on a single consumer base, its push for internationalisation should and surely will gather pace. Shilla is well-primed to acquire 44% of Miami-based 3Sixty Duty Free, which appears a sound move despite – or maybe because of – the current trading climate. It’s a tantalising marriage that could propel Shilla into number two place in the global league, given the opportunities and relationships that 3Sixty will bring globally.

Korean analysts spoken to by The Moodie Davitt Report believe that North America is a big prize and agree that internationalisation is an imperative. Combine 3Sixty’s offshore market experience, savvy, international experience, ecommerce innovation (think Singapore Airlines) and numerous master distributor relationships with Shilla’s powerhouse Korean presence and digital media brilliance and you have such a formula. The combo will certainly give the US and western hemisphere market a shake-up.

China Duty Free Group: Like DFS, the Chinese giant was hit brutally by the initial China-focused outbreak. Its acclaimed CDF Mall in Haitang Bay – the biggest duty free door in the world for many beauty brands – had to temporarily close and its airport stores all around China were affected by a combination of foreign-imposed travel bans and growing Chinese reluctance to travel. Its new Hong Kong downtown operation and its offshore business in Cambodia also suffered.

But the Chinese government’s admirable efforts in getting a monstrous and tragic crisis under control seem likely to result in China Duty Free Group being in the vanguard of the recovery. President Charles Chen told The Moodie Davitt Report last month that he believes Chinese citizens will particularly focus their initial travel plans close to home. In fact, at home, via China’s ‘Hawaii’ – the resort island of Hainan.

Chen even believes that with consumption demand not only undampened but actually heightened because of the crisis, the company could hit target in Hainan in the second half. No-one would say that a company that has been through so much doesn’t deserve it.

DFS: What an interesting case study the world’s leading luxury travel retailer represents. Of all the travel retail world’s players, DFS understands crises – and how to survive them – better than anyone. Look beyond the slick and luxury sophistication of the T Galleria operations and you will find a hard-nosed retailer that knows what it takes to roll with the punches. Do not underrate either the influence of Bob Miller (co-founder along with Chuck Feeney), who retains a near 38% stake. Miller is an even more hardened veteran (in fact by three decades) than Díaz and has steered the good ship DFS through many rocky moments as adeptly as he did when making record-breaking Atlantic yachting crossings.

DFS was caught in the first COVID-19 maelstrom. As Mainland China, Hong Kong and Macau begin to emerge from the crisis, and with any initial resurgence of Chinese travel likely to be close to home, the luxury retailer may be among the first to see green shoots of recovery.

Lagardère Travel Retail: “Undeniably, the COVID-19 health crisis is creating headwinds for all players in our industry, but our three business lines strategy and global footprint ensure the resilience of our model in the face of such events.”

That was the balanced, relatively upbeat message from Lagardère Travel Retail Chairman and CEO Dag Rasmussen on the potential impact of the COVID-19 outbreak, as he revealed growth in revenues and earnings for 2019 on 27 February.

With the impact expected at the time to centre around China and the wider Asian market, the Lagardère Group-owned company said EBIT for the first quarter of the year would fall by around €20 million (recurring EBIT from the division was €152 million in 2019, up +25.6%). This took into account its exposure to Chinese passenger spend at around 12% of the business.

With the spread of the coronavirus internationally, and the curtailing of flights within Europe and to/from Europe and the US, the impact may be more severe still. Lagardère Travel Retail runs the travel retail business at Rome Fiumicino and Ciampino airports, having acquired ADR Retail in 2012. Amid the suspension by many airlines of their flight schedules, Ciampino closes from 14 March and Fiumicino T1 from 17 March.

Lagardère Travel Retail also has exposure across its home French market, where travel has fallen sharply, and in Germany, Austria, Spain and other affected European markets. The Czech Republic’s decision to ban travel from 15 states in the region spells bad news for the Lagardère Travel Retail-run duty free business at Prague Airport.

The extended US travel ban (now affecting Schengen Area travellers) also stands to hurt business at international terminals in the country. Hope that domestic travel might offset some of that downturn may yet be hit by internal US flight restrictions, hinted at by President Trump on 12 March.

Currently, investors remain sceptical about Lagardère Group value (with the travel retail division heralded as an engine of growth). Some analysts have targeted a price of €18.00 for the stock with the more optimistic aiming higher at €28.00 per share. From €19.53 at the start of 2020, the company’s shares began to slide in week three of January and were priced at €10.45 by 12 March.

With the international picture gloomy, it may mean that the company’s China and wider Asian operations – a month ago the source of deep pessimism – could lead the eventual rebound in the second half. The diversity of the Lagardère Travel Retail portfolio – with food & beverage worth close to a €1 billion business plus travel essentials at €1.6 billion – is likely to prove crucial in offsetting declines in the vulnerable duty free and luxury business.

Gebr Heinemann: Any family company that has lasted five generations knows a thing or two about weathering storms and the Hamburg-based travel retailer is managing this one in typically disciplined fashion.

Nonetheless, it faces acute challenges from the COVID-19 impact in some of its biggest markets as the travel downturn in Europe becomes more alarming.

Lufthansa’s move to slash around 50% of flight capacity in the face of the crisis has obvious implications for Germany’s airports and the strength of their passenger bases.

Israel’s decision to curtail inbound travel (as it insists on all visitors going into 14-day quarantine) is already hitting the Heinemann-JR Duty Free joint venture at Tel Aviv Ben Gurion with March passenger traffic plunging.

Istanbul Airport, where retail sales were tracking to come close to €1 billion in its first full year, has been hit hard by the downturn in travel to and from China in particular. The fast-growing luxury business has suffered more than the core duty free business (which has held up relatively well for the Unifree Duty Free JV).

In Norway, where Heinemann runs the biggest arrivals wines & spirits business in the world, fears over the risks of travel and the slashing of airline schedules are having a deep impact. The COVID-19 outbreak has spread quickly, to around 700 cases in a population of just over 5 million. Now travellers from outside the Nordic region face a mandatory 14-day quarantine on arrival, one of a range of measures to curb the spread of the outbreak. SAS and Norwegian have cut around 5,000 flights between them in March and beyond.

Although Heinemann is now more diversified than ever before, around 75% of sales (2018 figures) are from Europe, where the crisis has become acute in recent weeks, as noted above. If Asia Pacific does lead the industry out of the downturn as we expect, that will thrust the spotlight on a region that contributes around 20% of Heinemann turnover today, led by Sydney, Hong Kong and other airport locations.